October 03, 2023

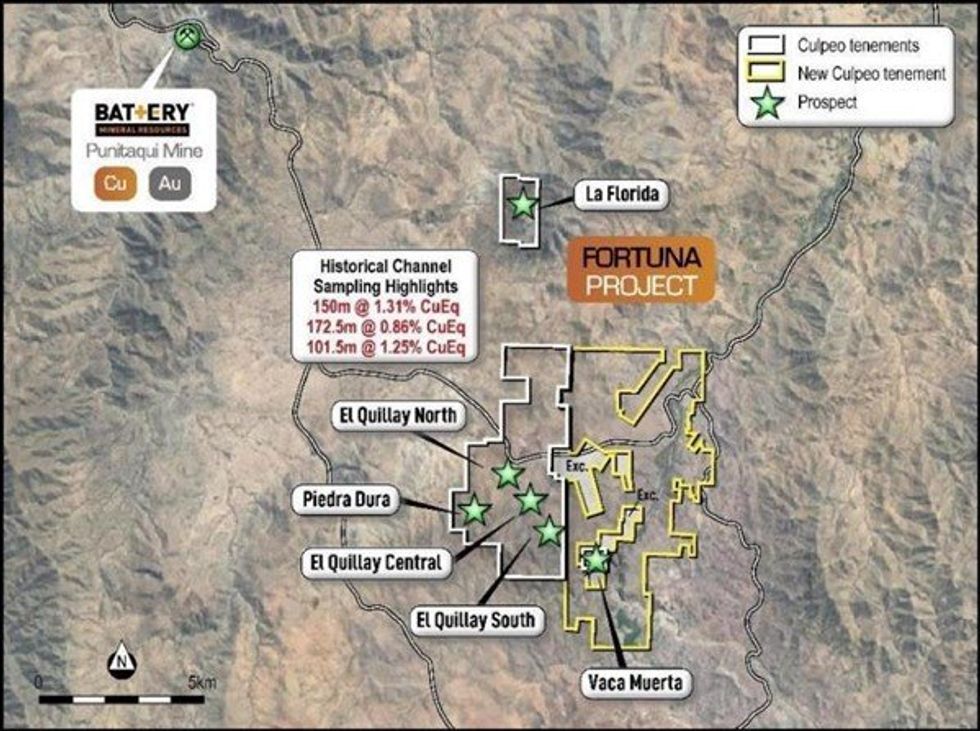

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to announce that it has increased its land package at the Fortuna Copper project by 2,250Ha to 4,025Ha further enhancing the Company’s district footprint.

HIGHLIGHTS

- The Company has secured a large new tenement package in the highly prospective coastal metallogenic belt of Chile, hosting the recently acquired Fortuna Project.

- New tenement applications cover an area of 2,250 Hectares and have been filed with the Chilean Judicial Authority (Civil Court), the authority responsible for the granting new tenements.

- Low total application cost of A$16,300.

- Reconnaissance mapping and geochemical sampling to commence immediately.

Culpeo Minerals’ Managing Director, Max Tuesley, commented:

“We are delighted to have secured this tenement package on the eastern boundary of our Fortuna Copper Project. These exploration tenements further enhance our district footprint with 2,250 hectares of highly prospective ground that is known to host copper mineralisation.”

"We know the same regional structures that host mineralisation at Vaca Muerta and El Quillay extend southeast into this area, so the lithological and structural setting is highly prospective.”

“Given the prospectivity we see here, our team believes that this significantly enhances the already substantial potential at Fortuna. We intend to immediately start exploring this area, as part of our overall strategy to explore the Fortuna Project and discover multiple shallow, high-grade copper deposits. The expanded Fortuna Project along with the recent Lana Corina Copper-Molybdenum discovery, only 10 km’s to the south underpins Culpeo’s district copper strategy”.

PROPSPECTIVITY OF NEW TENEMENTS

The new tenement area (2,250 ha) contains numerous historic shafts and small-scale mining sites, that have exploited the surface mineralisation (Figure 2). The lithological and structural setting is similar to the known copper occurrences at Fortuna, but has not been subject to modern exploration.

A preliminary geological assessment of the surface geology in the new tenure area has identified the presence of similar lithologies and alteration types that are observed at Fortuna and Lana Corina indicating that the area is highly prospective for hosting the high- grade copper mineralisation that we know exists in the district.

Mapping and targeted geochemical sampling will be used to define targets to be drilled. As is the case at the Lana Corina and Fortuna Projects, these new exploration tenements are accessible via paved roads, facilitating cost-effective and rapid exploration.

FORTUNA PROJECT

The Fortuna Project tenements are located 10km north of Lana Corina and consist of four additional groups of prospects: La Florida, El Quillay, Vaca Muerta and Piedra Dura. Extensive outcropping copper mineralisation and historic mining operations are present throughout the project area.

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CPO:AU

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

12h

ASX Copper Mining Stocks: 5 Biggest Companies in 2026

Copper prices have been volatile throughout 2025 and into 2026, fueled by economic uncertainty from an ever-changing US trade policy and strong supply and demand fundamentals. The International Copper Study Group, the leading copper market watcher, reported an apparent refined copper surplus of... Keep Reading...

12h

What Was the Highest Price for Copper?

Strong demand in the face of looming supply shortages has pushed copper to new heights in recent years.With a wide range of applications in nearly every sector, copper is by far the most industrious of the base metals. In fact, for decades, the copper price has been a key indicator of global... Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00