April 09, 2024

Description

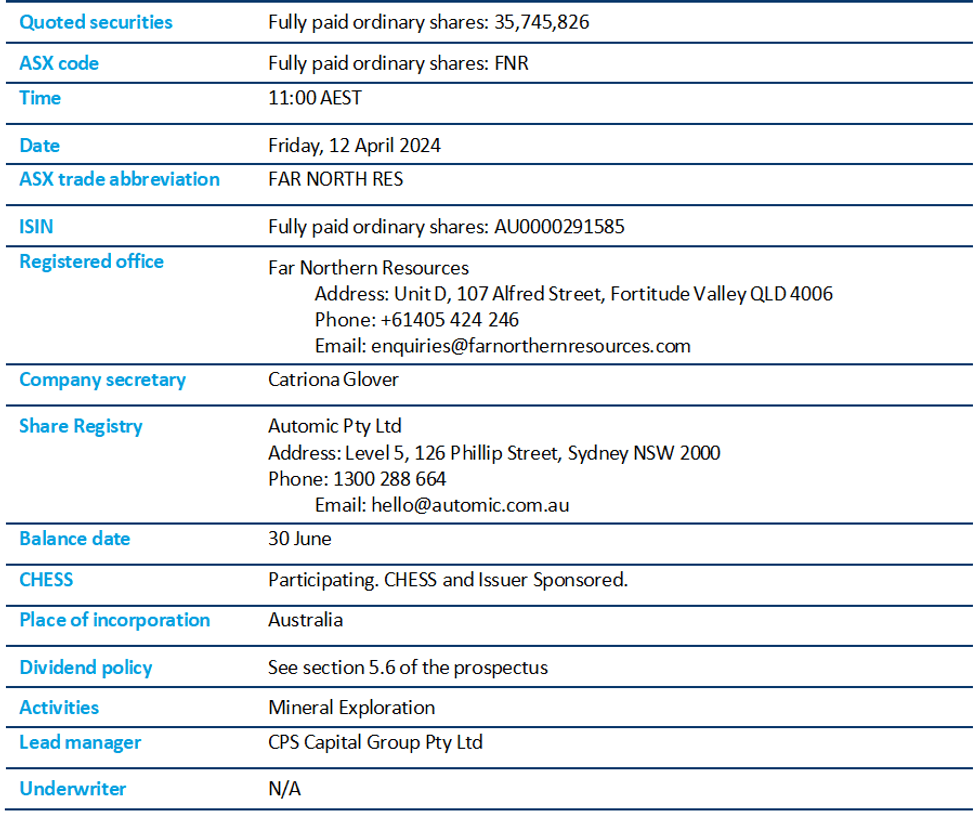

Far Northern Resources Limited (‘FNR’) was admitted to the Official List of ASX on Wednesday, 10 April 2024. The securities of FNR will commence quotation at 11:00 AEST on Friday, 12 April 2024.

FNR raised $4,165,000 pursuant to the offer under its prospectus dated 24 July 2023, as supplemented by the supplementary prospectus dated 19 October 2023 and the second supplementary prospectus dated 19 January 2024, by the issue of 20,825,000 shares at an issue price of $0.20 per share.

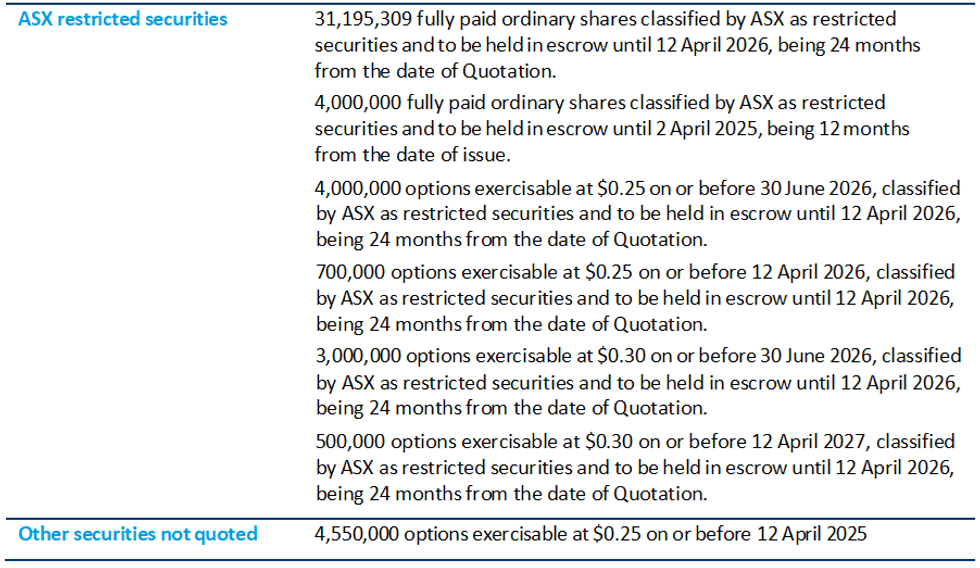

Quotation information

What do I need to do and by when?

For further information, please refer to FNR’s prospectus, as supplemented by the supplementary prospectus and the second supplementary prospectus.

Need more information?

For further information, please call Automic Pty Ltd on 1300 288 664 within Australia and +61 (2) 9698 5414 from outside Australia.

Disclaimer

Please refer to the following disclaimer.

Issued by

ASX Compliance

Click here for the full ASX Release

This article includes content from Far Northern Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00