April 17, 2024

Norfolk Metals Ltd (Norfolk or the Company) has executed an Exclusivity and Due Diligence Deed with Green Shift Commodities Ltd (GCOM), a company incorporated in Canada, to acquire 100% of the Las Alteras uranium project in Chubut, Argentina (Las Alteras). The successful acquisition will position Norfolk as a multinational multi-project uranium exploration company. This is an important step towards Norfolk’s plans to accumulate high value exploration projects in proven regions while maintaining a favorable company structure and cash reserves.

- Norfolk signs exclusivity agreement with Green Shift Commodities Ltd (TSXV GCOM) to acquire Las Alteras uranium project located in Argentina

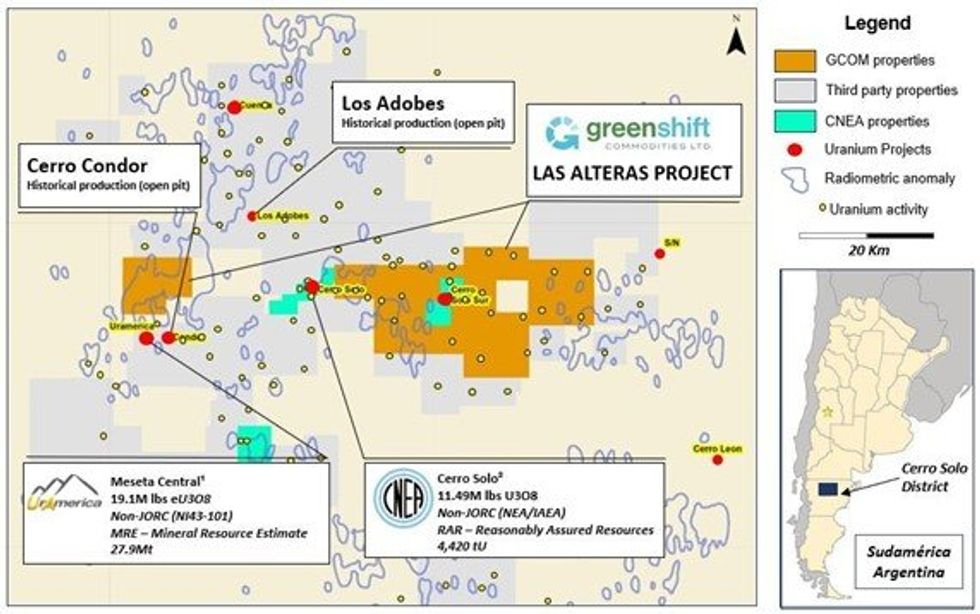

- Las Alteras uranium project surrounded by non-JORC foreign estimates* at URAmerica’s Meseta Central deposit (19.1Mlbs eU308¹), CNEA’s Cerro Solo deposit (11.49Mlbs U308²), ISO Energy’s Laguna Salada deposit (10.1Mlbs U308³) along with the Cerro Condor and Los Adobes historical uranium mines

- Norfolk receives firm commitments for a strategic placement of A$415,746 via ASX Listing Rule 7.1 capacity

- Additional funding to assist in expediting due-diligence on Las Alteras and exploration planning on the Company’s projects

- Strong cash position of A$3.49m as at 31 December 2023

- Norfolk continues to review complementary projects as the Company looks to expand uranium project suite

- Norfolk to conduct executive search for additional Key Management Personal to progress Australia and Argentina uranium exploration projects

Commenting on Norfolk Metals, Executive Chairman, Ben Phillips, states:

“Norfolk has secured an exceptional opportunity in Argentina where we expect to see strong increase in positive sentiment from government, uranium explorers and investors throughout 2024. Las Alteras is surrounded by multiple uranium deposits to the east, west and south with historical mines located to the north and south. We are currently reviewing the historical drill information boarding the eastern block of Las Alteras where uranium has been delineated in the same structures as the flagship Cerro Solo deposit. This uranium trend is increasing as the holes approach Las Alteras ground making this area one of several priorities of our focus.”

Las Alteras Exclusivity

Las Alteras uranium project is surrounded by non-JORC foreign estimates* at URAmerica’s Meseta Central deposit (19.1Mlbs eU308¹), CNEA’s Cerro Solo deposit (11.49Mlbs U308²), ISO Energy’s Laguna Salada deposit (10.1Mlbs U308³) along with the Cerro Condor and Los Adobes historical uranium mines. AlterasAs the uranium market continues to evolve globally it is Norfolk’s view that the Chubut region of the San Jorge Basin hosting the renowned government owned Cerro Solo deposit presents an exceptional opportunity to diversify and grow the Company. The addition of the Las Alteras project suite will allow Norfolk to progress the appointment of Key Management Personnel and advisors.

Please see the Company presentation regarding the Las Alteras uranium project released today on the ASX on the 18th of April 2024.

Click here for the full ASX Release

This article includes content from Norfolk Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NFL:AU

The Conversation (0)

03 August 2021

Norfolk Metals

ASX-listed uranium explorer

ASX-listed uranium explorer Keep Reading...

30 March 2025

Norfolk to earn-into Chilean Copper Project

Norfolk Metals (NFL:AU) has announced Norfolk to earn-into Chilean Copper ProjectDownload the PDF here. Keep Reading...

26 March 2025

Trading Halt

Norfolk Metals (NFL:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Norfolk Metals (NFL:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

12h

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

12h

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

20h

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold (TSX:ELD,NYSE:EGO) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that will create a larger, diversified gold and copper producer with two major development projects that are set to enter production in 2026.Following completion under a... Keep Reading...

21h

Stellar AfricaGold Intersects Multiple Gold-Bearing Zones and Confirms Structural Controls at Tichka Est, Morocco - Drilling Resumed on January 30, 2026

(TheNewswire) Vancouver, BC TheNewswire - February 3rd, 2026 Stellar AfricaGold Inc. ("Stellar" or the "Company") (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold... Keep Reading...

02 February

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

02 February

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00