May 06, 2024

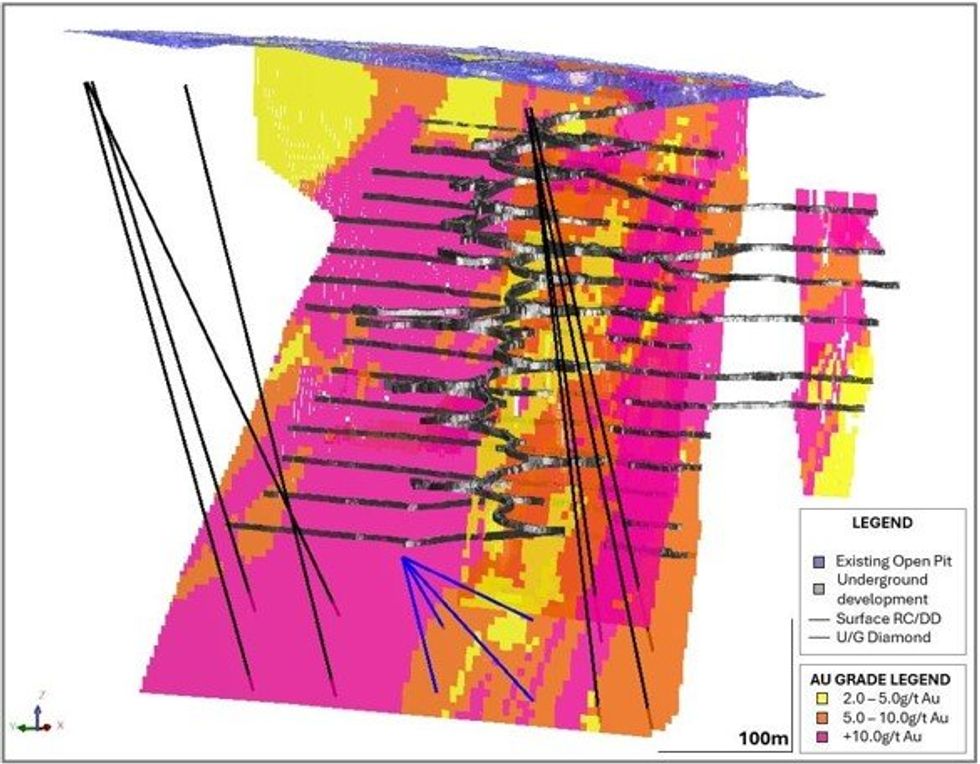

Brightstar Resources Limited (ASX: BTR) (Brightstar) is pleased to advise that Linden Gold Alliance Limited (subject to an off market takeover offer by Brightstar2) have recently completed its underground capital development program and is now in ore production on the 1085 level under its owner operator model. Production has also started from stoping activities (Figure 2) supplementing ongoing ore drive development along with commencement of surface road haulage activities from the Second Fortune gold mine (Figure 1).

HIGHLIGHTS

- Current stoping and development production of 7,000 - 9,000 t/month, ramping up to the 12,000 - 15,000 t/month previously achieved mining rate at Second Fortune.

- Stoping recommenced in April on the 1085 level (Main Lode South), with stoping performing in-line with or better than expectations, achieving an average stoping width of ~1.5 metres

- Road Haulage recommenced in April after significant weather event in previous month

- Sampled Main Lode ore vein grades within ore development drives exceeding +40g/t Au

- Surface & underground diamond drilling contractors engaged to commence resource definition and near-mine exploration programs in near term1

Brightstar’s Managing Director, Alex Rovira, commented “The recommencement of ore haulage activities at Second Fortune is exciting to see as the team builds momentum towards the steady state production rate of 12,000 - 15,000t per month by the September quarter 2024, which was the previous mining rate at Second Fortune.

Whilst the operational Linden team on site is focused on safe production, Brightstar and Linden geologists have worked together to design a surface and underground drill program to build confidence in the existing Mineral Resource Estimate as part of Brightstar’s broader +30,000m drilling program across the Menzies and Laverton portfolio in the near term. This forms part of Brightstar’s commitment to unlocking the inherent value in the Linden assets and advancing the enlarged groups’ assets towards development and monetisation of the combined resource base within the Eastern Goldfields.”

TECHNICAL DISCUSSION

The Second Fortune underground mine has a present production run rate of 7,000 – 9,000 tonnes per month with the mine expected to reach steady state production of 12,000 - 15,000 t/month in the September quarter 2024 consistently achieved in recent years. Stoping recommenced in April, along with ongoing capital (decline) and operating (ore drive) development activities in the mine.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

16 February

GNG: Preferred Contractor - Laverton Processing Plant

Brightstar Resources (BTR:AU) has announced GNG: Preferred Contractor - Laverton Processing PlantDownload the PDF here. Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

01 February

Strategic $180M capital raising funds Goldfields development

Brightstar Resources (BTR:AU) has announced Strategic $180M capital raising funds Goldfields developmentDownload the PDF here. Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Brightstar Resources (BTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00