July 27, 2022

Global Oil & Gas Limited (“Global” or “the Company”) is pleased to update shareholders on the work programme continuing over its 100% owned Exploration Permit 127 in the Northern Territory, along with a Company update on complimentary energy opportunities.

New Project Opportunities

Consistent with its ongoing strategy of continually reviewing new opportunities across the hydrogen, helium and conventional oil and gas sector, the Company has been undertaking advanced due diligence on several complimentary projects.

The Company believes diversifying into the clean technology sector is an economic, social and environmental obligation for all conventional oil and gas companies, which over recent years has brought world-class research and innovation into the sector. Like many up and coming industries, first mover advantage is always critical.

The Company will update shareholders once due diligence is complete and negotiations progress to an advanced stage.

EP127 Work Programme

In November 2021 GLV undertook a Helium and Hydrogen soil sampling survey across the license. A remote spectroscopy study was completed in June 2021, this data was reviewed and has been used to plan the next phase of field activities which include:

- Increase of the field gas sampling density, and refinement of the sampling methodology

- Investigation of water bore gasses

- Further desktop studies, including:

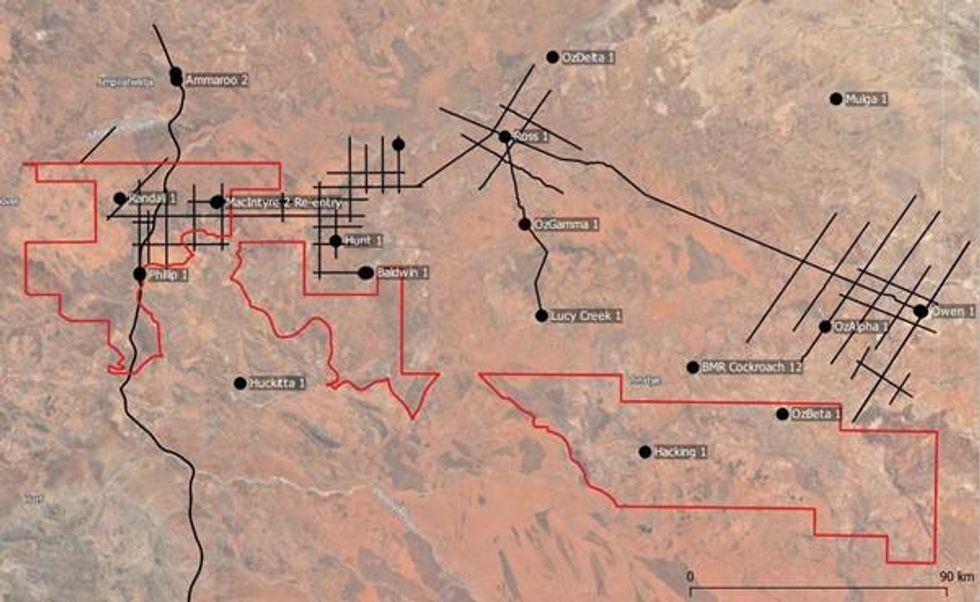

- Seismic interpretation (refer to Figure 1)

- Geological appraisal to refine play concept

- Definition of energy needs in the area, including mining and community

- Definition of cultural areas of significance in the area

- Consulting relevant stakeholders in the field area

The above planned activities will be used to define a clear area for further exploration activities.

Soil Gas Sampling

The aim of further soil gas sampling would be to prove the migration pathway from the relatively shallow basement via faults. Data collected in the previous campaign has been used to plan sampling grids. The grid will likely consist of a sample points every over an area near the MacIntyre-1 and -2 well head locations. A courser grid would be used around the well locations.

Figure 1-Current EP 127 permit with seismic and wells overlayed

Sampling Water Wells

The Company is currently assessing an additional method of non-invasive helium exploration by testing the regional water wells for helium concentration. This option requires further investigation to determine whether the option is viable option on existing wells or whether drilling new water wells would be required.

Drilling water wells has been proved as successful by Blue Star Helium (ASX:BNL) in Colorado. See BNL’s announcement on the 20th of October 2021.

Click here for the full ASX Release

This article includes content from Global Oil and Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

30 January

Angkor Resources Announces AGM Results and Appointment of New Director

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - (January 30, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the voting results from its Annual General Meeting of Shareholders (the "Meeting"), held on Thursday, January 29, 2026, including the... Keep Reading...

30 January

Syntholene Energy Announces Co-Listing in the United States on OTCQB Market Under Symbol SYNTF

Co-Listing Expands U.S. Investor Access and Visibility in World's Largest Aviation and Capital MarketsSyntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces that its common shares have been approved for quotation and have commenced... Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Kinetiko Energy (KKO:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

Is Now a Good Time to Invest in Oil Stocks?

Investing in oil stocks can be a lucrative endeavor, but determining the right time to enter a sector known for volatile swings can be tricky.Over the past five years, the oil market’s inherent volatility has been on clear display. Major declines in consumption brought on by the COVID-19... Keep Reading...

28 January

Quarterly Activities/Appendix 4C Cash Flow Report

MEC Resources (MMR:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

December 2025 Quarterly Report and Appendix 4C

BPH Energy (BPH:AU) has announced December 2025 Quarterly Report and Appendix 4CDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00