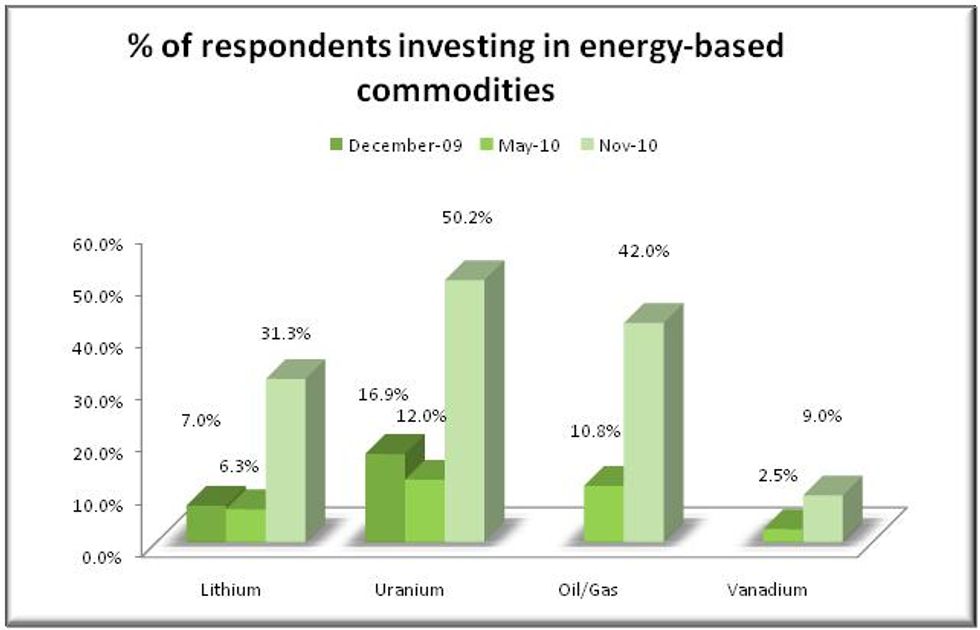

Three of the top six resources which survey participants invested in over the last year are based in the energy sector. Results demonstrate an apparent growth over the last 6 months across the energy realms with: more than 50 percent of participants invested in uranium; 31 percent invested in lithium; 42 percent invested in oil & gas and 9 percent invested in vanadium.

In a recent study by Resource Investing News, three of the top six resources that survey participants invested in over the last year are based in the energy sector. The study represents almost 600 individuals and was conducted in November to follow up on previous research conducted earlier in May and toward the end of last year. Interest in both uranium and lithium seemed to decline slightly during the first part of this year according to analysis of previous survey results, indicating that 4.9 percent and 1.3 percent fewer investors had exposure to the respective sectors. The recent results demonstrate an apparent growth over the last 6 months across the energy realms with more than 50 percent of participants invested in uranium, 31 percent invested in lithium, 42 percent invested in oil & gas and 9 percent invested in vanadium

Last year, energy developments were strongly determined by a continued global recession and, for the year as a whole, the international economy contracted for the first time since the Second World War, diminishing global energy consumption. World energy consumption decreased 1.1 percent while global GDP fell by 0.6 percent.

This dynamic transition came as the net result of two contrasting trends. Energy consumption growth remained vigorous in several developing countries, specifically in Asia showing growth in excess of 4 percent. Conversely, in the 33 countries belonging to the Organization for Economic Co-operation and Development (OECD), consumption declined significantly by 4.7 percent and was almost reset to its 2000 levels. In North America, Europe and CIS, consumptions shrank by 4.5 percent, 5 percent and 8.5 percent respectively due to the slowdown in economic activity. Consuming 18 percent of the world’s total energy production, China became the largest global consumer since its demand surged by 8 percent during 2009. Despite its declining share over time, oil remained the largest energy source, representing 33 percent of global demand. Coal posted a growing role in the world’s energy consumption: in 2009, it accounted for 27 percent of the total.

Securing Future Supply

Many of the same economic themes were important in 2010; however, a general shift away from environmentally sensitive sources was underscored by the oil spill. Policies from the two largest energy consuming nations of both China and the United States seemed to focus on investment in alternative energy sources and critical infrastructural changes. Catalysts providing the context for investment interest include the negative press regarding Gulf of Mexico, a pervasive shift towards nuclear energy in China and India and strong appetite for unconventional sources of natural gas. Patricia Mohr, Vice-President, Economics and Commodity Market Specialist at Scotiabank provided analysis on November 30 of China’s 12th Five-Year Plan, anticipated to be finalized by next March, which will double the role of nuclear energy, implying positive impact for uranium producers and investment industry.

On 10 November 2010, the European Commission released a report to ?more clearly define European energy priorities for the next ten years and create legislative initiatives and proposals within the next 18 months. This communication was also to provide an agenda for a discussion by government leaders at the very first EU Summit on Energy scheduled in early February. Primary focus is expected to be on environmental considerations with lower carbon emission sources playing a critical role in the future.

Concern about energy security; the need to supply inevitable growing energy demands, particularly within the emerging market nations; continued economic malaise; and the threat of climate change all pose major challenges to energy decision makers. Analysis of energy problems requires a comprehension of basic supply and demand data for all fuels in a manner which allows the easy comparison of the contribution that each fuel makes to the economy and their interrelationships through the conversion of one fuel into another. This type of data is critical for the study of energy substitution, energy conservation and forecasting.