(TheNewswire)

| |||||||||

Vancouver, Canada, July 2 8 2025 TheNewswire - Electrum Discovery Corp. (" Electrum " andor the " Company ") (TSX-V:ELY | FRA:R8N | OTC:ELDCF) is pleased to report the results of voting at its Annual General and Special Meeting (the " Meeting ") held on July 24 th 2025 in Vancouver, Canada. Shareholders voted in favor of all items put forward by the Board of Directors and management.

The Company warmly welcomes Michael Williams and John Anderson who were elected to the board of directors of the Company (the " Board ") to replace Eric Rasmussen and R. Michael Jones, whose terms ended at the Meeting.

Michael Williams has 29 years of experience as a senior executive within the mining industry. He was a founder and has served as Chairman of several public companies including Underworld Resources Ltd., which was sold to Kinross Gold Corp. He currently serves as Executive Chairman of Aftermath Silver and President and CEO of Vendetta Mining Corp.

John Anderson has over 20 years of capital markets experience specializing in the resource sector. He was a founder and financier of several start-up companies and has experience with issuers listed on senior North American stock exchanges, as well as the London AIM and Swiss Stock Exchange. He was a founder of Deep 6 PLC, American Eagle Oil and Gas as well as a founding general partner in Aquastone Capital LLC, a New York based gold fund. John currently serves as Chairman and interim CEO of Triumph Gold Corp.

The Company thanks Mr. Rasmussen and Mr. Jones for their valued contributions as directors of the Company and wishes them well in their future endeavours.

The percentage of votes cast for each item is as follows:

| VOTES FOR | % VOTES FOR | VOTES WITHELD | % VOTES WITHHELD | VOTES AGAINST | % VOTES AGAINST | |

| Number of Directors (5) | 17,315,239 | 99.99% | 0 | 0.00% | 1,562 | 0.01% |

| Dr Elena Clarici | 17,308,986 | 99.95% | 7,815 | 0.05% | 0 | 0.00% |

| Michael Thomsen | 17,308,986 | 99.95% | 7,815 | 0.05% | 0 | 0.00% |

| Ralph Rushton | 17,308,986 | 99.95% | 7,815 | 0.05% | 0 | 0.00% |

| Michael Williams | 15,681,143 | 90.55% | 1,635,658 | 9.45% | 0 | 0.00% |

| John Anderson | 15,681,143 | 90.55% | 1,635,658 | 9.45% | 0 | 0.00% |

| Appointment of Auditors | 17,316,801 | 100.00% | 0 | 0.00% | 0 | 0.00% |

| Stock Option Plan | 15,935,336 | 92.02% | 0 | 0.00% | 1,381,465 | 7.98% |

| Equity Incentive Compensation Plan | 15,641,153 | 90.32% | 0 | 0.00% | 1,675,648 | 9.68% |

| Continuance into the Jurisdiction of the Abu Dhabi Global Market | 17,246,788 | 99.60% | 0 | 0.00% | 70,013 | 0.40% |

| Other Business | 17,285,221 | 99.82% | 0 | 0.00% | 31,580 | 0.18% |

Shareholders of the Company voted in favour of (i) Smythe LLP, Chartered Accountants, as auditors of the Company for the ensuing year and authorizing directors to fix their remuneration; A total of 17,316,801 Electrum's common shares were voted, representing 17.49% of total shares issued and outstanding as at the record date of the meeting.

Shareholders of the Company also approved a special resolution to continue the corporate jurisdiction of the Company from British Columbia into the jurisdiction of the Abu Dhabi Global Market (the " Continuance "), and subject to and upon the Continuance, the proposal to adopt the new articles of continuance as detailed in the management information circular of the Company dated June 6, 2025 (the " Information Circular ").

The Company has sought and obtained shareholder approval for the Continuance for strategic reasons as described in the Information Circular. The timing and decision to consummate the Continuance remains at the discretion of the Board and remains subject to receipt of all necessary regulatory approval.

About Electrum Discovery Corp.

Electrum Discovery Corp. is an emerging mineral exploration and development company focused on the prolific Western Tethyan Belt with two main projects in the Republic of Serbia.

-

Timok East extends over 123 square kilometers across the Timok copper- gold region and includes multiple copper-gold targets and mineralized trends, and is located less than five kilometres from the Bor Mining Complex.

-

Novo Tlamino , located in the south-east of Serbia, includes an inferred mineral resource estimate of 670,000oz AuEq (7.1 Mt at 2.5 g/t Au and 38 g/t Ag containing 570,000 oz Au and 8.8 Moz of Ag), PEA (January 7, 2021) 1 .

Electrum is looking to maximize the value of its mineral projects for all stakeholders including our shareholders, the local community and government. We have an open-door policy and encourage all stakeholders to contact us through our website. We have a strong environmental and ethics policy to complete all our work in line with regulations in an open and transparent process. Our projects are at an early stage, and we plan to continue our consultation with all stakeholders in a climate of mutual respect, while fostering sustainability, governance, and knowledge transfer in the region.

Additional information on Electrum can be found by reviewing the Company's page on SEDAR+ at www.sedarplus.ca .

For more information contact:

Dr Elena Clarici, Chief Executive Officer and Director

T: +1 604 801 5432 | E: elena@electrumdiscovery.com | W: electrumdiscovery.com

Forward-Looking Statements

Certain statements contained in this news release constitute "forward-looking information" within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, are forward-looking information. Such forward-looking information includes, without limitation, statements related to the timing and consummation of the Continuation and any regulatory approvals required for the Continuation. Often, but not always, this forward-looking information can be identified by the use of words such as "estimate", "estimates", "estimated", "potential", "open", "future", "assumed", "projected", "used", "detailed", "has been", "gain", "upgraded", "offset", "limited", "contained", "reflecting", "containing", "remaining", "to be", "periodically", or statements that events, "could" or "should" occur or be achieved and similar expressions, including negative variations.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Electrum, to be materially different from any results, performance or achievements expressed or implied by forward-looking information. Such uncertainties and factors include, among others, uncertainties inherent in the PEA and exploration results and the estimation of mineral resources; risks related to the failure to obtain adequate financing on a timely basis and on acceptable terms; changes in general economic conditions and financial markets; risks associated with the results of exploration and development activities, and the geology, grade and continuity of mineral deposits; unanticipated costs and expenses; and such other risks detailed from time to time in Electrum's quarterly and annual filings with securities regulators and available under Electrum's profile on SEDAR+ at www.sedarplus.ca. Rock chips and surface results are early stage and there is no assurance that future exploration will find mineralization of further interest. Although Electrum has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking information contained herein is based on the assumptions, beliefs, expectations and opinions of management. Forward-looking information has been made as of the date hereof and Electrum disclaims any obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, investors should not place undue reliance on forward-looking information.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

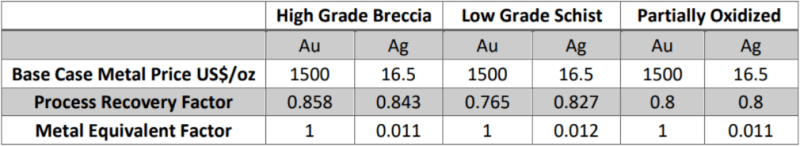

1 Preliminary Economic Assessment and NI43-101 Technical Report for the Medgold Tlamino Project, January 7, 2021, www.sedarplus.ca. The PEA is preliminary in nature, and it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be characterized as mineral reserves, and there is no certainty that the PEA will be realised. A gold price of US$1500/oz and a silver price of US$16.5/oz were used for estimations of metal equivalents. Metal equivalent factors were calculated separately for the three main material types of the mineral resource as shown below:

A gold equivalent (AuEq) grade was calculated using the formula AuEq = ((Ag g/t) x 0.011)) + (Au g/t) for the High Grade Breccia and Partially Oxidized materials, and AuEq = ((Ag g/t) x 0.012)) + (Au g/t) for the Low Grade Schist.

Copyright (c) 2025 TheNewswire - All rights reserved.