March 29, 2022

Challenger Exploration (ASX: CEL) (“CEL” the “Company”) is pleased to announce the results from recent drilling targeting extensions to the high-grade mineralisation at the Company's flagship Hualilan Gold Project, in San Juan Argentina. A total of 48 of the 58 drill holes (83%) reported significant gold mineralisation demonstrating the Company's ongoing success in extending the high-grade gold mineralisation at Hualilan.

Highlights

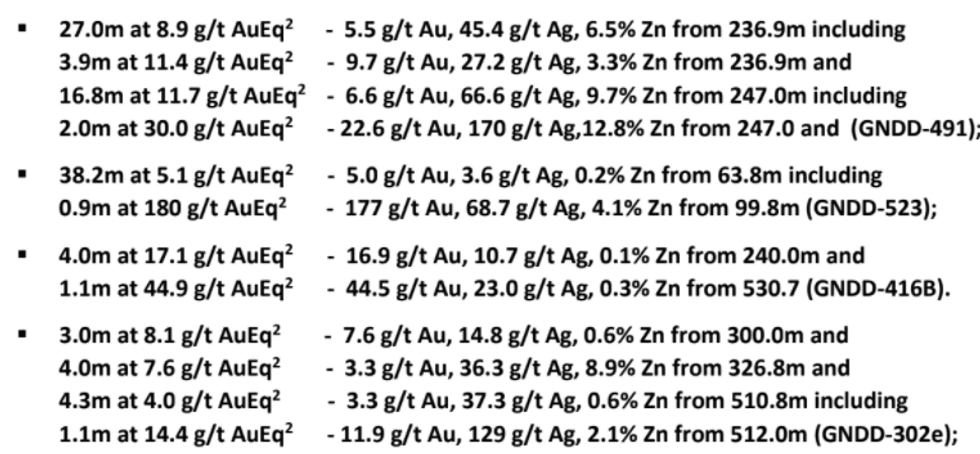

- Ongoing drilling at the Company's flagship Hualilan Gold Project has materially extended thehigh-grade mineralisation in multiple zones with results including (refer Table 1):

- GNDD-491 intersection of 27.0m at 8.9 g/t AuEq, opens an exciting new high-grade target belowprevious shallow drilling, being the first deeper hole on the western Magnata Fault.

- GNDD-302(ext) extended the Main Manto and Footwall Zones at Sentazon 250 metres down dipwith several follow up holes confirming significant new high-grade extensions at depth.

- Results extends the Sanchez Fault and Norte Manto and confirm a significant halo around thehigh-grade with results including 63.0m at 1.1 g/t AuEq incl 4.0m at 7.2 g/t AuEq (GNDD-443).

- Drilling with the portable rig continues to intersect high-grade mineralisation up-dip in theHualilan Hills

Commenting on the results, CEL Managing Director, Mr Kris Knauer, said

“The results from Hualilan continue to impress with this series of results unlocking several excitingnew high-grade targets. The first deeper hole on the eastern end of the Magnata Fault intersected27 metres at 8.9 g/t, opening up a new high-grade target below previous shallow drilling.

Deeper drilling at Sentazon hasreturned outstanding results extending the high-grade mineralisationmore than 200 metres down dip in multiple locations. Additionally, several deeper holes, for whichassays are pending, are logged as containing zones of massive sulphides within skarn alteration. Thisis typical of other high-grade intercepts at Hualilan and we expect assays to confirm a significantnew zone of high-grade mineralisation down-dip at Sentazon."

Click here for the full ASX Release

This article includes content from [Company Name], licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CEL:AU

The Conversation (0)

14 February 2022

Challenger Exploration

Gold and Copper Exploration Across Known and Untapped Sources

Gold and Copper Exploration Across Known and Untapped Sources Keep Reading...

14h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00