November 08, 2023

Chariot Corporation Limited (“Chariot”, “CC9” or the “Company”) is pleased to announce that following completion of site preparation and the earthworks required to support the drilling program at its flagship Black Mountain Project in Wyoming, USA (“Black Mountain”), a Boart Longyear LF90 surface diamond core drill rig (“Drill Rig”) has arrived at the site. Drilling operations will commence immediately with the first round of assay results from the drill cores expected in January 2024.

HIGHLIGHTS

- Site preparation and earthworks completed

- Drilling team mobilised with offsite infrastructure in place

- Drill rig arrived at the site on 8 November for immediate commencement of drilling operations

- Boart Longyear LF90 surface diamond core drill rig being used

- Initial assay results of the cores expected in January 2024

Chariot’s U.S. subsidiary, Panther Lithium Corporation, plans to drill 2,000 - 3,000m(1) of orientated triple tube HQ sized core. The initial phase 1 program targets outcropping spodumene-bearing LCT pegmatite dykes within a 1km long by 50m to 150m wide zone.

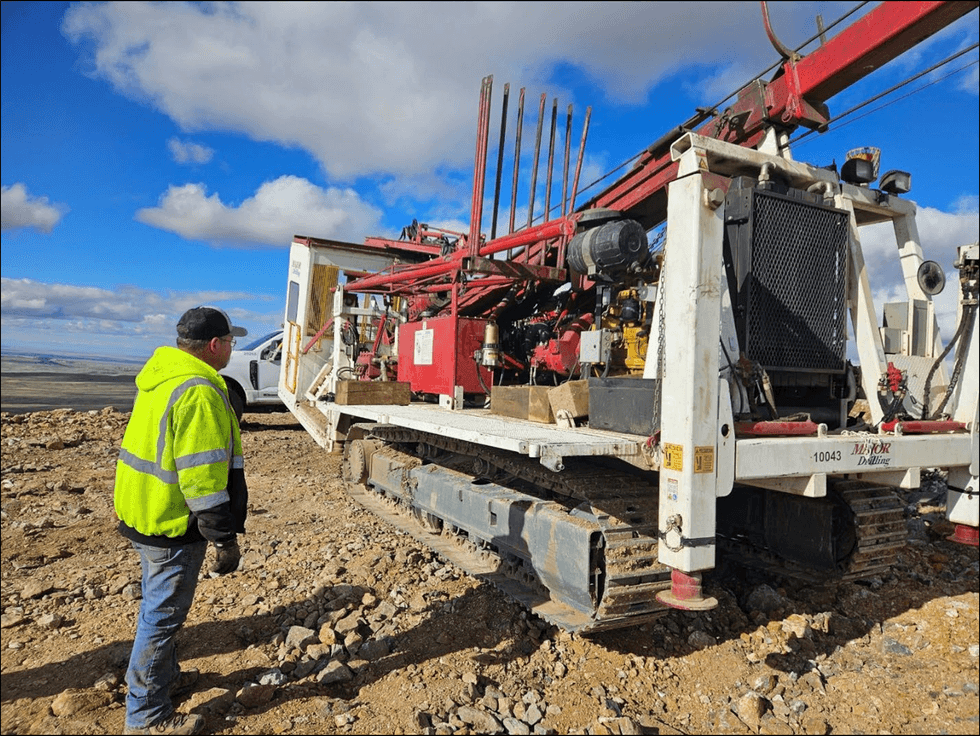

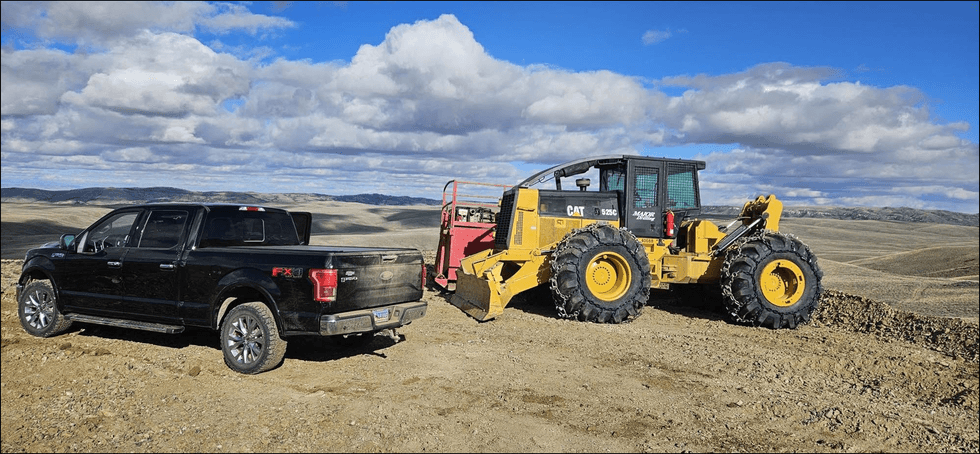

Figure 1: Major Drilling Drill Rig Positioned on a Drill Pad

Figure 1: Major Drilling Drill Rig Positioned on a Drill PadDrill Permitting

On 21 August 2023, the Company received formal approval from the United States Bureau of Land Management (“BLM”) to conduct drilling activities at Black Mountain(2). The Company has also obtained approvals for its drilling plan from the Land Quality Division of the Wyoming Department of Environmental Quality and the United States Department of Game and Fisheries.

Drill Site Earthworks and Access Road Upgrade

The Company has utilised the historical tracks and roadways in the Black Mountain area which were developed by ranching teams that lease the land from the BLM (for cattle grazing purposes only) and State and County personnel pursuing water drilling initiatives. Between August 2022 and June 2023, the Company’s technical team surveyed the numerous access routes into the site and engaged local stakeholders in order to ascertain time, physical and permitting requirements to enable access for the Drill Rig.

On 16 October 2023, a local earthmoving contractor was mobilised and completed work needed to allow access to the site within permitted disturbance limits, specifications and timeline requirements prescribed by the Company’s drilling contractor, Major Drilling America Inc. (“Major Drilling”). This work included the construction of initial drill pads and the improvement of the existing access road to accommodate the Drill Rig and associated equipment. The upgrade of the access road should be able to support drilling operations through the early winter months(3) and serves as base-level infrastructure for future drilling activities.

Drilling Plan

The Phase 1 drill program (“Phase 1 Drill Program”) is designed to test the central portion of the Black Mountain pegmatite dike swarm, comprising a 1,000m long by +100m wide zone of LCT pegmatite sub-crop and outcrop depicted in Figure 3. The Phase 1 Drill Program was developed in part based upon the highly encouraging assay results from the 22 rock chip samples collected to date at Black Mountain. Of the 22 rock chip samples, 14 assayed +300ppm Li (0.06% Li2O), 10 of which were +7,000 ppm Li (1.51% Li2O) with the highest value being 31,018 ppm Li (6.68% Li2O)(4,5). Refer to Figure 3.

These modelled zones were used to develop the initial twenty-three (23) hole drilling plan, which has overlapping fans of holes at varying azimuths and dips from levelled pads shown in the plan view overlain in Figure 3.

The diamond drilled cores will be orientated and HQ sized such that appropriate observations and measurements can be captured and later modelled as part of an in-depth lithological, geochemical, geological, geotechnical and structural analysis.

Chariot’s site geologist and manager will be actively monitoring operations and interactively working with Major Drilling and management to dynamically adjust the plan. Drilled cores from Black Mountain will be sent to Chariot’s core logging and sampling facility in Jeffrey City, Wyoming for core cutting, photography, density measurements, rock quality designation logging, lithological and structural logging with a view to determining appropriate intervals for assay and mineralogy studies.

Click here for the full ASX Release

This article includes content from Chariot Corporation, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CC9:AU

The Conversation (0)

07 February 2025

Chariot Corporation

Largest lithium exploration land holdings in the US

Largest lithium exploration land holdings in the US Keep Reading...

27 March 2025

Second Amendment to Black Mountain Purchase Option

Chariot Corporation (CC9:AU) has announced Second Amendment to Black Mountain Purchase OptionDownload the PDF here. Keep Reading...

26 March 2025

Convertible Note Financing of up to A$2.0 Million

Chariot Corporation (CC9:AU) has announced Convertible Note Financing of up to A$2.0 MillionDownload the PDF here. Keep Reading...

18 February 2025

High-Potential WA Lithium & Gold Tenements Secured

Chariot Corporation (CC9:AU) has announced High-Potential WA Lithium & Gold Tenements SecuredDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Chariot Corporation (CC9:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

26 November 2024

Black Mountain Phase 2 Program has Commenced

Chariot Corporation (CC9:AU) has announced Black Mountain Phase 2 Program has CommencedDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00