May 08, 2025

Errawarra Resources Ltd (ASX: ERW) is pleased to advise that it has awarded its inaugural drilling contract at the high-grade Elizabeth Hill Project, located in the Pilbara region of Western Australia.

HIGHLIGHTS:

- Inaugural Drilling Contract awarded for Elizabeth Hill.

- West Core Drilling has been awarded the diamond drilling contract under a partial drill for equity arrangement. Drilling is anticipated to commence imminently post EGM.

- Drill targeting currently being finalised following site visit by Errawarra’s Management to ground truth targets.

- Regional Soils program targeting regional structures with associated historical silver in soil anomalism is almost completed with 1,766 soils samples and 89 rock chip samples having been collected.

- Rock chip sampling is aided using pXRF technology to qualitatively assess with the samples in the field.

- Laboratory results are expected in 6-8 weeks.

Following a competitive tender process, the Company has awarded the diamond drilling contract to West Core Drilling. The upcoming drill program will be completed under a partial drill-for-equity arrangement and will focus on high-priority mine and near-mine targets. These include:

- Near-surface mineralisation,

- Down-plunge extensions, and

- Strategic drill holes to enhance the geological understanding and structural orientation of the mineralised system.

Drilling is anticipated to commence in the week following the Company’s upcoming General Meeting (GM) planned for 19 May 2025.

Executive Director Bruce Garlick commented:

“We are delighted to partner with West Core as part of our inaugural drilling program. This contract award demonstrates our continued progression of the project, and we look forward to testing the asset with the drill bit in the coming weeks. It was also fantastic for the board to recently visit site and see all the readily available nearby infrastructure that could potentially feed into our development planning.”

Targeting for the drill program is currently being finalised, with active involvement from the Board of Errawarra and technical consultants ERM Consulting. A recent site visit completed by management has enabled ground-truthing of the high-priority targets.

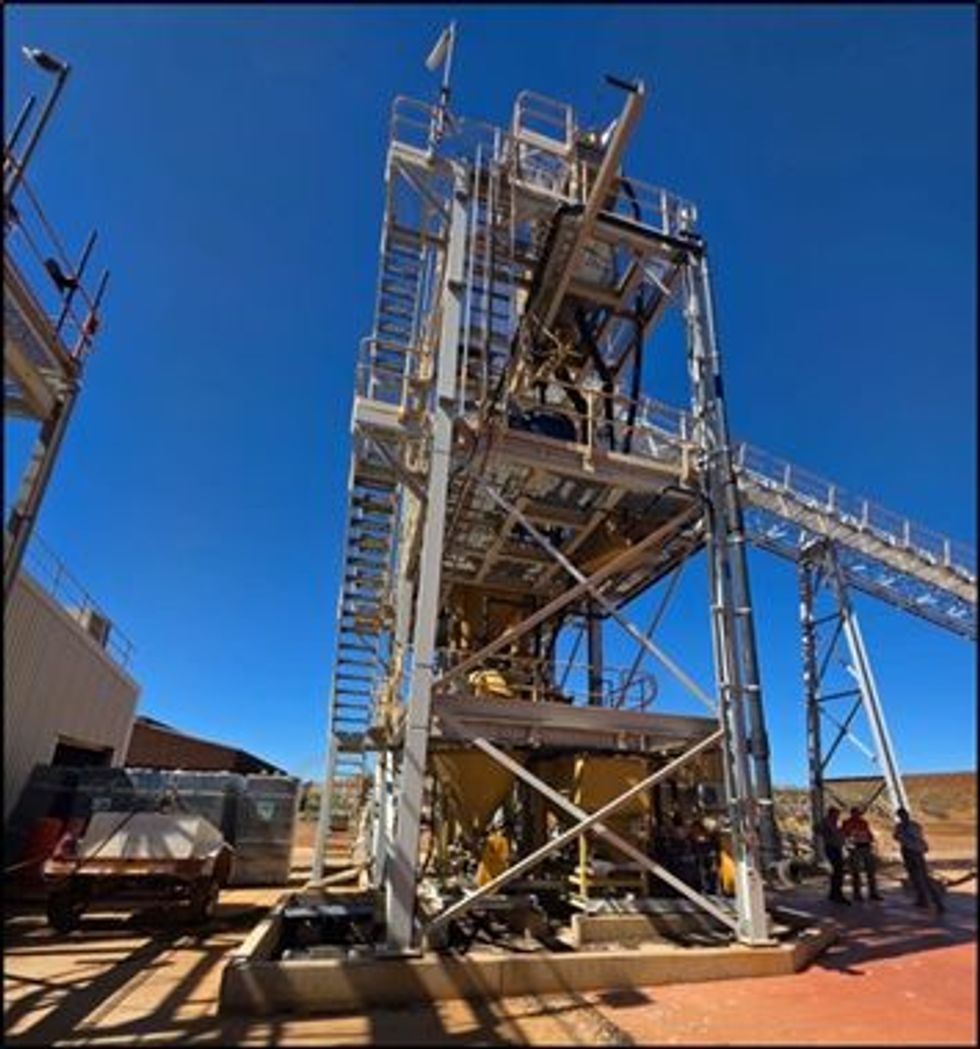

As part of Errawarra’s ongoing project development and planning, management visited the Radio Hill processing plant, approximately 15 kilometres to the north which is owned by Artemis Resources (ASX: ARV) and currently in care and maintenance.

During the same site visit, the team also observed the almost completed regional soil sampling campaign which is targeting regional structures with associated historical silver in soil anomalism. A total 1,766 soil samples and 89 rock chips samples have been collected to date during this program which is anticipated to be completed in the coming week.

Click here for the full ASX Release

This article includes content from Errawarra Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

19h

What's Next for the Silver Price After $100 Per Ounce?

First Majestic Silver (TSX:AG,NYSE:AG) CEO Keith Neumeyer’s silver price prediction of over US$100 per ounce came true in 2026. When will silver prices make a more lasting hold in triple digit territory?The silver price was up over 189 percent year-on-year as of March 2, 2026, on the back of... Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

26 February

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00