Dakota Gold Corp. (NYSE American: DC) ("Dakota Gold" or the "Company") is pleased to report additional drill hole assay results from the Richmond Hill Oxide Heap Leach Gold Project ("Richmond Hill" or the "Project") including expansion drilling that has intersected gold mineralization as far as 230 meters (755 feet) north of the current Measured and Indicated resource boundary. Drill results continue to confirm widespread gold mineralization and resource growth potential.

The Company has safely and successfully completed 242 drill holes in its 2025 drilling campaign totaling 29,279 meters (~96,000 feet). To date, a total of 136 drill hole assay results including the results today have been released from the campaign thus far. Assays for 106 drill holes are pending release, including many from northeast expansion drilling, which will be reported as they are received through early 2026.

Highlights from this update include:

- Expansion and infill drill holes RH25C-303 intersected 4.52 grams per tonne gold (g/t Au) over 15.2 meters (69 gram meters), including 31.90 g/t Au over 1.8 meters (57 gram meters), RH25C-307 intersected 1.43 g/t Au over 30.2 meters (43 gram meters) and RH25C-313 intersected 1.74 g/t Au over 25.7 meters (45 gram meters). The first two drill holes listed were located 50 meters (165 ft) and 100 meters (330 ft) north respectively of the current Measured and Indicated resource boundary. The mineralization in the northeast is only limited by drilling and remains open. The Company has drill-tested the area up to 300 meters (980 ft) north and 535 meters (1,750 ft) wide.

- Metallurgical drill hole RH25C-261 intersected 2.87 g/t Au over 17.3 meters (50 gram meters) in the northeast Project area. The Metallurgical drill testing program provides valuable information for mine planning and supports validation of the current resources.

"We're pleased with the results of expansion drilling in the northern Project area which have highlighted significant high-grade gold mineralization. These results will be incorporated into the updated resource model and inform the ongoing Feasibility Study. Drilling will pause briefly for the remainder of December and resume mid-January 2026. We look forward to sharing the remaining assay results from the 2025 campaign in the new year as they are received," said Jack Henris, President and COO of Dakota Gold.

The Company's core drilling for the 2025 campaign has been designed to collect metallurgical samples for column testing, condemnation drilling beneath proposed site infrastructure for mine planning, infill drilling to upgrade the existing resource, and expansion drilling where the resource remains open. The drill results will refine the modelled boundaries and improve the precision of the geo-metallurgical domains, as well as inform both the oxide and sulfide resource updates for the Feasibility Study.

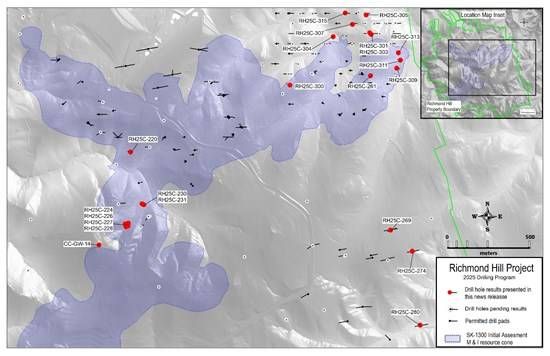

Figure 1. Plan Map of Dakota Gold Corp. Richmond Hill 2025 Drill Campaign Highlighted Drill Results.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8218/278854_4f6eba59c4b8798a_002full.jpg

Table 1. Richmond Hill Drill Results (Metric / Imperial)1,2,3,4,5,6

| Hole # | From (m) | To (m) | Interval (m) | Grade (g/t) | g x m | From (ft) | To (ft) | Interval (ft) | Grade (oz/ton) | Program |

| RH25C-220 | 9.5 | 43.6 | 34.1 | 0.67 | 23 | 31.1 | 143.0 | 111.9 | 0.020 | Infill |

| 94.0 | 101.5 | 7.5 | 0.73 | 5 | 308.4 | 333.0 | 24.6 | 0.021 | ||

| RH25C-224 | 8.1 | 25.1 | 16.9 | 0.95 | 16 | 26.7 | 82.2 | 55.5 | 0.028 | Metallurgical |

| 69.5 | 75.6 | 6.1 | 1.08 | 7 | 228.0 | 248.0 | 20.0 | 0.031 | ||

| 92.4 | 98.3 | 5.9 | 0.55 | 3 | 303.0 | 322.4 | 19.4 | 0.016 | ||

| 101.4 | 113.5 | 12.0 | 0.57 | 7 | 332.8 | 372.3 | 39.5 | 0.017 | ||

| RH25C-226 | 0.0 | 11.6 | 11.6 | 0.54 | 6 | 0.0 | 38.0 | 38.0 | 0.016 | Metallurgical |

| 16.8 | 20.2 | 3.4 | 0.67 | 2 | 55.0 | 66.2 | 11.2 | 0.020 | ||

| RH25C-227 | 0.0 | 12.0 | 12.0 | 0.74 | 9 | 0.0 | 39.5 | 39.5 | 0.021 | Metallurgical |

| 48.0 | 61.9 | 13.8 | 0.68 | 9 | 157.6 | 203.0 | 45.4 | 0.020 | ||

| RH25C-228 | 48.4 | 55.8 | 7.4 | 0.88 | 7 | 158.8 | 183.1 | 24.3 | 0.026 | Metallurgical |

| 69.6 | 78.9 | 9.3 | 0.55 | 5 | 228.2 | 258.8 | 30.6 | 0.016 | ||

| RH25C-230 | 12.2 | 16.2 | 4.0 | 0.68 | 3 | 40.0 | 53.0 | 13.0 | 0.020 | Metallurgical |

| 20.3 | 82.3 | 62.0 | 0.67 | 42 | 66.6 | 270.0 | 203.4 | 0.020 | ||

| RH25C-231 | 40.5 | 49.4 | 8.9 | 0.57 | 5 | 133.0 | 162.2 | 29.2 | 0.017 | Metallurgical |

| 54.6 | 76.2 | 21.6 | 0.58 | 13 | 179.2 | 250.1 | 70.9 | 0.017 | ||

| RH25C-261 | 37.0 | 54.3 | 17.3 | 2.87 | 50 | 121.4 | 178.0 | 56.6 | 0.084 | Metallurgical |

| 68.1 | 76.0 | 8.0 | 0.68 | 5 | 223.4 | 249.5 | 26.1 | 0.020 | ||

| 81.4 | 83.7 | 2.3 | 15.08 | 35 | 267.0 | 274.6 | 7.6 | 0.440 | ||

| RH25C-300 | 69.2 | 72.3 | 3.1 | 0.79 | 2 | 227.1 | 237.2 | 10.1 | 0.023 | Infill |

| RH25C-301 | 6.7 | 9.9 | 3.2 | 0.89 | 3 | 22.0 | 32.4 | 10.4 | 0.026 | Expansion |

| 33.9 | 37.3 | 3.4 | 1.82 | 6 | 111.2 | 122.4 | 11.2 | 0.053 | ||

| RH25C-303 | 5.1 | 8.3 | 3.3 | 0.73 | 2 | 16.6 | 27.3 | 10.7 | 0.021 | Expansion |

| 101.1 | 116.3 | 15.2 | 4.52 | 69 | 331.6 | 381.6 | 50.0 | 0.132 | ||

| inc. | 111.4 | 113.2 | 1.8 | 31.90 | 57 | 365.5 | 371.4 | 5.9 | 0.930 | |

| RH25C-304 | 51.0 | 55.1 | 4.2 | 1.12 | 5 | 167.2 | 180.9 | 13.7 | 0.033 | Expansion |

| RH25C-305 | 67.7 | 74.3 | 6.6 | 0.59 | 4 | 222.1 | 243.9 | 21.8 | 0.017 | Expansion |

| RH25C-307 | 102.7 | 132.9 | 30.2 | 1.43 | 43 | 337.0 | 436.0 | 99.0 | 0.042 | Expansion |

| RH25C-309 | 6.2 | 13.1 | 6.9 | 0.97 | 7 | 20.5 | 43.0 | 22.5 | 0.028 | Expansion |

| RH25C-311 | 18.3 | 32.0 | 13.7 | 1.05 | 14 | 60.0 | 105.0 | 45.0 | 0.031 | Expansion |

| RH25C-313 | 20.0 | 45.7 | 25.7 | 1.74 | 45 | 65.6 | 150.0 | 84.4 | 0.051 | Expansion |

| 53.3 | 56.4 | 3.1 | 0.68 | 2 | 175 | 185.2 | 10.2 | 0.020 | ||

| 89.9 | 103.6 | 13.7 | 1.43 | 20 | 295 | 340.0 | 45.0 | 0.042 | ||

| RH25C-315 | 32.0 | 36.6 | 4.6 | 0.62 | 3 | 105.0 | 120.0 | 15.0 | 0.018 | Expansion |

| 99.5 | 105.3 | 5.8 | 0.82 | 5 | 326.5 | 345.5 | 19.0 | 0.024 |

The table may contain rounding errors.

- Abbreviations in the table include ounces per ton ("oz/ton"); grams per tonne ("g/t"); feet ("ft"); meter ("m"); and gram meters ("g x m").

- True thickness unknown.

- Intervals calculated based on 0.5 g/t Au cut-off and maximum dilution of 3.05 meters.

- The July 7, 2025 Initial Assessment with Cash Flow has an open pit designed with 12.2m (40 ft) benches. The average grade for the Measured and Indicated mine plan is 0.566 g/t Au (0.017 oz/ton). A gram meter of 7 and above has been highlighted in Table 1 based on the bench height and average grade.

- The following condemnation holes drilled at the location of the planned heap leach pad 1 has confirmed no significant gold mineralization: RH25C-269; RH25C-274; RH25C-280

- The following monitoring water well hole drilled outside of the resource area for permitting has confirmed no significant gold mineralization: CC-GW-14

About Dakota Gold Corp.

Dakota Gold is expanding the legacy of the 145-year-old Homestake Gold Mining District by advancing the Richmond Hill Oxide Heap Leach Gold Project to commercial production as soon as 2029, and outlining a high-grade underground gold resource at the Maitland Gold Project, both located on private land in South Dakota.

Subscribe to Dakota Gold's e-mail list at www.dakotagoldcorp.com to receive the latest news and other Company updates.

Shareholder and Investor Inquiries

For more information, please contact:

Jack Henris

President and COO

Tel: +1 605-717-2540

Shawn Campbell

Chief Financial Officer

Tel: +1 778-655-9638

Carling Gaze

VP of Investor Relations and Corporate Communications

Tel: +1 605-679-7429

Email: info@dakotagoldcorp.com

Qualified Person and S-K 1300 Disclosure

James M. Berry, a Registered Member of SME and Vice President of Exploration of Dakota Gold Corp., is the Company's designated qualified person (as defined in Subpart 1300 of Regulation S-K) for this news release and has reviewed and approved its scientific and technical content.

Quality Assurance/Quality Control consists of regular insertion of certified reference materials, duplicate samples, and blanks into the sample stream. Samples are submitted to the ALS Geochemistry sample preparation facility in Winnipeg, Manitoba. Gold and multi-element analyses are performed at the ALS Geochemistry laboratory in Vancouver, British Columbia. ALS Minerals is an ISO/IEC 17025:2017 accredited lab. Check samples are submitted to Bureau Veritas, Vancouver B.C. as an umpire laboratory. Assay results are reviewed, and discrepancies are investigated prior to incorporation into the Company database.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this communication, the words "plan," "target," "anticipate," "believe," "estimate," "intend," "potential," "will" and "expect" and similar expressions are intended to identify such forward-looking statements. Any express or implied statements contained in this communication that are not statements of historical fact may be deemed to be forward-looking statements, including, without limitation: our expectations regarding additional drilling, metallurgy and modeling; our expectations for the improvement and growth of the mineral resources; completion of a feasibility study, and our overall expectation for the possibility of near-term production at the Richmond Hill project. These forward-looking statements are based on assumptions and expectations that may not be realized and are inherently subject to numerous risks and uncertainties, which could cause actual results to differ materially from these statements. These risks and uncertainties include, among others: the execution and timing of our planned exploration activities; our use and evaluation of historic data; our ability to achieve our strategic goals; the state of the economy and financial markets generally and the effect on our industry; and the market for our common stock. The foregoing list is not exhaustive. For additional information regarding factors that may cause actual results to differ materially from those indicated in our forward-looking statements, we refer you to the risk factors included in Item 1A of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, as updated by annual, quarterly and current reports that we file with the SEC, which are available at www.sec.gov. We caution investors not to place undue reliance on the forward-looking statements contained in this communication. These statements speak only as of the date of this communication, and we undertake no obligation to update or revise these statements, whether as a result of new information, future events or otherwise, except as may be required by law. We do not give any assurance that we will achieve our expectations.

All references to "$" in this communication are to U.S. dollars unless otherwise stated.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278854