MONTRÉAL, QC / ACCESSWIRE / 11 août 2022 / Corporation Lithium Éléments Critiques (TSX-V:CRE) (OTCQX:CRECF) (FSE:F12) (« Critical Elements » ou la « Société ») a le plaisir d'annoncer qu'elle a complété une étude d'ingénierie pour une usine d'hydroxyde de lithium monohydraté. Conformément à l'approche prudente et progressive de la Société, l'étude est basée sur une usine de conversion autonome et ne constitue pas un « projet minier » aux fins du Règlement 43-101 sur l'information concernant les projets miniers. De plus, l'usine ne fait pas partie du projet Rose lithium-tantale de la Société qui consiste uniquement en une mine pour produire du concentré de spodumène et de tantale (pour plus de détails, voir le communiqué de presse du 13 juin 2022 annonçant les résultats d'une nouvelle étude de faisabilité positive sur le projet Rose lithium-tantale). En date des présentes, nonobstant les résultats annoncés aujourd'hui, la Société n'est pas en mesure de confirmer qu'une usine d'hydroxyde de lithium monohydraté de haute qualité sera un jour implantée.

Cette étape stratégique pourrait permettre à Critical Elements de devenir un acteur important sur le marché nord-américain du lithium. La réalisation d'études d'ingénierie distinctes et autonomes pour (i) le projet Rose lithium-tantale et (ii) l'usine d'hydroxyde de lithium monohydraté pourrait optimiser les résultats des discussions avec les investisseurs stratégiques potentiels et les utilisateurs finaux.

L'étude est basée sur une production annuelle de 30 670 tonnes d'hydroxyde de lithium monohydraté de haute qualité à partir de 220 587 tonnes de concentré de spodumène acquis seulement sur le marché mondial en vertu de contrats à long terme. L'étude ne s'appuie pas ou n'est basée sur aucun achat de concentré de spodumène du projet Rose lithium-tantale de la Société. Les paramètres d'opération de l'étude d'ingénierie ont été tirés des programmes pilotes conjoints de Metso Outotec et de Critical Elements.

Usine d'hydroxyde de lithium

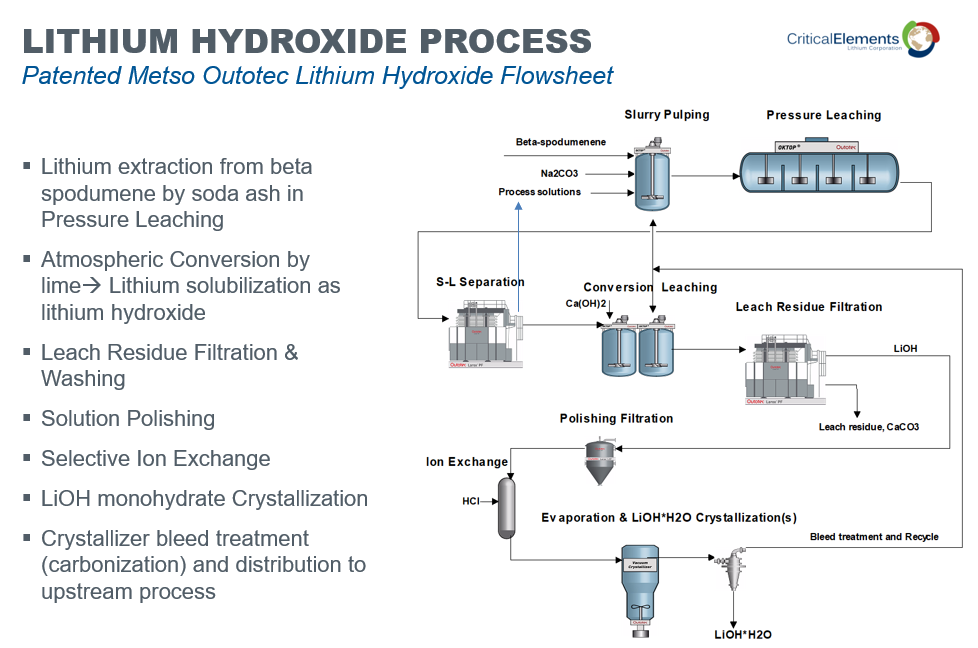

La conception et la technologie de l'usine de traitement de l'hydroxyde de lithium ont été développées par Metso Outotec et se composent de quatre domaines principaux : la calcination, l'hydrométallurgie, préparation des réactifs et les services, et l'emballage du produit final. Les infrastructures du site ont été conçues pour permettre l'exploitation de l'usine de traitement.

La zone de calcination consiste en la conversion du spodumène en un concentré lixiviable. Cette étape est nécessaire avant le procédé hydrométallurgique.

Le système de calcination comprend le séchage et le préchauffage de la matière première dans une étape de préchauffage, la calcination dans un calcinateur à lit fluidisé, le refroidissement du produit dans un refroidisseur à lit fluidisé. Le calcinateur sera alimenté au gaz naturel.

La zone hydrométallurgique inclut les étapes de lixiviation sous pression, de conversion, d'échange d'ions, ainsi qu'un stage de cristallisation pour produire de l'hydroxyde de lithium monohydraté de qualité batterie.

Les technologies de Metso Outotec se traduiront par une usine de production d'hydroxyde de lithium compacte avec une efficacité énergétique optimisée et une faible consommation de produits chimiques pour produire 27 000 tonnes métriques par an de carbonate de lithium équivalent (LCE), ce qui correspond à 30 670 tonnes métriques par an d'hydroxyde de lithium monohydraté (LMH) de qualité batterie.

Figure 1 : Organigramme du processus

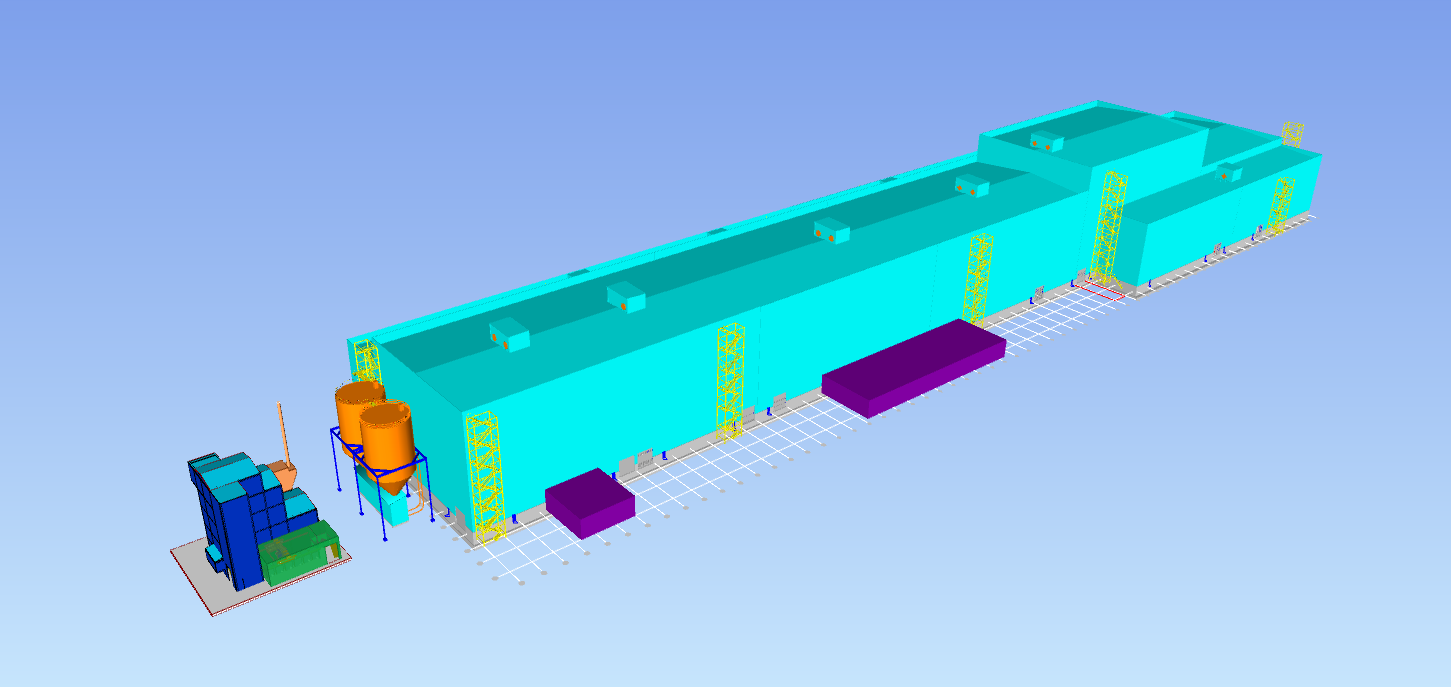

Figure 2 : Vue de l'usine de conversion d'hydroxyde de lithium

Infrastructure

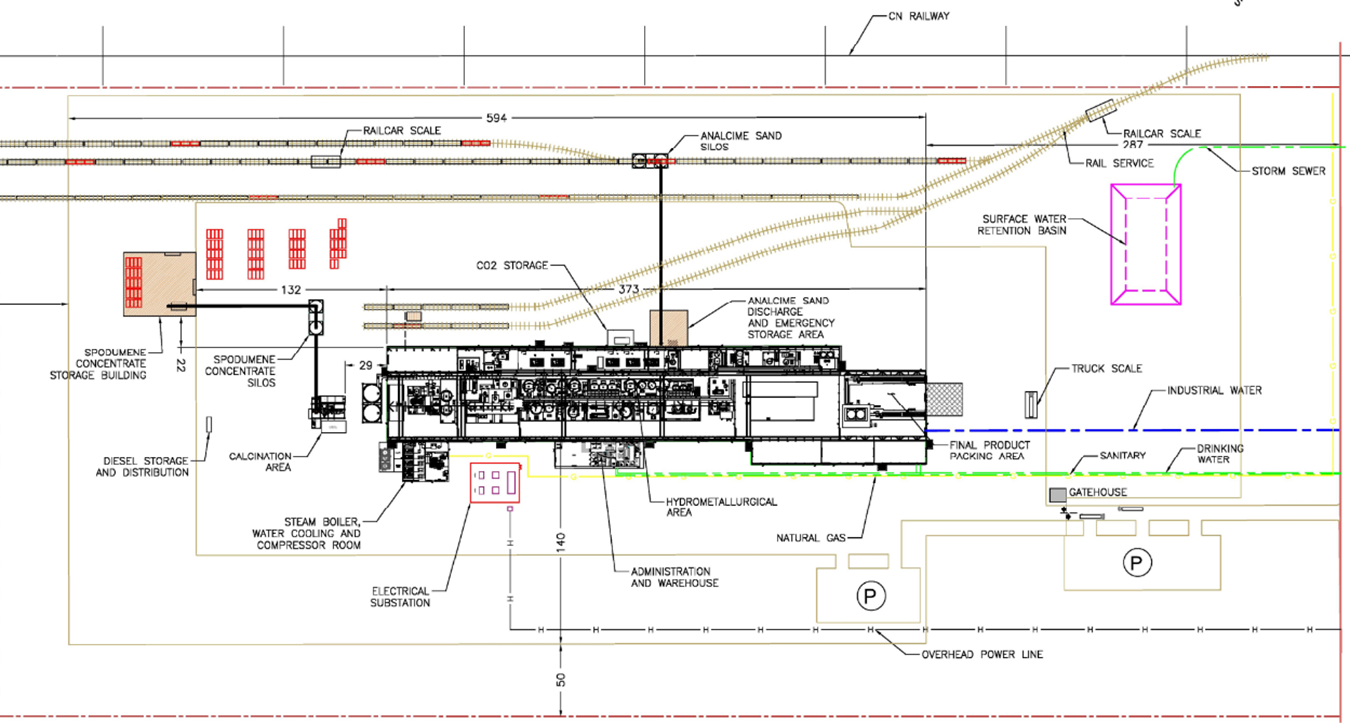

WSP a conçu l'infrastructure supportant le procédé de Metso Outotec conformément aux exigences opérationnelles et aux services de l'usine de traitement pour l'hydroxyde de lithium. Les infrastructures incluent les items suivants :

• Terrassement du site (route, plate-forme industrielle, services enterrés, stationnement, etc.);

• Bâtiment administratif et entrepôt;

• Bâtiment de la chaudière, des compresseurs et de la tour de refroidissement;

• Manipulation et stockage du spodumène;

• Manutention et stockage du sable Analcime;

- Poste électrique.

L'emplacement de l'usine n'a pas encore été identifié. Il y a plusieurs propriétés potentielles disponibles dans la province de Québec, Canada, avec les commodités nécessaires à proximité de l'endroit où l'usine pourrait être construite. L'emplacement de l'usine sur l'une ou l'autre de ces propriétés ne devrait pas avoir d'incidence importante sur les coûts d'investissement et d'exploitation de ce projet. Aux fins de l'étude, l'usine est censée être construite dans le parc industriel de Bécancour sur la rive sud du fleuve Saint-Laurent, à peu près à mi-chemin entre Montréal et Québec. Le parc est situé de l'autre côté du fleuve à partir de Trois-Rivières, une plaque tournante régionale importante sur le fleuve Saint-Laurent offrant un accès central aux autoroutes québécoises et au Corridor maritime du Saint-Laurent.

Figure 3 : Disposition générale de la propriété

En date des présentes, la Société n'est pas en mesure de confirmer qu'une usine d'hydroxyde de lithium monohydraté de haute qualité sera un jour implantée ou qu'elle sera située dans la région de Bécancour.

Coûts

Les coûts préparés pour cette étude sont basés sur une estimation de type Classe 3 telle que définie par la pratique internationale 18R-97 de l'American Association of Cost Engineers (AACE) (Système de classification des estimations de coûts - tel qu'appliqué dans l'ingénierie, l'approvisionnement et la construction dans les industries de transformation). L'estimation du coût en capital présente une précision de +/- 15 % et est basée des coûts du T2 2022.

Metso Outotec a fourni des estimations des coûts pour l'équipement de traitement, l'électrification, l'instrumentation, l'automatisation, la tuyauterie, l'ingénierie et l'assistance technique lors de la mise en service. WSP Canada a estimé le coût en capital de la construction du bâtiment de l'usine en fonction des quantités fournies par Metso Outotec. WSP Canada a estimé le coût en capital de toutes les infrastructures et de tous les équipements du site en dehors des limites de la batterie de l'usine.

Les coûts d'exploitation annuels et unitaires de l'usine de traitement ont été déterminés pour une production annuelle de 30 670 tonnes métriques par an d'hydroxyde de lithium monohydraté (LMH) de qualité batterie. Les coûts d'exploitation estimatifs de l'usine d'hydroxyde de lithium comprennent la main-d'œuvre, les coûts d'électricité, la consommation de gaz naturel, les coûts de l'eau potable et industrielle, les matériaux d'entretien, les coûts de l'équipement mobile et les réactifs. Metso Outotec a fourni la consommation de réactifs et de services sur lesquels WSP Canada a fondé ses coûts respectifs.

Prochaines étapes

Compte tenu des résultats positifs de l'étude, Critical Elements continuera d'évaluer les emplacements possibles d'une future usine potentielle. La Société est engagée dans un processus avec son conseiller financier, Cantor Fitzgerald, afin de trouver un partenaire stratégique pour le projet Rose lithium-tantale et s'efforce de maintenir une flexibilité stratégique qui explique la nature autonome de l'usine d'hydroxyde de lithium monohydraté. En date des présentes, la Société n'est pas en mesure de confirmer qu'une telle usine sera un jour implantée. Jusqu'à ce qu'une entente définitive soit en place avec un groupe stratégique, la stratégie de la Société est de maintenir cette flexibilité.

La Société continue de se concentrer principalement sur le développement du projet Rose lithium-tantale, qui a reçu l'approbation du ministre fédéral de l'Environnement et du Changement climatique sur recommandation du Comité d'évaluation conjointe, composé de représentants de l'Agence d'évaluation d'impact du Canada et du gouvernement de la Nation crie. La Société demeure confiante dans l'obtention d'une approbation similaire dans le cadre du processus d'évaluation environnementale du Québec et croit que l'obtention de l'approbation du Québec pourrait être un catalyseur pour conclure les discussions susmentionnées.

Discussion sur le partenariat stratégique et le financement de projets

Critical Elements continue de travailler en étroite collaboration avec son conseiller financier, Cantor Fitzgerald, pour évaluer l'intérêt continu des partenaires stratégiques mondiaux qui cherchent à accélérer la mise en production du projet Rose lithium-tantale.

Le processus est organisé et compétitif et l'intérêt pour le projet est fort. En parallèle, nous travaillons avec des banques et des institutions financières pour accélérer la partie financement par emprunt du projet.

La Société a eu des discussions avec plusieurs constructeurs automobiles, fabricants de cathodes, maisons de commerce et fabricants de cellules. Un nombre important d'accords de non-divulgation avec des partenaires stratégiques potentiels sont maintenant en place, illustrant la tension concurrentielle sur le marché du lithium. Ces parties sont actuellement en train d'examiner nos nombreuses données dans la salle de données.

Compte tenu de leurs antécédents, les utilisateurs finaux reconnaissent la capacité de la direction de Critical Elements à livrer avec succès des produits au lithium et notre stratégie de développement offre la flexibilité nécessaire pour répondre aux besoins actuels et futurs de tous les principaux utilisateurs finaux.

Consultants

L'étude est l'oeuvre de plusieurs consultants, dont WSP Canada, Metso Outotec et Gerrit Fuelling. Metso Outotec était responsable de la conception et de l'équipement du procédé de calcination du spodumène et de sa conversion au LiOH. La calcination des concentrés a été conçue par Outotec GmbH & Co. d'Allemagne et la conversion hydrométallurgique en LiOH a été conçue par Metso Outotec (Finland) Oy de Finlande.

WSP Canada était responsable de l'infrastructure nécessaire à l'exploitation de l'usine d'hydroxyde de lithium et à l'intégration de l'étude. Gerrit Fuelling a fourni l'étude de marché donnant des indications pour les prévisions de prix pour les concentrés d'hydrate de lithium monohydraté et de spodumène.

L'étude est basée sur une usine de conversion autonome et ne constitue pas un « projet minier » aux fins du Règlement 43-101 sur l'information concernant les projets miniers. De plus, l'usine ne fait pas partie du projet Rose lithium-tantale de la Société qui consiste uniquement en une mine de production de concentré de spodumène et de tantale. En date des présentes, nonobstant les résultats annoncés aujourd'hui, la Société n'est pas en mesure de confirmer qu'une usine d'hydroxyde de lithium monohydraté de haute qualité sera un jour implantée.

À propos de Critical Elements Lithium Corporation

Critical Elements aspire à devenir un fournisseur responsable de lithium aux industries florissantes des véhicules électriques et des systèmes de stockage d'énergie. À cette fin, Critical Elements fait progresser le projet de lithium de haute pureté Rose situé au Québec et détenu en propriété exclusive par la Société. Rose est le premier projet de lithium de la Société à être avancé dans un portefeuille de terrains de plus de 700 kilomètres carrés. Le 13 juin 2022, la Société a annoncé les résultats d'une étude de faisabilité sur Rose pour la production de concentré de spodumène. Le taux de rendement interne après impôts du Projet est estimé à 82,4 %, avec une valeur actualisée nette après impôts estimée 1,915 milliards US$ à un taux d'actualisation de 8 %. Du point de vue de la Société, le Québec est stratégiquement bien positionné pour les marchés des États-Unis et de l'UE et dispose d'excellentes infrastructures, notamment un réseau électrique à faible coût et à faible émission de carbone contenant 93 % d'hydroélectricité. Le Projet a reçu l'approbation du ministre fédéral de l'Environnement et du Changement climatique sur la recommandation du Comité d'évaluation conjoint, composé de représentants de l'Agence d'évaluation d'impact du Canada et du gouvernement de la Nation Crie; la Société travaille à obtenir une approbation similaire dans le cadre du processus d'évaluation environnementale du Québec. La Société a aussi une bonne relation avec la Nation Crie.

Pour plus d'informations, veuillez contacter :

Patrick Laperrière

Directeur des relations aux investisseurs

et développement corporatif

514-817-1119

plaperriere@cecorp.ca

www.cecorp.ca

Jean-Sébastien Lavallée, P. Géo.

Chef de la direction

819-354-5146

jslavallee@cecorp.ca

www.cecorp.ca

Ni la Bourse de croissance TSX ni son fournisseur de services de réglementation (tel que ce terme est

décrit dans les politiques de la Bourse de croissance TSX) n'acceptent la responsabilité de la

pertinence ou de l'exactitude de ce communiqué.

Mise en garde concernant les déclarations prospectives

Ce communiqué de presse contient des « informations prospectives » au sens de la législation canadienne sur les valeurs mobilières. En règle générale, les informations prospectives peuvent être identifiées par l'utilisation de termes prospectifs tels que « prévu », « anticipe », « s'attend à » ou « ne s'attend pas à », « est prévu », « prévu », « ciblé », ou « croit », ou des variantes de ces mots et phrases ou déclarations que certaines actions, événements ou résultats « pourraient », ou « seraient », « se produisent » ou « seront atteints ». Les informations prospectives contenues dans les présentes comprennent, sans s'y limiter, des déclarations concernant les futurs plans de la Société concernant le projet d'usine d'hydroxyde de lithium monohydraté (l'« usine ») ; modalités de financement potentielles; la production prévue d'hydroxyde de lithium monohydraté et les méthodes de traitement connexes ; le moment prévu d'une décision finale d'investissement, les activités de construction et la date potentielle de mise en service de la centrale ; les caractéristiques prévues du futur site de l'Usine et les avantages attendus de celui-ci ; les opinions, les croyances et les attentes de Critical Elements concernant la stratégie commerciale de la Société, les opportunités et les projets de développement et d'exploration, ainsi que les plans et les objectifs de gestion des opérations et des propriétés de la Société.

Les informations prospectives sont basées sur certaines estimations, attentes, analyses et opinions de la Société et, dans certains cas, d'experts tiers, que la direction de Critical juge raisonnables au moment où elles ont été faites. Ces informations prospectives ont été dérivées en utilisant de nombreuses hypothèses concernant, entre autres, l'offre et la demande, les livraisons et le niveau et la volatilité des prix des produits au lithium intermédiaires et finaux, la croissance, la performance et les opérations commerciales prévues, les futures prix des matières premières et les taux de change, les perspectives et les opportunités, les conditions commerciales et économiques générales, les résultats du développement et de l'exploration, la capacité de Critical Elements à se procurer les fournitures et autres équipements nécessaires à son activité. La liste qui précède n'est pas exhaustive de toutes les hypothèses qui peuvent avoir été utilisées dans l'élaboration des informations prospectives. Bien que Critical considère ces hypothèses comme raisonnables sur la base des informations actuellement disponibles, elles peuvent s'avérer incorrectes. Les informations prospectives ne doivent pas être interprétées comme une garantie de performances ou de résultats futurs.

Bien que Critical Elements ait tenté d'identifier des facteurs importants qui pourraient faire en sorte que les résultats réels diffèrent sensiblement de ceux contenus dans les informations prospectives, d'autres facteurs peuvent faire en sorte que les résultats ne soient pas ceux anticipés, estimés ou prévus. Les facteurs qui peuvent faire en sorte que les résultats réels diffèrent sensiblement des résultats attendus décrits dans les informations prospectives comprennent, sans s'y limiter : la capacité de la Société à accéder au financement nécessaire pour investir dans les opportunités et les projets disponibles (y compris l'usine proposée) et à des conditions satisfaisantes, les impacts négatifs actuels et potentiels de la pandémie de COVID-19, y compris les futures épidémies et toutes les politiques ou restrictions associées sur les activités, le risque que Critical ne soit pas en mesure de respecter ses obligations financières à leur échéance, les variations des prix des produits de base et autres, la capacité de Critical Elements à retenir et à attirer du personnel qualifié et à obtenir des matières premières auprès de fournisseurs tiers, des événements imprévus et d'autres difficultés liées à la construction, au développement et à l'exploitation de l'usine, le coût de la conformité aux lois et réglementations environnementales et autres, actuelles et futures, les vices de titre, la concurrence des concurrents existants et nouveaux, les variations des taux de change, les prix du marché des titres de Critical Elements, ainsi que les facteurs de risque énoncés dans le rapport de gestion de la Société pour son plus récent trimestre terminé le 31 mai 2022 et d'autres documents d'information disponibles sous le profil SEDAR de la Société à www.sedar.com. Les informations prospectives contenues dans les présentes sont faites à la date de ce communiqué de presse et Critical Elements décline toute obligation de mettre à jour toute information prospective, que ce soit à la suite de nouvelles informations, d'événements ou de résultats futurs ou autrement, sauf si requis par lois sur les valeurs mobilières.

SOURCE :Corporation Lithium Éléments Critiques

View source version on accesswire.com:

https://www.accesswire.com/711733/CRITICAL-ELEMENTS-ANNONCE-UNE-TUDE-DINGNIERIE-POSITIVE-POUR-UNE-USINE-DHYDROXYDE-DE-LITHIUM-MONOHYDRAT