(TheNewswire)

Calgary, Canada TheNewswire - September 7, 2022 Crestview Exploration Inc. ( CSE:CRS ) ( Frankfurt:CE7 ) (" Crestview " or "the Company") is pleased to announce it has entered into an option agreement (the "Agreement") with the Falcon Mine Group (" FMG "), whereby Crestview has optioned to purchase 100% of the Falcon Project (" Falcon " or the " Property ").

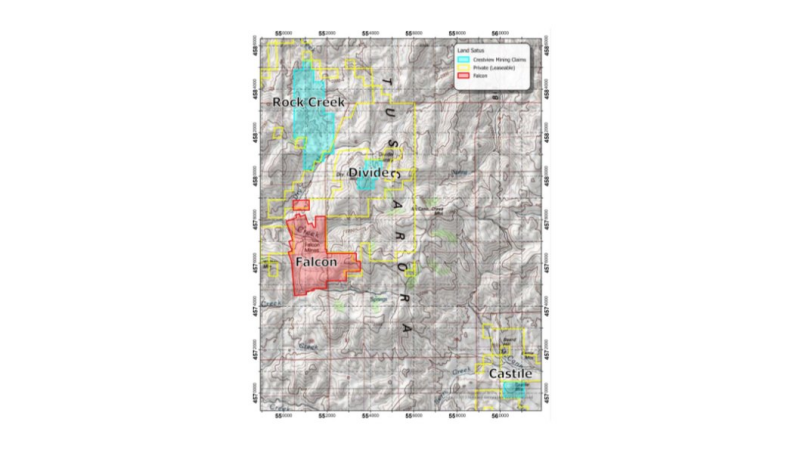

The Falcon project comprises eighty-seven (87) unpatented lode claim and six (6) patented claims associated with the historic Falcon mine. According to "in house" historical reports, "[t]he Falcon Mine was discovered in 1876 and produced high-grade ore, averaging 100 opt (ounces per ton) silver, until 1891" (Brian Bond, 2010 – Preliminary Geological Report, Falcon Claim Block). The property is situated just 2 km's south of Crestview's flagship Rock Creek prospect and a similar distance southwest of Crestview's Divide prospect (see Map 1), placing all three properties in close proximity for a total of 189 claims.

MAP 1

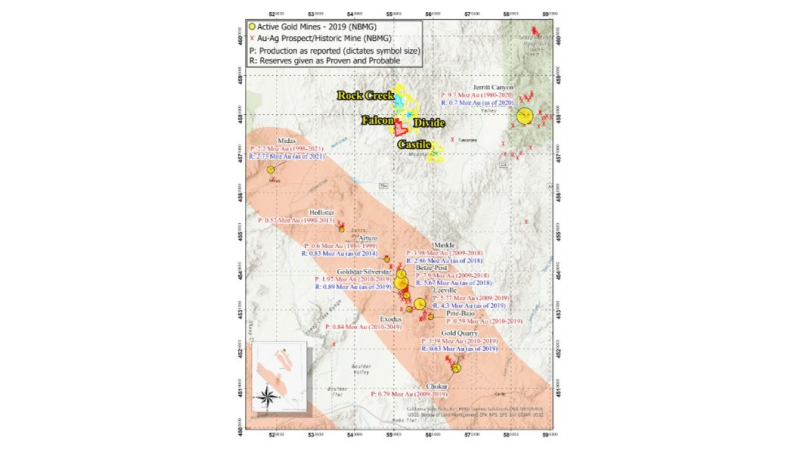

Crestview's Tuscarora district play (Rock Creek, Divide, Castile, and now Falcon) is in a highly prospective, prolific gold region (see Map 2). The properties are surrounded on three sides by giant, "world-class" gold deposits and mines, including the Midas mine, approximately 35 km's to the west-southwest, which has produced more than 2.2 Moz Au and 26.9 Moz Ag with proven and probable reserves of an additional 2.73 Moz Au and 199.92 Moz Ag from an epithermal Ag (Au) deposit (Hecla Mining Company Website – 2022); the Goldstrike operation, approximately 45 km's south, which includes both the Betze-Post open pit and the Meikle underground mine and boasts a combined 11.88 Moz Au production with an additional 8.53 Moz Au of proven and probable reserves from a Carlin-type gold deposit (Technical Report on the Goldstrike Mine, Eureka and Elko Counties, State of Nevada, USA NI 43-101 Report – 2019); and the Jerritt Canyon mine, approximately 30 km's to the east (further from the Carlin Trend than the Tuscarora properties), which has produced an incredible 9.7 Moz Au from a Carlin-type gold deposit (Technical Report on the Jerritt Canyon Mine, Elko County, Nevada, USA Report for NI 43-101 – 2021), with continued exploration ongoing.

MAP 2

The Falcon property occurs in the southwest portion of an Eocene-aged caldera complex, hosted in a sequence of Devonian sedimentary rocks overlain by andesitic, dacitic, and rhyolitic volcanic rocks of the Tuscarora volcanic field (Roney Long, 2000 – The Falcon Mine Project). Our exploration concept at Falcon is very similar to and consistent with our targeting model at Rock Creek and Divide. The historic production and exploration at Falcon focused on silver mineralization in epithermal veins in the upper volcanic sequence. As with the Rock Creek and Divide properties, previous work at the Falcon prospect resulted in stratigraphic interpretations of the surface metasedimentary sequence which indicate the possibility of a Carlin-type host rock at relatively shallow depths (Roney Long, 2000 – The Falcon Mine Project). As such, we envision both shallow, high grade silver vein targets and deeper, disseminated Carlin-type Au (Ag) targets at Falcon.

Chris Wensley, Crestview's CEO, commented "The Falcon project is an important strategic addition to our other Tuscarora prospects, greatly expanding our footprint in the region. The Falcon prospect lies just over a mile south of the Rock Creek and Divide properties creating additional synergy with our exploration program and greatly enhancing our chances for success."

The terms of the agreement are as follows: 1.5% Net Smelter Royalty (NSR); payment of $500,000 (US$); and 2,000,000 CRS shares payable as follows:

* Initial payment of $10,000 within 10 days after the Effective Date

* 1 st Anniversary of $40,000 and 200,000 CRS shares on or before December 15, 2023

* 2 nd Anniversary of $75,000 and 300,000 CRS shares on or before December 15, 2024

* 3 rd Anniversary of $100,000 and 400,000 CRS shares on or before December 15, 2025

* 4 th Anniversary of $125,000 and 500,000 CRS shares on or before December 15, 2026

* 5 th Anniversary of $150,000 and 600,000 CRS shares on or before December 15, 2027, upon which the Option Exercise will be complete

The Agreement provides that Crestview will conduct a minimum of $250,000 of exploration activities over the term of the option agreement. The agreement also provides a buyout option of the 1.5% NSR for an additional $2,000,000. The Option Agreement is conditional upon Crestview being satisfied as to the interest in the Property held by Optionor; receipt by Crestview of data, records and other information to allow Crestview to conduct Exploration of the Property; and receipt of Canadian Securities Exchange approval.

This News Release was prepared by J.A. Lowe, M.Sc. Geology, and has been approved by Brian T. Brewer, M.Sc., CPG #11508.

Brian T. Brewer is a Qualified Person as defined by NI 43-101 and has reviewed the scientific and technical disclosure included in this news release.

On Behalf of the Board of Directors,

Chris Wensley, CEO

About Crestview Exploration Inc:

Crestview Exploration is an experienced exploration company focused on the exploration and development of its portfolio of gold and silver properties located in prolific mining districts of Nevada.

Crestview's Rock Creek, Divide, Falcon, and Castile Mountain properties are situated in the Tuscarora Mountains of northern Elko County, Nevada. The company's Tuscarora properties total 6 patented and 196 u npatented lode mining claims, and comprise areas with local historic production and limited modern exploration.

The Cimarron project is located in the San Antonio Mountains of Nye County, Nevada, and is comprised of 31 unpatented lode mining claims, including control of 6 historically producing claims associated with the historic San Antonio mine.

For further information please contact:

Chris Wensley, Chief Executive Officer

Tel: 1-778-887-3900

Email: Chris@crestviewexploration.com

Forward-Looking Information

This news release includes certain information that may be deemed "forward-looking information" under applicable securities laws. All statements in this release, other than statements of historical facts, that address acquisition of the Property and future work thereon, mineral resource and reserve potential, exploration activities and events or developments that the Company expects is forward-looking information. Although the Company believes the expectations expressed in such statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the statements. There are certain factors that could cause actual results to differ materially from those in the forward-looking information. These include the results of the Company's due diligence investigations, market prices, exploration successes, continued availability of capital financing, and general economic, market or business conditions, and those additionally described in the Company's filings with the Canadian securities authorities.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking information. For more information on the Company, investors are encouraged to review the Company's public filings at www.sedar.com. The Company disclaims any intention or obligation to update or revise any forward- looking information, whether as a result of new information, future events or otherwise, other than as required by law .

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS REGULATION SERVICES PROVIDER HAS REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

Copyright (c) 2022 TheNewswire - All rights reserved.