(TheNewswire)

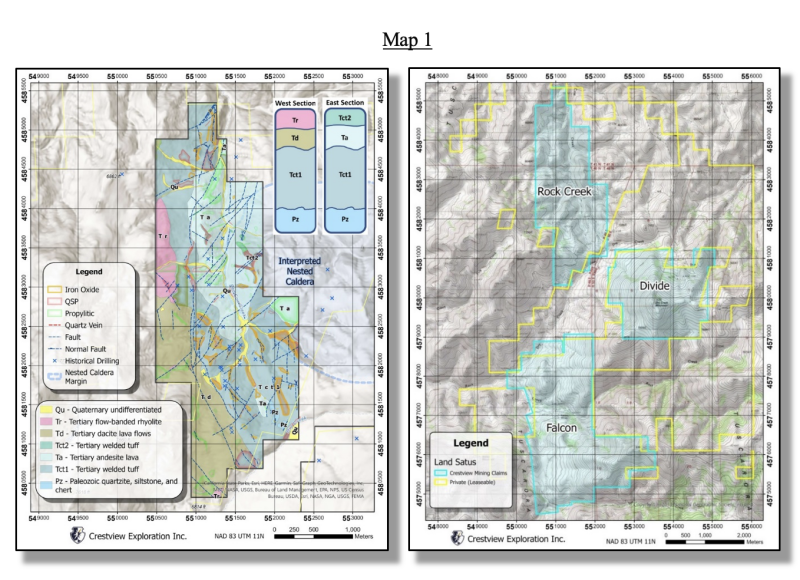

Calgary, Canada December 13, 2022 TheNewswire - Crestview Exploration Inc. ( CSE: C RS ) ( Frankfurt:CE7 ) ("Crestview" or "the Company") is pleased to announce the results from the 2022 mapping campaign at the Rock Creek gold prospect in the Tuscarora Mountains of Elko County, Nevada. These results include the completion of the geology map and overlays, detailed descriptions of structures and mapped units, and alteration and mineralization observations and interpretations. A digitized and simplified version of the geology map is attached below (Map 1).

The mapping project accomplished several key goals, including:

-

A base map of surface features to guide drill targeting and better understand geophysical results, by

-

Identifying and delineating the mineralized and unmineralized surface lithologies

-

Modelling the strength and distribution of alteration features

-

An updated and more accurate model of veins and structures controlling surface mineralization

The mapping project was completed at the 1:2,000 scale, producing five folios with three geological overlays (geology, alteration, and Fe oxides) that were used to generate the South, Central, West, North and North End interpretive folios. S cans of the original (hand-drawn) interpretive folios and field progress reports will be available on the company website at www.crestviewexploration.com .

As a reminder to the reader, the Rock Creek property consists of 74 unpatented lode mining claims, but is in close proximity to (as near as currently possible) Crestview's Divide and Falcon properties which comprise an additional 186 claims, for a total of approximately 2,009 hectares or 4,965 acres between the three. Small historical prospecting occurred at all three properties, and more extensive historic mining occurred at Falcon and Divide. At Rock Creek, there was also some historic drilling which confirmed anomalous precious metal values; however, none of these holes penetrated deeper than 500 ft (Unpublished report by Cruson and Limbach, 1985).

The property is located within the Eocene Big Cottonwood Canyon caldera in the Tuscarora volcanic field, hosting low sulfidation epithermal quartz veins with precious metal mineralization. The Big Cottonwood Canyon caldera complex consists of multiple episodes of rhyolitic ash-flow tuff and lava flows of andesitic to dacitic composition. The mapping at Rock Creek concurs with the geological views of Henry and Boden (1998) on the general evolution of the Big Cottonwood Canyon Caldera.

MAPPED ROCK UNITS

On the accompanying maps, the ash-flow tuff of Big Cottonwood Canyon isbroken into an lower and upper unit (Tct1 and Tct2), which are separated by a thin andesitic lava flow (Ta).The lower ash-flow tuff unit (Tct1) is the main host for quartz veins at the property. The unit is a weakly to moderately lithic, densely to moderately welded ash-flow tuff with abundant fiamme. In altered samples, plagioclase and biotite are generally removed resulting in pitted textures. Lithic fragments are small ( are found in several locations.

Overlying this unit is an unaltered to propylitic altered, dark to light greenish porphyritic plagioclase andesite lava flow (Ta). These andesites range from hornblende to plagioclase dominant, with low content in biotite (

Outcropping in topographic highs in the central portion of the property, an upper ash-flow rhyolitic tuff unit with 5-7% coarse lithic fragments (Tct2) overlies the andesites. This may be an indication of near- vent facies and a small nested caldera within the larger caldera. Sparse and small NE-trending quartz veins cut the Tct2 tuffs.

Field observations suggest that the dacite lava flows (Td) along the southern and central borders of the Rock Creek property overlie the lithic-rich ash-flow tuffs of Tct1. The dacite is medium-grained with clear plagioclase phenocrysts (15%), scarce quartz (

The last eruptive episode(s) is represented by a small eruption(s) of rhyolitic lava(s) from several plugs (Tr), which may have occurred between 35 and 33 Ma based on nearby radiometric dating (Ar-Ar; Henry and Boden, 1998). The rhyolite is light- tan/pinkish colored with a strong flow banding foliation. The Tr unit is weakly altered to propylitic-c assemblage (Hudson, 2003).

The oldest and deepest unit mapped at Rock Creek is the Paleozoic metasedimentary sequence (Pz), which is comprised of intensely fractured and folded quartzite/quartzarenite, metasiltstone, and chert. The Pz unit was mapped in small, structurally controlled outcrops in the southern portion of the property. The Pz rocks feature abundant Fe-oxides along fractures and quartz veins with late quartz vein stockworks.

STRUCTURES, ALTERATION AND QTZ VEINS

The faults and quartz veins delineate major structural trends of mineralization and alteration at Rock Creek. The quartz veins occur in several structural systems that dominate the entire Rock Creek property. In the field, these structures can be traced for a few to a few hundred meters, with greater strike lengths interpreted from aerial imagery. Most of the structures/veins have well-developed slickensides with apparent normal and oblique slips. The width of the vein systems is variable, up to 140 meters.

The structural trends are NE (with a minor NNE component), NS and NW -trending with moderate to high dips. In general, NE-trending faults are the younger structures, cutting NS and NW-trending structures. The oblique-slip movements of the primary NNE-system may have caused the development of NS and NNW dilational/extensional fractures/veins between the primary fractures. Ta dikes may be aligned to the NE-trending fractures in the Central Folio. Lastly, there is a discrete East-West fracture fabric that cuts all the former structures.

The fractured-controlled alteration envelopes at Rock Creek are small, decreasing outward from the hanging-wall section of the main structures. In general, textures are preserved within the alteration envelopes. Three main alteration types have been identified within the mapping area, including silicification, quart+sericite/illite± pyrite (QSP), and propylitization.

Mineralized quartz veins are primarily hosted in the lower ash-flow tuff unit (Tct1) at Rock Creek. Quartz veins exhibit multiple phases of growth and emplacement in faults, with frequent post-mineral brecciation affecting both the host rocks and veins. The veins have a sharp boundary with the host rock, with variable widths ranging from centimeter-scale up to ten meters. The quartz vein textures observed include crustiform, cockade, comb, and massive. Lattice quartz textures were observed in a few localities, indicating shallow boiling and (probable) precious metals deposition. Late, cross-cutting stockwork quartz veinlets are a common feature in most veins.

Quantitative data from fluid inclusions from quartz veins in the Tuscarora mining district (Castor et al., 2003; Henry et al., 1998) suggest shallow depths of vein formation (200 to 400 meters), which agrees with the textures and alteration patterns observed during field mapping.

The original pyrite content is estimated between one to three percent. Late Fe-oxides (jarosite and hematite) and euhedral barite fill cavities and late fractures.

Field mapping, aerial photo lineaments, and magnetic anomalies suggest a nested caldera within the older Big Cottonwood Canyon caldera. The nested caldera is an oval structure having a diameter of about 3 km. Within the property, plagioclase andesitic flows (Ta) and the lithic-rich ash-flow tuff unit Tct2 were emplaced along the western margins of the caldera. Aeromagnetic data shows three magnetic highs toward the west margin of the nested caldera; these magnetic highs may be the result of stacked plagioclase andesite flows, and the presence of andesitic intrusion(s) at depth.

A small siliceous, unmineralized sinter was mapped at the north end of the property, near the intersection zone of a NE and N-striking structures.

CONCLUSIONS

The mapping at the Rock Creek property has revealed the presence of low grade but laterally extensive precious metals mineralization controlled by NNW, NS, and NNE-trending, high to low angles faults and fractures. The mineralization is primarily hosted in the intracaldera Tct1 ash-flow tuffs.

The interpretation that caldera ring fracture zones and cymoid loops had a major control on mineralization opens an additional area for further exploration in the nested caldera within the property.

A follow-up hyperspectral imaginary survey is recommended at Rock Creek to delineate alteration zonation of clays and carbonates and the orientation of potential ore-bearing structures.

REFERENCES

Castor, S., et al., 2003. The Tuscarora Au-Ag District: Eocene Volcanic-Hosted Epithermal Deposits in the Carlin Gold Region, Nevada: Economic Geology, Vol.98, 339-366.

Cruson, M. and F. Limbach, 1985. Progress Report Cow Creek Prospect Elko County, Nevada. Unpublished Report.

Henry, C. et al (1998), Geology and Mineralization of the Eocene Tuscarora Volcanic Field, Elko County, Nevada: US Geological Survey Open Files Report 98-338.

Henry, C. et al. (1998), Geology of the Mount Blitzen Quadrangle: Nevada Bureau of Mines , Map 110.

Hudson, D. (2003), Epithermal Alteration and Mineralization in the Comstock District, Nevada, Economic Geology Vol. 98, pp.367-385.

Marma, J. and Vance, R. (2010), Importance of cymoid loops and implications for exploration and development of epithermal gold-silver veins in the Gold Circle district, Midas, Nevada, Great Basin Evolution and Metallogeny, 2010 Symposium, pp.777-793.

This News Release was prepared by J.A. Lowe, M.Sc. Geology and J. Ruiz, M.Sc. Geology, and has been approved by Alan Morris, M.Sc., CPG #10550.

Alan J. Morris is a Qualified Person as defined by NI 43-101 and has reviewed the scientific and technical disclosure included in this news release.

On Behalf of the Board of Directors,

Chris Wensley, CEO

About Crestview Exploration Inc:

Crestview Exploration is an experienced exploration company focused on the exploration and development of its portfolio of gold and silver properties located in prolific mining districts of Nevada.

The Rock Creek gold project is Crestview's flagship asset, with 74 unpatented lode mining claims wholly owned and controlled by CRS. The Rock Creek property was acquired in 2017, and the company went public in 2019. Emboldened by the results coming out of Rock Creek, Crestview strategically expanded on the land position with the acquisition of the nearby Divide Mine prospect in April 2020, and the acquisition of the Falcon silver-gold prospect in September 2022. Between the three properties, all targeting similar mineralization and likely the same hydrothermal system, Crestview now holds 260 total claims in close proximity of one another. These three gold prospects, along with the nearby Castile prospect, are situated in a region with proven "world class" gold deposits (including Midas, Jerritt Canyon, Betze-Post, Meikle, and Gold Quarry), where the potential of finding large, high-grade gold-silver deposits is favourable.

The Cimarron project is located in the San Antonio Mountains of Nye County, Nevada, and is comprised of 31 unpatented lode mining claims, including control of 6 historically producing claims associated with the historic San Antonio mine. The property is located in the prolific Walker-Lane trend, approximately 44 kms south of the "world class" Round Mountain deposit.

For further information please contact:

Chris Wensley, Chief Executive Officer

Tel: 1-778-887-3900

Email: Chris@crestviewexploration.com

Forward-Looking Information

This news release includes certain information that may be deemed "forward-looking information" under applicable securities laws. All statements in this release, other than statements of historical facts, that address acquisition of the Property and future work thereon, mineral resource and reserve potential, exploration activities and events or developments that the Company expects is forward-looking information. Although the Company believes the expectations expressed in such statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the statements. There are certain factors that could cause actual results to differ materially from those in the forward-looking information. These include the results of the Company's due diligence investigations, market prices, exploration successes, continued availability of capital financing, and general economic, market or business conditions, and those additionally described in the Company's filings with the Canadian securities authorities.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking information. For more information on the Company, investors are encouraged to review the Company's public filings at www.sedar.com. The Company disclaims any intention or obligation to update or revise any forward- looking information, whether as a result of new information, future events or otherwise, other than as required by law .

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS REGULATION SERVICES PROVIDER HAS REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

Copyright (c) 2022 TheNewswire - All rights reserved.