NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWS WIRES

Nevada Silver Corporation ("NSC" or the "Company") (TSXV:NSC) is pleased to provide an update on its 100% owned subsidiary North State Manganese Inc ("North Star") and the Emily Manganese Project ("Emily"). Emily is in the Cuyuna Iron Range, Crow Wing County, Minnesota and was the subject of a June 2020 NI 43-101 mineral resource estimate by Barr Engineering Company (Table 1)1

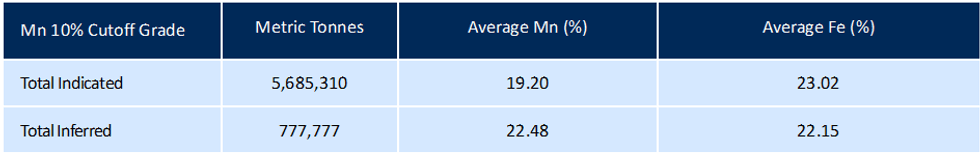

TABLE 1: NI 43-101 COMPLIANT INDICATED AND INFERRED MINERAL RESOURCE ESTIMATE

Review of NI 43-101 resource drill data highlights high-grade intersections

North Star recently commissioned a review of drilling and other technical data contained within the Barr Engineering mineral resource estimate. A number of high-grade drill intersections were identified within thicker zones of mineralization2, including:

- Drill hole VC-01-11: 33.68 meters from 70.56 meters @ 16.93% Mn

- Including 8.99 meters @ 34.58% Mn; and

- Including 1.07 meters @ 50.10% Mn

- Drill hole AC-01-11: 36.88 meters from 135.02 meters @ 9.98% Mn

- Including 7.47 meters @ 29.48% Mn; and

- Including 1.52 meters @ 43.00% Mn

- Drill hole AC-02-11: 19.5 meters from 70.1 meters @ 18.5% Mn

- Including 8.84 meters @ 32.94% Mn; and

- Including 6.10 meters @ 39.33% Mn; and

- Including 3.05 meters @ 45.74% Mn

- Drill hole AC-04-12: 9.0 meters from 137.2 meters @ 17.6% Mn

- Including 4.47 meters @ 24.47% Mn (Figure 1)

A summary of intersections of the drill holes included in the Barr Engineering NI 43-01 Technical Report is contained in the appendix.

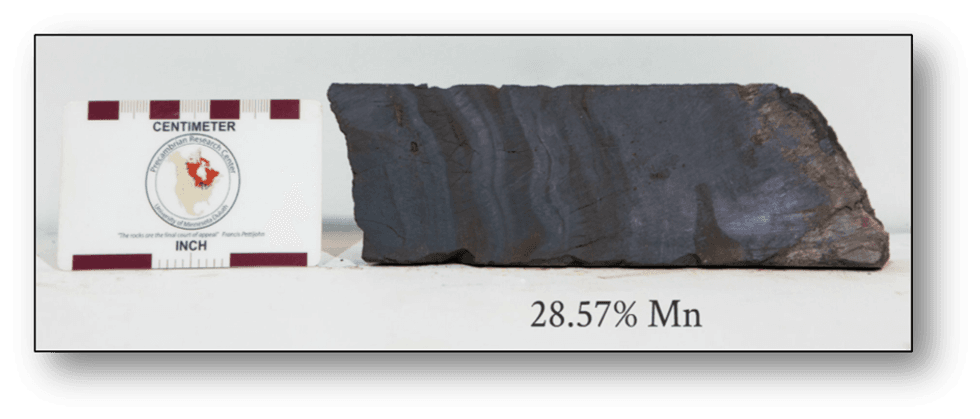

FIGURE 1: DRILL HOLE AC-04-12 SHOWING HIGH-GRADE BANDED MANGANESE OXIDES BETWEEN 144.6-144.8 METERS (28.57% Mn)

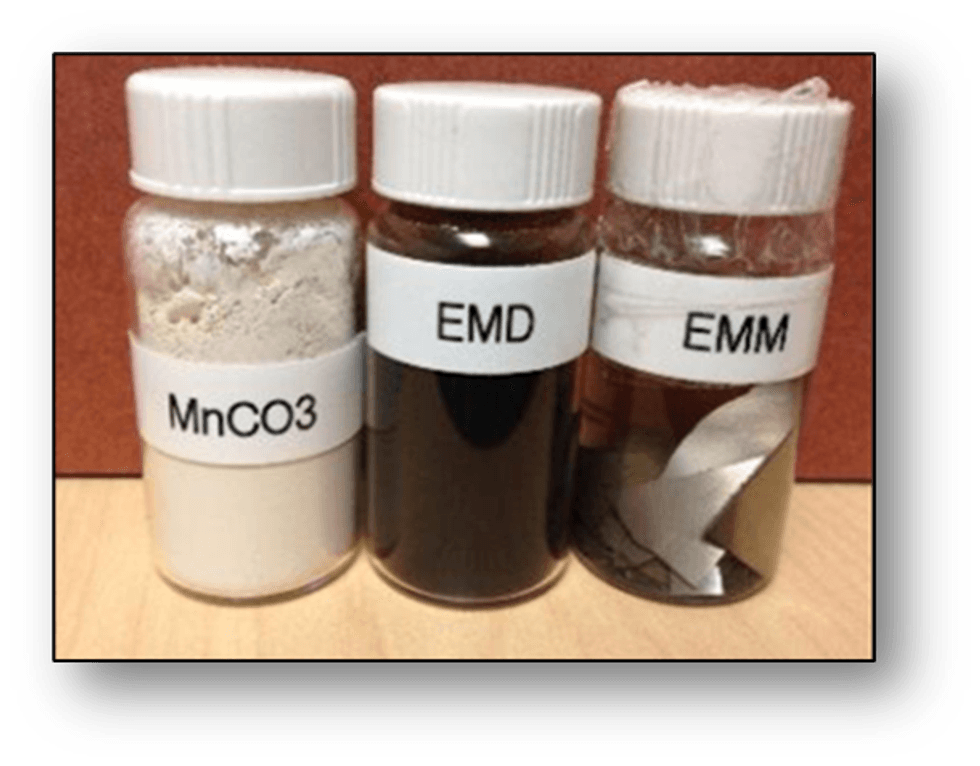

Historical metallurgical work at Emily was undertaken by Montana Tech, of the University of Montana, Coleraine Minerals Research Laboratory, Hazen Research, Inc., Outotec, USA, and Kemetco Research, Inc. North Star is presently updating the metallurgical tests performed by Kemetco on samples from the Emily deposit. Historic samples were successfully upgraded to produce MnCO3 (manganese carbonate), EMD (electrolytic manganese dioxide - MnO2) and EMM (electrolytic manganese metal - Mn) (Figure 2).

FIGURE 2: MANGANESE CHEMICALS PRODUCED BY KEMETCO FROM EMILY SAMPLES

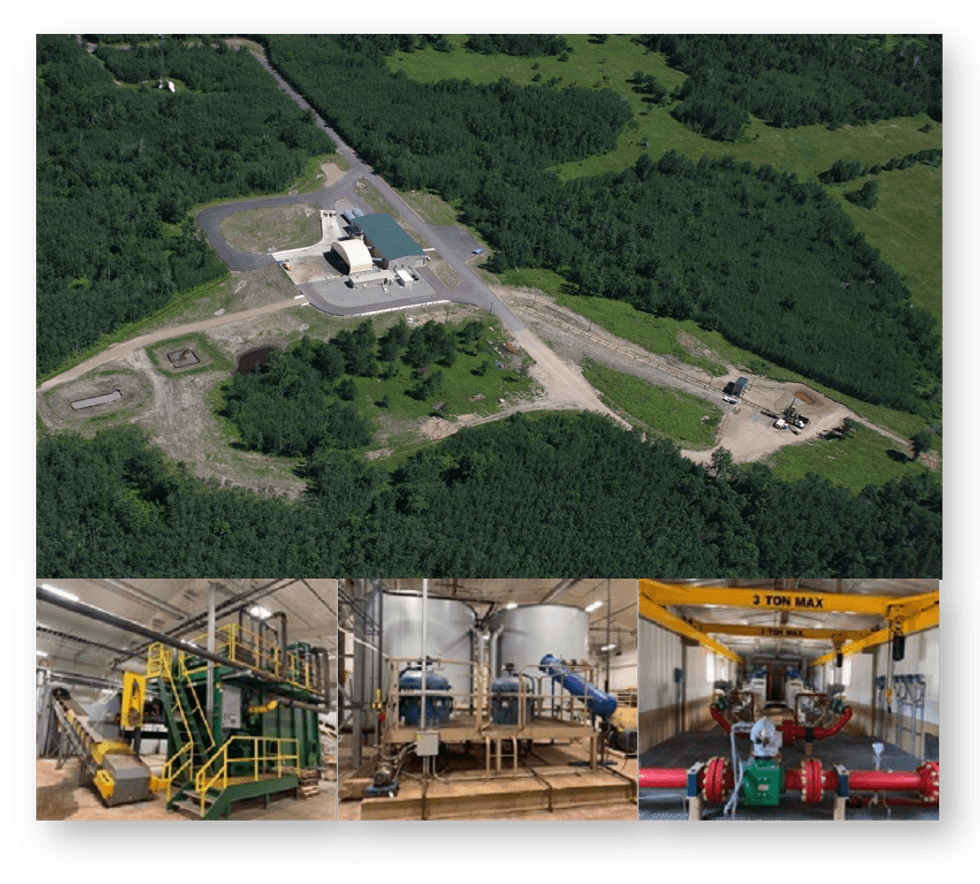

Emily is well located near regional industrial centers (iron mining and processing) with major transportation linkages (road, rail and shipping). In addition to its ownership and management rights, North Star also has exclusive surface leases and operational rights to the structures and facilities located at Emily (Figure 3).

Building A High-Purity Manganese Supply Chain In North America

It is North Star's ultimate aim is to produce high-purity manganese products for North American technology and energy markets. There are currently no producing manganese mines in the USA or Canada, and manganese is on the strategic metals list in both countries.

Manganese is a critical component to the lithium-ion battery (Li-B) supply chain, being used in two of the most prominent batteries in production, i.e., Nickel Lithium Manganese Oxide (LMO) and Manganese Cobalt (NMC) batteries. Within LMO batteries, there is approximately 61% manganese in the cathode, while in the NMC battery, manganese constitutes 20-30% of the total cathode material3. BASF recently unveiled ambitious plans to boost investment in battery cathode active materials (CAM), including a new family of manganese-rich products. Volkswagen and Tesla have each announced plans to mass produce a new battery that requires a high proportion of manganese with no cobalt (Tesla at ~ 33% Mn, and VW over 50% Mn)4.

"We believe the high-purity manganese market will be driven by the demand for these specialized products over the next decade" commented NSC's CEO Gary Lewis. "This is line with the North Star's aspiration to capture significant value of the supply chain for high-purity manganese products, from raw material extraction and product upgrading, through chemical processing and high-purity manganese sales in the North American marketplace."

FIGURE 3: SITE WORKS AND INFRASTRUCTURE AT THE EMILY PROJECT

Corporate update

The Company is continuing to assess options for the commercialization of the Emily Manganese Project to the benefit of NSC shareholders. Alternatives under investigation include potential joint venture arrangements and / or the spinning-out of North Star into a standalone listed entity. NSC will provide a further update early in the new year.

Qualified Person

The scientific and technical data contained in this news release was reviewed and approved by Ian James Pringle PhD, who is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

For further Information please contact:

Gary Lewis

Group CEO & Director

Phone: +1 (416) 941 8900

Email: gl@nevadasilvercorp.com

About Nevada Silver Corporation

Nevada Silver Corporation (TSXV: NSC) is a multi-commodity resource company with two advanced-stage exploration projects in the USA. NSC's principal asset is the Corcoran Silver-Gold Project in Nevada. Corcoran has an existing NI 43-101 mineral resource estimate of 33.5M oz AgEq5. In addition, NSC has ownership and management rights over the Emily Manganese Project in Minnesota, which was the subject of a June 2020 NI 43-101 mineral resource estimate and contains North America's highest grade manganese resource.

About North Star Manganese Inc

North Star Manganese is a Minnesota-based company with ownership and management rights to the Emily Manganese Project ("Emily"). Emily consists of the mining and processing of manganese ores in the Emily District of the Cuyuna Iron Range in Crow Wing County, Minnesota. North Star is a wholly owned subsidiary of NSC. Emily has an existing NI 43-101 mineral resource estimate and has been the subject of significant technical and environmental studies, with US$24 million invested to date.

Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the Company's actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including, without limitation, risks as a result of the Company having a limited operating history and may have a wide variance from actual results, risks concerning the ability to raise additional equity or debt capital to continue its business, uncertainty regarding the inclusion of inferred mineral resources in the mineral resource estimate which are too speculative geologically to be classified as mineral reserves, uncertainty regarding the ability to convert any part of the mineral resource into mineral reserves, uncertainty involving resource estimates and the ability to extract those resources economically, or at all, uncertainty involving exploration (including drilling) programs and the Company's ability to expand and upgrade existing resource estimates, risks involved in any future regulatory processes and actions, risks from making a production decision (if any) without any feasibility study completed on the Company's properties, risks applicable to mining exploration, development and/or operations generally, and risk as a result of the Company being subject to certain covenants with respect to its activities by creditors, as well as other risks.

Forward-looking information is based on the reasonable assumptions, estimates, analysis, and opinions of management made in light of its experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances at the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information.

All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events, or developments, except as required by law.

1 The Emily Manganese Project's NI 43-101 Mineral Resource Estimate is available at www.nevadasilvercorp.com. The Mineral Resource Estimate incorporates drilling results from two separate drilling programs in 2011 and 2012 for seven diamond drill core holes using an inverse distance squared method and evaluated at 5%, 10%, 15% and 20% manganese weight percent cutoff grades. Mineral resource tonnage and grades are reported as undiluted. Mineral resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate and numbers may not add due to rounding. This Mineral Resource Estimate was prepared under the requirements of National Instrument 43-101 "Standards of Disclosure for Mineral Projects" of the Canadian Securities Administrators by Mr. Brad M. Dunn, CPG, Senior Mining Geologist, Barr Engineering Company and has an effective date of June 12, 2020.

2 3% Mn cut-off

5 The Corcoran Canyon Silver-Gold Property Mineral Resource Estimate was prepared under the requirements of National Instrument 43-101 "Standards of Disclosure for Mineral Projects" of the Canadian Securities Administrators by Mr. G. Mosher, P.Geo., M.Sc. and Mr. D. Smith, P.Geo., M.S. and has an effective date of October 12, 2020.

SOURCE: Nevada Silver CorporationView source version on accesswire.com:

https://www.accesswire.com/678880/Corporate-and-Project-Update-on-the-Emily-Manganese-Project