April 08, 2024

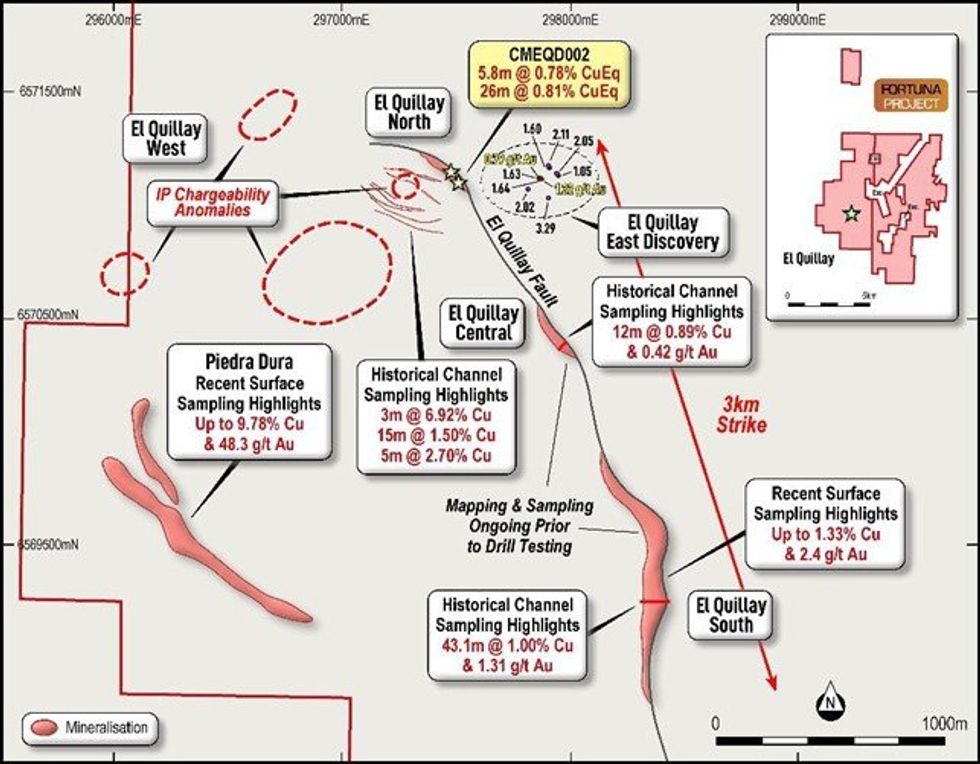

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to announce, that a possible new third zone of copper sulphide mineralisation has been identified within the El Quillay copper trend at its Fortuna Project in Chile (Figure 1). Considerable exploration potential exists within the 3km long trend which hosts high-grade copper mineralisation in a series of parallel structures.

HIGHLIGHTS

- Significant new El Quillay West targets generated through remodelled geophysical data at the Fortuna Project enhancing recent exploration success.

- New target has potential for additional zone of mineralisation 500m to the southwest of the already defined El Quillay Fault Zone (see Figure 1).

- An Induced Polarisation (IP) chargeability anomaly, indicative of copper sulphide mineralisation, has a large footprint of 500m x 300m.

- The new El Quillay West target has had no prior exploration.

- The El Quillay Fault Zone extends for >3km where previous drilling returned an intersection of 26m @ 0.81% CuEq1.

- Upcoming drilling to test lateral and depth extensions of mineralisation within multiple structures proximate to the El Quillay Fault Zone.

- Culpeo’s exploration program continues with new breccia targets at Lana Corina and Vista Montana to be drilled in the coming weeks.

Culpeo Minerals’ Managing Director, Max Tuesley, commented:

“The identification of the new El Quillay West target confirms our belief that a much larger mineralised system exists at El Quillay than previously recognised. Geophysical data remodelling has identified a large chargeability anomaly suggesting the presence of a third zone of parallel mineralisation to the south-west of the El Quillay North Prospect. We look forward to drill testing these targets during 2024.”

RESULTS

During January 2024, Resource Potentials Pty Ltd (ResPot) was commissioned to review, reprocess, model, image and interpret historic Pole-Dipole Induced Polarisiation (PDIP) survey data. ResPot identified four PDIP chargeability anomaly targets from the raw PDIP data, which have potential for copper sulphide mineralisation.

The four PDIP chargeability anomalies are located within the north-western part of the PDIP survey area, including one chargeability anomaly high coincident with known copper sulphide within the El Quillay North Prospect area (Figure 2). Three of the PDIP target areas are untested by existing drilling, including a high-priority target with follow-up ground based exploration planned.

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CPO:AU

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

5h

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data showed that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00