Overview

Gold is a worthy addition to your portfolio, whether through commodities or stock in mining companies. The price of gold is projected to reach US$2,500 by 2026, and mining companies are poised for both short and long-term profits as it steadily increases. Therefore, miners need to choose assets with significant deposits to capitalize on the metal’s growing value.

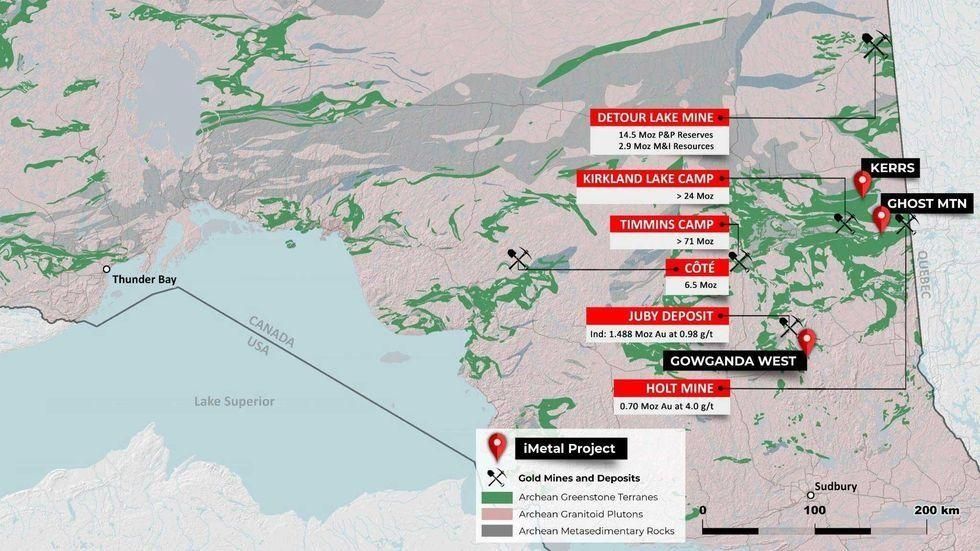

Archaean greenstone belts are famous geological formations known for hosting vast gold deposits alongside other sought-after metals like silver, zinc, iron, copper and other base metals. The largest archaean greenstone belt is the Abitibi Greenstone Belt in Ontario, Canada. Several mining companies have significant assets along the Abitibi Belt, such as Agnico Eagle Mines (NYSE:AEM), Newmont (NYSE:NEM) and Osisko Mining (TSX:OSK). Since 1901 the Abitibi Belt has produced over 200 million ounces of gold, silver, copper and zinc. As a result, the Abitibi Greenstone Belt has helped Ontario become the second-best in Canada and one of the top mining jurisdictions in the world.INN Disclaimer: This profile is sponsored by iMetal Resources ( TSXV:IMR ). This profile provides information which was sourced by the Investing News Network (INN) and approved by iMetal Resources in order to help investors learn more about the company. iMetal Resources is a client of INN. The company's campaign fees pay for INN to create and update this profile.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. In exchange for publishing services rendered by INN on behalf of iMetal Resources named herein, including the promotion by INN of iMetal Resources in any content on the INN website, the INN receives from iMetal Resources annual cash compensation of typically up to two hundred and fifty thousand dollars. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with iMetal Resources and seek advice from a qualified investment advisor.