- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

November 05, 2024

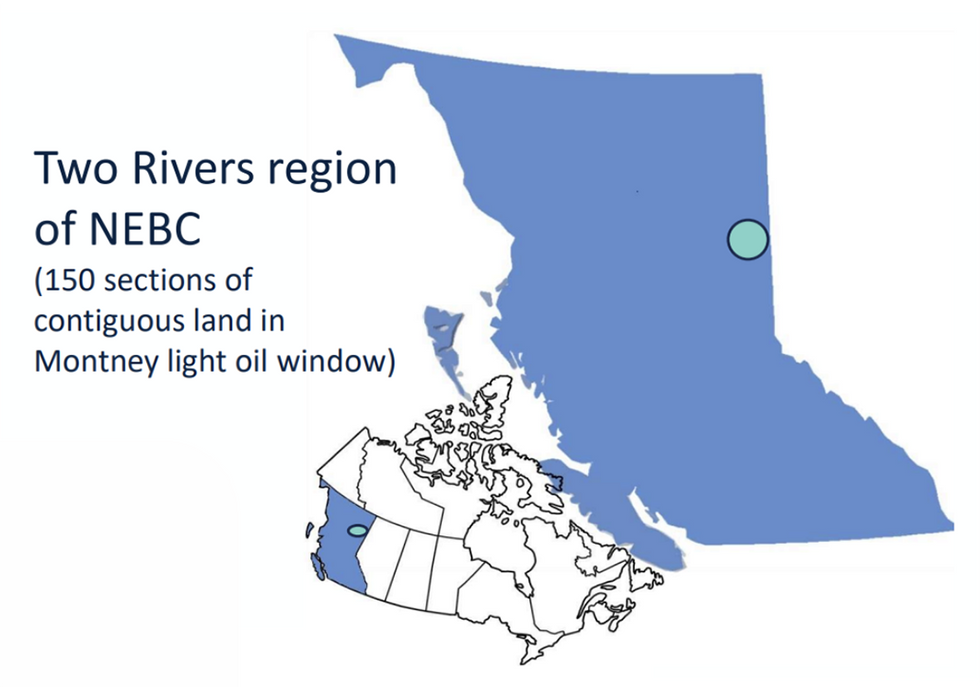

Coelacanth Energy (TSXV:CEI) is a junior oil and natural gas exploration and development company exploring the prolific Montney region in northeastern British Columbia, Canada. Coelacanth is strategically positioned to harness the potential of one of the most resource-rich natural gas basins in North America with a substantial landholding of approximately 150 net sections in the Two Rivers area of Montney.

The company is in the process of deploying $ 80 million to facilitate the smooth transition from exploration to production. Coelacanth’s financial health is further evidenced by its $64.4 million in working capital as of Q2 2024.

Coelacanth’s landholdings are strategically located in the Two Rivers area of Montney, giving it access to a highly productive portion of the basin. Unlike many junior exploration companies, Coelacanth is drill-ready, positioning it favorably among its peers. By securing significant infrastructure and landholdings, Coelacanth ensures its ability to tap into the natural gas and oil resources that lie beneath its properties, a key advantage in the competitive Montney region.

Company Highlights

- The company holds approximately 150 net sections of land in the Two Rivers area, a prolific oil and liquids rich natural gas region.

- Coelacanth is fully permitted and financially secure, with $64.4 million in working capital as of Q2 2024 and a $52 million credit facility with its main lender.

- The company is spending approximately $80 million to construct pipeline and facility infrastructure to bring production on in April 2025.

- The company’s strategic location in Montney places it near major producers like ARC Resources, Tourmaline Oil Corp, Shell, and ConocoPhillips.

- Two Rivers East, its primary project, boasts 1,532 (thousand barrels of oil equivalent) mboe per well in proved and probable reserves.

This Coelacanth Energy profile is part of a paid investor education campaign.*

Click here to connect with Coelacanth Energy (TSXV:CEI) to receive an Investor Presentation

CEI:CC

Sign up to get your FREE

Coelacanth Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

19 June

Coelacanth Energy

Light oil & Natural gas exploration and production in the prolific Montney region in British Columbia

Light oil & Natural gas exploration and production in the prolific Montney region in British Columbia Keep Reading...

12h

Coelacanth Energy Inc. Announces Increased Bank Credit Facility and Provides Operations Update

Coelacanth Energy Inc. (TSXV: CEI,OTC:CEIEF) ("Coelacanth" or the "Company") is pleased to provide the following update: BANK CREDIT FACILITYCoelacanth has signed an agreement to increase its bank credit facility from $52 million to $80 million with closing expected in mid-November. The Company... Keep Reading...

29 October

Coelacanth Energy Inc. Engages ICP Securities Inc. for Automated Market Making Services

Coelacanth Energy Inc. (TSXV: CEI,OTC:CEIEF) ("Coelacanth" or the "Company") is pleased to announce that it has engaged the services of ICP Securities Inc. ("ICP") to provide automated market making services, including use of its proprietary algorithm, ICP Premium™, in compliance with the... Keep Reading...

27 August

Coelacanth Energy Inc. Announces Operations Update, Revised Reserve Report and Initial Resource Report

Coelacanth Energy Inc. (TSXV: CEI,OTC:CEIEF) ("Coelacanth" or the "Company") has provided an Operations Update, Reserve Report, and Resource Report. OPERATIONS UPDATE Coelacanth completed and commissioned its new battery facility in early June and subsequently started to systematically place the... Keep Reading...

27 August

Coelacanth Announces Q2 2025 Financial and Operating Results

Coelacanth Energy Inc. (TSXV: CEI,OTC:CEIEF) ("Coelacanth" or the "Company") is pleased to announce its financial and operating results for the three and six months ended June 30, 2025. All dollar figures are Canadian dollars unless otherwise noted. FINANCIAL RESULTS Three Months Ended Six... Keep Reading...

29 May

Coelacanth Announces Q1 2025 Financial and Operating Results

Coelacanth Energy Inc. (TSXV: CEI) ("Coelacanth" or the "Company") is pleased to announce its financial and operating results for the three months ended March 30, 2025. All dollar figures are Canadian dollars unless otherwise noted. FINANCIAL RESULTS Three Months Ended March 31 ($000s, except... Keep Reading...

5h

World Bank: Oil Glut to Drive Commodity Prices to Six-Year Low

Global commodity prices are on track to fall to their lowest level in six years by 2026, as weaker demand, a widening oil surplus, and policy uncertainty continue to weigh on markets, according to the World Bank’s latest Commodity Markets Outlook. The World Bank expects global energy prices to... Keep Reading...

9h

TSX-V Exchange Approves Shares For Debt Transactions

(TheNewswire) GRANDE PRAIRIE, AB TheNewswire - (October 30, 2025): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF and OTC: ANKOF) ("Angkor" or "the Company") announces approval from the TSX Exchange following its review of a proposed ‘shares for debt' transaction for an aggregate $1,922,800 debt... Keep Reading...

28 October

5 Biggest ASX Oil and Gas Stocks of 2025

Oil and gas are key energy fuels, and ASX-listed oil and gas stocks could benefit from their price moves. For the most part, 2025 was a volatile year for both the oil and gas markets. In the first half of the year, oil prices posted moderate gains, spurred on by rising tensions in the Middle... Keep Reading...

28 October

CHARBONE Announces the Official Start of Civil Construction Work in Sorel-Tracy, in Line with the Announced Schedule

(TheNewswire) Brossard, Quebec TheNewswire - October 28, 2025 CHARBONE CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (" CHARBONE " or the " Company "), a North American producer and distributor specializing in clean Ultra High Purity (" UHP ") hydrogen and strategic industrial gases,... Keep Reading...

28 October

CHARBONE annonce le debut officiel des travaux de construction civil a Sorel-Tracy, conformement a l'echeancier annonce

(TheNewswire) Brossard, Quebec TheNewswire - le 28 octobre 2025 CORPORATION CHARBONE (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« CHARBONE » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

24 October

Angkor Finalizes Disposition of Oyadao North License in Ratanakiri, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - October 24, 2025 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces it has finalized the sale of all mineral rights on Oyadao North license to Almighty Natural Resources ("Almighty"). Angkor negotiated a sale... Keep Reading...

Latest News

Sign up to get your FREE

Coelacanth Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00