March 13, 2023

Charger Metals NL (ASX: CHR, “Charger” or the “Company”) is pleased to announce the completion of the maiden drill programme at its 100%-held Medcalf Prospect, located approximately 450km east of Perth, Western Australia. (Refer to Figure 2).

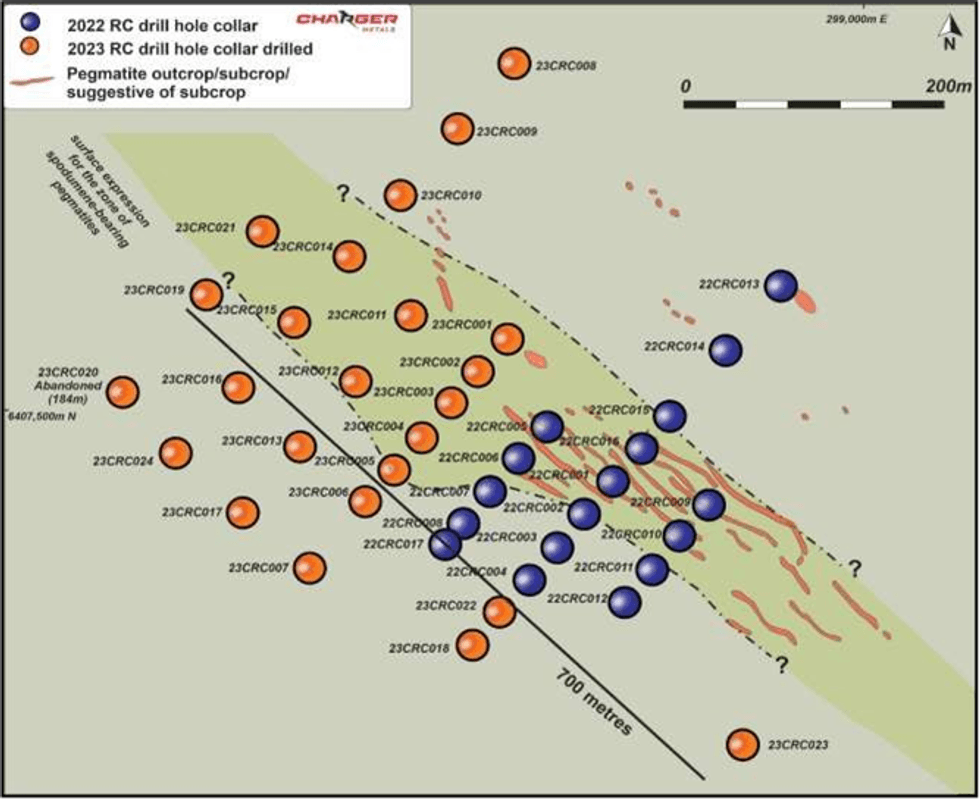

- 24 reverse circulation (RC) drill holes completed in early 2023 - assays due shortly.

- The total programme totalled 41 RC holes, for 7,199 metres of drilling.

- Preparations advancing for follow-on, deeper core drilling.

- Target generation geochemistry continuing at Mt Day and Medcalf West Prospects.

The programme tested pegmatites over a length of 700 metres at surface and up to 280 metres down dip of mapped spodumene-bearing pegmatite1 outcrops. (Refer to Figure 1).

The drilling programme increased the known extent of the swarm of spodumene-bearing pegmatites, which occur within a 100m zone, and demonstrated that these extend under transported cover2 and at depth.

Charger’s Managing Director, David Crook commented:

“With the drilling programme returning multiple intersections of spodumene-pegmatites, the Company’s geologists are planning deeper core holes designed to expand the known mineralisation to a greater depth. Assays from holes drilled in late 2022 included high-grade lithium intersections from surface down to a vertical depth of at least 210m. This year’s drilling has increased the known extent of the spodumene-pegmatites which are still open along strike and at depth.”

OUTLOOK

Down-hole surveys will confirm the dip and provide physical properties of individual pegmatites. The survey tools used will include an optical televiewer and a rock density probe. The information gained is being used in the development of three-dimensional model of the known mineralisation.

When completed, the 3D model will be an aid when planning the next phase of deeper, core drilling.

In preparation for core drilling, extensional heritage and flora surveys have been initiated, and a water management plan implemented.

All samples from the 2022-2023 RC drilling have been submitted to a commercial laboratory for analysis. The first samples from 2023 were submitted mid-February, with the laboratory noting that current the assay turn-around time is in the order of 7 weeks.

In addition, soil geochemistry and detailed mapping will be undertaken at the recently acquired Medcalf (E63/1883) and the Mt Day Prospects. (Refer to Figure 3).

Click here for the full ASX Release

This article includes content from Charger Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CHR:AU

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

10h

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00