(TheNewswire)

Toronto, Ontario February 8, 2022 TheNewswire - Canstar Resources Inc. (TSXV:ROX ) ( OTCPK:CSRNF) (" Canstar" or the "Company ") is pleased to announce additional assay results from 2021 drilling and channel sampling from the Kendell prospect at its Golden Baie project in south Newfoundland. The Company also announces that a winter diamond drill program has commenced at the Kendell prospect. This program is expected to include up to 35 new drill holes which total approximately 2,000 metres and reflect the shallow nature of the mineralization.

Drilling highlights from the final 2021 drill hole assays at the Kendell prospect are provided in Table 1 and include some of the highest-grade intervals to date from this prospect. In addition, gold mineralization was extended by approximately 50 metres down-dip. Notable intervals and higher grade intercepts include:

-

11.8 g/t gold over 5.69 metres in drill hole GB-21-50

-

45.7 g/t gold over 1.07 metres near surface in drill hole GB-21-20

-

11.7 g/t gold over 3.00 metres including 249.7 g/t gold over 0.09 metres in drill hole GB-21-51

Selected detailed drill hole assay results and collar data are provided in Tables 3 and 4, respectively. All assays from drill hole and channel samples from Kendell have now been received and reported. Additional infill sampling of selected 2021 drill core is now being done to ensure that all core from the interpreted zone of mineralization has been assayed.

Table 1 - Highlight assay results from Kendell reported drill holes

| Drill Hole | From (m) | To (m) | Length (m) | Gold (g/t) |

| GB-21-18 | 2.28 | 5.60 | 3.32 | 4.9 |

| including | 2.77 | 3.40 | 0.63 | 19.1 |

| GB-21-19 | 3.35 | 4.57 | 1.22 | 5.2 |

| GB-21-20 | 2.00 | 4.10 | 2.10 | 24.3 |

| including | 2.00 | 3.07 | 1.07 | 45.7 |

| GB-21-22 | 2.95 | 4.95 | 2.00 | 9.5 |

| GB-21-50 | 21.89 | 27.58 | 5.69 | 11.8 |

| GB-21-51 | 10.32 | 13.32 | 3.00 | 11.7 |

| including | 11.14 | 11.23 | 0.09 | 249.7 |

| GB-21-53 | 29.63 | 33.56 | 3.93 | 12.2 |

| including | 30.82 | 31.45 | 0.63 | 58.3 |

Notes:

-

All intersections are downhole length as there is insufficient information to calculate true width.

-

Reported grades have not been capped.

Matthieu Lapointe, VP Exploration of Canstar, commented: "We continue to be encouraged by the shallow, high-grade gold intercepts at the Kendell prospect. Gold mineralization has been observed in a 50 by 100 metre footprint that remains open along strike and down-dip/plunge. With less than 3,000 metres drilled to date, and limited drilling below 150 metres vertically, there is remarkable potential to expand the mineralization. Given the results announced today, we are excited to commence a winter drill program to further improve our understanding of the controls on gold mineralization and to better define and extend the high-grade gold mineralization identified from the 2021 drilling."

Additional channel samples from the Kendell prospect trench were also collected in the summer of 2021. The highlights of the channel samples are provided in Table 2 and are interpreted as the surface expression of the gold mineralization intercepted by the drill holes.

Table 2. Highlight assay results from Kendell channel sampling

| Channel | Composite |

| M | 10.4 g/t Au over 7.9m |

| L | 9.4 g/t Au over 6.9m |

Discussion of Assay Results

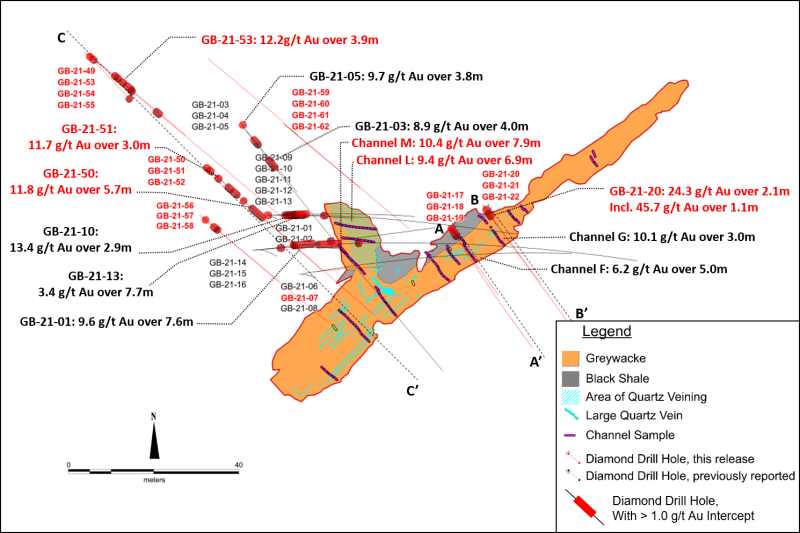

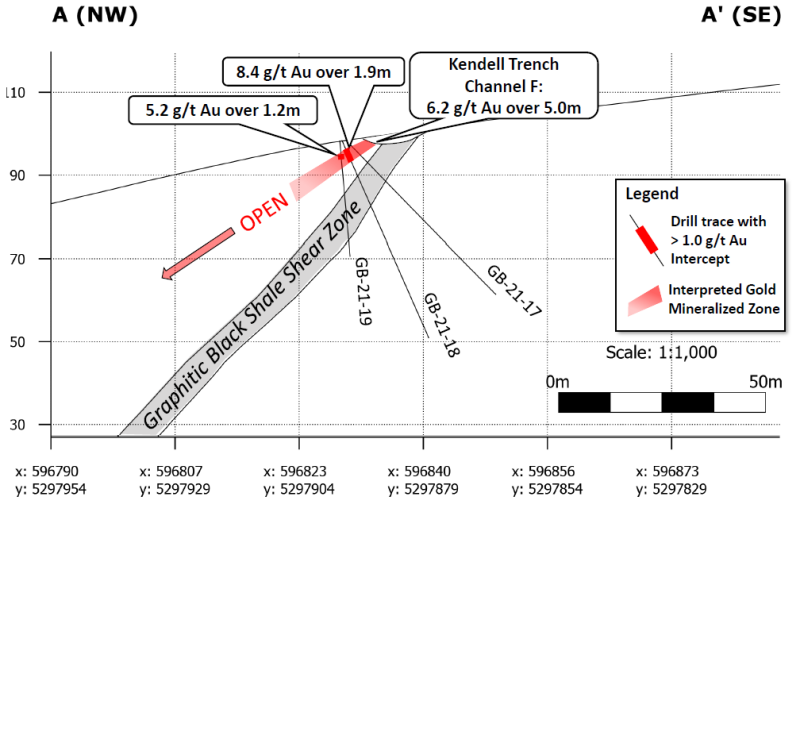

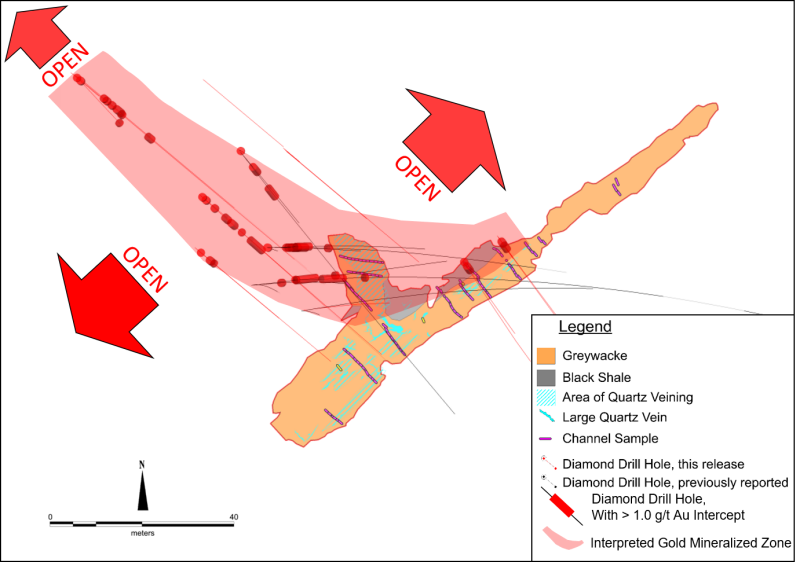

Drill holes GB-21-17 to GB-21-19 were drilled from the same platform to test the area below Channel F from the Kendell TGB-20-01 trench , which returned 2.9 g/t gold over 11.0 metres, including 6.2 g/t gold over 5.0 metres (announced November 30, 2020 ) . See the plan map in Figure 1 and vertical section in Figure 2. Drill holes GB-21-18 and GB-21-19 intersected gold mineralization associated with quartz veining and acicular arsenopyrite starting from a depth of two to three metres down hole. Drill hole GB-21-17 was not sampled at the projected depth of the mineralization and this interval is now being sampled as part of the infill sampling program.

Figure 1 - Plan view of Kendell Target showing collars of 2021 drill holes (36 holes drilled, 2,620 metres total)

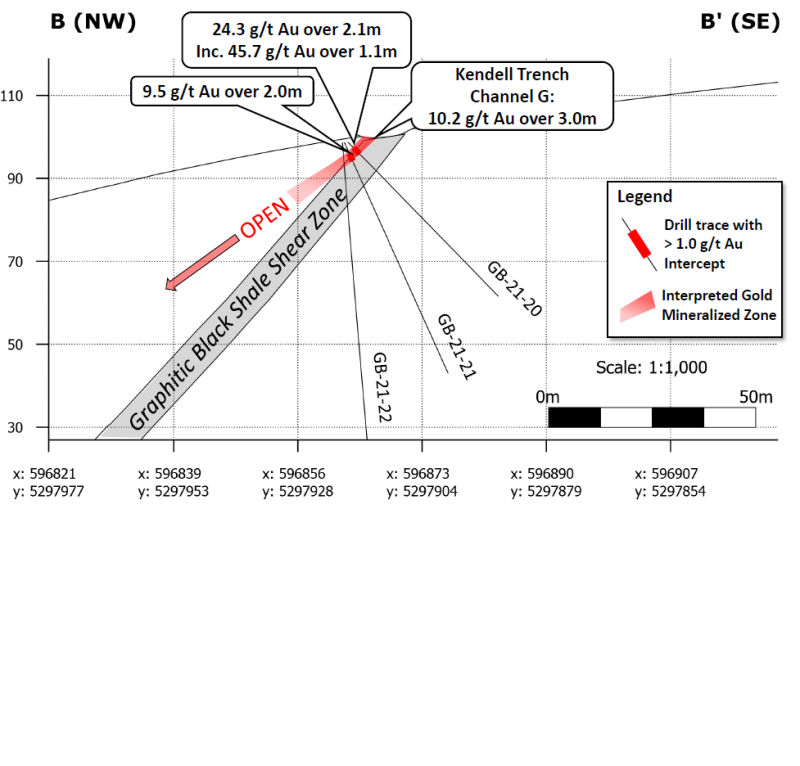

Drill holes GB-21-20 to GB-21-22 were drilled from the same platform to test the area below Channel G in trench TGB-20-01, which yielded an average grade of 4.7 g/t gold over 6.7 metres, including 10.2 g/t gold over 3.0 metres (see Figures 1 and 3). Drill holes GB-21-20 and GB-21-21 intersected 2.0 metre intervals of 24.3 g/t gold and 9.5 g/t gold, respectively. Coarse gold is generally associated with quartz veining and acicular arsenopyrite.

Figure 2 – Kendell Section A-A' Showing newly reported drill hole assays (looking northeast). Mineralization is open to depth (down-dip) and along strike to the NE and SW.

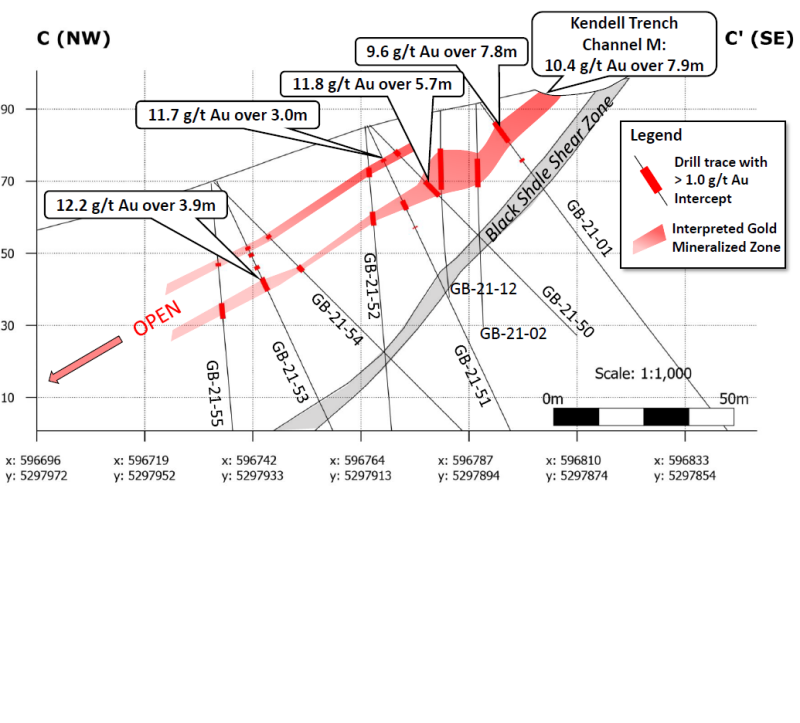

Drill holes GB-21-50 to GB-21-55 were drilled from two platforms, with three holes per platform, and were designed to test the area 20 to 50 metres down-dip of the mineralization intersected in drill holes GB-21-01 to GB-21-13 (see vertical section in Figure 4). It is interpreted that these drill holes have intersected two mineralized zones, an upper zone approximately one to three metres in length and a lower zone which ranges from three to six metres in length. Both zones are associated with quartz veining and arsenopyrite plus antimony-bearing minerals that are hosted in deformed black shales. The intersection lengths and mineralization styles are comparable to those noted up-dip and the zones appear to form a continuous horizon.

Figure 3 – Kendell Section B-B' Showing newly reported drill hole assays (looking northeast). Mineralization is open to depth (down-dip) and along strike to the NE and SW.

Figure 4 – Kendell Section C-C' Showing highlights of newly reported assays (looking northeast). Mineralization is open to depth (down-dip) and along strike to the NE and SW

Winter Drill Program

Gold mineralization at Kendell was delineated over a down-dip length of approximately 100 metres and a strike length of 50 metres based on assays from 36 drill holes in the 2021 drill program (Figure 5). Mineralized intercepts ranged from one metre to 11 metres in length and are spatially associated with metasedimentary rocks within the interpreted hanging wall of a fault zone that is defined by a four metre to 10 metre thick strongly sheared unit of dark grey to black graphitic shale.

Gold mineralization remains open along strike and down-dip/plunge at the Kendell prospect, as shown in Figure 5. A winter diamond drill program has now commenced to test the continuity of the shallow-dipping gold mineralization along strike, down-dip, and down-plunge. The Company anticipates that the drill program will consist of approximately 2,000 metres in up to 35 drill holes.

Figure 5 - Kendell Plan Map Showing Mineralized Intercepts and Areas to be Drill Tested

Acknowledgements

Canstar wishes to acknowledge the financial support of the 2021 exploration program through the Junior Exploration Assistance Program from the Department of Natural Resources, Government of Newfoundland and Labrador.

QA/QC:

All rock samples were collected by company personnel and shipped to Eastern Analytical of 403 Little Bay Road, Springdale, NL, a commercial laboratory that is ISO/IEC 17025 accredited and completely independent of Canstar Resources Inc. Samples are analyzed for gold using fire assay (30g) with AA finish and an ICP-34, four acid digestion followed by ICP-OES analysis for 34 additional elements. Metallic screening is being used for samples with visible gold and all samples with initial fire assays over 1.0 g/t Au. In addition to Eastern Analytical's quality control program of standards, blanks and duplicates, Canstar's QAQC program utilizes four commercially available reference standards, blanks and duplicate samples to ensure data quality. In addition, duplicates of selected samples are being sent to a second laboratory as check assays.

Qualified Person

Bob Patey, B.Sc., P.Geo, Senior Geologist of Canstar, and a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects, is responsible for the scientific and technical data presented herein and has reviewed and approved this release.

About Canstar Resources Inc.

Canstar is focused on district-scale gold exploration in Newfoundland, Canada. Canstar has a 100% interest in the Golden Baie and Hermitage projects, large claim packages at the south end south-central Newfoundland covering 77,350 hectares or 774 km 2 with multiple outcropping gold occurrences on a major structural trend. The Company also holds the Buchans-Mary March project and other mineral exploration properties in Newfoundland. Canstar Resources is based in Toronto, Canada, and is listed on the TSX Venture Exchange under the symbol ROX and trades on the OTCPK under the symbol CSRNF.

For further information, please contact:

Rob Bruggeman, President & CEO

Email: rob@canstarresources.com

Phone: 1-647-247-8715

Website: www.canstarresources.com

Table 3 - Selected drill hole sample assays

| Hole ID | From (m) | To (m) | Length (m) | Au (ppb) |

| GB-21-07 | 2.33 | 3.45 | 1.12 | 13 |

| GB-21-07 | 3.45 | 4.4 | 0.95 | 84 |

| GB-21-07 | 4.4 | 5.42 | 1.02 | 158 |

| GB-21-07 | 5.42 | 6.22 | 0.8 | 532 |

| GB-21-07 | 6.22 | 7.29 | 1.07 | 46 |

| GB-21-07 | 7.29 | 7.67 | 0.38 | 8 |

| GB-21-16 | NSR | |||

| GB-21-17 | NSR | |||

| GB-21-18 | 1.4 | 2.28 | 0.88 | 69 |

| GB-21-18 | 2.28 | 2.77 | 0.49 | 954 |

| GB-21-18 | 2.77 | 3.4 | 0.63 | 19089 |

| GB-21-18 | 3.4 | 4.15 | 0.75 | 4237 |

| GB-21-18 | 4.15 | 5.6 | 1.45 | 267 |

| GB-21-18 | 5.6 | 6.6 | 1 | 371 |

| GB-21-18 | 51 | 52 | 1 | 6 |

| GB-21-19 | 1.15 | 2.35 | 1.2 | 76 |

| GB-21-19 | 2.35 | 3.35 | 1 | 45 |

| GB-21-19 | 3.35 | 4.57 | 1.22 | 5220 |

| GB-21-19 | 4.57 | 5.58 | 1.01 | 371 |

| GB-21-19 | 5.58 | 6.5 | 0.92 | 718 |

| GB-21-19 | 6.5 | 7.5 | 1 | 128 |

| GB-21-19 | 7.5 | 8.6 | 1.1 | 28 |

| GB-21-19 | 27.3 | 28.38 | 1.08 | 19 |

| GB-21-20 | 1 | 2 | 1 | 271 |

| GB-21-20 | 2 | 3.07 | 1.07 | 45682 |

| GB-21-20 | 3.07 | 4.1 | 1.03 | 2050 |

| GB-21-20 | 4.1 | 5.04 | 0.94 | 231 |

| GB-21-20 | 5.04 | 6.08 | 1.04 | 10 |

| GB-21-20 | 6.08 | 7.08 | 1 | 2.5 |

| GB-21-21 | 1 | 1.8 | 0.8 | 195 |

| GB-21-21 | 1.8 | 2.95 | 1.15 | 350 |

| GB-21-21 | 2.95 | 4.03 | 1.08 | 11214 |

| GB-21-21 | 4.03 | 4.95 | 0.92 | 7512 |

| GB-21-21 | 4.95 | 5.95 | 1 | 488 |

| GB-21-21 | 5.95 | 6.8 | 0.85 | 37 |

| GB-21-21 | 6.8 | 7.8 | 1 | 34 |

| GB-21-22 | NSR | |||

| GB-21-49 | 19.11 | 20.3 | 1.19 | 7 |

| GB-21-49 | 20.3 | 20.8 | 0.5 | 30 |

| GB-21-49 | 20.8 | 21.33 | 0.53 | 67 |

| GB-21-49 | 21.33 | 22 | 0.67 | 2639 |

| GB-21-50 | 8.37 | 9.31 | 0.94 | 5 |

| Hole ID | From (m) | To (m) | Length (m) | Au (ppb) |

| GB-21-50 | 9.31 | 10.02 | 0.71 | 6 |

| GB-21-50 | 10.02 | 10.88 | 0.86 | 4463 |

| GB-21-50 | 10.88 | 11.9 | 1.02 | 1326 |

| GB-21-50 | 11.9 | 12.87 | 0.97 | 382 |

| GB-21-50 | 12.87 | 13.85 | 0.98 | 186 |

| GB-21-50 | 13.85 | 14.85 | 1 | 89 |

| GB-21-50 | 14.85 | 15.87 | 1.02 | 12 |

| GB-21-50 | 15.87 | 16.87 | 1 | 25 |

| GB-21-50 | 16.87 | 17.72 | 0.85 | 20 |

| GB-21-50 | 17.72 | 18.74 | 1.02 | 11 |

| GB-21-50 | 18.74 | 19.2 | 0.46 | 30 |

| GB-21-50 | 19.2 | 19.95 | 0.75 | 43 |

| GB-21-50 | 19.95 | 20.9 | 0.95 | 1143 |

| GB-21-50 | 20.9 | 21.89 | 0.99 | 414 |

| GB-21-50 | 21.89 | 22.46 | 0.57 | 2332 |

| GB-21-50 | 22.46 | 22.95 | 0.49 | 12507 |

| GB-21-50 | 22.95 | 23.68 | 0.73 | 1161 |

| GB-21-50 | 23.68 | 24.62 | 0.94 | 21427 |

| GB-21-50 | 24.62 | 25.26 | 0.64 | 14303 |

| GB-21-50 | 25.26 | 26.26 | 1 | 20201 |

| GB-21-50 | 26.26 | 27.17 | 0.91 | 6164 |

| GB-21-50 | 27.17 | 27.58 | 0.41 | 5661 |

| GB-21-50 | 27.58 | 28.22 | 0.64 | 343 |

| GB-21-50 | 28.22 | 28.73 | 0.51 | 68 |

| GB-21-50 | 28.73 | 29.72 | 0.99 | 62 |

| GB-21-50 | 29.72 | 30.46 | 0.74 | 35 |

| GB-21-50 | 30.46 | 31.2 | 0.74 | 2.5 |

| GB-21-50 | 31.2 | 31.88 | 0.68 | 9 |

| GB-21-50 | 31.88 | 32.5 | 0.62 | 1361 |

| GB-21-50 | 32.5 | 33.22 | 0.72 | 1246 |

| GB-21-50 | 33.22 | 33.45 | 0.23 | 10 |

| GB-21-50 | 33.45 | 33.5 | 0.05 | 5 |

| GB-21-51 | 7.88 | 8.96 | 1.08 | 47 |

| GB-21-51 | 8.96 | 9.82 | 0.86 | 45 |

| GB-21-51 | 9.82 | 10.32 | 0.5 | 33 |

| GB-21-51 | 10.32 | 11.14 | 0.82 | 8086 |

| GB-21-51 | 11.14 | 11.23 | 0.09 | 249744 |

| GB-21-51 | 11.23 | 12.29 | 1.06 | 4815 |

| GB-21-51 | 12.29 | 13.32 | 1.03 | 773 |

| GB-21-51 | 13.32 | 14.47 | 1.15 | 378 |

| GB-21-51 | 14.47 | 15.1 | 0.63 | 71 |

| GB-21-51 | 20.19 | 20.89 | 0.7 | 27 |

| GB-21-51 | 20.89 | 21.6 | 0.71 | 99 |

| Hole ID | From (m) | To (m) | Length (m) | Au (ppb) |

| GB-21-51 | 21.6 | 22.2 | 0.6 | 377 |

| GB-21-51 | 22.2 | 23.03 | 0.83 | 340 |

| GB-21-51 | 23.03 | 23.93 | 0.9 | 649 |

| GB-21-51 | 23.93 | 24.82 | 0.89 | 2319 |

| GB-21-51 | 24.82 | 25.85 | 1.03 | 2069 |

| GB-21-51 | 25.85 | 26.85 | 1 | 276 |

| GB-21-51 | 26.85 | 27.41 | 0.56 | 240 |

| GB-21-51 | 27.41 | 28.18 | 0.77 | 127 |

| GB-21-51 | 28.18 | 29.27 | 1.09 | 1770 |

| GB-21-51 | 29.27 | 30.23 | 0.96 | 54 |

| GB-21-51 | 30.23 | 30.8 | 0.57 | 355 |

| GB-21-51 | 30.8 | 31.13 | 0.33 | 14 |

| GB-21-51 | 31.13 | 31.41 | 0.28 | 5580 |

| GB-21-51 | 31.41 | 32.33 | 0.92 | 18 |

| GB-21-51 | 32.33 | 32.8 | 0.47 | 13 |

| GB-21-51 | 32.8 | 33.18 | 0.38 | 6 |

| GB-21-52 | 10.1 | 11.09 | 0.99 | 2.5 |

| GB-21-52 | 11.09 | 11.67 | 0.58 | 174 |

| GB-21-52 | 11.67 | 12.16 | 0.49 | 6364 |

| GB-21-52 | 12.16 | 13.53 | 1.37 | 252 |

| GB-21-52 | 13.53 | 14.29 | 0.76 | 1803 |

| GB-21-52 | 14.29 | 15.11 | 0.82 | 46 |

| GB-21-52 | 15.11 | 16.07 | 0.96 | 220 |

| GB-21-52 | 16.07 | 16.45 | 0.38 | 170 |

| GB-21-52 | 16.45 | 17.5 | 1.05 | 15 |

| GB-21-52 | 17.5 | 18.51 | 1.01 | 14 |

| GB-21-52 | 23.86 | 24.64 | 0.78 | 730 |

| GB-21-52 | 24.64 | 25.17 | 0.53 | 591 |

| GB-21-52 | 25.17 | 26 | 0.83 | 702 |

| GB-21-52 | 26 | 26.52 | 0.52 | 1493 |

| GB-21-52 | 26.52 | 27.1 | 0.58 | 391 |

| GB-21-52 | 27.1 | 27.74 | 0.64 | 1279 |

| GB-21-52 | 27.74 | 28.73 | 0.99 | 120 |

| GB-21-52 | 30.99 | 31.14 | 0.15 | 84 |

| GB-21-52 | 40.17 | 41.1 | 0.93 | 6 |

| GB-21-53 | 18.28 | 19.09 | 0.81 | 12 |

| GB-21-53 | 19.09 | 20.1 | 1.01 | 33 |

| GB-21-53 | 20.1 | 21 | 0.9 | 2716 |

| GB-21-53 | 21 | 21.55 | 0.55 | 51 |

| GB-21-53 | 21.55 | 22.1 | 0.55 | 356 |

| GB-21-53 | 22.1 | 23.18 | 1.08 | 1662 |

| GB-21-53 | 23.18 | 23.85 | 0.67 | 322 |

| GB-21-53 | 23.85 | 24.55 | 0.7 | 609 |

| Hole ID | From (m) | To (m) | Length (m) | Au (ppb) |

| GB-21-53 | 24.55 | 25.08 | 0.53 | 100 |

| GB-21-53 | 25.08 | 25.97 | 0.89 | 35 |

| GB-21-53 | 25.97 | 27.01 | 1.04 | 3643 |

| GB-21-53 | 27.01 | 27.69 | 0.68 | 19 |

| GB-21-53 | 27.69 | 28.45 | 0.76 | 16 |

| GB-21-53 | 28.45 | 29.11 | 0.66 | 13 |

| GB-21-53 | 29.11 | 29.63 | 0.52 | 45 |

| GB-21-53 | 29.63 | 29.75 | 0.12 | 6617 |

| GB-21-53 | 29.75 | 30.82 | 1.07 | 4053 |

| GB-21-53 | 30.82 | 31.45 | 0.63 | 58293 |

| GB-21-53 | 31.45 | 32 | 0.55 | 1497 |

| GB-21-53 | 32 | 32.69 | 0.69 | 1457 |

| GB-21-53 | 32.69 | 33.56 | 0.87 | 4989 |

| GB-21-53 | 33.56 | 34.54 | 0.98 | 316 |

| GB-21-53 | 34.54 | 35.46 | 0.92 | 51 |

| GB-21-53 | 36.76 | 37.2 | 0.44 | 77 |

| GB-21-54 | 10.3 | 11.3 | 1 | 10 |

| GB-21-54 | 11.33 | 12.3 | 0.97 | 9 |

| GB-21-54 | 20 | 21 | 1 | 8 |

| GB-21-54 | 21 | 22 | 1 | 1480 |

| GB-21-54 | 22 | 23 | 1 | 435 |

| GB-21-54 | 23 | 24 | 1 | 407 |

| GB-21-54 | 24 | 25 | 1 | 235 |

| GB-21-54 | 25 | 26 | 1 | 179 |

| GB-21-54 | 26 | 27 | 1 | 11 |

| GB-21-54 | 27 | 28 | 1 | 20 |

| GB-21-54 | 28 | 29 | 1 | 22 |

| GB-21-54 | 29 | 30 | 1 | 31 |

| GB-21-54 | 30 | 31 | 1 | 799 |

| GB-21-54 | 31 | 32 | 1 | 380 |

| GB-21-54 | 32 | 33 | 1 | 148 |

| GB-21-54 | 33 | 34 | 1 | 1095 |

| GB-21-54 | 34 | 35 | 1 | 1056 |

| GB-21-54 | 35 | 36 | 1 | 91 |

| GB-21-54 | 36 | 37 | 1 | 93 |

| GB-21-54 | 37 | 38 | 1 | 151 |

| GB-21-54 | 38 | 39 | 1 | 405 |

| GB-21-54 | 39 | 40 | 1 | 57 |

| GB-21-55 | 2 | 2.96 | 0.96 | 2.5 |

| GB-21-55 | 20.22 | 21.12 | 0.9 | 10 |

| GB-21-55 | 21.12 | 22.2 | 1.08 | 57 |

| GB-21-55 | 22.2 | 23.12 | 0.92 | 2215 |

| GB-21-55 | 23.12 | 24.05 | 0.93 | 133 |

| Hole ID | From (m) | To (m) | Length (m) | Au (ppb) |

| GB-21-55 | 24.05 | 25.02 | 0.97 | 93 |

| GB-21-55 | 25.02 | 25.98 | 0.96 | 243 |

| GB-21-55 | 25.98 | 27 | 1.02 | 374 |

| GB-21-55 | 27 | 27.95 | 0.95 | 41 |

| GB-21-55 | 27.95 | 28.95 | 1 | 22 |

| GB-21-55 | 28.95 | 29.9 | 0.95 | 22 |

| GB-21-55 | 29.9 | 30.98 | 1.08 | 6 |

| GB-21-55 | 30.98 | 31.86 | 0.88 | 11 |

| GB-21-55 | 31.86 | 32.79 | 0.93 | 21 |

| GB-21-55 | 32.79 | 33.48 | 0.69 | 58 |

| GB-21-55 | 33.48 | 34.04 | 0.56 | 1602 |

| GB-21-55 | 34.04 | 34.93 | 0.89 | 106 |

| GB-21-55 | 34.93 | 35.93 | 1 | 2699 |

| GB-21-55 | 35.93 | 36.83 | 0.9 | 1301 |

| GB-21-55 | 36.83 | 37.8 | 0.97 | 6115 |

| GB-21-55 | 37.8 | 38.93 | 1.13 | 167 |

| GB-21-55 | 96.32 | 97.12 | 0.8 | 10 |

| GB-21-55 | 97.12 | 98.13 | 1.01 | 2.5 |

| GB-21-55 | 100.69 | 101.53 | 0.84 | 15 |

| GB-21-55 | 101.53 | 102.02 | 0.49 | 2.5 |

| GB-21-55 | 102.02 | 103 | 0.98 | 6 |

| GB-21-56 | 4.05 | 4.92 | 0.87 | 10 |

| GB-21-56 | 4.92 | 5.7 | 0.78 | 33 |

| GB-21-56 | 5.7 | 6.58 | 0.88 | 14 |

| GB-21-56 | 6.58 | 7.35 | 0.77 | 564 |

| GB-21-56 | 7.35 | 8 | 0.65 | 35 |

| GB-21-56 | 8 | 8.65 | 0.65 | 1116 |

| GB-21-56 | 8.65 | 9.63 | 0.98 | 942 |

| GB-21-56 | 9.63 | 10.2 | 0.57 | 16 |

| GB-21-56 | 10.2 | 11.1 | 0.9 | 17 |

| GB-21-56 | 11.1 | 12.02 | 0.92 | 11 |

| GB-21-56 | 30.36 | 31 | 0.64 | 20 |

| GB-21-56 | 51 | 52 | 1 | 11 |

| GB-21-57 | 4.83 | 5.57 | 0.74 | 25 |

| GB-21-57 | 5.57 | 6.47 | 0.9 | 55 |

| GB-21-57 | 7 | 7.48 | 0.48 | 184 |

| GB-21-57 | 7.48 | 8.02 | 0.54 | 1501 |

| GB-21-57 | 8.02 | 8.73 | 0.71 | 400 |

| GB-21-57 | 8.73 | 9.46 | 0.73 | 13 |

| GB-21-57 | 16.51 | 16.67 | 0.16 | 56 |

| GB-21-57 | 18.71 | 19.37 | 0.66 | 268 |

| GB-21-57 | 19.37 | 19.76 | 0.39 | 237 |

| GB-21-57 | 19.76 | 20.36 | 0.6 | 144 |

| Hole ID | From (m) | To (m) | Length (m) | Au (ppb) |

| GB-21-57 | 51 | 51.5 | 0.5 | 31 |

| GB-21-57 | 51.5 | 52 | 0.5 | 2.5 |

| GB-21-58 | 3.61 | 4.59 | 0.98 | 6 |

| GB-21-58 | 4.59 | 5.67 | 1.08 | 2.5 |

| GB-21-58 | 5.67 | 6.39 | 0.72 | 135 |

| GB-21-58 | 6.39 | 7.09 | 0.7 | 37 |

| GB-21-58 | 7.09 | 7.8 | 0.71 | 572 |

| GB-21-58 | 7.8 | 8.56 | 0.76 | 51 |

| GB-21-58 | 8.56 | 9.49 | 0.93 | 471 |

| GB-21-58 | 9.49 | 10.31 | 0.82 | 86 |

| GB-21-58 | 10.31 | 10.97 | 0.66 | 8 |

| GB-21-58 | 19.6 | 20.77 | 1.17 | 126 |

| GB-21-58 | 20.77 | 21.15 | 0.38 | 38 |

| GB-21-58 | 21.15 | 21.78 | 0.63 | 196 |

| GB-21-58 | 21.78 | 22.2 | 0.42 | 108 |

| GB-21-58 | 22.2 | 22.36 | 0.16 | 1677 |

| GB-21-58 | 22.36 | 23.32 | 0.96 | 178 |

| GB-21-58 | 23.32 | 24.15 | 0.83 | 63 |

| GB-21-58 | 24.15 | 25.15 | 1 | 869 |

| GB-21-58 | 25.15 | 26 | 0.85 | 46 |

| GB-21-58 | 26 | 26.25 | 0.25 | 2.5 |

| GB-21-58 | 31.55 | 31.79 | 0.24 | 31 |

| GB-21-58 | 36.4 | 36.88 | 0.48 | 10 |

| GB-21-59 | 25.35 | 26.1 | 0.75 | 905 |

| GB-21-59 | 26.1 | 27 | 0.9 | 423 |

| GB-21-59 | 27 | 28 | 1 | 348 |

| GB-21-59 | 28 | 28.85 | 0.85 | 567 |

| GB-21-59 | 28.85 | 29.6 | 0.75 | 73 |

| GB-21-59 | 29.6 | 30.16 | 0.56 | 2.5 |

| GB-21-60 | 29.98 | 30.68 | 0.7 | 8 |

| GB-21-60 | 30.68 | 31.4 | 0.72 | 602 |

| GB-21-60 | 32.65 | 33.38 | 0.73 | 6 |

| GB-21-60 | 33.38 | 34.1 | 0.72 | 5 |

| GB-21-61 | NSR | |||

| GB-21-62 | 21.75 | 22.45 | 0.7 | 56 |

| GB-21-62 | 22.45 | 23.26 | 0.81 | 119 |

| GB-21-62 | 23.26 | 24.27 | 1.01 | 201 |

| GB-21-62 | 24.27 | 25.31 | 1.04 | 791 |

| GB-21-62 | 25.31 | 26.43 | 1.12 | 10 |

| GB-21-62 | 50.9 | 51.5 | 0.6 | 5 |

| GB-21-62 | 51.5 | 52 | 0.5 | 54 |

Table 4 - Collar Data for Reported Drill Holes

| Hole ID | Location | UTME | UTMN | Azimuth | Dip | Total Length (m) |

| GB-21-07 | Kendell | 596809 | 5297874 | 82 | -65 | 50 |

| GB-21-16 | Kendell | 596797 | 5297880 | 110 | -85 | 97 |

| GB-21-17 | Kendell | 596849 | 5297884 | 145 | -45 | 52 |

| GB-21-18 | Kendell | 596848 | 5297885 | 145 | -65 | 52 |

| GB-21-19 | Kendell | 596848 | 5297886 | 145 | -85 | 28.4 |

| GB-21-20 | Kendell | 596857 | 5297891 | 145 | -45 | 52 |

| GB-21-21 | Kendell | 596856 | 5297891 | 145 | -65 | 61 |

| GB-21-22 | Kendell | 596856 | 5297892 | 145 | -85 | 82 |

| GB-21-49 | Kendell | 596754 | 5297930 | 130 | -45 | 22 |

| GB-21-50 | Kendell | 596785 | 5297901 | 130 | -45 | 82 |

| GB-21-51 | Kendell | 596784 | 5297901 | 130 | -65 | 145 |

| GB-21-52 | Kendell | 596784 | 5297902 | 130 | -85 | 112 |

| GB-21-53 | Kendell | 596754 | 5297931 | 130 | -65 | 172 |

| GB-21-54 | Kendell | 596754 | 5297931 | 130 | -45 | 109 |

| GB-21-55 | Kendell | 596753 | 5297931 | 130 | -85 | 103 |

| GB-21-56 | Kendell | 596784 | 5297888 | 130 | -65 | 52 |

| GB-21-57 | Kendell | 596783 | 5297889 | 130 | -45 | 52 |

| GB-21-58 | Kendell | 596783 | 5297889 | 130 | -85 | 49 |

| GB-21-59 | Kendell | 596805 | 5297912 | 130 | -45 | 52 |

| GB-21-60 | Kendell | 596805 | 5297913 | 130 | -65 | 52 |

| GB-21-61 | Kendell | 596804 | 5297913 | 130 | -85 | 52 |

| GB-21-62 | Kendell | 596804 | 5297913 | 310 | -65 | 52 |

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, and those risks set out in the Company's public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Copyright (c) 2022 TheNewswire - All rights reserved.