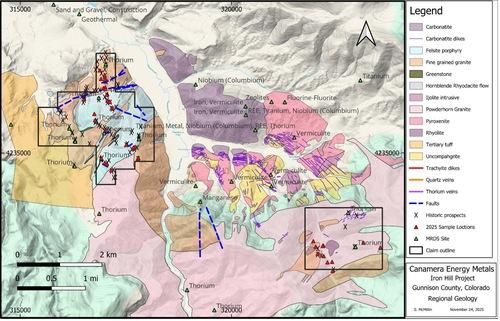

EDMONTON, AB / ACCESS Newswire / December 2, 2025 / Canamera Energy Metals Corp. (CSE:EMET)(OTCQB:EMETF)(FSE:4LFO) (the "Company" or "Canamera") announces that it has staked a total of 85 unpatented lode mining claims covering approximately 1,756 acres (711 hectares) and located approximately 22 miles south-southwest of Gunnison, Colorado (the "Claims").

The Claims are adjacent to Teck Resources Limited's (TSX:TECK.A,OTC:TCKRF)(TSX:TECK.B) Iron Hill deposit, which hosts one of the largest rare earth oxide [1] and titanium [2] deposits in the United States, in addition to thorium [3] and niobium [4] mineralization.

The Claims were staked on the Company's behalf by Rangefront Mining Services and an application to register the Claims is currently pending with the U.S. Bureau of Land Management (BLM).

"Staking and filing for these claims adjacent to the East and to the West of Teck Resources' Iron Hills deposit furthers the Company's strategy of seeking out compelling rare earth and critical minerals claims" said Brad Brodeur, Chief Executive Officer of Canamera. "Entering the U.S. market remains a high priority for the Company, aligning with our focus on building a geographically diversified critical minerals portfolio in jurisdictions with established regulatory frameworks."

Figure 1: Claims Map

The scientific and technical information in this news release has been reviewed and approved by Warren Robb, P.Geo. (British Columbia), Vice-President, Exploration of the Company and a "Qualified Person" as defined by National Instrument 43-101.

About Canamera Metals Corp.

Canamera Energy Metals Corp. is a rare earth and critical metals exploration company building a portfolio of district-scale opportunities across the Americas. The Company's asset base includes the Mantle project in British Columbia, the Garrow rare earth elements project in Northern Ontario, the Schryburt Lake rare earth and niobium project in Ontario, the Iron Hills critical and rare earth project in Colorado, USA, and the Turvolândia and São Sepé rare earth element projects in Brazil. Across this portfolio, Canamera targets underexplored regions with strong geological signatures and supportive jurisdictions, applying geochemical, geophysical, and geological datasets to generate and advance high-conviction, first-mover exploration targets.

FOR FURTHER INFORMATION PLEASE CONTACT:

Brad Brodeur, Chief Executive Officer

brad@canamerametals.com

780-238-716

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation, including statements regarding: the exploration potential and geological prospectivity of the Claims and the receipt of BLM approval.

Forward-looking information is based on assumptions, estimates, and opinions of management at the date the statements are made and is subject to a variety of risks and uncertainties that could cause actual results to differ materially from those anticipated or projected. These risks include, but are not limited to: uncertainties related to BLM approval, and general risks associated with mineral exploration.

Additional risk factors affecting the Company can be found in the Company's continuous disclosure documents available at www.sedarplus.ca. Readers are cautioned not to place undue reliance on forward-looking information. The Company does not intend, and expressly disclaims any obligation, to update or revise any forward-looking information whether as a result of new information, future events, or otherwise, except as required by applicable securities laws.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

[1] Van Gosen, B. S. (2008). Geochemistry of rock samples collected from the Iron Hill carbonatite complex, Gunnison County, Colorado (Open-File Report 2008-1119). U.S. Geological Survey.

[2] Shaver, K. C., & Lunceford, R. A. (1998). White Earth project, Colorado: The largest titanium resource in the United States. Canadian Industrial Minerals.

[3] Staatz, M. H., Armbrustmacher, T. J., Olson, J. C., Brownfield, I. K., Brock, M. R., Lemons, J. F., Jr., Coppa, L. V., & Clingan, B. V. (1979). Principal thorium resources in the United States (Circular 805). U.S. Geological Survey.

[4] Van Gosen, B. S. (2009). The Iron Hill (Powderhorn) carbonatite complex, Gunnison County, Colorado-A potential source of several uncommon mineral resources (Open-File Report 2009-1005). U.S. Geological Survey. https://pubs.usgs.gov/of/2009/1005/downloads/OF09-1005.pdf

SOURCE : Canamera Energy Metals Corp

View the original press release on ACCESS Newswire