- WORLD EDITIONAustraliaNorth AmericaWorld

July 27, 2023

Blackstone Minerals Limited (“Blackstone” or the “Company”) is pleased to present its Quarterly Report and Cash Flow Report.

HIGHLIGHTS

- Blackstone announced the inclusion of Metso as the technology supplier for the precursor cathode active material (“pCAM”) into the Ta Khoa Refinery Definitive Feasibility Study (“DFS”) delivery team.

- Blackstone provided an update on the Company’s progress in strengthening government relations in Vietnam.

CORPORATE

- End of quarter cash position of $10.65m plus $2.8m received post quarter end.

- Listed investments of $11.2m at the end of quarter.

- Post quarter end on 18 July 2023, the company received $2.8m before costs from advanced funding for the company’s 2023 R&D program.

METSO JOINS TA KHOA REFINERY PROJECT TEAM

Blackstone announced the inclusion of Metso as the technology supplier for the pCAM into the Ta Khoa Refinery DFS delivery team. Metso is currently designing the pCAM plant with Wood, the lead engineering consultant for the DFS, providing invaluable experience and engineering technical support. Metso will also conduct independent pCAM test work to ‘validate’ the nickel and cobalt sulphates generated during the ALS Pilot Program (refer to ASX announcement 20 December 2022) to be suitable for pCAM generation.

Metso is a known industry leader in sustainable technologies, end-to-end solutions and services for the aggregates, minerals processing and metals refining industries, and has supported Blackstone during the Ta Khoa Project prefeasibility study with test work, pilot work at site and technology selections. Metso provides sustainable technology and equipment for the entire lithium, nickel, and cobalt production chain from the mine to battery materials and black mass recycling with project scope ranging from equipment packages to plant deliveries. For active cathode precursors manufacturing, Metso's technology offering starts from optimised raw materials selection down to precipitated metal hydroxide precursor materials. Metso’s battery material and pCAM team was established in 2019 with industry experts, researchers, and specialised engineers to develop solutions for the growing battery industry. The team is supported by its own pCAM testing facilities. More information can be found on Metso’s website at Battery minerals - Metso.

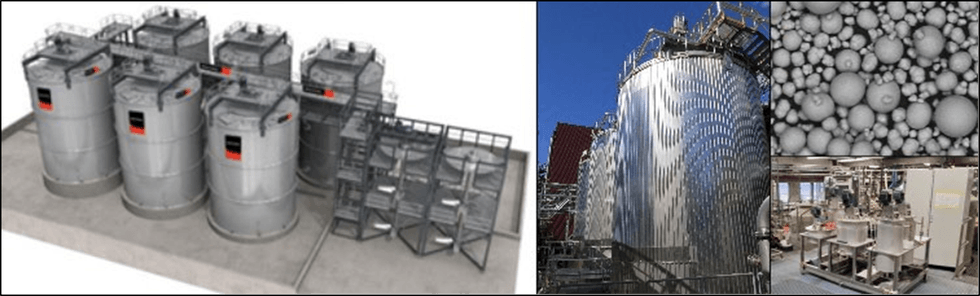

In addition to technical support, Metso brings a suite of bespoke and high value technology to the pCAM facility design, such as the modular OKTOP® reactors (with industrial references for scaling-up pCAM precipitation processes), Larox® filtration technologies and Courier® HX continuous product quality analyser equipment to enable precision control and real time optimisation. Metso has shown that precursors precipitated with OKTOP® reactor technology are proven to meet the required chemical and physical properties for high performance cathode active material.

BLACKSTONE STRENGTHENS GOVERNMENT RELATIONS IN VIETNAM

Son La Delegation visits Blackstone in Perth

Blackstone was honoured to host a senior delegation visit from Son La Province in northern Vietnam in late April. The visit was organised and funded by the Vietnamese Ministry of Foreign Affairs. The Son La Officials delegation included Dang Ngoc Hau (Son La Peoples Party Committee Vice Chairman & Chairman of Son La / Blackstone Minerals Working Group), Phung Kim Son (Son La Department of Natural Resources & Energy – Director) and Cam Duy Hieu (Son La Peoples Party Committee – Economic Department – Head of Department).

Blackstone was pleased to have Ms Thanh Ha Nguyen, the Consul General of Vietnam (Western Australia), and Mr Albert Purnomo, previous Global Engagement Manager, Austrade also attend the visit.

The objective of the visit was to further strengthen the relationship between Blackstone’s management team and the Son La Government and to introduce them to Australia’s highest standard of mining safety & environmental performance, and to update the delegation on progress Blackstone has made with the piloting work and the Definitive Feasibility Study.

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSX:AU

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

25 July 2025

Blackstone Minerals

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

19 December 2025

Nickel Price 2025 Year-End Review

After peaking above US$20,000 per metric ton (MT) in May 2024, nickel prices have trended steadily down. Behind the numbers is persistent oversupply driven by high output from Indonesia, the world’s largest nickel producer. At the same time, demand from China's manufacturing and construction... Keep Reading...

Latest News

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00