October 30, 2024

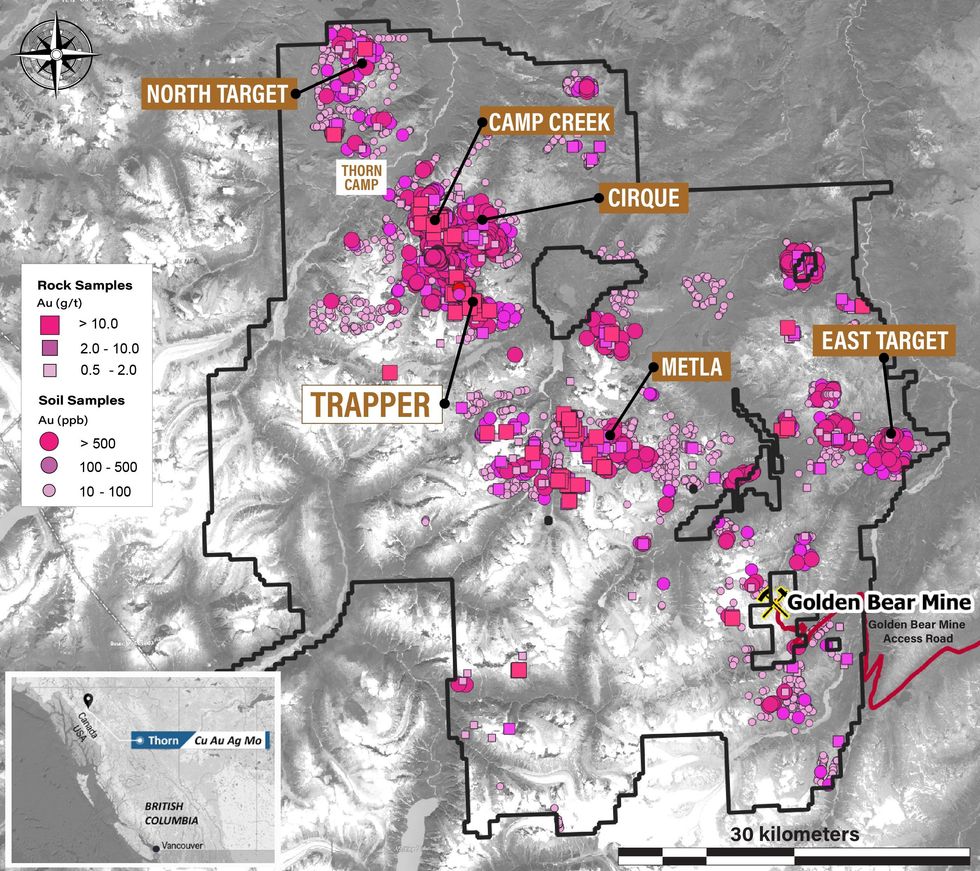

Brixton Metals Corporation (TSX-V: BBB, OTCQB: BBBXF) (the “Company” or “Brixton”) is pleased to announce additional 2024 drill results from the Trapper Gold Target at its wholly owned Thorn Project. The project is located in Northwest British Columbia, 90km east of Juneau, Alaska.

Highlights

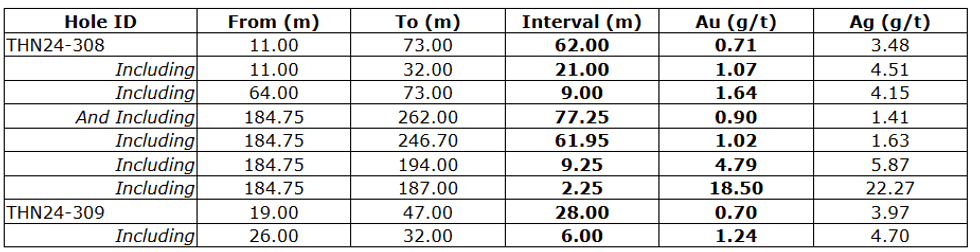

- Hole THN24-308 yielded 61.95m of 1.02 g/t Au from 184.75m depth within 77.25m of 0.9 g/t Au

- Including 9.25m of 4.79 g/t Au

- Including 2.25m of 18.50 g/t Au

- Hole THN24-309 yielded 28.00m of 0.70 g/t Au

- Including 6.00m of 1.24 g/t Au

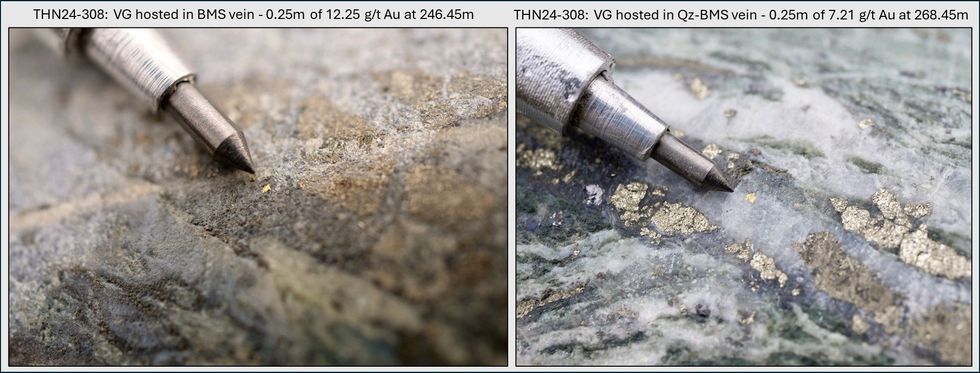

- Gold occurs as native gold and is associated with base metal veins as galena, sphalerite, chalcopyrite, quartz-carbonate and pyrite

“We’re pleased with the recent drill results which reveal encouraging gold grades and align well with our exploration model,” stated Vice President of Exploration, Christina Anstey. “These results strengthen our understanding of the mineralization in the area and support our strategy to unlock further potential through continued drilling.”

All assay values are uncut weighted averages and intervals reflect drilled lengths as further drilling is required to determine the true widths of the mineralization.

Discussion

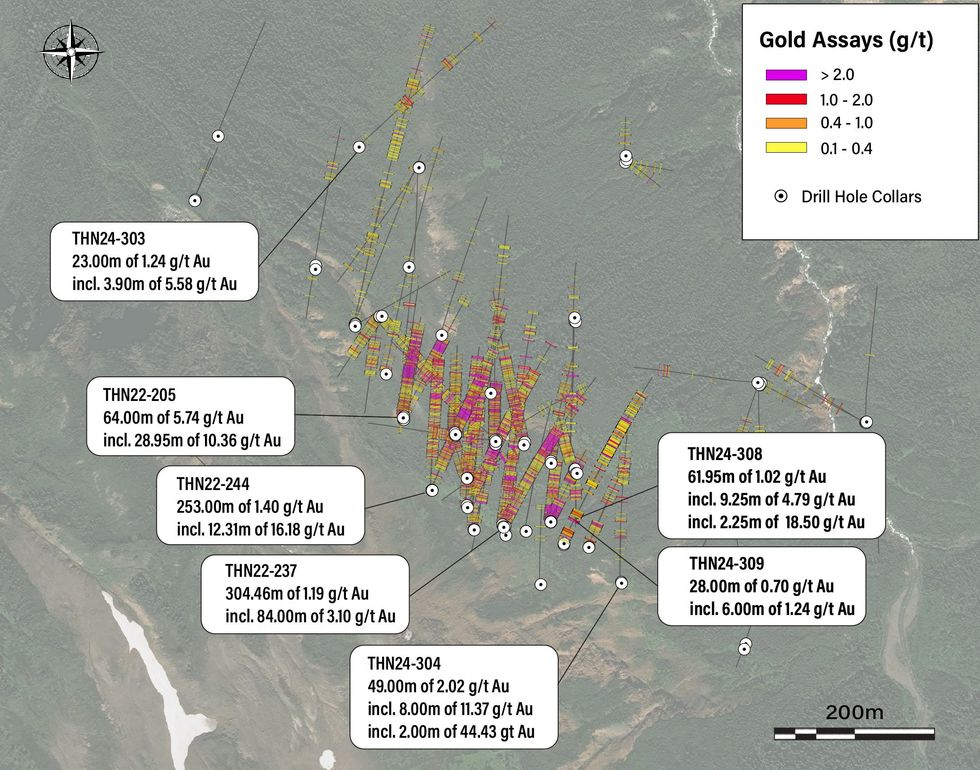

The 2024 drill campaign at the Trapper Gold Target totaled 2,745.60m of drilling across 11 HQ-sized diamond drill holes of which 762.00m are covered in this release. The program was designed to test the extents and continuity of the main mineralized corridor along the Lawless Fault zone through a combination of infill and step-out drilling. Additional step-out drilling was completed north of the main zone, following-up on undercover mineralized zones that were identified during the 2023 drill program. Drilling was planned through a combination of mapping, oriented core data analysis, geophysics, and soil geochemistry. Additional assays from the 2024 drill campaign will be released as they become available.

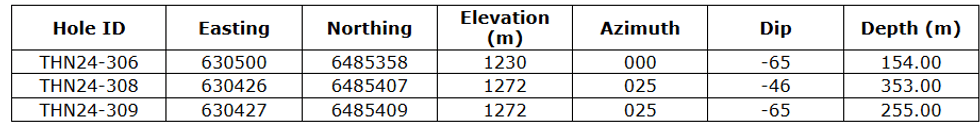

THN24-308 and THN24-309 were drilled from the same pad location and planned as infill to assess grade continuity between previously released holes THN22-251 and THN22-239 from the 2022 drill campaign. Both holes were successful in intercepting broad intervals of near surface gold mineralization. Hole 308 was drilled at an azimuth of 025 degrees and dip of -46 degrees to a final depth of 353.00m returning 313.00m of 0.44 g/t Au including 61.95m of 1.02 g/t Au and including 9.25m of 4.79 g/t Au. Hole 309 was drilled at a steepened angle below hole 309 at an azimuth of 025 degrees and a dip of -65 degrees to a final depth of 255.00m. Hole 309 returned 156.00m of 0.24 g/t Au including 28.00m of 0.70 g/t Au and including 6.00m of 1.24 g/t Au.

THN24-306 was drilled at an azimuth of 000 degrees and dip of -65 degrees to a final depth of 154.00m and was drilled from the same pad location as previously released hole THN24-304 testing a steeper inclination. The holes were planned as southeastern step-outs along the Lawless Fault to determine the extents of mineralization. Although THN24-304 returned 227.50m of 0.50 g/t Au including 27.00m of 3.49 g/t Au, no significant assays were intercepted in hole 306 which drilled into the footwall of the Lawless Fault at 65m depth. However, based on the broad gold intervals intercepted in hole 304 the potential for future extension to the east remains open along the hanging wall of the main mineralizing structure.

Gold mineralization at Trapper is structurally controlled along the Lawless Fault, trending northwest-southeast and dipping moderately to the north in the main drilling area. There are multiple CVG features (see news release dated October 10th, 2024) that could reflect similar parallel structures to the Lawless Fault which remain open to test for new gold potential. Mineralization appears to favour the contact between the Cretaceous (85.2 +/- 1.2Ma) quartz diorite and the Triassic lapilli tuffs with broad gold intervals largely hosted along the faulted contact. The gold is associated with silver and base metal veins containing pyrite-galena-sphalerite +/- chalcopyrite +/- bornite, which occur conjugate to the Lawless Fault. Through a combination of oriented core drilling, surface mapping, geochemistry and geophysics, the aim is to achieve predictability of the gold-bearing zones. The current drilling at the Trapper Target is located 7km southeast from the Camp Creek Copper Porphyry Target. At surface, the Trapper Target is expressed as a 4km northwest trending gold and zinc soil geochemical anomaly which is part of the larger 11km gold geochemical anomaly trending from Camp Creek to the Trapper Target. Future drilling at the Trapper Target will focus on identifying new zones of gold-bearing mineralization undercover within the footprint of this larger gold geochemical anomaly.

Drilling Information

About the Trapper Gold Target

The geochemical footprint for the Trapper Gold Target was expanded in 2021 to 4km by 1.5km with a gold-in-soil geochemical signature that has a strong positive correlation to zinc and lead. The Trapper Target represents an intermediate-sulphidation epithermal system hosted in volcanic and intrusive rocks. The volcanics are Triassic Stuhini lapilli tuff, while the intrusive phase is a Cretaceous quartz diorite dated at 85.2Ma +- 1.2Ma. Visible gold has been identified in both drill core and surface outcrops across the Trapper Target area and rock grab samples have returned up to 152 g/t Au. Visible gold is recognized in several environments: within base metal veins (sphalerite-galena-pyrite-chalcopyrite), quartz-stockwork, sulphosalt-pyrite veinlets, and rarely disseminated gold in the diorite. In 2021, 2022 and 2023, Brixton drilled 3,107m, 9,119m and 6,625m, respectively. In 2011, forty-two drill holes were completed by a previous operator. The Trapper Target is royalty free.

Quality Assurance & Quality Control

Quality assurance and quality control protocols for drill core sampling were developed by Brixton. Core samples were mostly taken at 1.0m intervals. Blank, duplicate (lab pulp) and certified reference materials were inserted into the sample stream for at least every 20 drill core samples. Core samples were cut in half, bagged, zip-tied and sent directly to ALS Minerals preparation facility in Langley, British Columbia. ALS Minerals Laboratories is registered to ISO 9001:2008 and ISO 17025 accreditations for laboratory procedures. Samples were analyzed at ALS Laboratory Facilities in North Vancouver, British Columbia for gold by fire assay with an atomic absorption finish, whereas Ag, Pb, Cu and Zn and 48 additional elements were analyzed using four acid digestion with an ICP-MS finish. Over limits for gold were analyzed using fire assay and gravimetric finish. The standards, certified reference materials, were acquired from CDN Resource Laboratories Ltd., of Langley, British Columbia and the standards inserted varied depending on the type and abundance of mineralization visually observed in the primary sample. Blank material used consisted of non-mineralized siliceous landscaping rock. A copy of the QAQC protocols can be viewed at the Company’s website.

About the Thorn Project

The wholly-owned 2,945 square kilometer Thorn Project is located in British Columbia, Canada, approximately 90 km east of Juneau, AK. The southern limit of the Thorn claim boundary is roughly 50 km from tide water. The Thorn Project hosts a district-scale 80km megatrend of Triassic to Eocene, volcano-plutonic complex with several styles of mineralization related to porphyry and epithermal environments. Many large-scale copper-gold targets have been identified for further exploration work. Information on each of the targets may be found at the following link: https://brixtonmetals.com/thorn-gold-copper-silver-project/

Qualified Person

Mr. Corey A. James, P.Geo., is a Senior Project Geologist for the company and a qualified person as defined by National Instrument 43-101. Mr. James has verified the data disclosed in this press release, including the sampling, analytical and test data underlying the technical information and has approved this press release.

About Brixton Metals Corporation

Brixton Metals is a Canadian exploration company focused on the advancement of its mining projects. Brixton wholly owns four exploration projects: Brixton’s flagship Thorn copper-gold-silver-molybdenum Project, the Hog Heaven copper-silver-gold Project in NW Montana, USA, which is optioned to Ivanhoe Electric Inc., the Langis-HudBay silver-cobalt-nickel Project in Ontario and the Atlin Goldfields Project located in northwest BC which is optioned to Eldorado Gold Corporation. Brixton Metals Corporation shares trade on the TSX-V under the ticker symbol BBB, and on the OTCQB under the ticker symbol BBBXF. For more information about Brixton, please visit our website at www.brixtonmetals.com.

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO

For Investor Relations inquiries please contact: Mr. Michael Rapsch, Senior Manager, Investor Relations. email: michael.rapsch@brixtonmetals.com or call Tel: 604-630-9707

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the use of proceeds. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.

BBB:CC

Sign up to get your FREE

Brixton Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

12 January

Brixton Metals

Diversified exposure to copper, gold and silver with projects in North America

Diversified exposure to copper, gold and silver with projects in North America Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Sign up to get your FREE

Brixton Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00