June 28, 2024

Australian uranium producer Boss Energy (ASX:BOE) has two projects – the 100 percent-owned Honeymoon uranium project in South Australia and the 30 percent-owned Alta Mesa project in the US.

The macro-environment and steps taken by the US government remain favorable for uranium producers such as Boss Energy. The US Congress recently enacted legislation prohibiting the importation of Russian uranium products known as the Prohibiting Russian Uranium Imports Act (HR 1042), valid until 2040.

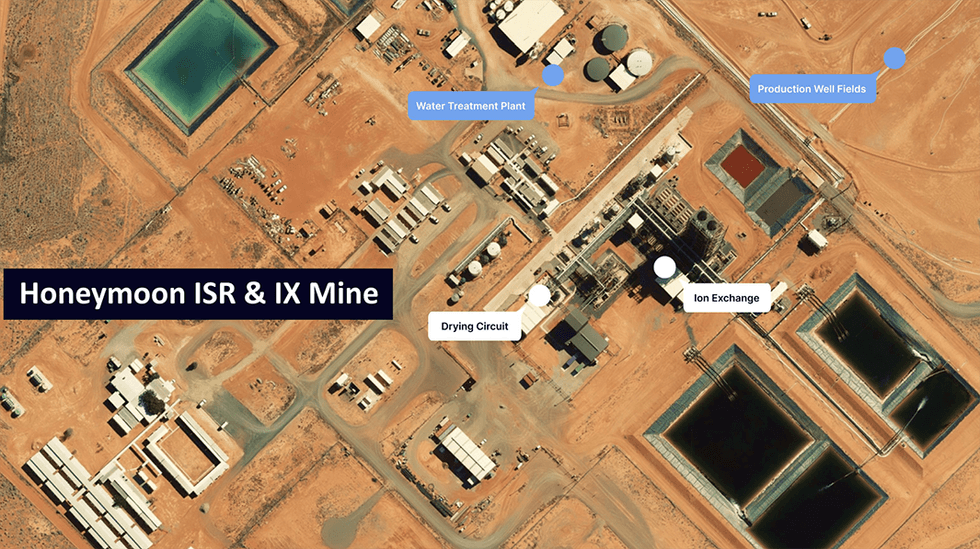

The Honeymoon uranium project in South Australia spans approximately 80 kms northwest of Broken Hill. The project is home to the historical Honeymoon uranium mine, Australia's second operating in-situ recovery uranium mine. It began production in 2011 under the previous ownership of Uranium One. Operations at Honeymoon were halted in November 2013 due to declining uranium prices. Subsequently, Boss Energy acquired the project in 2015. The company has since restarted the mine, with the first drum of uranium produced in April 2024.

Company Highlights

- Boss Energy is an Australia-based uranium producer focused on its two key projects – the 100 percent owned Honeymoon Uranium Project in South Australia and the 30 percent owned Alta Mesa Project in the US.

- In June 2024 Boss became a multi-mine uranium producer through the Honeymoon and Alta Mesa Projects.

- The Honeymoon uranium mine commenced production in April 2024, with the first sale of uranium expected in July 2024.

- Annual production at Honeymoon is forecast to reach 2.45 Mlbs of U3O8.

- The Alta Mesa uranium mine commenced production in June 2024, with first sale of uranium expected in October 2024.

- Annual production at Alta Mesa is forecast to reach 1.50 Mlbs of U3O8. Once steady-state operations are established, Boss’s 30 percent share of the production amounts to 500,000 lbs per year.

- Uranium prices have been the highest since 2008 at over US$80/lb. Prices are expected to remain strong due to the tightness of the uranium supply/demand balance. The company’s first production is timed with strong market fundamentals.

- The company has signed two sales agreements to supply 1.8 million pounds of U3O8 to leading power utilities in Europe and the US, spanning eight years from 2024 to 2032. The company plans to pursue additional agreements as the price of uranium increases.

This Boss Energy profile is part of a paid investor education campaign.*

Click here to connect with Boss Energy (ASX:BOE) to receive an Investor Presentation

BOE:AU

The Conversation (0)

27 June 2024

Boss Energy Limited

Multi-mine uranium producer in Australia and the US

Multi-mine uranium producer in Australia and the US Keep Reading...

28 January 2025

December 2024 Quarterly Results Presentation

Boss Energy Limited (BOE:AU) has announced December 2024 Quarterly Results PresentationDownload the PDF here. Keep Reading...

28 January 2025

Quarterly Cashflow Report - December 2024

Boss Energy Limited (BOE:AU) has announced Quarterly Cashflow Report - December 2024Download the PDF here. Keep Reading...

28 January 2025

Quarterly Activities Report - December 2024

Boss Energy Limited (BOE:AU) has announced Quarterly Activities Report - December 2024Download the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

27 January

Standard Uranium CEO Outlines Athabasca Exploration Plans and Uranium Market Outlook

Standard Uranium (TSXV:STND,OTCQB:STTDF) is advancing an ambitious exploration strategy in Saskatchewan’s Athabasca Basin, according to CEO and Chairman John Bey, who spoke with the Investing News Network at the 2026 Vancouver Resource Investment Conference.The company is preparing for a... Keep Reading...

23 January

Investment establishes valuation of C$50M for the polymetallic Häggån project

Aura Energy Limited (ASX: AEE, AIM: AURA) (“Aura” or “the Company”) is pleased to announce that MMCAP International Inc. SPC (‘MMCAP’) and certain other strategic investors (together the ‘Strategic Investors’) will provide funding of C$10 million for a 19.7% interest in the Company’s... Keep Reading...

21 January

Laramide Exits Kazakhstan Uranium Project After Government Policy Shifts

Laramide Resources (TSX:LAM,OTCQX:LMRXF) has pulled out of a greenfield uranium exploration venture in Kazakhstan, citing policy changes that it says have effectively shut the door on economically viable foreign investment in the country’s uranium sector.The Toronto-based company announced on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00