November 05, 2024

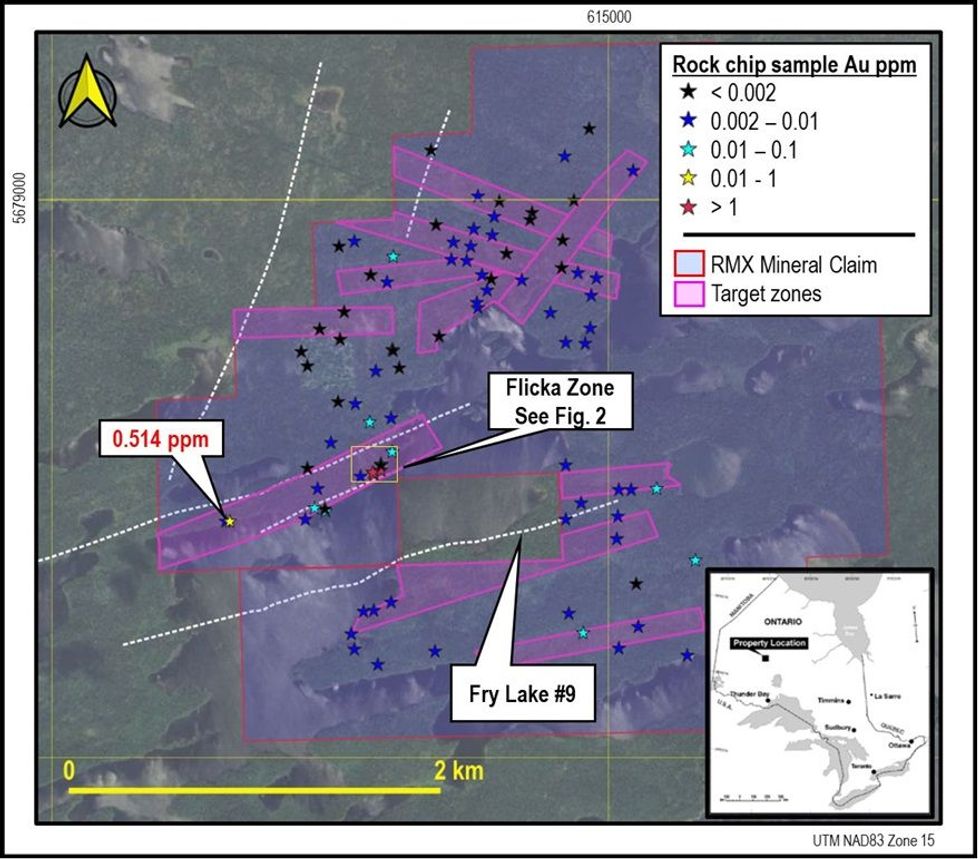

Red Mountain Mining Limited (“RMX” or the “Company”) is pleased to advise that it has received gold results for 91 rock grab samples collected during September from the Company’s 100%-owned Flicka Lake prospect in Ontario, Canada. The rock chip sampling was carried out in parallel with a soil sampling program. Approximately 400 locations were visited within the Flicka Lake claims and 91 rock grab samples and 283 soil samples were collected and submitted for multielement geochemical analysis, including gold by Flame Assay and a base metal suite by four acid digest with ICP-OES finish. Soil results assay results are expected before the end of November.

HIGHLIGHTS

- Gold results from 91 rock chip samples collected from Flicka Lake received

- Bonanza grade values confirmed for the Flicka Zone:

- Flicka Vein #2 returned values of 24.2ppm (24.2 g/t Au) and 19.4ppm (19.4 g/t Au)

- Flicka Vein #3 returned a peak value of 9.35ppm (9.35 g/t Au)

- Results supported by historical desktop study as announced last week

- 0.514ppm (0.514 g/t Au) returned for a pyritic vein sample 800m WSW of Flicka Zone, along the strike of the main shear, highlighting the potential for strike extension of high grade mineralisation

- Soil assay results are expected to be received before the end of November

As outlined in RMX’s ASX announcement of 30 October 2024, the rock and soil sampling program was designed to test ten target zones defined using available geological and geophysical data for the Flicka Lake tenement. Zones sampled included the Flicka Zone, previously identified and sampled by Troon Ventures in the early 2000s.

High gold grades for the Flicka Zone confirmed by rock chip sample results

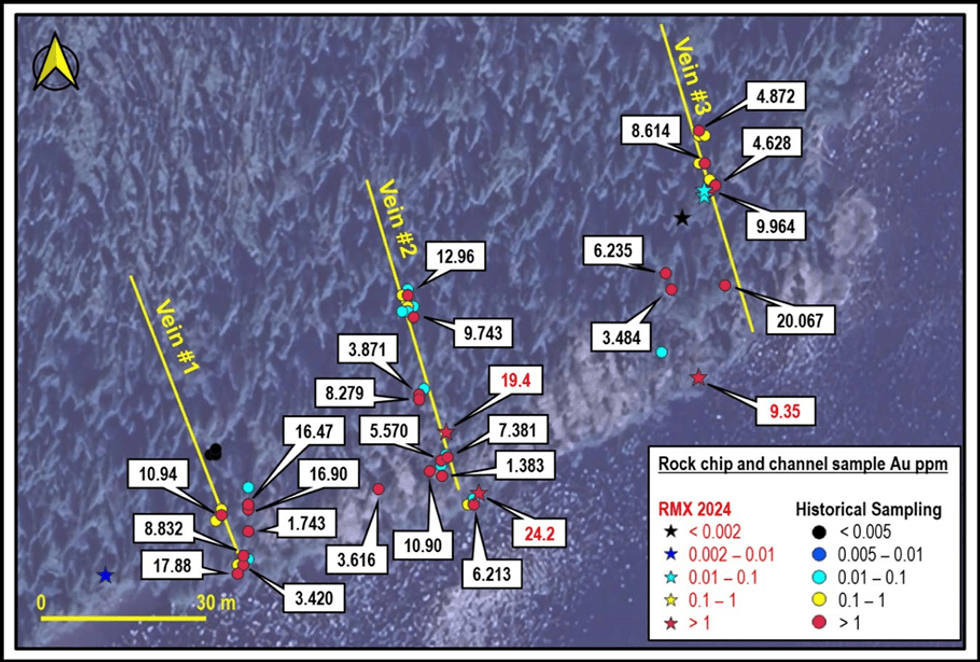

The gold values returned for the 91 rock chip samples are shown on Figure 1 and Figure 2 and listed on Table 1. The best results were obtained from Vein #2 and Vein #3 of the Flicka Zone, with peak values of:

- 24.2ppm (24.2 g/t Au) (Sample 1292085) and 19.4ppm (19.4 g/t Au) (Sample 1292094, shown in Figure 3) from Vein #2.

- 9.35ppm (9.35 g/t Au) (Sample1292086) from Vein #3.

The RMX rock chip results are consistent with historical rock chip and channel sampling results reported by Troon Ventures for the Flicka Zone (Figure 2) that range up to 16.88ppm (16.88 g/t Au) for Vein #1, 12.96ppm (12.96 g/t Au) for Vein #2 and 20.067ppm (20.067 g/t Au) for Vein #3 (refer to RMX ASX Announcement 30 October 2024).

The gold results to date from the Flicka Zone veins are comparable to the recorded grade of the Golden Patricia Mine (refer to Figure 4), a steeply dipping narrow quartz vein system averaging only 40cm in width that is located approximately 25km NE of the Flicka Lake project area. Between 1987 and 1997, Golden Patricia produced 0.62Moz of gold from 1.22Mt of ore averaging 14.4ppm (14.4 g/t Au)1.

An additional pyritic vein sample, located ~800m WSW of the Flicka Zone along the strike of and striking approximately parallel to the main Flicka Zone shear (Figure 1) returned a value of 0.514ppm (0.514 g/t Au), which highlights the potential for the high-grade mineralisation sampled at the Flicka Zone to persist along the shear system.

Next steps

Following receipt of soil geochemistry and full base metal rock chip sample results, expected during November, RMX will evaluate the full dataset to prioritise targets within the Flicka Lake claims for further surface sampling, where justified and drill testing during the 2025 Canadian field season.

Click here for the full ASX Release

This article includes content from Red Mountain Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

1h

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals remains strong. Don't forget to follow us... Keep Reading...

09 March

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

09 March

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

09 March

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

09 March

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00