November 05, 2024

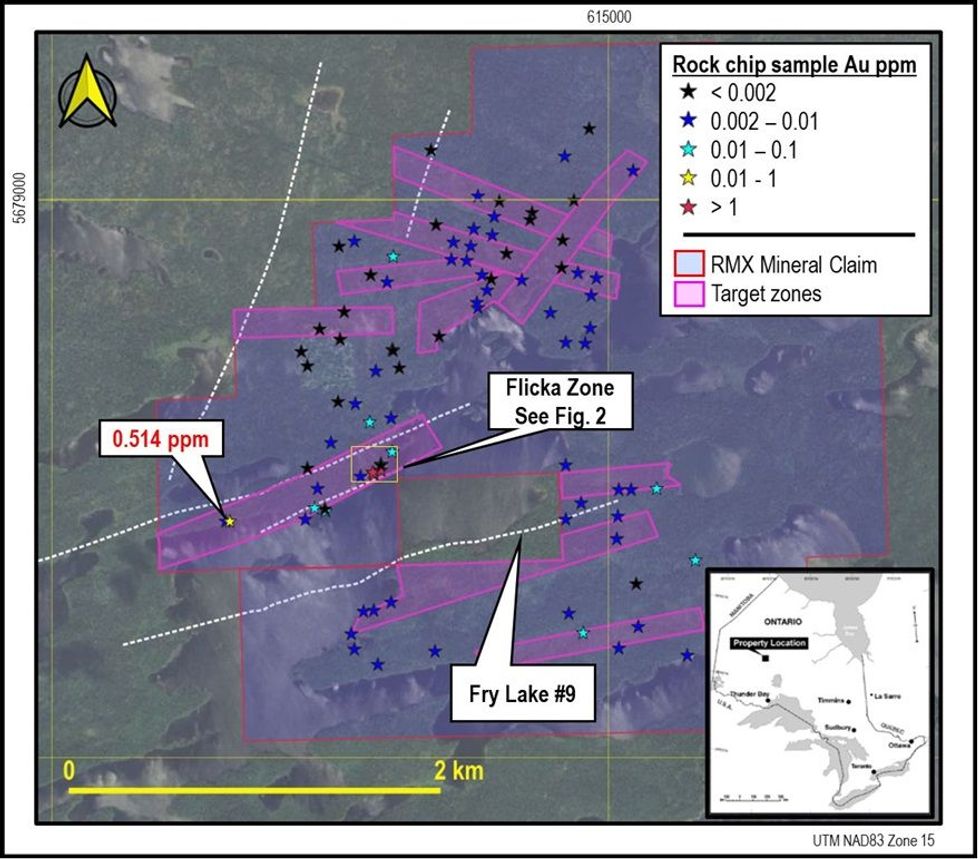

Red Mountain Mining Limited (“RMX” or the “Company”) is pleased to advise that it has received gold results for 91 rock grab samples collected during September from the Company’s 100%-owned Flicka Lake prospect in Ontario, Canada. The rock chip sampling was carried out in parallel with a soil sampling program. Approximately 400 locations were visited within the Flicka Lake claims and 91 rock grab samples and 283 soil samples were collected and submitted for multielement geochemical analysis, including gold by Flame Assay and a base metal suite by four acid digest with ICP-OES finish. Soil results assay results are expected before the end of November.

HIGHLIGHTS

- Gold results from 91 rock chip samples collected from Flicka Lake received

- Bonanza grade values confirmed for the Flicka Zone:

- Flicka Vein #2 returned values of 24.2ppm (24.2 g/t Au) and 19.4ppm (19.4 g/t Au)

- Flicka Vein #3 returned a peak value of 9.35ppm (9.35 g/t Au)

- Results supported by historical desktop study as announced last week

- 0.514ppm (0.514 g/t Au) returned for a pyritic vein sample 800m WSW of Flicka Zone, along the strike of the main shear, highlighting the potential for strike extension of high grade mineralisation

- Soil assay results are expected to be received before the end of November

As outlined in RMX’s ASX announcement of 30 October 2024, the rock and soil sampling program was designed to test ten target zones defined using available geological and geophysical data for the Flicka Lake tenement. Zones sampled included the Flicka Zone, previously identified and sampled by Troon Ventures in the early 2000s.

High gold grades for the Flicka Zone confirmed by rock chip sample results

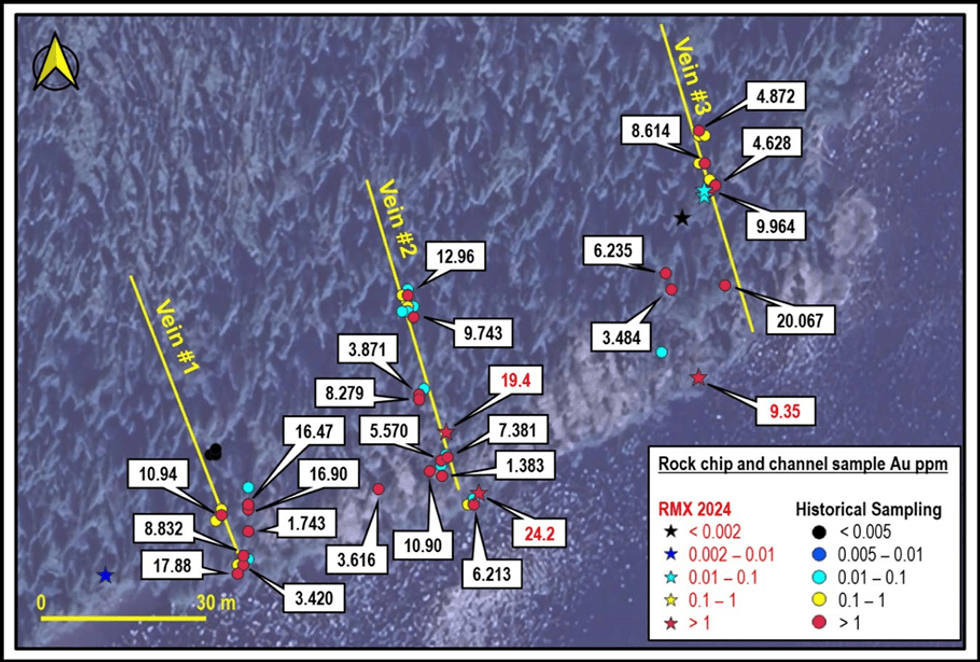

The gold values returned for the 91 rock chip samples are shown on Figure 1 and Figure 2 and listed on Table 1. The best results were obtained from Vein #2 and Vein #3 of the Flicka Zone, with peak values of:

- 24.2ppm (24.2 g/t Au) (Sample 1292085) and 19.4ppm (19.4 g/t Au) (Sample 1292094, shown in Figure 3) from Vein #2.

- 9.35ppm (9.35 g/t Au) (Sample1292086) from Vein #3.

The RMX rock chip results are consistent with historical rock chip and channel sampling results reported by Troon Ventures for the Flicka Zone (Figure 2) that range up to 16.88ppm (16.88 g/t Au) for Vein #1, 12.96ppm (12.96 g/t Au) for Vein #2 and 20.067ppm (20.067 g/t Au) for Vein #3 (refer to RMX ASX Announcement 30 October 2024).

The gold results to date from the Flicka Zone veins are comparable to the recorded grade of the Golden Patricia Mine (refer to Figure 4), a steeply dipping narrow quartz vein system averaging only 40cm in width that is located approximately 25km NE of the Flicka Lake project area. Between 1987 and 1997, Golden Patricia produced 0.62Moz of gold from 1.22Mt of ore averaging 14.4ppm (14.4 g/t Au)1.

An additional pyritic vein sample, located ~800m WSW of the Flicka Zone along the strike of and striking approximately parallel to the main Flicka Zone shear (Figure 1) returned a value of 0.514ppm (0.514 g/t Au), which highlights the potential for the high-grade mineralisation sampled at the Flicka Zone to persist along the shear system.

Next steps

Following receipt of soil geochemistry and full base metal rock chip sample results, expected during November, RMX will evaluate the full dataset to prioritise targets within the Flicka Lake claims for further surface sampling, where justified and drill testing during the 2025 Canadian field season.

Click here for the full ASX Release

This article includes content from Red Mountain Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

4h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

4h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

04 March

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00