February 28, 2024

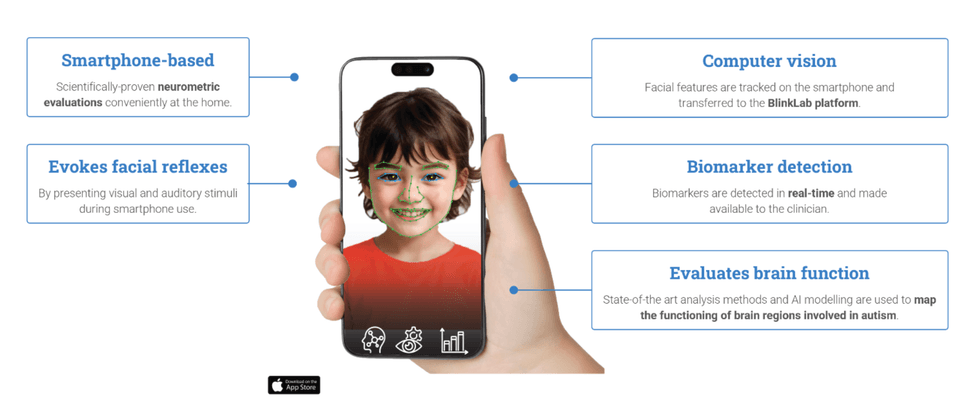

Australia-based BlinkLab leverages computer vision, artificial intelligence and machine learning by developing an app-enabled, smartphone-based diagnostic tool for evaluating children with neurodevelopmental conditions such as autism and ADHD. The app turns the mobile phone into a medical device for an effortless way of conducting remote and rapid tests.

The BlinkLab Test aims to perform neurobehavioural testing free from facial instruments or other fixed location equipment. This AI-based platform is designed to be used at home or in similar environments, independently or with the assistance of a caregiver while following instructions from the mobile device application.

In collaboration with Princeton University in the US and Erasmus Medical Center in the Netherlands, Blinklab Test is initially developed as a prescription diagnostic aid to healthcare professionals (HCP). BlinkLab will need to complete a pivotal registrational study and subsequently apply for FDA registration and reimbursement for the tests.

Company Highlights

- Australia-based BlinkLab is focused on transforming mental healthcare through an AI-enabled smartphone application, a breakthrough technology developed at Princeton University.

- The company’s innovative approach leverages the power of smartphones, AI and machine learning to deliver screening tests specifically designed for children as young as 18 months old. This marks a significant advancement, considering traditional diagnoses typically occur around five years of age, often missing the crucial early window for effective intervention.

- Once approved by the regulators, this cutting-edge digital technology is poised to capture the imagination of both investors and major pharmaceutical companies, eager to embrace transformative solutions in healthcare.

- BlinkLab is led by an experienced management team and leading experts in the field of machine learning, autism and brain development bridging the most advanced technological innovations with groundbreaking scientific research. The company is chaired by Brian Leedman, an experienced biotechnology entrepreneur and founder of ResApp Health, a digital diagnostic company recently acquired by Pfizer.

This BlinkLab is part of a paid investor education campaign.*

Click here to connect with BlinkLab to receive an Investor Presentation

The Conversation (0)

26 September

Tech Weekly: Tech Stocks React to Fed, AI News and Geopolitical Tensions

This week’s market action reflected renewed caution amid evolving signals from the US Federal Reserve, with tech stocks facing pressure from shifting interest rate expectations and renewed overvaluation concerns. Artificial intelligence (AI) heavyweight NVIDIA (NASDAQ:NVDA) announced a US$100... Keep Reading...

26 September

Syntheia Signs Definitive Agreement for Call Center Acquisition

Syntheia Corp. (CSE: SYAI) ("Syntheia" or the "Company") (syntheia.ai), today announced that it has entered into an amended and restated agreement dated September 25, 2025 (the "Restated Agreement") with Call Center Guys Inc. ("CCG"), to amend and restate the terms of an asset purchase agreement... Keep Reading...

23 September

NVIDIA Commits US$100 Billion to OpenAI in Landmark AI Infrastructure Push

Semiconductor giant NVIDIA (NASDAQ:NVDA) plans to invest up to US$100 billion in OpenAI to build what executives are calling the largest artificial intelligence (AI) infrastructure project in history.The companies said on Monday (September 22) that OpenAI will deploy NVIDIA's systems on a scale... Keep Reading...

22 September

How to Invest in OpenAI's ChatGPT

OpenAI’s ChatGPT is one of the latest technological breakthroughs in the artificial intelligence space. But what is ChatGPT, and can you invest in OpenAI?This emerging technology is representative of a niche subsector of the AI industry known as generative AI — systems that can generate text,... Keep Reading...

19 September

Tech Weekly: Semiconductor Stocks Rally on Fed Rate Cut and Strategic Deal

The US Federal Reserve lowered its key interest rate for the first time in 2025 this week, while the Bank of Canada resumed cutting after pausing in March, providing a boost to growth-oriented sectors.Tech stocks, particularly semiconductor and artificial intelligence (AI) companies, responded... Keep Reading...

Latest News

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00