The Conversation (0)

Blackstone Minerals Limited ("Blackstone" or the "Company") is pleased to announce that the Company will collaborate with the Vietnamese Government to identify new nickel opportunities outside of the Company's current Ta Khoa Ni-Cu-PGE district tenement holdings in Northern Vietnam.

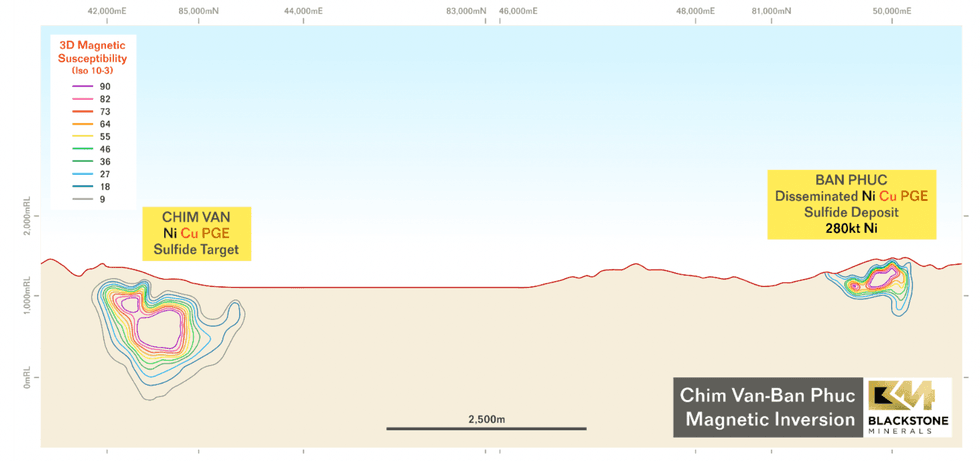

Blackstone's 90% owned subsidiary Ban Phuc Nickel Mines (BPNM) will work in collaboration with the General Department of Geology & Minerals of Vietnam (GDGMV), initially conducting new geophysics exploration to advance the Chim Van target, a highly prospective nickel target, located approximately 10km from the Company's large Ban Phuc open pit deposit (refer Figure 1 & 2). Highlights of the Chim Van joint exploration exercise include:

Read the full article here.

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia