October 04, 2022

Barksdale Resources (TSXV:BRO,OTCQX:BRKCF),OTCQX:BRKCF) focuses on the acquisition and exploration of highly prospective mineral properties in Arizona and Mexico. Barksdale resources' assets are located in high-value mining districts. The company spent years developing a loyal following, including key shareholders such as Teck Resources (TSX:TECK.A,NYSE:TECK) and Osisko Development Corp (TSX:ODV).

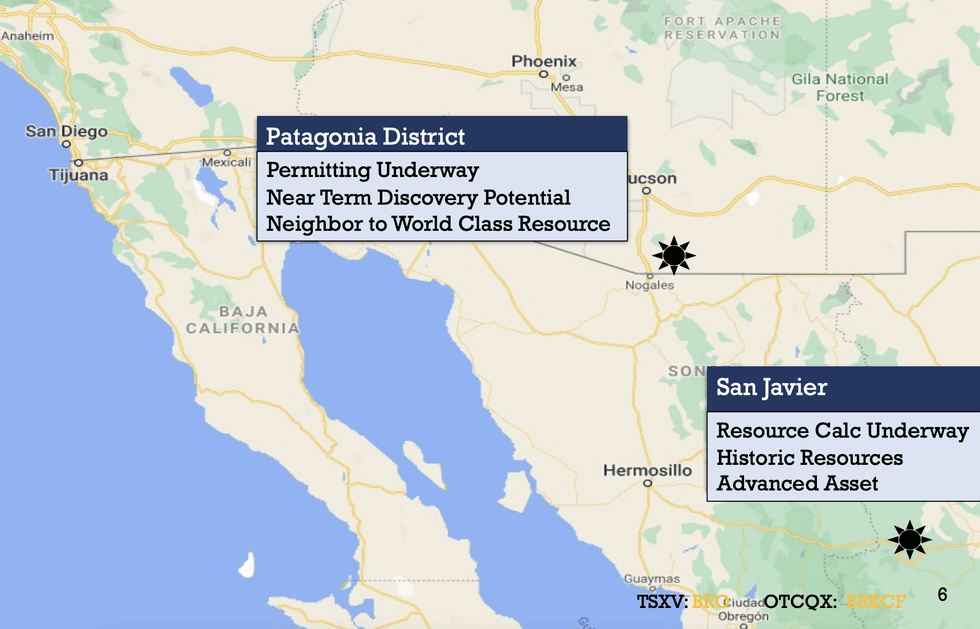

The company's flagship Sunnyside project in the Patagonia mining district of southern Arizona has seen a significant mineral discovery as well as US$1.6 billion of M&A since 2018. Barksdale is now the second largest mineral claim holder in the area behind South32 (ASX:S32), and controls five projects including Sunnyside, San Antonio, Four Metals, Goat Canyon and Canelo. Barksdale has received the exploration permit for San Antonio, and is actively advancing exploration drill permits so that it can fully explore its Sunnyside project, where the company hosts a large copper porphyry and the extension of South32’s Taylor deposit.

Company Highlights

- Barksdale Resources CEO Rick Trotman has successfully acquired and integrated world-class properties; his integral experience and reputation has allowed him to recruit industry leaders and partners.

- Barksdale currently operates five key projects: Sunnyside, San Antonio, Goat Canyon, Canelo and the Four Metals projects in the Patagonia district, Arizona, as well as the San Javier project in Sonora, Mexico.

- Arizona is the heart of copper production in the US – 68 percent of all copper mined in America comes from Arizona. Most notable are the significant porphyry copper deposits found in Southern Arizona.

- Barksdale is actively permitting the Sunnyside project for exploration. The plan is to drill Sunnyside and San Antonio in tandem in Q1 2023.

- Teck Resources, US Global and Osisko Development Corp are key shareholders, with approximately 25 percent combined ownership

- Barksdale is actively reviewing and qualifying other properties as an ongoing strategy to increase shareholder value.

This Barksdale Resources Corp. profile is part of a paid investor education campaign.*

BRO:CA

The Conversation (0)

24 May 2023

Barksdale Resources Corp.

Advanced Precious and Base Metals Properties in Mexico and Arizona

Advanced Precious and Base Metals Properties in Mexico and Arizona Keep Reading...

3h

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

5h

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00