February 21, 2024

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to provide an update on exploration activities within the Company’s large 100%-owned Bangemall Project in the Gascoyne region of Western Australia.

- Fixed loop EM survey continues at Mount Vernon Project

- Evidence of differentiated sill and mafic cumulate rocks

- Shallow EM conductor confirmed at Trouble Bore Project

Miramar is exploring for Norilsk-style nickel, copper and platinum group element (Ni-Cu-PGE) mineralisation related to 1070Ma aged Kulkatharra Dolerite sills, part of the Warakurna Large Igneous Province and the same age as the large Nebo-Babel Ni-Cu deposits in the West Musgraves.

The fixed loop electromagnetic (FLTEM) survey underway within the Mount Vernon project areas has recommenced after a short break due to extreme weather conditions throughout the Gascoyne region.

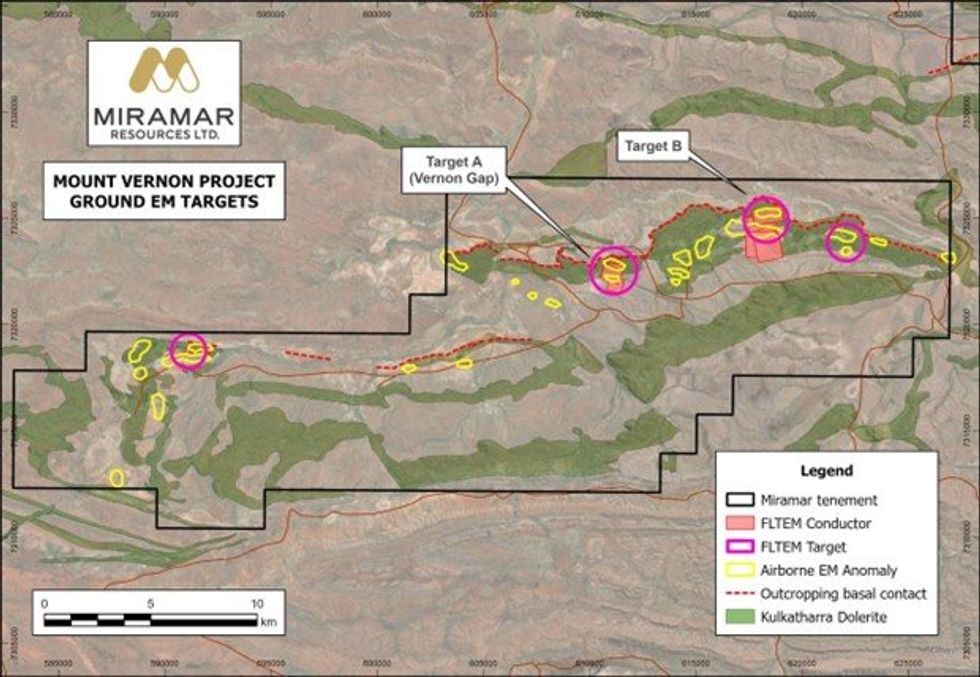

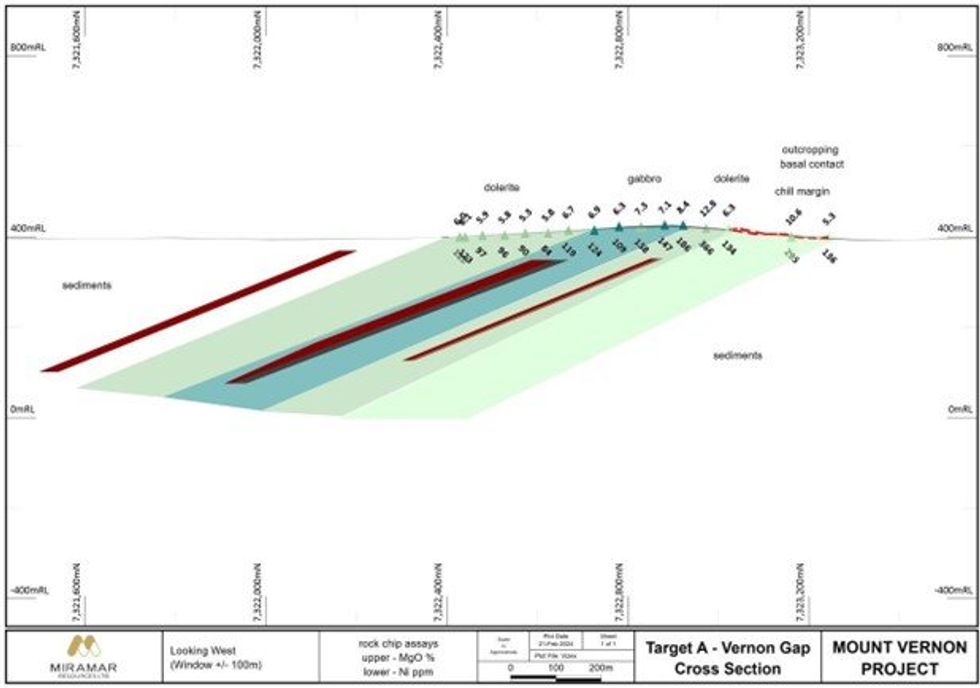

As discussed in the ASX release on 13 February 2024, the FLTEM survey at Mount Vernon has so far identified multiple late-time conductors at the first two targets tested to date (Figure 1), with modelling of the data indicating south-dipping conductive plates near the base of the dolerite sill where nickel-copper sulphides may have accumulated (Figure 2).

In addition to the EM results, evidence that the dolerite sill has undergone differentiation, and could therefore host Ni-Cu-PGE sulphide mineralisation, includes the following, as shown in Figure 2:

- Variation in grain size from very fine-grained chill margins at the extremities to coarser-grained gabbro in the centre of the sill.

- Increasing magnesium oxide (MgO), nickel and PGE results towards the bottom (northern margin) of the sill

- Nickel-chromium-titanium (Ni-Cr-Ti) ratios suggesting the presence of mafic cumulate rocks which are an important component of this style of mineralisation

The FLTEM survey will test two further targets within the Mount Vernon Project where strong late-time airborne EM anomalies are seen within and/or underneath the northernmost dolerite sill.

Miramar’s Executive Chairman, Mr Allan Kelly, said the Company believed the Bangemall Project had the potential for a style of Ni-Cu-PGE mineralisation not previously seen in WA.

“We are the first company to explore for this style of mineralisation in the Bangemall region and are systematically progressing our targets towards the maiden drilling programme,” he said.

“At Mount Vernon, we identified multiple targets from our airborne EM survey and have now confirmed two of these with ground EM surveys and rock chip sampling,” he added.

“It is worth noting that, in contrast to many existing WA nickel deposits, the style of mineralisation we are looking for in the Bangemall occurs as large and very valuable orebodies that are basically immune to short-term swings in the nickel price,” Mr Kelly said.

“Like the discovery of Nebo-Babel in 2000, or Nova-Bollinger in 2012, if we can show proof of concept of the Norilsk-style deposit model at Mount Vernon and/or Trouble Bore, it opens up the entire Bangemall region as a new nickel-copper province, one where we have built a dominant landholding,” he added.

Trouble Bore

Prior to taking a short break due to extreme weather conditions in the region, the geophysical contractors completed a reconnaissance moving loop electromagnetic (MLEM) survey over the 3 kilometre long historic late-time SkyTEM anomaly at the recently granted Trouble Bore Target.

The SkyTEM anomaly occurs at the intersection of a dolerite sill and a potential N-S trending feeder dyke both of which are mostly buried beneath later sediments (Figure 3).

Evidence of the dolerite sill is seen in outcrop along strike in either direction.

A single historic RC hole drilled in 2013 targeted channel iron deposits and did not intersect the dolerite sill or test the SkyTEM anomaly. There is no recorded historical geochemical sampling in the area.

The recent MLEM survey confirmed the historic SkyTEM anomaly, with subsequent modelling suggesting a shallow, sub-horizontal conductor with a moderate conductance of approximately 200 Siemens.

Given the interpreted geological setting of the EM anomaly compared with known Ni-Cu-PGE deposits, especially step 2 of Figure 4, Miramar has submitted a Program of Work (POW) application for drilling at Trouble Bore.

The Company already has POW approval for drilling at Mount Vernon and will apply for co-funding under the WA Government’s Exploration Incentive Scheme (EIS) for drilling at both Mount Vernon and Trouble Bore.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

16h

Faraday Copper Signs LOI to Acquire BHP’s San Manuel Property in Arizona

Faraday Copper (TSX:FDY,OTCQX:CPPKF) has signed a letter of intent (LOI) to acquire BHP's (ASX:BHP,NYSE:BHP,LSE:BHP) San Manuel property, which sits next to its Copper Creek project in Arizona. The company says the move will combine the two adjacent assets into a single US-focused copper... Keep Reading...

23 February

ASX Copper Mining Stocks: 5 Biggest Companies in 2026

Copper prices have been volatile throughout 2025 and into 2026, fueled by economic uncertainty from an ever-changing US trade policy and strong supply and demand fundamentals. The International Copper Study Group, the leading copper market watcher, reported an apparent refined copper surplus of... Keep Reading...

23 February

What Was the Highest Price for Copper?

Strong demand in the face of looming supply shortages has pushed copper to new heights in recent years.With a wide range of applications in nearly every sector, copper is by far the most industrious of the base metals. In fact, for decades, the copper price has been a key indicator of global... Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00