May 21, 2023

Lunnon Metals Limited (ASX: LM8) (the Company or Lunnon Metals) is pleased to announce the completion of the Preliminary Feasibility Study (PFS) and the initial Probable Ore Reserve for the Baker deposit of 612,000 tonnes at 2.86% Ni for 17,500 contained nickel tonnes1.

KEY POINTS

- Strong financial returns with low start-up capital requirements.

- Initial Probable Ore Reserve of 612kt averaging 2.86% Ni for 17.5kt contained nickel1.

- Indicated Mineral Resource converted 73% to Ore Reserve.

- Pre-tax and post-tax free cash flow generation of $196 million and $145 million.

- Pre-tax NPV8% of $164 million and 324% internal rate of return (IRR).

- Pre-production capex of $18.6 million, maximum cash drawdown of $26.4 million including working capital.

- A premium sulphide concentrate, averaging ~14.6% Ni, Fe:MgO ratio of ~18.8 and low arsenic of ~440ppm.

- Detailed offtake discussions can now commence for Baker’s high grade nickel sulphide ore.

- Significant upside potential from the initial base case outlined in the PFS:

- No Inferred Mineral Resources included in PFS

- Likely future extensions to Baker with the deposit remaining open down plunge

- Potential contribution from East Trough deposit (approx. 450m from Baker)

- Scale and synergies with Foster’s Mineral Resources.

The PFS confirms that the Baker Project is a commercially robust high-grade nickel sulphide orebody (2.86% Ni), with a modest pre-production capital cost ($18.6 million), located in a Tier 1 jurisdiction in the heart of Kambalda, Western Australia. The PFS also confirms that Baker will produce a premium nickel concentrate, the results of which now enable detailed offtake discussions for the Project. The PFS leaves significant future upside potential, with a depth of mining of less than 200m below surface and the deposit remaining open down plunge. Lunnon Metals will now continue further studies (including reviewing scale and synergy benefits with Foster’s Mineral Resources), as the Company looks to build on its initial Ore Reserve for the Kambalda Nickel Project, which comes less than two years since listing and 18 months after Baker’s discovery.

Key PFS Outcomes and Assumptions

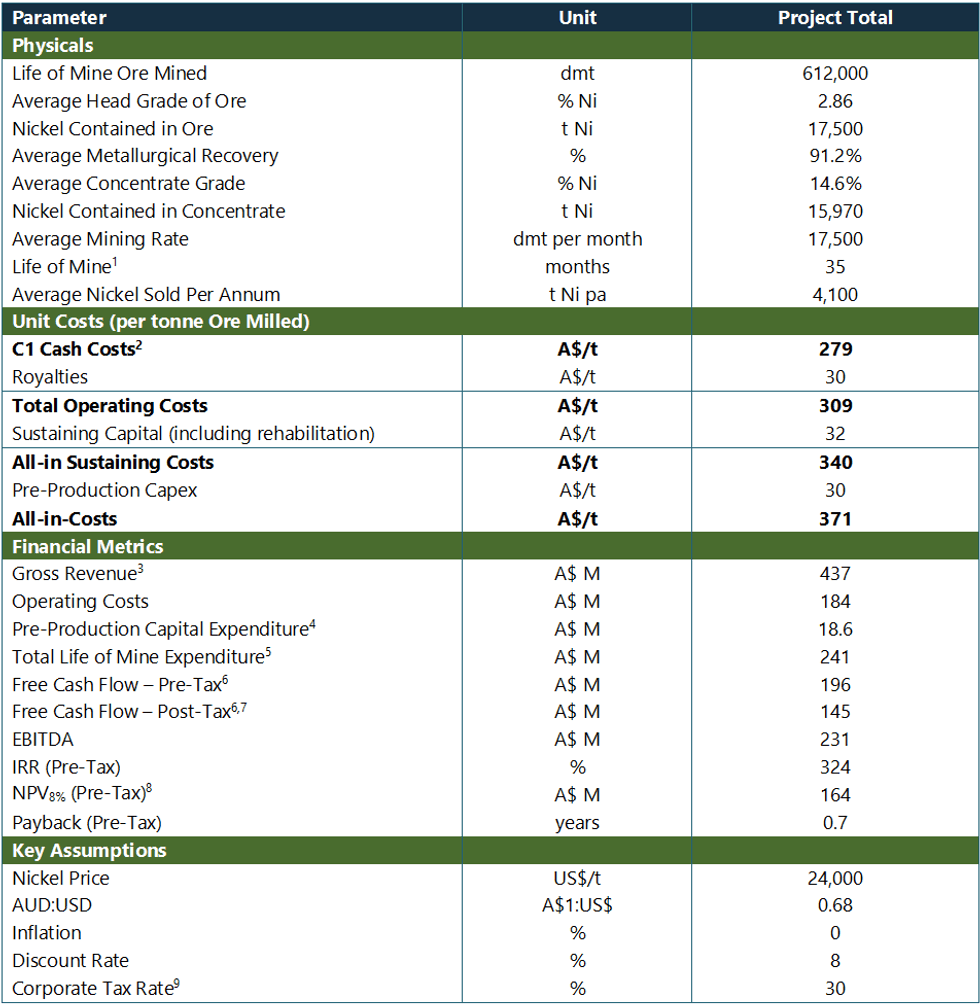

A summary of the initial physical and financial evaluation of the Project is shown in Table A, with additional details provided in the PFS Executive Summary.

1 Refer to Section 7 of the Preliminary Feasibility Study – Executive Summary below for a full breakdown of the Ore Reserve.

Table A: Key Production and Financial Outcomes and Assumptions

Notes:

1: Life of Mine is calculated from first stope ore, being approximately four months into Project commencement.

2: C1 Cash Costs includes Operating Costs, including mining, processing (excluding penalties), surface haulage, G&A, less by-products, divided by ore tonnes for processing. Excludes pre-production and sustaining capital expenditure, rehabilitation cost and royalties.

3: Gross Revenue excludes deduction of penalties from revenue and excludes revenue credits to Pre-Production Capital. 4: Pre-Production Capital Expenditure is to first stope ore, not commercial production.

5: Total LOM Expenditure includes Operating Costs, Royalties, Sustaining Capital, Closure Costs and Pre-Production Capital.

It excludes any by-product or revenue credits.

6: Free Cash Flow is Gross Revenue (less penalties) minus Operating Costs, Capital Expenditure (pre-production and sustaining), Royalties, and Closure Costs.

7: Post-Tax includes an assumption of $30 million in accumulated tax losses to 31 March 2024 and 30% Corporate Tax Rate.

8: NPV is based on real cash flow forecasts and represents value as at projected start date of 1 April 2024.

9: Corporate Tax Rate may be less, with a tax rate of 25% if aggregated turnover is less than $50 million in any financial year.

Managing Director, Ed Ainscough, commenting said:

“Kambalda has been one of Australia’s most prolific nickel production centres for over 55 years. Despite this long history, the district is still a globally relevant nickel belt and remains an important strategic source of high-grade, premium quality nickel sulphides. Baker continues this proud Kambalda tradition and the Company is likewise proud to report the results for that deposit’s PFS and initial Ore Reserve. These impressive results come within two years of listing on the ASX and at a time when Kambalda is once again in the headlines, this time as a sought after key production centre driven by its many positive attributes including its high-grade, superior concentrate quality and consequent low energy and capital intensity to exploit.

I would like to thank the Lunnon Metals’ team who have worked to deliver these outcomes over the past two years. They more than anyone know that this is just the start, these are very much initial results, with plenty more to come from our growing Mineral Resource base already defined at Baker and Foster but also from the many exciting exploration programs across the rest of our portfolio. To have access to such high-quality tenure in the heart of Kambalda is truly amazing and sets the Company and its shareholders up for a bright future.”

Click here for the full ASX Release

This article includes content from Lunnon Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00