October 27, 2022

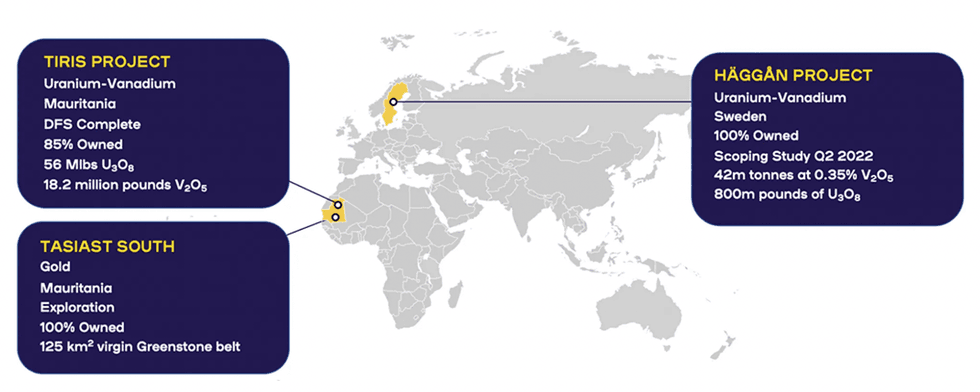

Aura Energy (ASX:AEE, AIM:AURA) is advancing its fast-tracked Tiris Uranium project in Mauritania, as it continues to transition from explorer to producer. The company's mission is to produce sustainable, low-cost uranium for the world’s future energy needs.

Aura Energy’s flagship Tiris Uranium Project in Mauritania is well-positioned to achieve near-term production from its Phase 1 project in 2024, supported by a stable jurisdiction and a mining-friendly government. The company has completed a definitive feasibility study which was recently updated with a 2021 capital estimate and has since submitted its draft Key Management Plans for Tiris to the National Authority for Radioprotection, Safety and Nuclear Security in Mauritania, part of the next steps to obtain authorisation for production and export of uranium oxide concentrate from Mauritania.

Company Highlights

- Aura Energy is an exploration and development company with a mission to produce sustainable, low-cost uranium for the world’s future energy needs.

- The Tiris Uranium Project in Mauritania is poised for near-term production, with low capital and operating costs, supported by a stable and mining-friendly jurisdiction.

- Tiris mineralisation occurs at surface, is free-digging and the grade is easily upgraded by 500 to 600 percent while rejecting 80 percent of the mass prior to leaching. All these characteristics contribute to low capital and operating costs.

- The company has submitted draft management plans to Mauritanian authorities as an important step towards production and export of uranium oxide concentrates from Mauritania.

- The company has developed a net-zero emissions pathway to support a positive ESG rating for its Tiris project.

- Phase 1 of the Tiris project uses only 20% of total resources, providing significant opportunity to more fully utilise resources with expanded production.

- The company is progressing with a feasibility study into expanded production, with a target of 2 to 4 Mlb pa U3O8 shortly after first U3O8 production from Phase 1.

- Aura Energy’s 100-percent-owned Häggån uranium-vanadium project contains significant vanadium deposits, an essential mineral for the steel industry as well as for the development of VRFB to support renewable energy technologies.

- An experienced management team with expertise throughout the mining industry leads the company towards its goals.

This Aura Energy profile is part of a paid investor education campaign.*

Click here to connect with Aura Energy (ASX:AEE, AIM:AURA) to receive an Investor Presentation

AEE:AU

The Conversation (0)

02 June 2023

Aura Energy

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future Keep Reading...

3h

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

10h

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten plans to expand US nuclear power, according to the chief executive of Centrus Energy Corp (NYSE:LEU), one of the country’s largest suppliers of enriched uranium fuel.Amir Vexler, chief executive of Centrus, warned that rising... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00