April 03, 2025

Australian Rare Earths Limited (ASX: AR3) is pleased to provide an update on the chemical assays received from samples recovered from the shallow calcrete hosted intersections in drill hole OV047.

Highlights:

- Assays confirm Uranium intersections in the first hole where a calcrete-hosted surficial uranium occurrence was detected, atOV047:

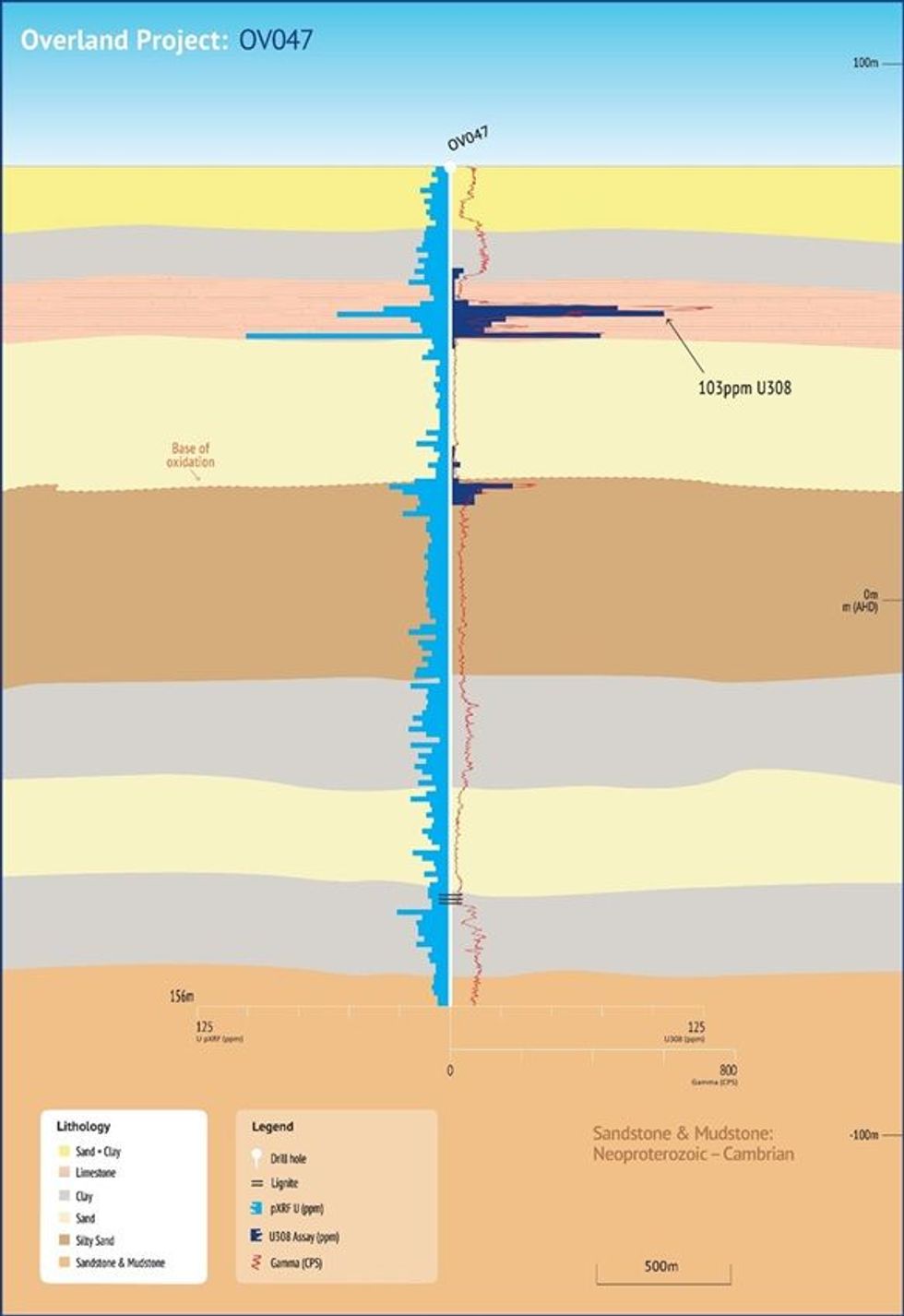

- 2m at 92ppm U3O8 from 26m, including:

- 1m at 103ppm U3O8 from 27m;

- 1m at 82ppm U3O8 from 26m; and

- 1m at 72ppm U3O8 from 31m

- 2m at 92ppm U3O8 from 26m, including:

- Significant mineralisation potential at Overland: The modern drainage setting indicates an anomalous mineralised zone up to 6m thick and over 1km wide, open in all directions.

- Dual Uranium potential: Assays now confirm Overland demonstrates potential for both near surface, calcrete-hosted uranium, and deeper, ISR-amenable deposits, highlighting the strategic significance of AR3’s 4,000km² exploration land package.

- Drilling and assays continue:

- Assays from the remainder of the infill holes following up OV047 are expected in the June quarter 2025.

- Our 2025 drilling program will continue through April, following up the surficial uranium discovery and deeper ISR-amenable deposits.

- Engage with this announcement at the AR3 investor hub.

AR3 Managing Director and CEO, Travis Beinke, said:

“These assay results from the first hole where the occurrence of shallow calcrete-hosted uranium was discovered underscore the significant potential of the Overland project. The search for both shallow calcrete-hosted uranium, and sedimentary hosted, ISR amenable targets, continues in this frontier uranium play.

“We look forward to providing further updates on our ongoing drill program and sharing assay results as AR3 pursues active uranium exploration activity at Overland.”

The assay results conform with down hole gamma responses and in-field pXRF measurements for contained uranium in OV047. This provides continued confidence that these immediate field- based measurements can guide drill hole targeting at Overland.

Now supported by these recent assays and significant uranium intersections, follow-up drilling of OV047’s anomalous gamma and pXRF uranium readings in shallow carbonate-cemented sediments, point to the potential for a widespread continuation of calcrete hosted uranium mineralisation.

The follow-up drilling, consisting of nine drill holes targeting the shallow carbonate-cemented sediments, have consistently confirmed anomalous gamma and pXRF uranium responses1. The discovery remains open in all directions for calcrete-hosted uranium mineralisation. The mineralisation spans an extensive area, with a potential strike length stretching dozens of kilometres along the modern drainage profile and a width exceeding one kilometre.

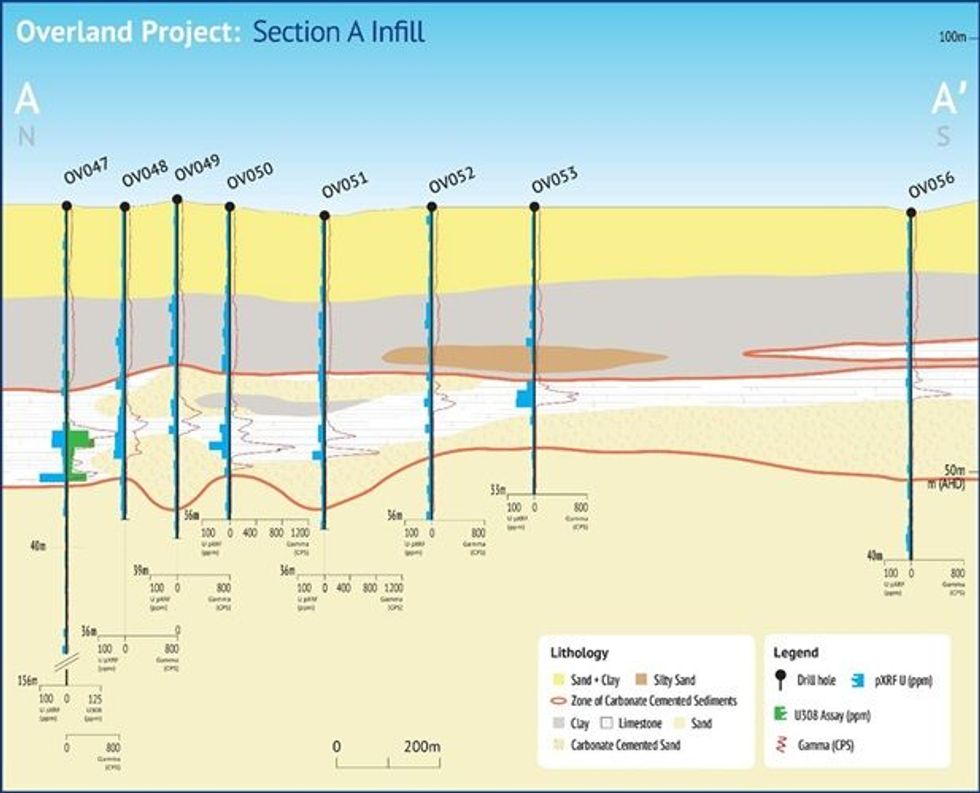

The follow up drilling was conducted at 100 to 600 metre spacings to depths of up to 42 metres, with anomalous zones occurring between 20 and 32 metre depths (Figure 1: section A-A’ ).

Initial indications of a shallow uranium occurrence at Target 1 of EL6678 came in drill hole OV047, which intersected a 6 metre interval containing anomalous gamma and pXRF uranium responses. Gamma responses peaked at 741 counts per second (cps), with maximum pXRF uranium response of 105ppm uranium in OV047. Subsequent drilling has provided further evidence of this style of mineralisation, with gamma responses peaking at 1,010cps in hole OV050 and additional anomalous pXRF uranium values exceeding 50ppm occurring in holes OV050 and OV053. The identified anomalous zones range from two to six metres thick.

Mineralogical assessments of hole OV047 drill cuttings through scanning electron microscope (SEM) and micro XRF analysis indicate that uranium is hosted in the secondary calcite cementation of both the limestone and the sandy sediments in this setting. Indicative uranium levels of up to ~350ppm uranium have been detected in the calcite cement infilling these sediments. The uranium within the calcite cement was identified by analysing samples with a Bruker M4 Tornado Plus μXRF instrument operated by Adelaide Microscopy at the University of Adelaide2.

This shallow sedimentary uranium mineralisation in secondary carbonate cementation is similar to Namibia’s surficial uranium deposits, as found at Paladin Energy’s Langer Heinrich mine or Deep Yellow’s Tumas project. Similar calcrete-hosted deposits are also found in Western Australia at Cameco’s Yeelirrie deposit and Toro Energy’s Wiluna project.

Click here for the full ASX Release

This article includes content from Australian Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00