May 12, 2023

Antler Gold Inc. (TSXV: ANTL) ("Antler" or the "Company") is pleased to announce that Antler and its subsidiary Antler Exploration Zambia Limited ("Antler Exploration") have entered into an option agreement (the "Option Agreement") with Prospect Resources Limited (ASX: PSC) (FSE: 5E8) ("Prospect" or the "Partner") pursuant to which Prospect has an option to acquire 51% interest in Antler Exploration, which holds the Kesya Rare Earth Project ("Project") located in southern Zambia.

Deal Highlights:

- Prospect has up to two years to acquire a 51% interest in Antler Exploration which holds the Kesya Rare Earth Project via a total combined counterparty consideration and project expenditure payments amounting to US$3.05 million.

- Phase 1 commitment by Prospect is two cash payments of an aggregate of US$150,000 and US$350,000 in exploration expenditures as well as an issuance of US$500,000 worth of Prospect common shares within 30 days of the completion of Phase 1.

- Phase 2 option commitment by Prospect is a cash payment of US$150,000 and US$750,000 in exploration expenditures as well as an issuance of US$500,000 worth of Prospect common shares within 30 days of electing to proceed to Phase 2.

- The final phase commitment by Prospect is a cash payment of US$150,000 as well as an issuance of US$500,000 worth of Prospect common shares at the end of the 2 year option period which will then earn Prospect 51% of Antler Exploration.

Project Highlights:

- The Project covers a Large-Scale Exploration License Application where geological mapping and surface sampling conducted by Antler Exploration has identified a large, rare earth-element enriched carbonatite.

- Rock chip samples assayed by Antler Exploration outline very encouraging total rare earth element oxide (TREO) mineralisation contained within monazite and bastnaesite with low levels of uranium and thorium.

- The Kesya rock chip results provide highly anomalous surface values in rare earth elements with the highest grab sample to date assaying 6559 ppm (0.66%) TREO.

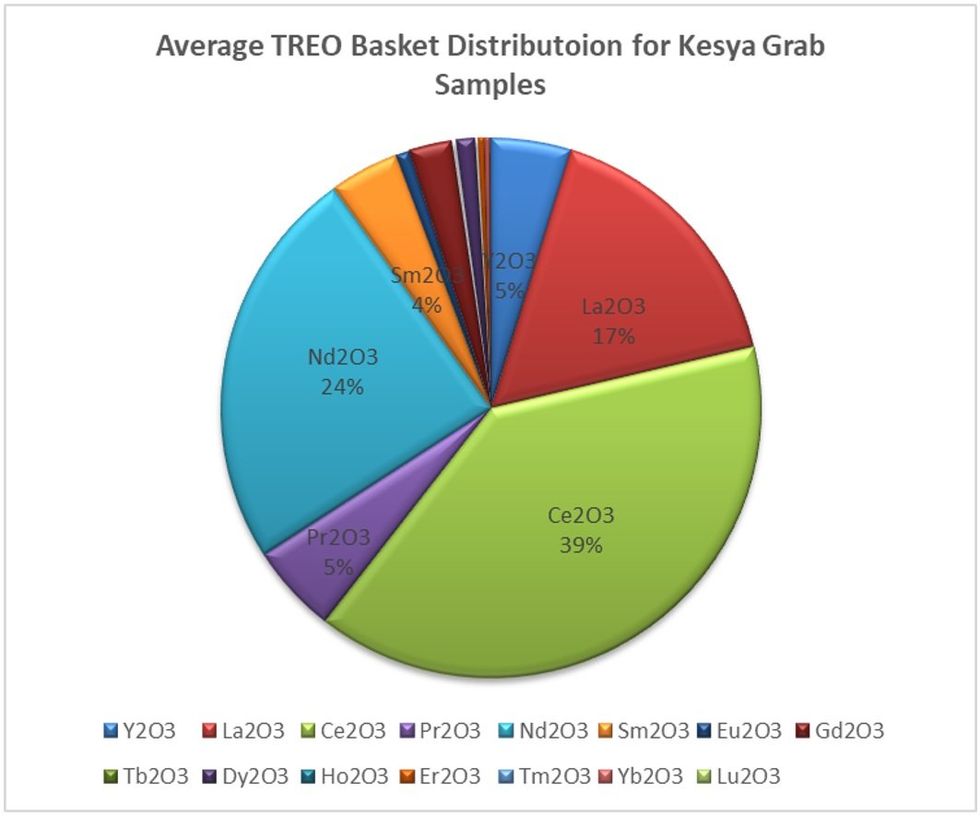

- The grab samples are enriched in neodymium (Nd) and praseodymium (Pr) oxides which average 29% of the TREO content and makes this a very encouraging basket distribution.

- Keysa's large amount of carbonatite outcrop allows for easy drill targeting offering prospectivity to rapidly delineate a mineral resource and make a significant new rare earth element discovery in Zambia.

- Antler Exploration along with its partner Prospect are preparing for an initial 1,500m diamond drilling program to test the subsurface expression and depth extent of the mapped and sampled rare earth element enriched carbonatite.

Christopher Drysdale, CEO of Antler commented:

"We are extremely excited to announce this agreement with Prospect. It's a testament to our commitment to strategic partnerships with highly credible organizations that share our vision for value creation. Prospect has an outstanding track record, which is demonstrated by their successful advancement of the Arcadia lithium project in Zimbabwe. This agreement represents a significant milestone for Antler Gold as it underscores our ability to identify promising mineral prospects across Africa and align ourselves with top-tier companies. Not only does this partnership enable us to leverage Prospect's industry-leading expertise, but it also establishes a solid foundation for potential future collaborations, while maintaining significant exposure to the highly promising Kesya REE project."

Prospect's Managing Director and CEO, Sam Hosack, commented:

"The Option Agreement we have struck in relation to the highly prospective Kesya REE Project in Zambia is another significant milestone, which extends our reach further into the battery and electrification mineral sector in Africa, in line with our strategic objectives. Kesya has all the ingredients of a world-class, rare earth enriched, carbonatite-hosted system, having also returned significant values of the high-value REEs, neodymium and praseodymium, over a broad surface area of the Project. Zambia is a leading jurisdiction to explore and develop mining operations in subSaharan Africa, having a long-standing history in the resources sector, particularly for copper. This includes excellent infrastructure and strong support from both the government and community, with major companies like Barrick Gold and First Quantum Minerals already calling it home. We are delighted to have reached this agreement with Antler, which is an established and respected Canadian exploration and development company focussed on its flagship Erongo and Onkoshi Gold Projects, located in central Namibia. The Kesya REE Project offers excellent potential to deliver a significant new, highvalue rare earths discovery, with defined existing drilling targets and a well-established operating environment. Subject to the satisfaction of all relevant conditions precedent, this is a high-quality greenfield exploration play for Prospect."

Introduction and deal terms:

The Kesya carbonatite was first identified in 1961 by Bailey in the Kafue district in southern Zambia. An initial mapping campaign by Antler demonstrated that it is enriched with rare earth elements and warrants further exploration and drilling.

The Option Agreement is among Prospect, Antler and a subsidiary of Antler, Antler Exploration. Subject to satisfaction of certain conditions precedent, Prospect will have the right to earn a 51% interest in Antler Exploration over a two-phased earn-in arrangement over two years for total consideration of US$3.05 million, which includes consideration payments to Antler and in-ground project expenditure.

Prospect will pay an initial non-refundable cash payment to Antler of US$50,000 on signing. Following satisfaction of the conditions precedent under Phase 1, Prospect will pay Antler a further US$100,000 in cash, and commit to spend US$350,000 on the Project within one year (subject to certain extensions permitted under the Option Agreement). Prospect will also issue to Antler US$500,000 worth of Prospect common shares at the completion of Phase 1 (the value of the common shares will be set at the price of Prospect shares at the time of signing, based on previous 10-day VWAP).

After completion of Phase 1, Prospect can elect to proceed to Phase 2 or terminate the Option Agreement (and in this case Prospect will hold no interest in Antler Exploration).

If Prospect proceeds to Phase 2, it is required to pay Antler a further US$150,000 in cash and issue US$500,000 worth of Prospect common shares (the value of the common shares will be set at the price of Prospect shares as at the time of election to proceed to Phase 2, based on previous 10-day VWAP), and it will have the right, but not the obligation, to spend a further US$750,000 on the Project within one year from completion of Phase 1 (subject to certain extensions permitted under the Option Agreement).

If Phase 2 is completed, Prospect will be entitled to exercise a call option to acquire 51% of the issued and outstanding shares of Antler Exploration. To exercise the option, Prospect must make a final payment to Antler of US$150,000 cash and issue US$500,000 worth of Prospect common shares (the value of the common shares will be set at the price of Prospect shares as at the time of the exercise of the call option, based on previous 10-day VWAP).

Prospect will consult with Antler in relation to the work program and budget but will ultimately determine and manage all exploration activities in relation to the Project.

Upon completion of the acquisition, Antler Exploration will be governed by a shareholders agreement ("Shareholders Agreement") among its shareholders. Prospect and Antler Exploration have agreed on the key terms of the Shareholder Agreement, with a full form Shareholder Agreement to be entered into in due course. Development funds for the Project are to be contributed by shareholders of Antler Exploration on a pro-rata basis. If a party does not contribute its pro rata share, its shareholding will be diluted via a prescribed formula. Neither party can be diluted below a 15% interest, from which point such interest shall be free-carried through to the completion of a JORC-Code reportable or NI 43-101 compliant Feasibility Study. The shareholder can then elect to convert its free carried interest to a 2% NSR or equivalent ("Royalty") and the other shareholder has a right but not the obligation to purchase one half of the Royalty for US$5,000,000.

Proposed Exploration Programme

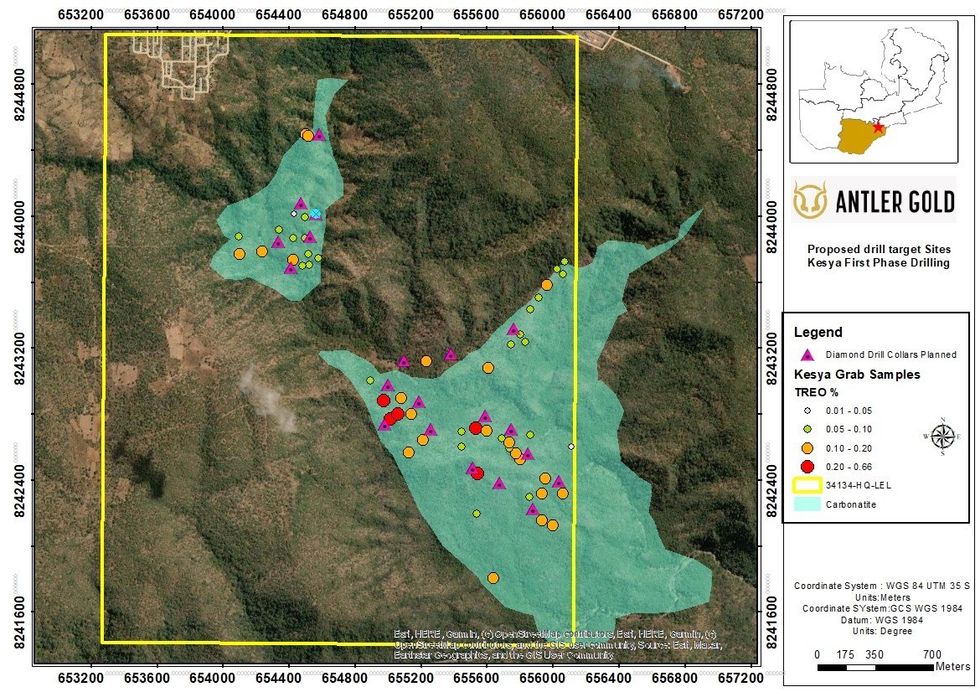

There has been no historic drilling done on the Kesya carbonatite and the subsurface beneath the extent of the mapped carbonatite complex and the depth extension is yet to be tested. Antler along with Prospect is designing a preliminary 1,500 metre diamond drilling programme at the project. (Figure.1) The aim is to evaluate the continuity of the identified surface REE mineralisation to depth. The initial exploration plan will be to drill twenty (20) 75m deep holes along the carbonatite as well as its contacts with the country rock by using a heli-man portable drill rig and pending all environmental and statutory approvals.

Project Location and Background

Figure 1.) Proposed Diamond Drill hole location plan for initial 1500m drilling.

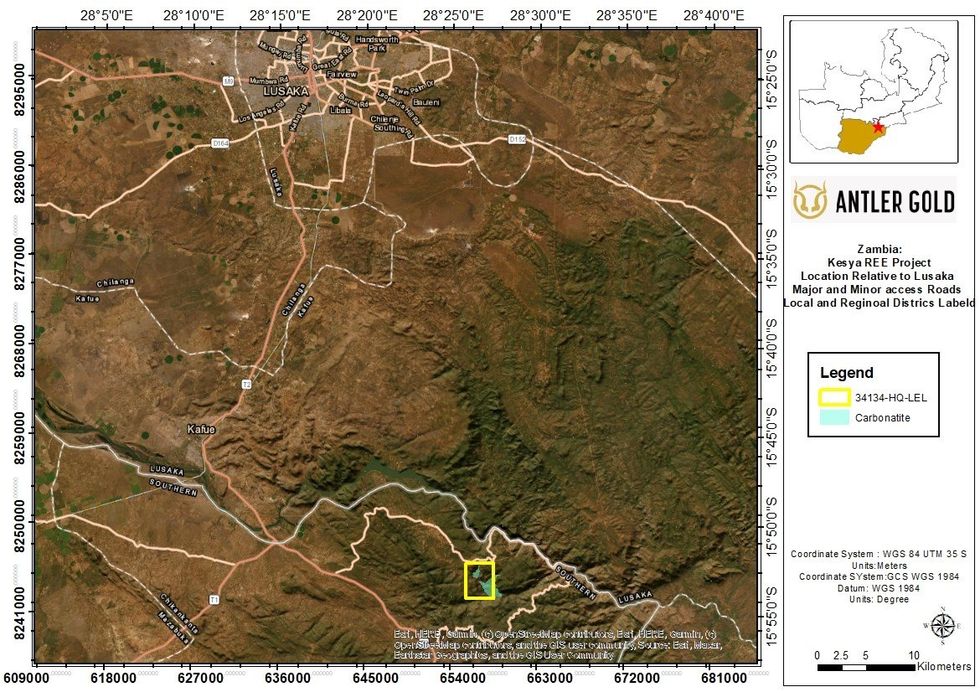

The Kesya REE Project, comprises a single, large-scale exploration license (LEL) application covering 1053.13 hectares and is located near the town of Kafue in southern Zambia in the Kafue Gorge. This license is located approximately 90 km via a tarred road traveling south of the capital city of Lusaka and has water and power infrastructure nearby. Once the LEL is granted, Antler's wholly owned Zambian subsidiary, Antler Exploration Zambia Limited will own 95% of the Kesya REE Project. The remaining 5% of the Project has local ownership.

Figure 2.) Map of the location of the Kesya carbonatite located south of the capital city Lusaka.

Project Geology

The Kesya Carbonatite intruded into gneisses of the Paleoproterozoic Basement Complex rock sequences near the intersection of the mid-Zambezi-Luangwa Rift Valley and the Kesya Rift.

The Kesya Carbonatite is divided into two major rock types: Firstly, a coarse-grained carbonatite with scattered country rock xenoliths: This carbonatite is mostly composed of coarse sövite with small amounts of chlorite. The second rock type is a carbonatite breccia, which surrounds the main intrusion.

The major minerals identified are magnetite, quartz, apatite, Fe-rich phlogopite, monazite, thorite, Ti-oxides, Fe-sulphides, calcite, ilmenite, and the REE-bearing mineral bastnaesite. Dating of apatite in samples from the carbonatite indicate that it is of Neoproterozoic age (Kesya is ca. 535±16 Ma).

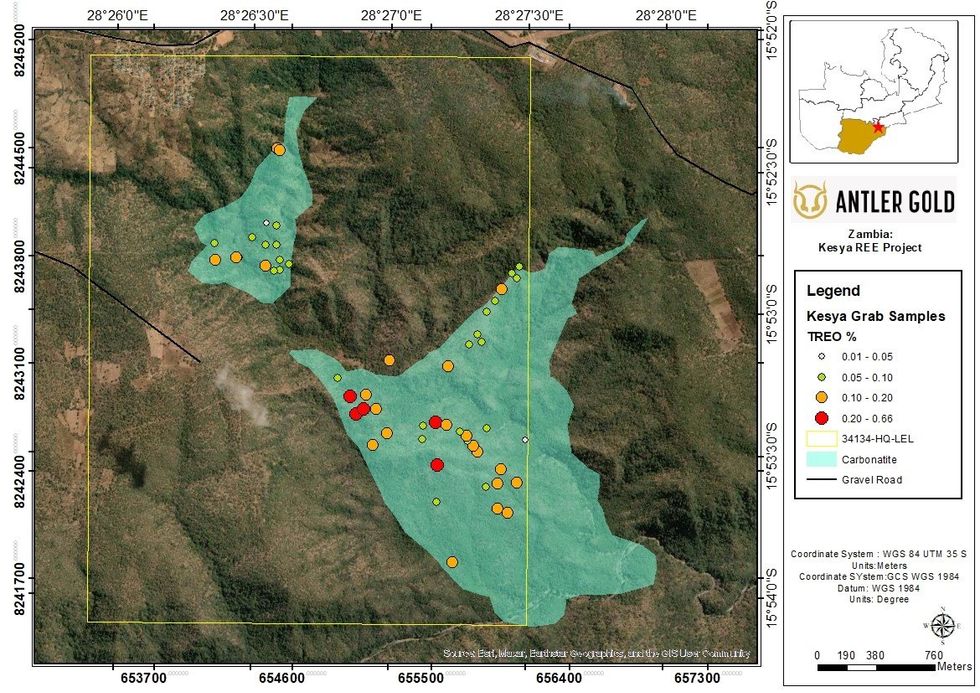

Figure 3.) Map of the grab sample locations with associated TREO assay values.

The carbonatite forms a central topographic high surrounded by deeply incised valleys along its margins where weathering processes are more intense.

Field investigations by Antler, and petrological (Scanning Electron Microscope (SEM)) studies completed during 2021 demonstrated that the rare earth mineralisation at Kesya is hosted mainly in monazite (a REE phosphate mineral) and bastnaesite (a REE fluoro-carbonate mineral).

Figure 4.) View of the Kesya carbonatite (Looking towards the East from the Western edge of the Kafue Gorge)

Rare Earth Element Mineralisation

Antler Gold has completed mapping and sampling campaigns at Kesya in 2021, which involved reconnaissance work across the carbonatite complex and the collection of 51 rock chip grab samples taken on the license.

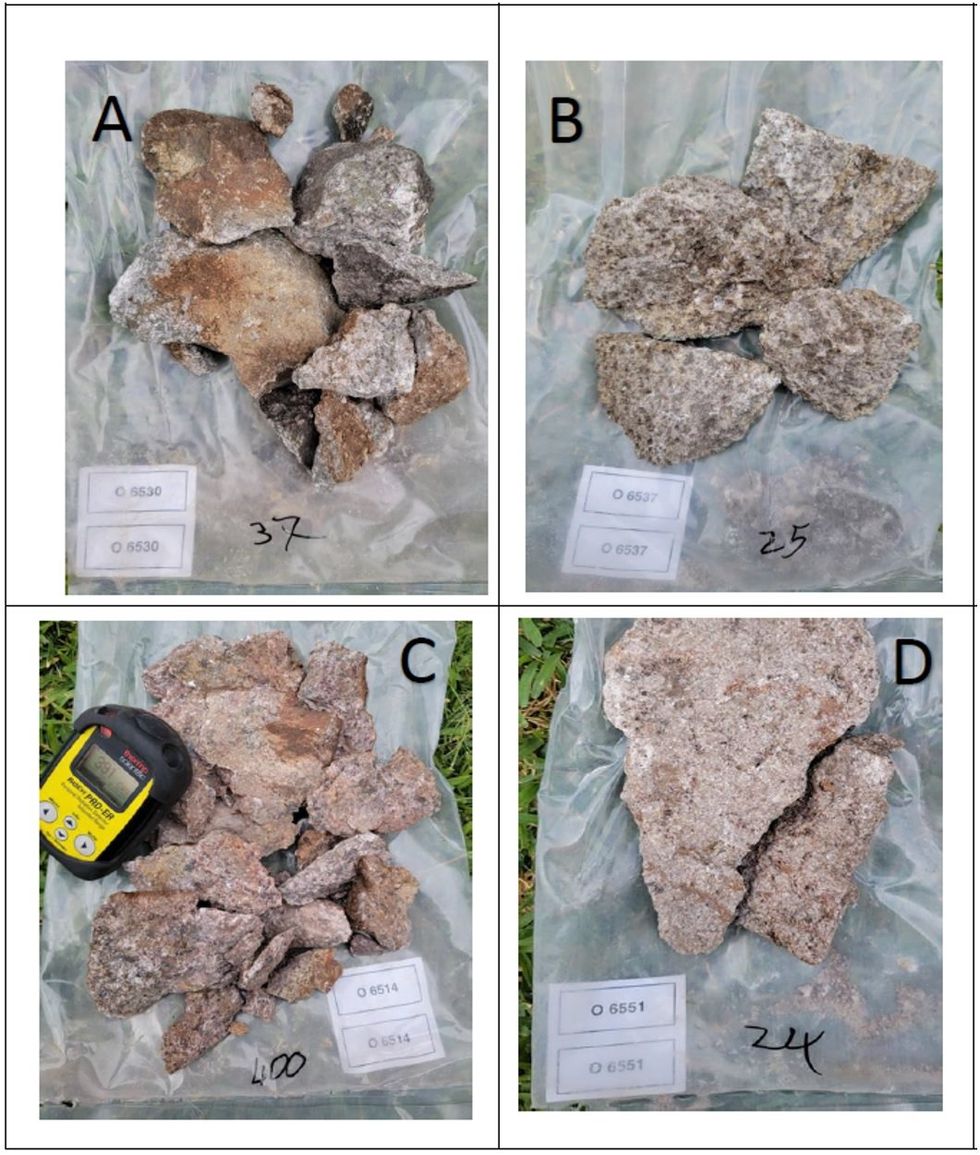

Figure 6; below shows a small selection of these rock chip grab samples along with their sample ID's O6530 (A), O6537 (B), O6514 (C) and O6551 (D).

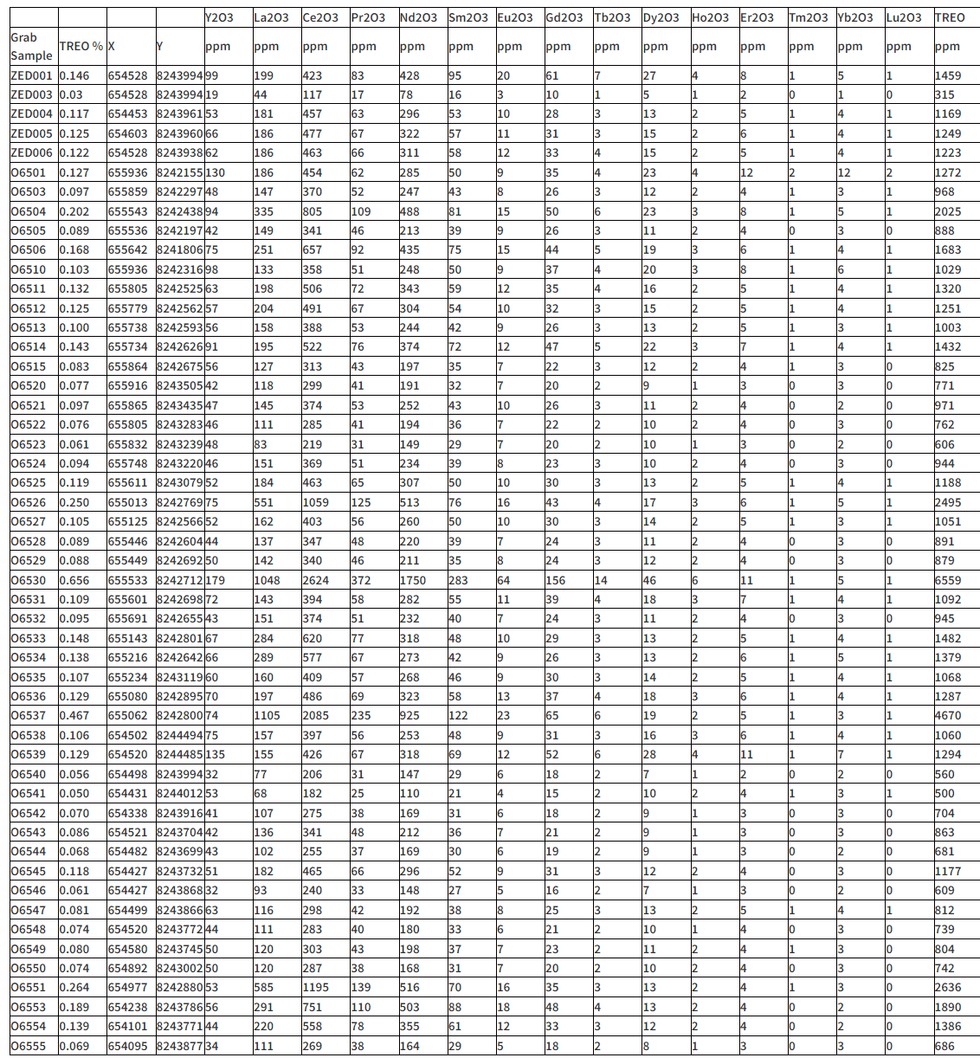

The rock chip samples collected by Antler at Kesya proved to be strongly and consistently mineralised with REE, with an average of 1280 ppm (0.13%) Total Rare Earth Oxide (TREO) content, peaking at 6559 ppm (0.66%) TREO.

Encouragingly, these samples also show consistently high contents of neodymium- and praseodymium oxide - key primary materials in the manufacture of strong permanent magnets for powerful motors, used in such devices as large, wind turbines, increasingly utilised in the global renewable energy sector.

Neodymium and praseodymium oxides average 29% of the Total Rare Earth Oxide (TREO) content of the rock chip samples collected from Kesya (Figure 5).

Figure 5.) Pie Chart showing average grades of Individual REO's from the Kesya sampling campaign.

Figure 6.) Images of rock chip grab samples from field mapping at Kesya.

Summary of most recent grab assay results

During the mapping campaign undertaken by Antler Gold, 51 rock chip grab samples were taken from in-situ outcrop at the Kesya REE Project. Sample sizes were 1-3 kg and taken to fairly represent the lithology recorded at each sample site.

In addition to the rock chip samples, an extra 15% of QAQC materials (2 x blanks, 2 x each of CRM AMIS0185, AMIS0304, AMIS0356 and 2 x duplicate field samples) were added to the batch of samples dispatched for assaying to comply with QAQC regulations.

All samples were shipped to Namibia and prepared by crushing and milling at Activation Laboratories Ltd (ACTLABS) in Windhoek.

Pulped samples were then exported to ACTLABS in Ancaster, ON, Canada, for Code 8 - REE analysis, which is a lithium metaborate/tetraborate fusion with subsequent analysis by ICP-OES and ICP-MS.

Qualified Person

The technical and scientific information in this presentation has been reviewed and approved by Oliver Tors, B.Sc (Hons)., Exploration Manager of the Company, who is registered Professional Natural Scientist with the (SACNASP) South African Council for Natural Scientific Professions (Pr. Sci. Nat. No. 120660) who is a Qualified Person as defined by NI 43-101. Mr. Tors is an employee of Antler Gold Inc. and is not independent of the Company under NI 43-101.

About Antler Gold Inc.

Antler Gold Inc. (TSXV: ANTL) is a Canadian listed mineral exploration company focused on the acquisition and exploration of mineral projects in Africa's Top-Ranked Jurisdictions, with exposure to both gold and REE. Antler's total license position now comprises 6 projects for a total landholding of approximately 584,347 ha. The Company continues to assess new regional opportunities with the aim of building a risk diversified business model, which allows the company to generate short and long- term income whilst providing stakeholders with exposure to potential multiple returns that are generated from the discovery process.

About Prospect Resources Limited (ASX: PSC) (FSE: 5E8)

Prospect Resources Limited (ASX: PSC) (FSE:5E8) is an ASX listed company focused on the exploration and development of mining projects, specifically battery and electrification metals, in Zimbabwe and the broader sub-Saharan African region.

Cautionary Statements

This press release may contain forward-looking information, such as statements regarding the completion of the transactions subject to the Option Agreement and future plans and objectives of Antler and its subsidiary, Antler Exploration in relation to the Project. This information is based on current expectations and assumptions (including assumptions in connection with the continuance of the applicable company as a going concern and general economic and market conditions) that are subject to significant risks and uncertainties that are difficult to predict, including risks relating to the ability to satisfy the conditions to completion of the transactions contemplated by the Option Agreement. Actual results may differ materially from results suggested in any forward-looking information. Antler assumes no obligation to update forward-looking information in this release, or to update the reasons why actual results could differ from those reflected in the forward-looking information unless and until required by applicable securities laws. Additional information identifying risks and uncertainties is contained in filings made by Antler with Canadian securities regulators, copies of which are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information, please contact Chris Drysdale, CEO of Antler Gold Inc at +264 81 220 2439 or Daniel Whittaker, Executive Chairman of Antler Gold Inc., at (902) 488-4700.

The Conversation (0)

21 August 2023

Antler Gold

Strategic Project Generation in Africa's Rare Earths and Gold Market

Strategic Project Generation in Africa's Rare Earths and Gold Market Keep Reading...

14h

Jaime Carrasco: Gold at US$7,000 is "Conservative," Plus Silver Outlook

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, explains what's driving gold and silver prices. "The real question here is not how high silver is going — forget about that," he said. "The right question is how high does gold have to go to... Keep Reading...

15h

Precious Metals Price Update: Another Week of Volatility for Gold, Silver, PGMs

It's been another week of strong volatility in precious metals prices.Gold, silver and platinum have posted new all-time highs in 2026, but so far February has been more choppy seas than smooth sailing. A complex web of push-and-pull factors are at play in the precious metals market. Let’s take... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00