October 30, 2024

Antilles Gold Limited (“Antilles Gold” or the “Company”) (ASX Code: AAU, OTCQB: ANTMF) is pleased to present its Quarterly Activities and Cash Flow Report.

DEVELOPMENT OPPORTUNITIES IN MINERAL RICH CUBA

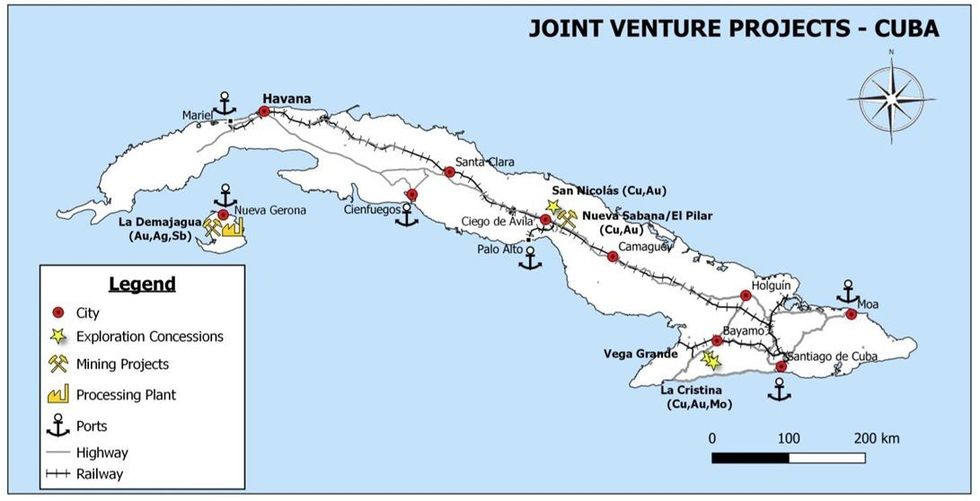

Antilles Gold is participating in the development of two mines in Cuba to produce copper, gold, silver, and antimony, and in the exploration of potentially large porphyry copper properties, through a 50:50 joint venture with the Government’s mining company, GeoMinera.

The joint venture intends to fund the copper exploration from surplus cash flow expected to be generated by the near-term development of the proposed Nueva Sabana copper-gold mine.

- JOINT VENTURE

Minera La Victoria SA (“MLV”) was registered as a Cuban foreign joint venture mining company in August 2020 to develop the Country’s largest known gold deposit at La Demajagua on the Isle of Youth off the south-west coast.

MLV has since committed to progressively establishing itself as a broadly based mining company to develop previously explored mineral deposits controlled by GeoMinera. To date, the Nueva Sabana project and four concessions hosting porphyry copper prospects have been added to its portfolio.

Features of the Joint Venture include:

- A foreign Bank account will hold all proceeds from loans, and product sales, with the only funds remitted to Cuba being for local expenses, which will minimise Country credit risk.

- Antilles Gold nominates all senior management for the operations and exploration activities.

- Income tax rate of 15% waived for 8 years.

- No import duties on plant & equipment.

- Low entry cost for near term development of previously explored properties.

- Low operating costs.

- Association with GeoMinera ensures rapid permitting.

GeoMinera transferred a 900ha mining concession for the La Demajagua gold-antimony-silver open pit mine with 50,000m of historic drilling to the joint venture for US$13.5 million of MLV shares, and a 752ha concession covering the Nueva Sabana gold-copper oxide deposit, and the underlying El Pilar porphyry copper system for US$1.5 million of MLV shares.

A subsidiary of Antilles Gold is “earning-in” to a 50% holding in MLV by contributing US$15.0 million equity, of which approximately US$14.6 million had been invested to 30 September 2024, with the balance to be contributed in November 2024.

Click here for the full ASX Release

This article includes content from Antilles Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AAU:AU

The Conversation (0)

23 June 2024

Antilles Gold Limited

Developing Gold and Copper Projects in mineral‐rich Cuba

Developing Gold and Copper Projects in mineral‐rich Cuba Keep Reading...

17 February 2025

Antilles Gold to Raise $1.0M for Working Capital

Antilles Gold Limited (AAU:AU) has announced Antilles Gold to Raise $1.0M for Working CapitalDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Antilles Gold Limited (AAU:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

12 January 2025

Summary of Pre-Feasibility Study for Nueva Sabana Mine

Antilles Gold Limited (AAU:AU) has announced Summary of Pre-Feasibility Study for Nueva Sabana MineDownload the PDF here. Keep Reading...

11 December 2024

Revision to Updated Scoping Study Nueva Sabana Mine, Cuba

Antilles Gold Limited (AAU:AU) has announced Revision to Updated Scoping Study Nueva Sabana Mine, CubaDownload the PDF here. Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00