- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

December 27, 2023

ASX-listed Antilles Gold (ASX:AAU, OTCQB:ANTMF) is an Australian mining company focused on gold and copper projects in Cuba through joint ventures with the Cuban government’s mining company GeoMinera, which opens new development opportunities for Antilles and de-risks permitting processes.

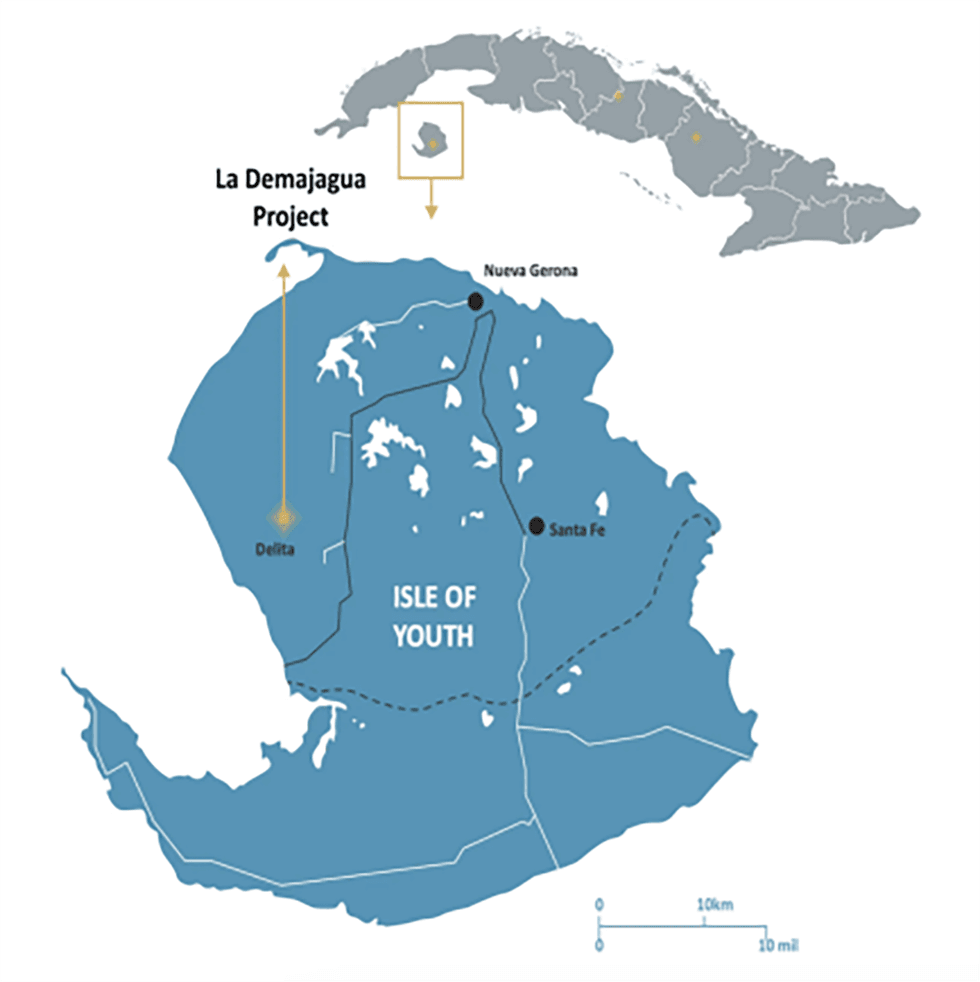

The company is focused on four development projects: 1) Nueva Sabana gold‐copper mine; 2) La Demajagua gold mine; 3) El Pilar porphyry copper project; and 4) Sierra Maestra copper concessions. Of these, Nueva Sabana and La Demajagua offer near‐term development opportunities.

- Nueva Sabana is a near‐term gold‐copper mine development project with a 10‐month construction beginning in June 2024. The project is expected to generate strong cash flow from concentrate sales from mid‐2025.

- The second mine development project is La Demajagua, an open-pit mine gold project where construction will commence in late 2024 and commissioning begins mid‐2026. This project is anticipated to produce approximately 10,000 tons per annum (tpa) of antimony‐gold concentrate (30,000 oz gold equivalent per year).

AAU:AU

The Conversation (0)

23 June 2024

Antilles Gold Limited

Developing Gold and Copper Projects in mineral‐rich Cuba

Developing Gold and Copper Projects in mineral‐rich Cuba Keep Reading...

17 February 2025

Antilles Gold to Raise $1.0M for Working Capital

Antilles Gold Limited (AAU:AU) has announced Antilles Gold to Raise $1.0M for Working CapitalDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Antilles Gold Limited (AAU:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

12 January 2025

Summary of Pre-Feasibility Study for Nueva Sabana Mine

Antilles Gold Limited (AAU:AU) has announced Summary of Pre-Feasibility Study for Nueva Sabana MineDownload the PDF here. Keep Reading...

11 December 2024

Revision to Updated Scoping Study Nueva Sabana Mine, Cuba

Antilles Gold Limited (AAU:AU) has announced Revision to Updated Scoping Study Nueva Sabana Mine, CubaDownload the PDF here. Keep Reading...

4h

Lion One Acknowledges Receipt of Shareholder Requisition and Reiterates Constructive Dialogue and Engagement with All Shareholders

Lion One is committed to transparency and keeping its Shareholders informed No need for Shareholders to take actionLion One Metals Limited (TSXV: LIO,OTC:LOMLF) (OTCQX: LOMLF) ("Lion One" or the "Company") acknowledges receipt of a shareholder meeting requisition notice pursuant to section 167... Keep Reading...

6h

Joe Cavatoni: Gold Volatility Picking Up, Price Setting New Floors

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, discusses gold's recent price activity, weighing in on its safe-haven status as volatility rises. "We should probably just be accepting of these higher levels of vol and understand that you still see the same type of... Keep Reading...

6h

Joe Mazumdar: Bullish on Copper, but Time to Hold Gold is Now

Joe Mazumdar, editor of Exploration Insights, explains his strategy for picking stocks in a bull market, saying good companies are getting pricier. "When you find deposits that don't have that fatal flaw ... you will have to pay up for it," he said. "And I'm not worried about paying up for it,... Keep Reading...

6h

Top 7 ASX Gold ETFs for Australian Investors in 2026

The price of gold reached record highs in 2026, driven by global economic uncertainty stemming from shifting US trade policy and escalating geopolitical tensions in the Middle East.For many investors, gold is a tool for diversification. The precious metal is known for its ability to act as a... Keep Reading...

7h

Avidian Gold Announces the Appointment of a New Director

TORONTO, ON / ACCESS Newswire / March 12, 2026 / Avidian Gold Corp. ("Avidian" or the "Corporation") (TSXV:AVG,OTC:AVGDF) is pleased to announce the appointment of Jean-François Meilleur to Avidian's Board of Directors, effective immediately.Mr. Meilleur graduated from HEC Montréal in 2003 with... Keep Reading...

8h

Wheaton Precious Metals Announces Record Annual Revenue, Earnings and Cash Flow for 2025

FOURTH QUARTER AND FULL YEAR FINANCIAL RESULTS "Wheaton's portfolio of high-quality, long-life assets delivered another outstanding year in 2025, surpassing our production guidance and achieving record revenue, earnings, and operating cash flow," said Randy Smallwood, Chief Executive Officer of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00