- WORLD EDITIONAustraliaNorth AmericaWorld

September 15, 2025

Founded in 2009 and listed in 2011, Angkor Resources (TSXV:ANK,OTCQB:ANKOF) has developed a dual focus on energy and minerals across Asia and North America.

Angkor Resources is advancing a dual-track strategy across energy and minerals. In Canada, its subsidiary EnerCam Exploration generates revenue from oil production, water disposal, and gas processing, while also pioneering carbon capture and conversion solutions.

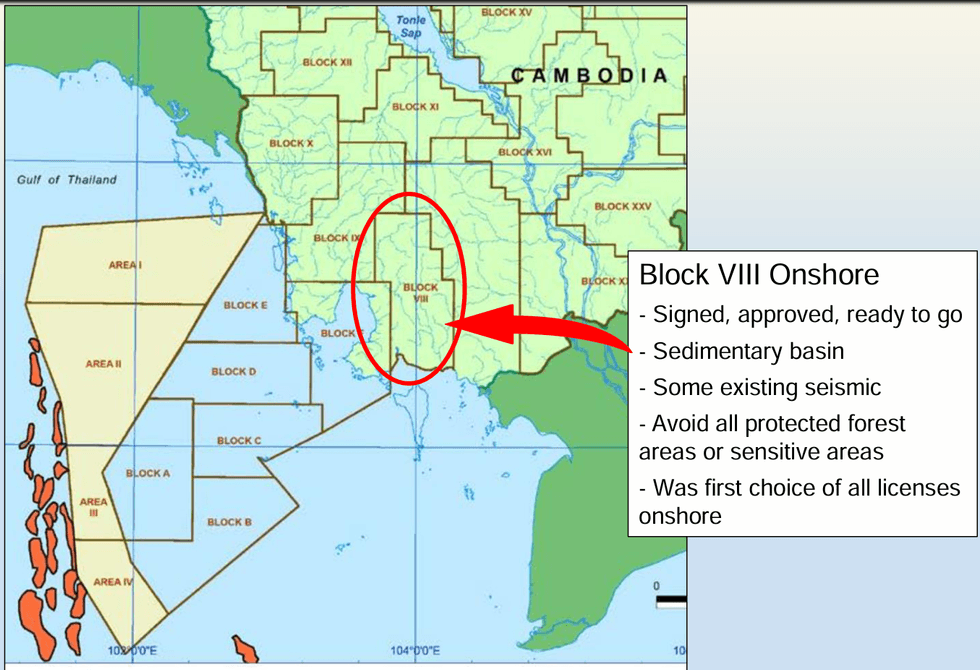

In Cambodia, subsidiary EnerCam Resources is driving the nation’s first-ever onshore oil and gas exploration on Block VIII, positioning the company for transformational growth. On the mineral side, Angkor is a first-mover in Cambodia’s underexplored belts, with licenses at Andong Meas and Andong Bor targeting both precious and base metals, where exploration has already confirmed copper porphyry systems and high-grade gold mineralization.

Angkor mitigates risk by diversifying revenue, combining recurring Canadian cash flow with high-impact exploration in Cambodia, where management prioritizes hydrocarbons and copper, highlighting 25 million recoverable barrels and significant copper-gold potential.

Company Highlights

- Diversified Energy & Mineral Portfolio: Exposure to high-impact oil and gas exploration in Cambodia (Block VIII), recurring energy revenues in Canada, and copper-gold porphyry systems with gold epithermal near-surface prospects in Cambodia.

- Near-term Catalysts:

- Results from copper porphyry in Cambodia within 30 to 60 days;

- Seismic completion and interpretation for drill targets on Block VIII within 90 days; and

- Acquisition of oil production for increased recurring revenue streams.

- Transformational Asset: Block VIII is Cambodia’s first onshore oil and gas exploration license, strategically located near export infrastructure. Potential minimum targets estimated at 25 to 50+ million recoverable barrels.

- Revenue-backed Model: EnerCam Canada provides recurring revenue streams via oil production, water disposal, gas processing, and carbon capture solutions, insulating Angkor from over-reliance on equity markets.

- Strong ESG Commitment: Recognized at the United Nations for sustainability, Angkor integrates carbon capture, community partnerships and environmental responsibility into every project.

- Aligned Shareholder Base: Over 40 percent insider ownership with regular insider buying, demonstrating management’s confidence in long-term growth.

This Angkor Resources profile is part of a paid investor education campaign.*

Click here to connect with Angkor Resources (TSXV:ANK) to receive an Investor Presentation

TSXV:ANK

The Conversation (0)

2h

Dynamic Active Multi-Crypto ETF

A single ticket solution offering access to leading crypto assets and companies deploying blockchain technology in real world applications.

A single ticket solution offering access to leading crypto assets and companies deploying blockchain technology in real world applications. Keep Reading...

26 March 2020

Angkor To Issue Shares

Angkor Resources Corp. (TSXV:ANK, OTC:ANKOF) (“Angkor” or “the Company”) CEO Stephen Burega is pleased to provide an update on a stock issuance and the Company’s Covid-19 response. As previously announced in a press release dated January 13, 2020, the Company entered into an Earn-In Agreement... Keep Reading...

27 January 2020

Angkor Delivers Dental Care Campaign In Rural Cambodia

Angkor Resources Corp. (TSXV:ANK, OTC:ANKOF) (“Angkor” or “the Company”) was pleased to facilitate a regional dental campaign in collaboration with an American dental team in northeastern Cambodia this January. Dental Campaign 2020 took place from January 1 to 4 this year providing free and much... Keep Reading...

24 January 2020

Angkor Issues Shares For Debt

Angkor Resources Corp. (TSXV:ANK, OTC:ANKOF) (“Angkor” or “the Company”) CEO Stephen Burega reported that further to its announcement of July 16, 2018, regarding the issuance of convertible debentures (“Debentures”), and in settlement of other obligations, Angkor has entered into units for debt... Keep Reading...

13 January 2020

Angkor Signs USD $4.6 Million Earn-In Agreement on Oyadao License

Angkor Resources Corp. (TSXV:ANK, OTC:ANKOF) (“Angkor” or “the Company”) CEO Stephen Burega is pleased to report that it has signed an Earn-In Agreement on its Oyadao License with Canadian development company Hommy Oyadao Inc. (“Hommy”) to earn up to a 70% interest in Angkor’s Oyadao North... Keep Reading...

10h

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00