- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

May 05, 2025

Description:

A recent analyst report from East Coast Research underscores Boab Metals (ASX:BML) as a compelling investment opportunity, assigning a base-case valuation of AU$0.47 per share and a bull-case valuation of AU$0.51. This assessment reflects the company's robust fundamentals, particularly in terms of its Sorby Hills lead-silver-zinc project, which boasts a pre-tax NPV8 of A$411 million and an IRR of 37 percent.

The report emphasizes Boab Metals' strategic advancements, including securing a binding offtake agreement with Trafigura and moving towards full ownership of Sorby Hills, positioning the company for significant growth.

Key Highlights:

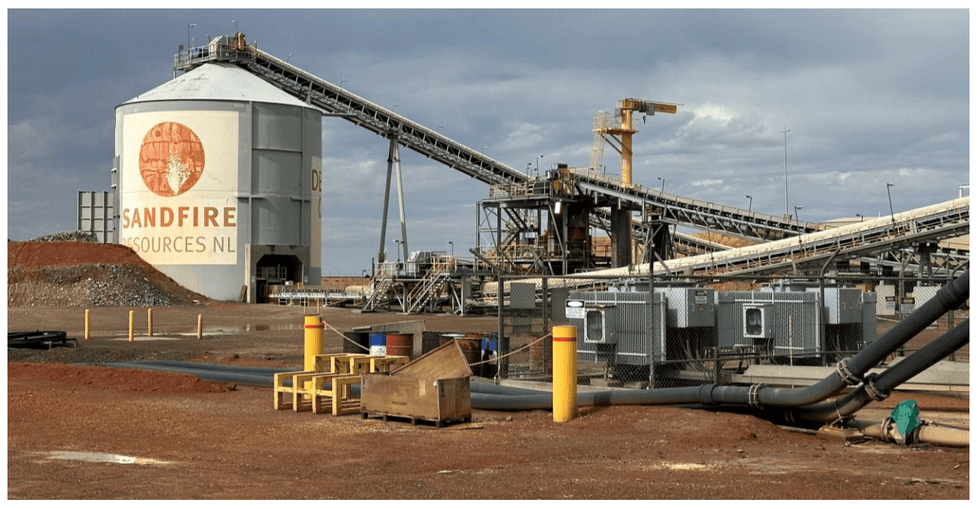

- Acquisition of DeGrussa Plant to Reduce Capex: Boab has acquired the DeGrussa processing plant from Sandfire Resources for AU$10 million, payable in tranches. The existing plant will be refurbished and integrated into Sorby Hills, cutting pre-production capex (estimated at AU$264 million) and accelerating development. Sandfire has also taken equity in Boab (~3 percent stake), demonstrating confidence in the project.

- Trafigura Offtake Agreement: Boab Metals has finalized a binding offtake agreement with Trafigura, covering 75 percent of Sorby Hills' lead-silver concentrate production over seven years. This deal includes a US$30 million prepayment facility with favorable terms, enhancing Boab's financial flexibility and reducing reliance on equity markets.

- Acquisition of Remaining Interest in Sorby Hills: The company has entered into an option agreement to acquire the remaining 25 percent interest in Sorby Hills from its joint venture partner, Henan Yuguang. This move toward full ownership simplifies operations and enhances Boab's exposure to the project's economic potential.

- Project Economics and Development Timeline: The updated FEED Study (June 2024) confirms robust economics, including pre-tax NPV8 of AU$411 million, IRR of 37 percent, C1 cash cost of US$0.36/lb, and average EBITDA of AU$126 million per year. Boab aims to make a final investment decision in the second half of 2025, with production targeted for mid-2027.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

BML:AU

The Conversation (0)

09 January 2025

Boab Metals Limited

Advancing toward near-term lead and silver production in Western Australia

Advancing toward near-term lead and silver production in Western Australia Keep Reading...

07 September 2025

Extension of Option to Acquire 100% of Sorby Hills

Boab Metals Limited (BML:AU) has announced Extension of Option to Acquire 100% of Sorby HillsDownload the PDF here. Keep Reading...

03 September 2025

EPBC Approval Granted for Sorby Hills

Boab Metals Limited (BML:AU) has announced EPBC Approval Granted for Sorby HillsDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Boab Metals Limited (BML:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 June 2025

Completion of Capital Raising

Boab Metals Limited (BML:AU) has announced Completion of Capital RaisingDownload the PDF here. Keep Reading...

16 June 2025

A$6 Million Placement to Advance the Sorby Hills Project

Boab Metals Limited (BML:AU) has announced A$6 Million Placement to Advance the Sorby Hills ProjectDownload the PDF here. Keep Reading...

06 March

Peter Krauth: Silver Cycle Still Early, Big Money Ready to Buy

Peter Krauth, editor of Silver Stock Investor and Silver Advisor, shares his thoughts on silver price activity and where the white metal is in the cycle. He believes the awareness phase is just beginning, with mania still relatively far in the future. Don't forget to follow us @INN_Resource for... Keep Reading...

05 March

Chen Lin: Key Silver Date to Watch, My Favorite 2026 Commodities

Chen Lin of Lin Asset Management weighs in on silver and gold, as well as the critical minerals market, which is his favorite sector for 2026. He also discusses how conflict in the Middle East could impact the resource sector. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

05 March

Prince Silver: Fully Funded and Targeting 100 Million Ounces Silver Equivalent in Nevada

Ranking first in the world in the Fraser Institute’s 2025 Annual Survey of Mining Companies, Nevada remains a top choice for companies. Prince Silver’s (CSE:PRNC,OTCQB:PRNCF) flagship Prince silver project stands to benefit from its outstanding permitting process and geology.Prince Silver CEO... Keep Reading...

04 March

What's Next for the Silver Price After $100 Per Ounce?

First Majestic Silver (TSX:AG,NYSE:AG) CEO Keith Neumeyer’s silver price prediction of over US$100 per ounce came true in 2026. When will silver prices make a more lasting hold in triple digit territory?The silver price was up over 189 percent year-on-year as of March 2, 2026, on the back of... Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00