Oil Price and Inflation: What’s the Correlation?

Rising oil prices have historically preceded high inflation. Learn how the relationship between oil, inflation and consumer prices has changed.

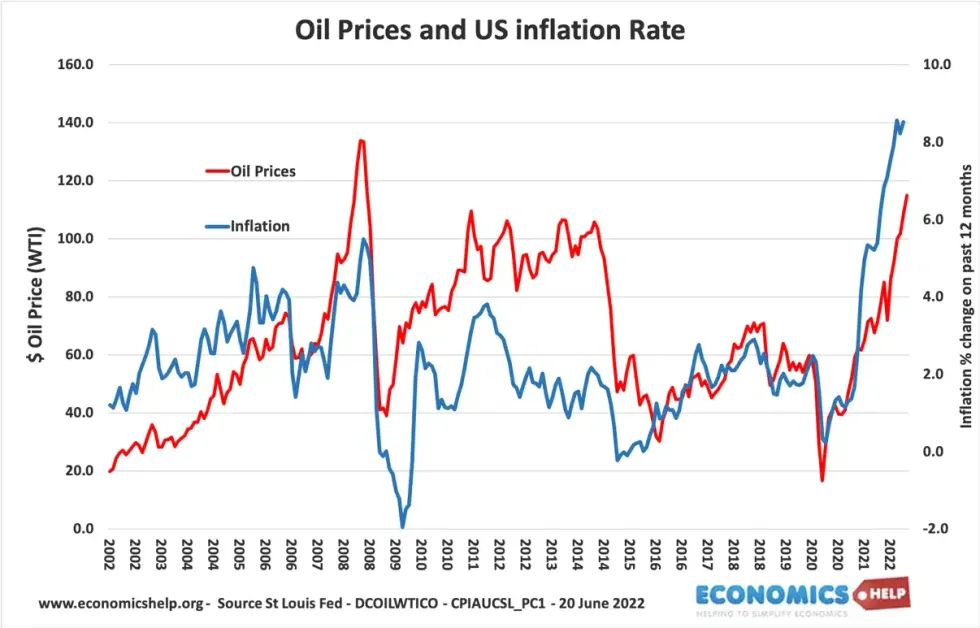

When oil prices plunged to four-year lows this year, many analysts immediately turned to the inflation narrative, dusting off the long-held belief that where oil prices go, inflation follows.

But this time, the correlation isn't as straightforward.

Brent crude fell to US$58.62 per barrel and West Texas Intermediate (WTI) to US$55.38 in early April of 2025, marking a sharp decline of over 21 percent since January. The slump was driven by a mix of soft global demand, US-China trade tensions, and an unexpected about-face by OPEC+ to increase output after previously committing to production cuts.

The downturn marked a significant shift in sentiment from earlier in Q1, when prices rallied on geopolitical jitters and hopes of tighter supply. Historically, oil price swings would set off alarms about inflation. But today’s economists are more cautious about declaring oil as the prime driver of consumer price hikes.

What is oil's relationship to the consumer price index?

Before examining the changing relationship between oil prices and inflation, it's important to understand the link between oil and the economy. Traditionally, the most-watched inflation indicator is the consumer price index (CPI), which the US Bureau of Labor Statistics defines as “a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.”

The CPI basket includes products and services in many categories, with the highest weighted ones including shelter, food, energy, transportation, medical care, recreation, education and communication. While oil price movements are directly reflected by the energy category, their economic impact has historically stretched beyond that.

At the macroeconomic level, higher oil prices make it more expensive for companies to produce and transport goods or offer services. Rising oil prices can also indirectly raise the costs of production, transportation and heating for businesses, making production more expensive. In turn, producers may choose to pass on those costs to consumers.

At the microeconomic level, rising prices at the pump and in stores can cut into discretionary spending that might otherwise have been spent on new electronics, clothes or a vacation. Higher goods and services prices in the long term can dampen demand for those products, leading to slow economic growth or even a recession.

However, 2023 analysis by the US Federal Reserve focused on oil prices and inflation in advanced economies showed that the ripple-through effect of rising oil prices on other parts of the economy has lessened over time.

A historical parallel with a modern rebuttal

“History shows the two are correlated, but the relationship has deteriorated since the oil price spike of the 1970s,” said Bob Iaccino, co-founder of Path Trading Partners.

Indeed, the narrative that oil prices directly cause inflation is now considered an oversimplification by many. New evidence, both historical and structural, points instead to a much more nuanced, and at times inverse, relationship between the two.

In the 1970s and early 1980s, the world witnessed back-to-back oil crises triggered by the OPEC embargo in 1973 and the Iranian Revolution in 1979. Oil prices soared, and inflation in the US and other Organization for Economic Cooperation and Development (OECD) economies followed suit. By the end of 1980, the CPI had more than doubled, giving rise to the term “stagflation” — a period of low growth, high unemployment and high inflation.

But the underlying causes of that inflation are now contested.

An analysis by Lutz Kilian, vice president at the Federal Reserve Bank of Dallas, challenges the traditional view.

“Worldwide shifts in monetary policy regimes in the early 1970s played a major role in causing both oil price increases and the high inflation in many OECD economies,” Killian highlighted in a 2024 presentation.

Under this view, it was expansionary monetary policy — not oil prices alone — that lit the inflationary fire.

Structural models have shown that the primary cause of price surges was oil demand shocks, rather than supply shocks or geopolitically driven shortages. The oil price, in many respects, followed inflationary pressures rather than led them.

The relationship between oil prices and the CPI has eroded in the years since then. When the fuel climbed from US$14 to US$30 per barrel within six months in 1991 during the first Gulf War, the CPI barely budged.

Additionally, the monumental oil price rally that drove crude prices up from just US$16 to US$50 between 1999 and 2005 had a marginal impact on the CPI. More importantly, these more recent oil prices spikes had little impact on economic growth, unemployment rates or inflation levels.

What's behind this decoupling?

Some have suggested improvements in energy efficiency have lowered energy consumption per dollar across many industries. Others have argued that since the 1990s, monetary policymakers have changed the methods by which they control inflation, in effect softening the impact of higher oil prices.

Economists, including those at the St. Louis Federal Reserve, have pointed to the fact that the US CPI basket has increasingly become more heavily weighted with services rather than goods tied to oil.

Interest rates, oil and a new dynamic

In the past, the Fed has often responded to rising inflation (and by extension, oil prices) by raising interest rates.

But does this monetary tightening then pull oil prices down? Not necessarily. In fact, Iaccino pointed out in 2022 that in the last six rate hike cycles, oil prices actually rose by an average of 16.06 percent in the six months following the first hike of each cycle, although the hikes themselves may not be the cause of that pattern.

“There are many other factors affecting the price of crude oil, including geopolitics and sudden increases in supply or demand,” he noted. “Typically, rising crude oil prices are either a significant component in the cause of broader inflation, or the rise in oil price is a function of a strong economy and greater demand.”

This complexity was on full display in 2023. Oil prices briefly dipped after the Fed raised interest rates in May, but they rebounded quickly, climbing from US$65.48 in early May to US$83.60 by late July — even after another rate hike. It was clear that supply-side dynamics, such as OPEC+ production decisions and falling US inventories, had a stronger short-term influence than monetary policy.

The 2025 oil market tug-of-war

The first quarter of 2025 has reinforced the idea that oil prices are shaped more by geopolitics and market fundamentals than by central banks. Oil prices started the year above US$70 and climbed through mid-January.

However, they pulled back through the remainder of the quarter as economic instability led by US tariff threats and trade wars coupled with soft demand weighed on prices.

Prices tumbled even further in April after OPEC+ reversed course on production cuts, announcing a 411,000 barrel per day production increase. Analysts saw this move as a punitive measure against over-producing members like Iraq and Kazakhstan, despite the group officially claiming it was to “support market stability.”

In April, Ole Hansen, head of commodity strategy at Saxo Bank, told the Investing News Network, “We're into supply destruction territory for some of the high-cost producers.” He added that if prices remain in the high US$50s, US output will likely slow — a dynamic that may help realign supply and demand later in the year.

The US Energy Information Administration (EIA) now expects Brent crude to average US$68 per barrel in 2025, citing growing inventories and subdued demand. The EIA's April report also forecasts a further drop to US$61 per barrel in 2026.

Oil prices still matter, but are no longer driving inflation

While oil is an important factor in inflation dynamics, it is no longer the inflationary hammer it once was.

As Kilian emphasizes, “Rising oil prices were a symptom rather than the cause of high US inflation (in the 1970s)." That lesson appears to hold true today, as monetary policy, labor costs and supply chain dynamics play increasingly dominant roles in shaping price pressures.

Moreover, the disconnect between headline oil prices and refined product costs, such as gasoline or diesel, complicates matters. Factors like refining costs, taxes and distribution markups can dilute the direct pass-through of crude oil changes to the consumer level.

Natural gas markets illustrate a parallel complexity. While colder-than-average winter conditions in early 2025 pushed US natural gas prices up 13.9 percent in Q1, the overall inflationary impact has remained marginal and contained largely within energy-related sectors.

The once-clear link between oil and inflation has become fogged by decades of structural economic shifts, policy changes and new global dynamics. Oil prices remain an important — but no longer dominant — signal of inflation.

In 2025, watching oil is still useful, but interpreting its message requires caution. A broader macroeconomic view does not demonstrate a single cause-and-effect story anymore, but rather a crucial variable in a vastly interconnected market propelled by real-world events.

In other words, the next time oil prices spike or plunge, investors, policymakers and consumers alike should ask a more complicated question: Why?

This is an updated version of an article first published by the Investing News Network in 2021.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.