3 Biggest US Silver Miners in 2026

Top 9 Global Lithium Stocks (Updated January 2026)

Zinc Stocks: 5 Biggest Canadian Companies in 2025

Top 5 Canadian Silver Stocks of 2025

ASX Silver Stocks: 5 Biggest Companies

American Copper Development Corp. (CSE:ACDX) is an exploration and development mining company poised to become a key player in U.S. domestic copper production, with a significant land package in a tier 1 jurisdiction. The company is led by a strong management team with decades of mining experience and exploration success, including Andy Bowering, founder of American Lithium (TSXV:LI) and former CEO of Prime Mining (TSXV:PRYM), and Rick Van Nieuwenhuyse, who has led notable companies in the mining industry, including Nova Gold (NYSE:NG), Contango Ore (NYSE:CTGO) and Trilogy Metals (NYSE:TMQ)

Copper is the non-critical metal that makes all other metals critical. It is important in leading the charge toward global electrification and net-zero agendas. Copper demand is expected to greatly exceed supply in the coming years, and as a result, copper prices are expected to increase steadily..

Domestic US copper production only satisfies 65 percent of its in-country demand, making it crucial to develop a new domestic source of copper within the US.

American Copper’s flagship Lordsburg Project has the potential to become a significant source of domestic copper to supply US demand.

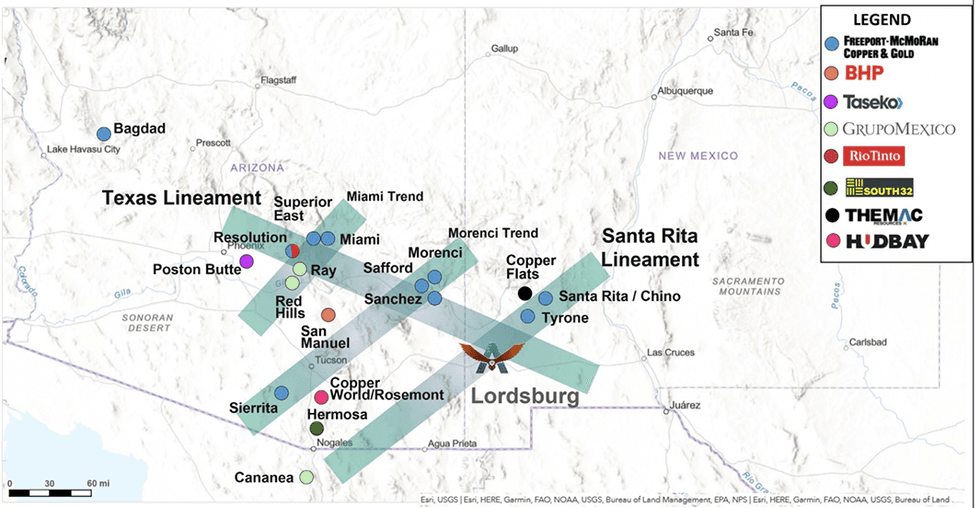

The Lordsburg project is located in copper porphyry country in the American Southwest, where 80 percent of copper in the US comes from. It has the potential to become a world-class asset, with historical production of 150.3 million lbs of copper between 1904 to the 1970s. Yet, it has not been actively explored using modern technology and exploration techniques. Now, American Copper has the opportunity to capitalize on the asset’s porphyry targets associated with past high-grade copper production.

The company also owns the Chuchi South project in British Columbia, a project with significant potential for future exploration.

American Copper has the technical expertise to explore its past-producing copper porphyry district, thanks in part to the leadership of geologist Van Nieuwenhuyse, who is credited for Nova Gold’s 30 to 40-million-ounce gold resource in Alaska.

American Copper’s management team and company insiders hold one-third of the company’s shares. This level of ownership strongly indicates the team’s confidence in its ability to advance its promising assets. In addition the company is led by an experienced management team with experience in corporate administration, international finance and mining project development, including Van Nieuwenhuyse and Bowering.

Company Highlights

- American Copper is an exploration and development mining company with a significant land package in New Mexico, a tier-1 jurisdiction, and a secondary asset in British Columbia.

- The company has the advantage of a robust technical team leading the exploration and development of its promising assets, which includes Rick Van Nieuwenhuyse, Andy Bowring and Curt Freeman, recognized leaders credited with significant discoveries worldwide.

- The Lordsburg project, the company’s flagship asset, is a district-scale opportunity at the intersection of two prominent copper lineaments. These lineaments are known to control 80 percent of copper production in the US.

- American Copper is well-capitalized, completing a $10-million financing in Q2 2022.

- The company’s Chuchi South project in British Columbia creates additional opportunities for future discoveries.

- The experienced management team has generated billions of investor returns through its decades of experience and expertise throughout the mining industry.

Get access to more exclusive Copper Investing Stock profiles here