April 28, 2023

Alvo Minerals Limited (ASX: ALV) (“Alvo” or the “Company”) is pleased to provide its Quarterly Activities Report for the period ending 31 March 2023*. Alvo is exploring its Palma VMS Project in Brazil (“Palma Project” or the “Project”), a Project that has significant high-grade copper and zinc potential in existing prospects, brownfields prospects and greenfields targets within a district scale exploration package.

HIGHLIGHTS

- Extensional drilling at the Palma Volcanic hosted Massive Sulphide (“VMS”) Project delivers significant high-grade mineralisation, including:

- PD3-059: 14.2m @ 3.0% CuEq* (1.1% Cu, 6.1% Zn, 0.2% Pb, 12g/t Ag & 0.04g/t Au) from 228m

- Inc. 4.8m @ 7.3% CuEq (1.8% Cu, 16.8% Zn, 0.4% Pb, 24g/t Ag & 0.1g/t Au) from 237m

- PD3-065: 13.0m @ 1.5% CuEq (1.0% Cu, 1.8% Zn, 0.1% Pb, 8g/t Ag & 0.02g/t Au) from 333m

- Inc. 4.7m @ 3.1% CuEq (1.9% Cu, 4.6% Zn, 0.31% Pb, 21g/t Ag & 0.05g/t Au) from 340m

- PD3-065: 14m @ 1.7% CuEq (0.7% Cu, 3.3% Zn, 0.2% Pb, 10g/t Ag & 0.03g/t Au) from 376m

- Inc. 5.3m @ 3.6% CuEq (1% Cu, 8% Zn, 0.5% Pb, 25g/t Ag & 0.05g/t Au) from 379m

- PD3-059: 14.2m @ 3.0% CuEq* (1.1% Cu, 6.1% Zn, 0.2% Pb, 12g/t Ag & 0.04g/t Au) from 228m

- High-grade mineralisation intersected approximately 50m down-dip of the existing JORC 2012 Mineral

- Resource Estimate (“MRE”).

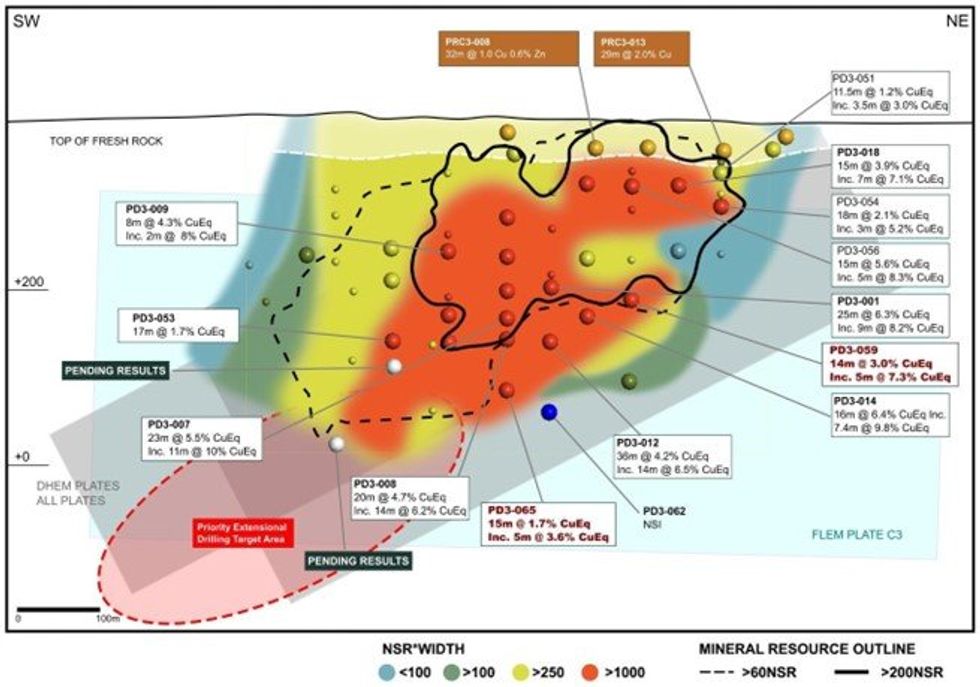

- Phase 2 drilling is ongoing at C3, with aggressive step-outs down-plunge, aiming to significantly expand the MRE of 4.6Mt @ 1.0% Cu, 3.9% Zn, 0.4% Pb & 20g/t Ag.

- Down-Hole Electromagnetic surveys (“DHEM”) at C3 have highlighted conductive plates that demonstrate the potential to significantly expand C3 mineralisation and is assisting with the extensional drilling.

- Regional exploration planned with a combination of in-house auger drilling, geophysics and geochemistry to advance greenfield prospects to drill ready status with the aim of making new VMS discoveries.

- Nickel/Copper/PGE exploration to commence in Q2 CY2023 at Cana Brava for “Julimar Style” deposits.

- Binding agreement to earn-in to the Afla Cu/Zn Project, consolidating the southern portion of the highly prospective Palma VMS belt.

- Cash balance of A$1.3M at 31 March 2023

*Refer to the detailed explanation of assumptions and pricing underpinning the copper equivalent (CuEq) on page 11 of this Quarterly Activities Report

Exploration Activities

Diamond Drilling at the Palma VMS Project

During the reporting period, Alvo announced assay results from its extensional diamond drill program at the C3 prospect, within the Palma Project in central Brazil1.

Phase 2 drilling at the C3 prospect is aiming to significantly expand the existing Palma Project JORC 2012 MRE2 of 4.6Mt @ 1.0% Cu, 3.9% Zn, 0.4% Pb & 20g/t Ag (see Figure 1). Phase 2 drilling follows an exceptional Phase 1 drill program that delivered high-grade Copper and Zinc in thick VMS intercepts. Phase 1 and initial Phase 2 drill results continue to exceed expectations on grade and thickness when compared to the existing JORC 2012 MRE that used historical drilling only.

C3 Upgrade Drilling

Phase 2 diamond drilling resumed during the reporting period and is targeting extensions to the high-grade VMS mineralisation, predominately focusing on the down-dip extensions emerging on the south-westerly plunge orientation from the known mineralisation. The Company believes this is the most prospective orientation extension defined to date.

Click here for the full ASX Release

This article includes content from Alvo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ALV:AU

The Conversation (0)

08 August 2022

Alvo Minerals

District-Scale Copper-Zinc VMS Project in Brazil

District-Scale Copper-Zinc VMS Project in Brazil Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

22 January

Red Metal Resources Closes First Tranche of Financing

RED METAL RESOURCES LTD. (CSE: RMES) (OTC Pink: RMESF) (FSE: I660) ("Red Metal" or the "Company") announces that it has closed the first tranche of its previously announced non-brokered private placement financing (the "Offering") (see news releases dated January 7, 2026, and January 19, 2026)... Keep Reading...

22 January

Questcorp Mining and Riverside Resources Chip Channel Sample 30 Meters @ 20 g/t Gold and 226 g/t Silver at the Mexican Union Project

Questcorp Mining Inc. (CSE: QQQ) (OTCQB: QQCMF) (FSE: D910) (the "Company" or "Questcorp") along with its partner Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY0) ("Riverside"), is pleased to report a high grade interval of 20.2 g/t gold and 226 g/t silver with 2.7% zinc over a 30... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00