November 12, 2024

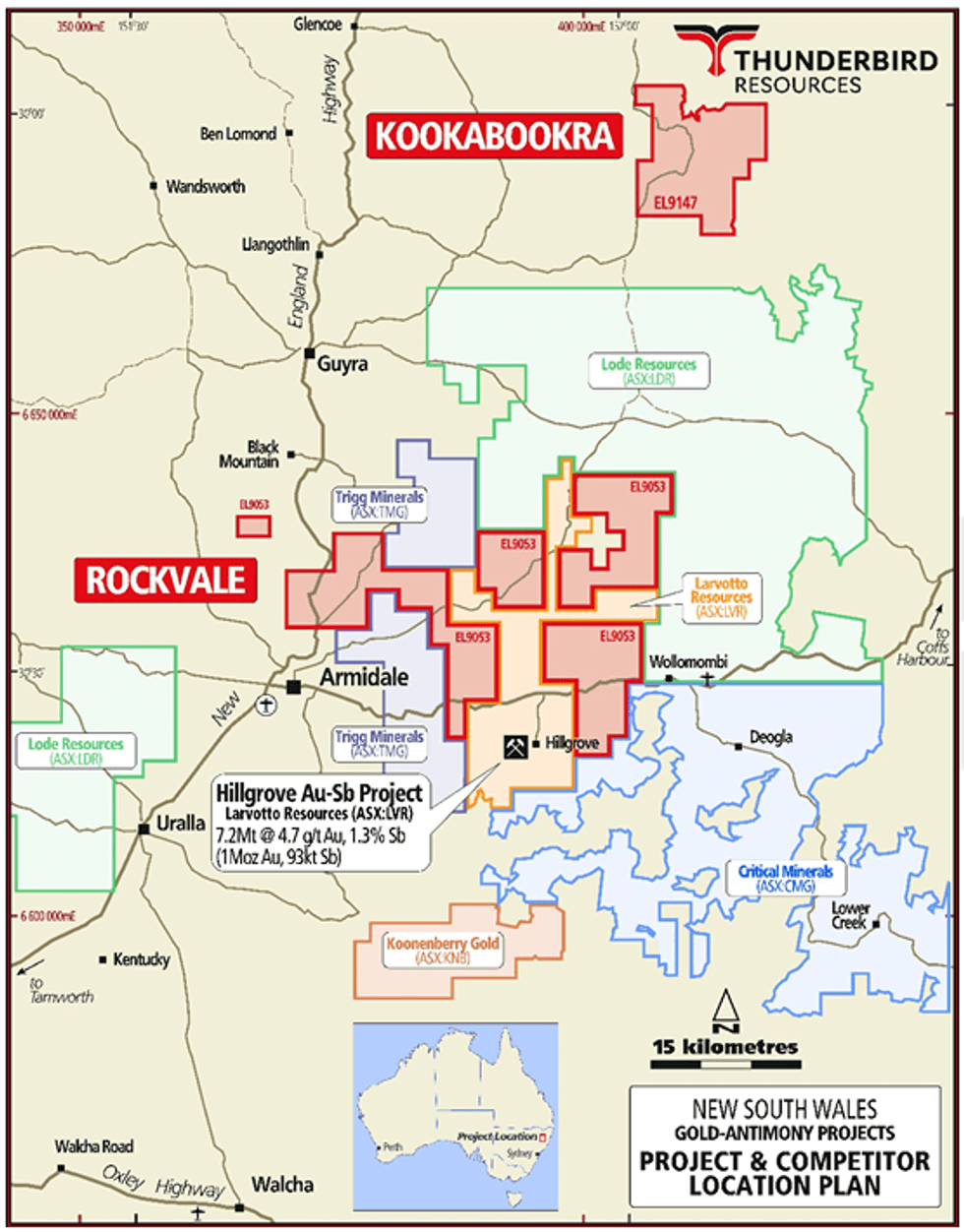

Thunderbird Resources Limited (Thunderbird or the Company) (ASX: THB) is pleased to advise that it has entered into an agreement to acquire a highly prospective antimony and gold exploration land package in the New England Orogen of New South Wales. The high-potential exploration portfolio is located immediately adjacent to Australia’s largest antimony deposit, the Hillgrove Gold & Antimony Project owned by Larvotto Resources (ASX: LRV) (LRV) (Figures 1 and 2).

Highlights

- Thunderbird enters into binding agreement to acquire a 100% interest in a highly prospective 488km2 exploration portfolio surrounding the Hillgrove Gold-Antimony project, a Top-10 global antimony deposit.

- The package, comprising EL9053 and EL9147, including sampling grades of up to 18.2%3 antimony and 76g/t gold4, sits in the heart of the New England Orogen of NSW, which is currently undergoing a major exploration renaissance.

- EL9053, known as the Rockvale Project, covers potential strike extensions of the gold-antimony mineralisation at Hillgrove and encompasses multiple known gold and antimony occurrences, including numerous high-grade historical workings.

- EL9053 adjoins Larvotto Resources’ (ASX: LRV) Hillgrove Gold & Antimony Project, the largest antimony deposit in Australia, with a Mineral Resource of 7.3Mt @ 4.4g/t Au and 1.3% Sb for 1.04Moz of contained gold and 93kt of contained antimony1,2.

- EL9147, known as the Kookabookra Gold Project, covers multiple gold reefs in the historical high-grade Kookabookra gold field.

- Both Projects are considered highly prospective for the discovery of high-grade orogenic gold +/- antimony mineralisation and intrusion-related gold mineralisation.

- The proposed acquisition provides a low-cost opportunity to explore high-quality assets that offer exposure to very favourable commodities, with the ability to explore and generate newsflow during the northern hemisphere winter when Thunderbird’s Canadian assets are less accessible.

- Antimony is a critical metal used for producing high-tech and defence products, including flame retardant materials, semiconductors and superhard materials. Antimony prices have been rising strongly since China, which dominates global supply, imposed export restrictions earlier this year.

Figure 1: Map showing location of EL9053 (Rockvale) and EL9147(Kookabookra) (shown in red outline).

Thunderbird has entered into a binding share purchase agreement with the shareholders of Kooky Resources Pty Ltd (Kooky Resources) to acquire all the issued share capital of Kooky Resources (Proposed Acquisition).

Kooky Resources holds a 100% interest in exploration licences EL9053 and EL9147, which offer strong prospectivity for high-grade antimony and gold mineralisation.

EL9053 lies directly adjacent to the Hillgrove Gold & Antimony Project held by LRV, which represents the largest antimony deposit in Australia with a Mineral Resource of 7.3Mt @ 4.4g/t Au and 1.3% Sb for 1.04Moz of contained gold and 93kt of contained antimony.

The Hillgrove Gold & Antimony Project is currently being redeveloped by LRV and already has most of the surface infrastructure in place, including the process plant, power, roads, decline and substantial underground development. Leveraging this existing infrastructure, LRV recently announced a positive pre-feasibility study, targeting first ore production by early 20261.

EL9053 covers potential strike extensions of the geology and structures that host the antimony-gold mineralisation at Hillgrove.

Numerous historical prospects and occurrences are reported within EL9053 with sampling grades of up to 18.2%3 antimony and 76g/t4 gold reported. Despite the number of historical gold and antimony occurrences the area has had minimal modern exploration or drilling since the 1980s.

EL9047 covers the historical Kookabookra gold field, which has seen virtually no modern exploration, with multiple gold occurrences and potential for both orogenic gold +/-antimony mineralisation and intrusion related gold mineralisation.

This article includes content from Thunderbird Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

THB:AU

The Conversation (0)

22h

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

22h

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00