March 31, 2022

A.I.S. Resources Limited (TSXV: AIS, OTCQB: AISSF) (the “Company” or “AIS”) announces that the Company along with its joint venture partner Spey Resources Corp. (“SPEY”) has acquired the Candela II Project in the Incahuasi Salar in Argentina. The Company paid US$1 million to purchase 100% interest in the project. Concurrently SPEY exercised its option with AIS to acquire an 80% interest in the Candela II Project by paying US$1 million to the Company. AIS retains a 20% interest in the Candela II Project.

Highlights of Candela II work completed to date:

- 25 surface samples and 3 bulk samples.

- 5 rotary drill holes with hole 5 down to 209 metres.

- A NI43-101 report is being written by Montgomery & Associates.

- Ekosolve™ reports from sample 002 that had 160ppm of lithium, recovery using a multiple wash program extracted more than 90% of the lithium contained in the brine, the highest known recovery ever recorded and published by a direct lithium extraction system using the Ekosolve™ DLE process.

Fig. 1 – Work continues to progress at the Candela II Project.

Production well program

A production well program will now be put in place to measure the brine flow and to determine the porosity and transmissivity of the aquifers. Concurrently, a larger pilot plant is now being designed to complete the proof of process for Ekosolve™ solvent exchange DLE lithium process.

SPEY has an option to acquire AIS’ remaining 20% interest in the Candela II project by paying US$6 million by March 18, 2023.

Pocitos 1 & 2 Options

In June 2021, AIS optioned its Pocitos 1 and 2 licences on the Pocitos Salar to SPEY Resources for an option fee of US$100,000 per exploration licence and 2,500,000 Spey common shares.

Spey will be able to exercise the Option and acquire a 100% interest in the Property from AIS by paying a total of US$1,732,000 (the “Purchase Price”) prior to June 23, 2022. In addition, Spey must complete a US$500,000 exploration program on the Property prior to June 23, 2022. Upon exercise of the Option and Spey’s acquisition of a 100% interest in the Property, AIS will retain a 7.5% royalty on the sales revenue of lithium carbonate or other lithium compounds from the Pocitos 1 and 2 properties, net of export taxes. Refer to press release dated June 24, 2021, for additional details.

In 2018 AIS completed two drill holes at Pocitos 1. The results from assays conducted by Alex Stewart show that lithium values of up to 125ppm Li were contained in brines that flowed from 350m to 400m intervals at more than 50,000L per minute. The project was abandoned in 2018 due to the high magnesium but now that Ekosolve™ is able to treat brines with high magnesium the project has become viable and was re-optioned in 2021.

Pocitos 7 & 9 and Yareta III Exploration Licence Options

AIS also has options on Pocitos 7 and 9 and Yareta III properties and is actively seeking joint venture partners to develop these lithium projects.

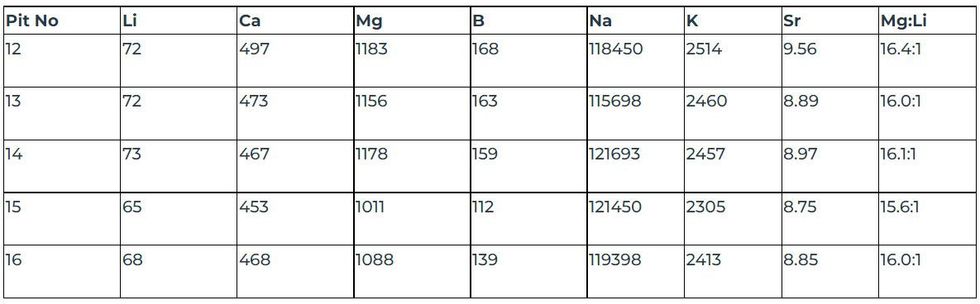

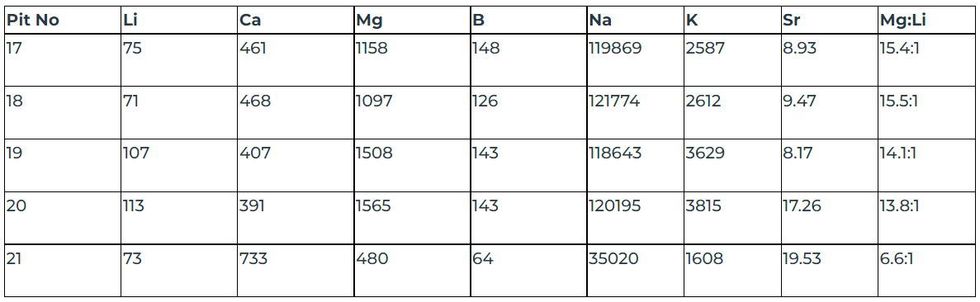

Pocitos 7 and 9 are located on the southern end of the Pocitos salar. A geophysics TEM survey and deep trench sampling was completed in 2018. The results showed low resistivity on the eastern side of the salar indicating sandy units containing brine may be present. The lithium values assayed in the trenches by Alex Stewart are as follows:

Pocitos 7

Pits (All Values in ppm (parts per million) 10,000 ppm=1%) Lat 24˚ 34’ 11.57”S Long 67˚ 00’ 50” (Pit 12)

Pocitos 9

Pits (All Values in ppm (parts per million) 10,000 ppm=1%) Lat 24˚ 35’ 52.86”Long 66˚ 59’ 20.62” (pit 17)

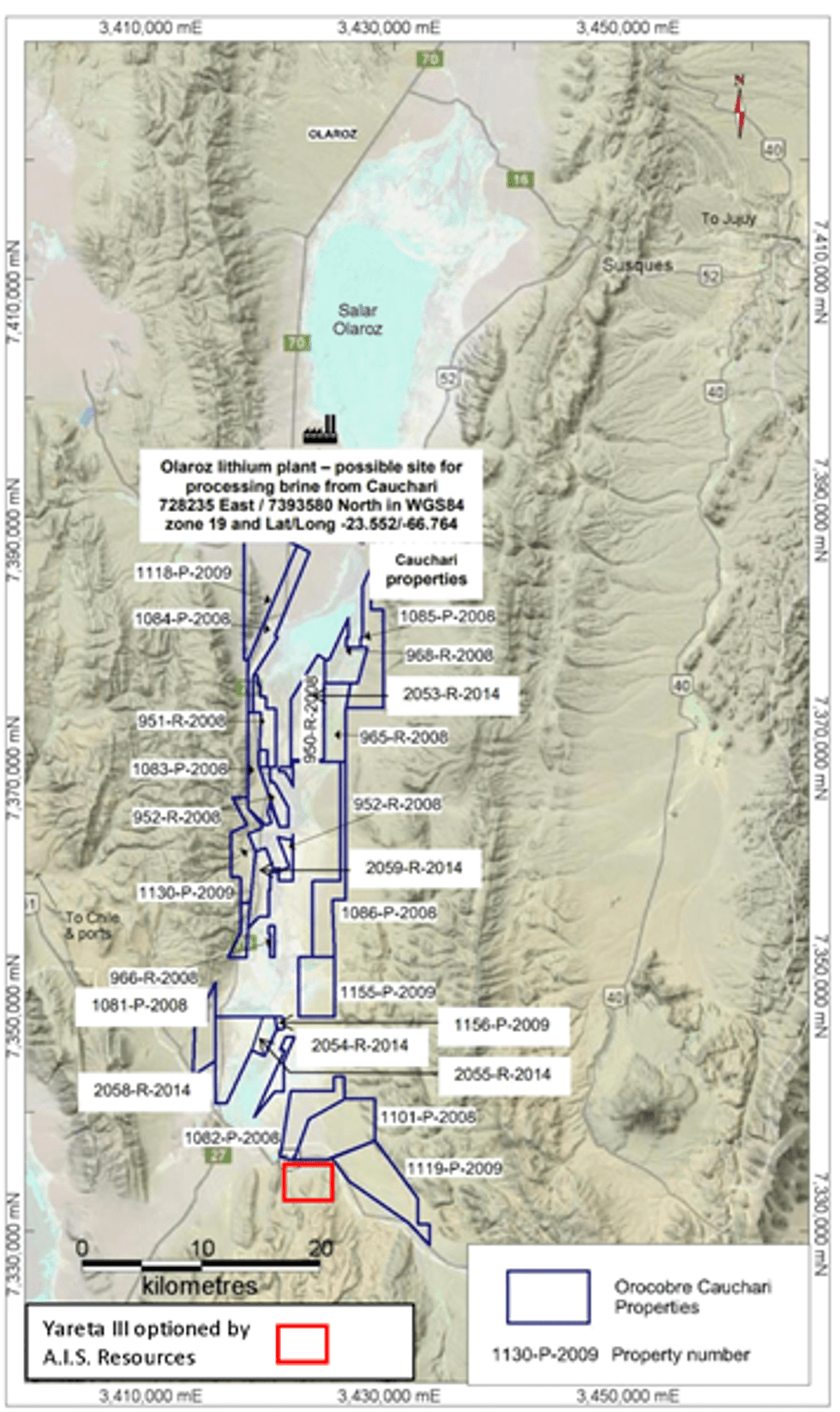

Yareta III Exploration Licence

Yareta III is at the southern end of the Cauchari Salar near Orocobre’s properties (now Allkem ASX:AKE). The project is not on the halite on the salar. A gravity survey and TEM survey was conducted by Orocobre in 2010 (the south east survey) with results that indicate that if brine is there concentrating at the southern end of the salar it will be at depth.

Technical information in this news release has been reviewed and approved by Phillip Thomas, BSc Geol, MBM, FAusIMM MAIG MAIMVA(CMV) who is a Qualified Person under the definitions established by the National Instrument 43-101 and is President, CEO of AIS Resources Ltd.

Fig. 2 – Yareta III exploration licence near Orocobre/Allkem.

About A.I.S. Resources Limited

A.I.S. Resources Limited is a publicly traded investment issuer listed on the TSX Venture Exchange focused on precious and base metals exploration. AIS’ value add strategy is to acquire prospective exploration projects and enhance their value by better defining the mineral resource with a view to attracting joint venture partners and enhancing the value of our portfolio. The Company is managed by a team of experienced geologists and investment bankers, with a track-record of successful capital markets achievements.

AIS owns 100% of the 28 sq km Fosterville-Toolleen Gold Project located 9.9km from Kirkland Lake’s Fosterville gold mine, a 60% interest in the 57sq km Bright Gold Project (with the right to acquire 100%), a 60% interest in the 58 sq km New South Wales Yalgogrin Gold Project (with the right to acquire 100%), and 100% interest in the 167 sq km Kingston Gold Project in Victoria Australia near Stawell and Navarre. It also has a 20% joint venture interests with Spey Resources Corp in lithium brines in Argentina at the Incahuasi and Pocitos Salars.

On Behalf of the Board of Directors,

A.I.S. Resources Ltd.

Phillip Thomas, President & CEO

Corporate Contact

For further information, please contact:

Phillip Thomas, Chief Executive Officer

T: +1-323 5155 164

E:pthomas@aisresources.com

Or

Martyn Element.Chairman

T: +1-604-220-6266

E:melement@aisresources.com

Website:www.aisresources.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

ADVISORY: This press release contains forward-looking statements. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. The forward-looking statements contained in this press release are made as of the date hereof and the Company undertakes no obligations to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The Conversation (0)

08 July 2019

A.I.S. Resources

Exploring and Expanding Australian Gold Assets

Exploring and Expanding Australian Gold Assets Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00