June 17, 2024

CuFe Ltd (ASX: CUF) (CuFe or the Company) is pleased to provide an update on the following exploration activities within E15/1495 at North Dam.

HIGHLIGHTS

- Columbite Rock chip sample ND11 sourced from pegmatite returned significant results for Niobium 47.1 % (Nb) and Tantalum 9.01% (Ta) within the North Dam Project.

- This follows up from previously announced (22 August 2023) rock chips collected from a stream bed which returned results 43.93% Nb and 14.53% Ta.

- Anomalous Nb in soil geochemistry is coincident with out cropping pegmatites within the central area of E15/1495, which will be drill tested in the upcoming RC drill program.

- Preliminary heritage survey report now received and supports performing the planned activities, final report is expected this month, with drilling continuing to be targeted to commence in July.

- Infill soil sampling has been completed in targeted zones and results will be incorporated into the final drill hole plans as results are received.

CuFe Executive Director, Mark Hancock, commented “The recent work by the team at North Dam further illustrates the potential of the tenement and although the results are from a columbite chip it shows the potential of the pegmatites across the tenement to host critical minerals other than lithium. We are eager to start our maiden drilling program to further understand the potential of the region”.

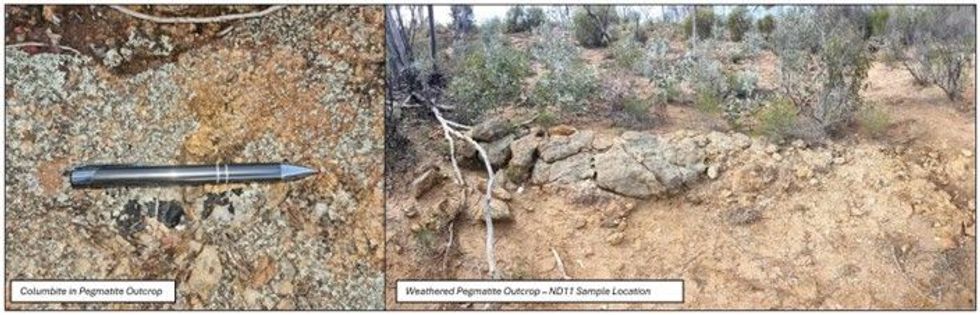

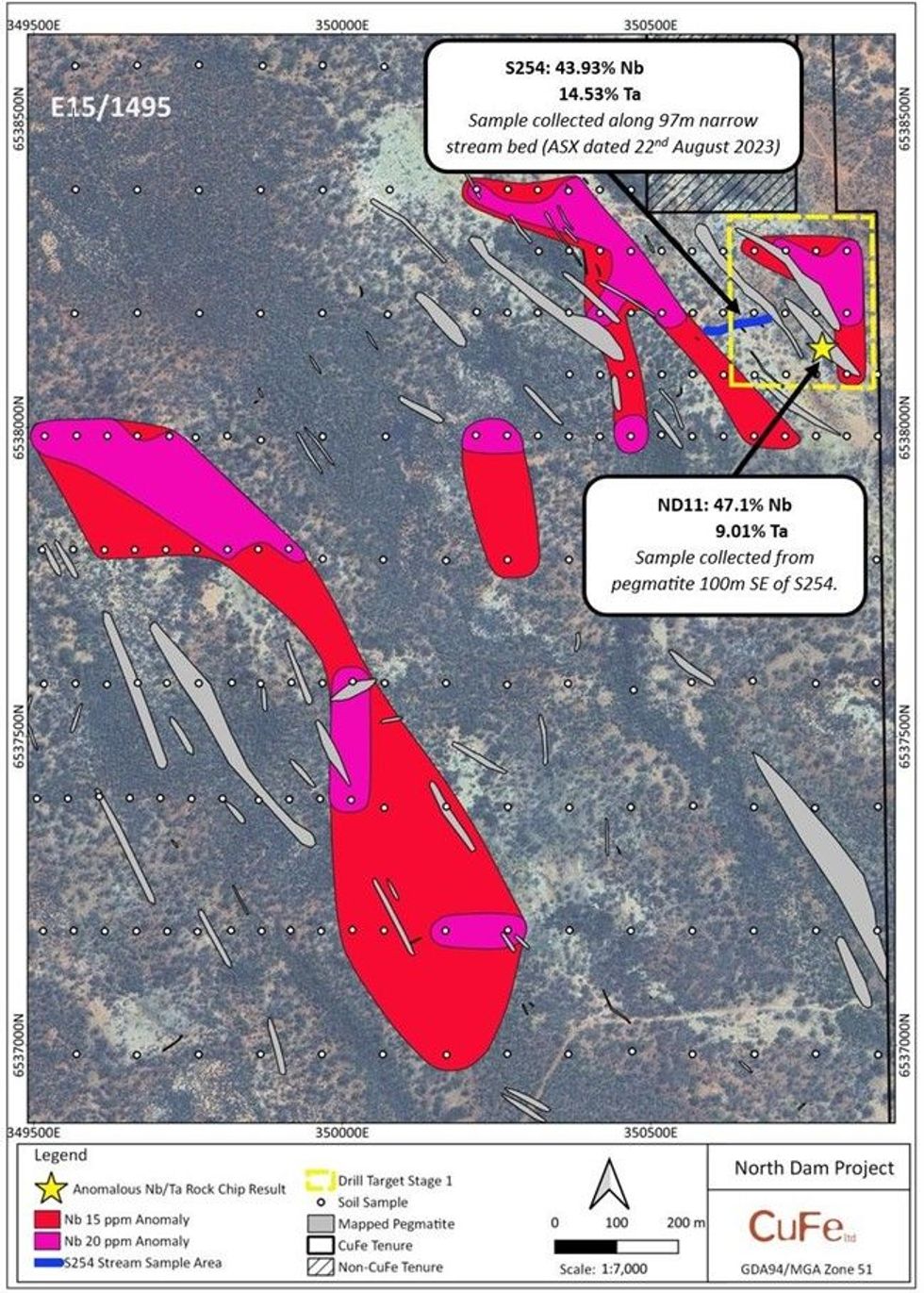

As per ASX announcement dated 28th May 2024 a soil geochemistry review, detailed pegmatite mapping and rock chip sampling was undertaken to identify the source pegmatites that have likely shed the columbite and tantalite rock chips along a 97m narrow stream bed which returned 43.93% Nb and 14.53% Ta from sample S254 (refer to ASX release dated 22nd August 2023). A recent rock chip sample ND11 of columbite was collected directly from an outcropping pegmatite located nearby the Niobium soil anomaly and 100m South East from S254.

The selective sample of columbite from weathered pegmatite is biased and does not represent the true concentration of the overall pegmatite but yielded a Niobium content of 47.1% and Tantalum 9.01% (see Figure 1 and Table 1).

Broader zones of anomalous Niobium (>15ppm and > 20ppm) from soil geochemistry have been interpreted (See Figure 2) and are coincident with outcropping pegmatites. These pegmatites to the West will both be mapped in detail for the presence of columbite and have drill holes planned to intersect them as part of the wider RC program, which is primarily targeting Li2O.

A preliminary report has been received for the recent heritage survey and supports performing the planned activities, with the final report expected this month. Following this, preparatory works can be executed prior to mobilisation of the drilling contractor, with drilling targeted to commence in July.

Infill soil sampling work to assist in definition of the priority drill holes has now been completed and results will be incorporated into the drill plans once received.

Table 1: Sample ND11 rock chip niobium and tantalum chemistry.

Click here for the full ASX Release

This article includes content from CUFE LTD, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CUF:AU

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 July 2025

CuFe Limited

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium.

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium. Keep Reading...

02 February

Government Funding to Unlock Critical Metals Processing

CuFe Limited (CUF:AU) has announced Government Funding to Unlock Critical Metals ProcessingDownload the PDF here. Keep Reading...

29 January

Quarterly Activities and Cashflow Report

CuFe Limited (CUF:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

28 October 2025

Quarterly Activities and Cashflow Report

CuFe Limited (CUF:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

20 October 2025

Review Highlights High Grade Bismuth Intercepts at Orlando

CuFe Limited (CUF:AU) has announced Review Highlights High Grade Bismuth Intercepts at OrlandoDownload the PDF here. Keep Reading...

14 October 2025

Placement to Raise $5.4 Million

CuFe Limited (CUF:AU) has announced Placement to Raise $5.4 MillionDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00