September 25, 2024

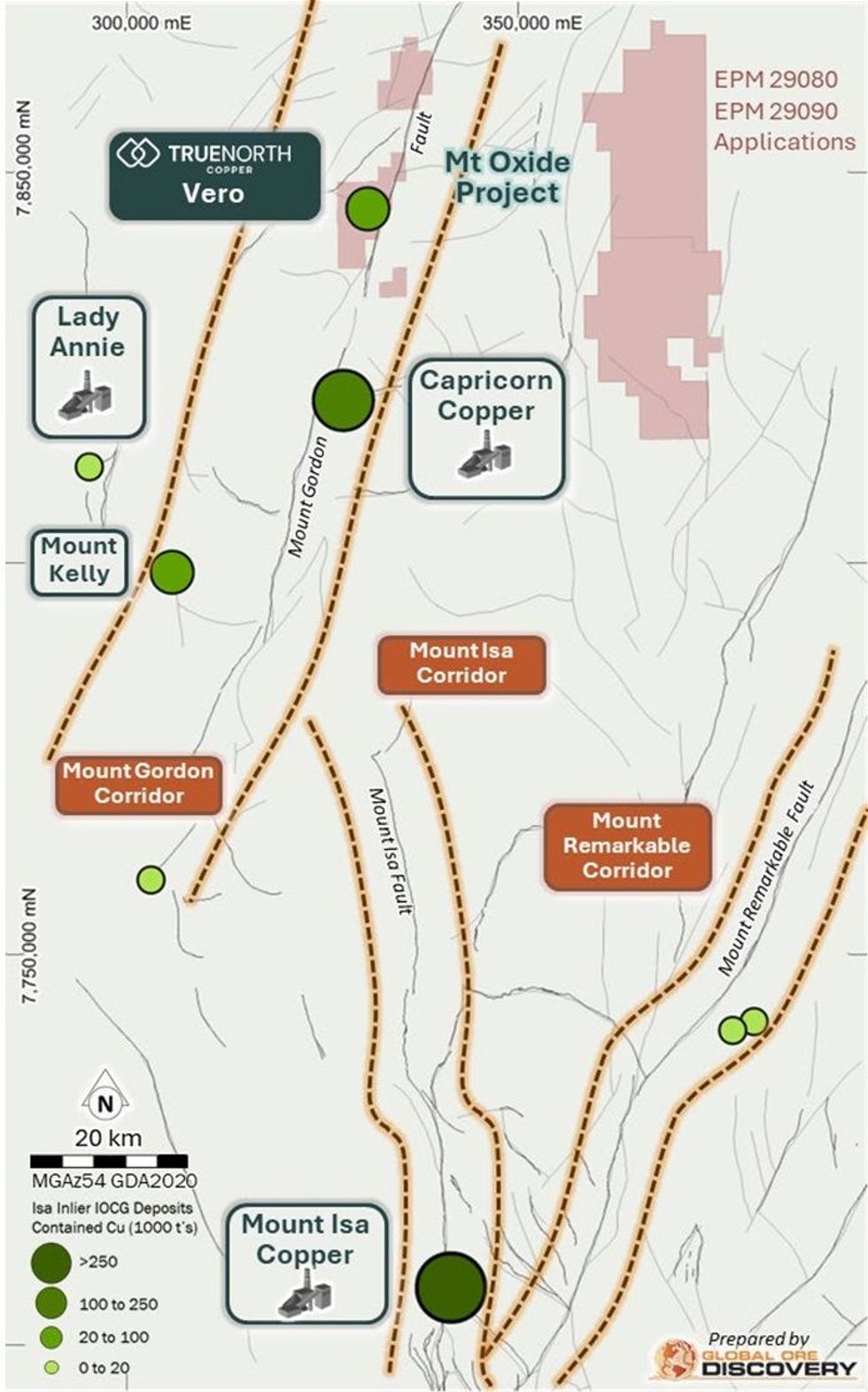

True North Copper Limited (ASX:TNC) (True North, TNC or the Company) is pleased to announce results from the geophysical survey at the Mt Gordon and Aquila prospects, part of TNC’s Mt Oxide Project, 140km north of Mt Isa in Queensland. The survey has been supported by a $300,000 Queensland Government Collaborate Exploration Initiative (CEI) Grant.

HIGHLIGHTS

- Three MIMDAS Induced Polarisation (IP) and Magnetotelluric (MT) lines at the historic Mt Gordon Copper Mine and Aquila prospect have revealed multiple unexplored geophysical targets with similar signatures to the Vero Cu-Ag-Co resource at Mt Oxide.

- Mt Gordon – Three new shallow and untested anomalies, similar to the Vero resource, have been identified and are partially coincident with historic drilling intersections, including 1.9m @ 3.0% Cu from 106m downhole in ECM11.

- Aquila –Chargeability highs of 15mV/V from two MIMDAS lines spaced 85m apart are coincident with mapped iron oxide-rich breccias which returned up to 0.94% Cu in rock chip samples2.

- A 20m wide, shallow highly chargeable anomaly associated with a 150m long trend of fault breccias with anomalous Cu +/- Ag-As-Bi and no previous drilling.

- A 20m wide and up to 25m deep +25mV/V chargeability and <250ohm.m conductivity anomaly, un-drill tested and correlating with a Dorman trending structure 80m below surface.

- Next Steps

- The geophysical survey is nearing completion with processing pending on Ivena North and an additional line being undertaken at Camp Gossans to test the strike extent of the anomaly at Camp Gossans and the new Black Marlin target3.

- True North Copper’s Exploration team are currently sampling recently identified mineralised structures at Aquila, Rhea and Black Marlin.

- The new geophysics will be integrated with ongoing mapping and surface geochemical sampling campaigns to identify and prioritise targets for future drill campaigns.

- Heritage clearance and access planning for drilling has commenced.

COMMENT

True North Copper’s Managing Director, Bevan Jones said:

“Our geophysical survey at Mt Oxide has revealed several new, highly prospective targets that share similar characteristics with our high-grade Vero deposit. The results of this survey, which has been supported by a Queensland Government CEI Grant, have uncovered significant anomalies at both the historic Mt Gordon Copper Mine and Aquila prospect. These results are in addition to the positive results at Vero and Camp Gossans announced in August. With these exciting developments, we’re optimistic about expanding our exploration footprint and identifying additional drill targets. The continued integration of geophysics, mapping, and sampling will be key to advancing our future exploration programs at Mt Oxide, including the design of the next phase of drilling.”

Mt Oxide MIMDAS Survey Results Summary

In July 2024, TNC announced it had commenced its leading edge MIMDAS Induced Polarisation (IP), Resistivity and Magnetotellurics (MT) geophysical survey (MIMDAS survey) at Mt Oxide4. Partial funding of $300k was granted to TNC in Round 8 of the Collaborative Exploration Initiative (CEI) to undertake the survey (Figure 6).

The MIMDAS survey has aimed to identify potential sulphide mineralisation developed below numerous leached gossan zones and build an improved understanding of the regional scale structural and geological architecture. Two previously reported lines identified chargeability anomalies correlating with mineralisation in the Vero resource and a series of untested anomalies including a chargeability anomaly 1km east of Vero, and two chargeability high responses at Camp Gossans3 beneath outcropping breccias with similar surface geochemical signatures to the Esperanza Deposit5. The coincidence of anomalies directly associated with the Vero resource highlights the applicability of MIMDAS to target copper-silver mineralisation within the Mt Oxide District.

Three additional lines have recently been completed, including two lines 85m apart for 2.3 line-kms over the highly prospective Aquila prospect and one line for 1.5 line-kms over the historic Mt Gordon Copper Mine (Figure 2).

At Aquila, the survey has identified two (2) chargeability responses in the Mount Gordon Fault Zone and the Dorman fault trend, and one conductivity response below a geochemically anomalous fault breccia.

At Mt Gordon, the survey has identified four (4) chargeability responses in the Mount Gordon Fault Zone and in resistive sandstone over a 600m wide chargeability trend.

The geophysical survey is nearing completion with processing pending on Ivena North and an additional line at Camp Gossans, 150m northeast of the line completed in August that returned a very high-order chargeability anomaly coincident with mapped Gossans and defined the new Black Marlin Target3.

Click here for the full ASX Release

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

6h

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00