May 24, 2022

Latest drill results extend known mineralisation, paving way for an upgrade of the existing 873,500 oz mineral resource

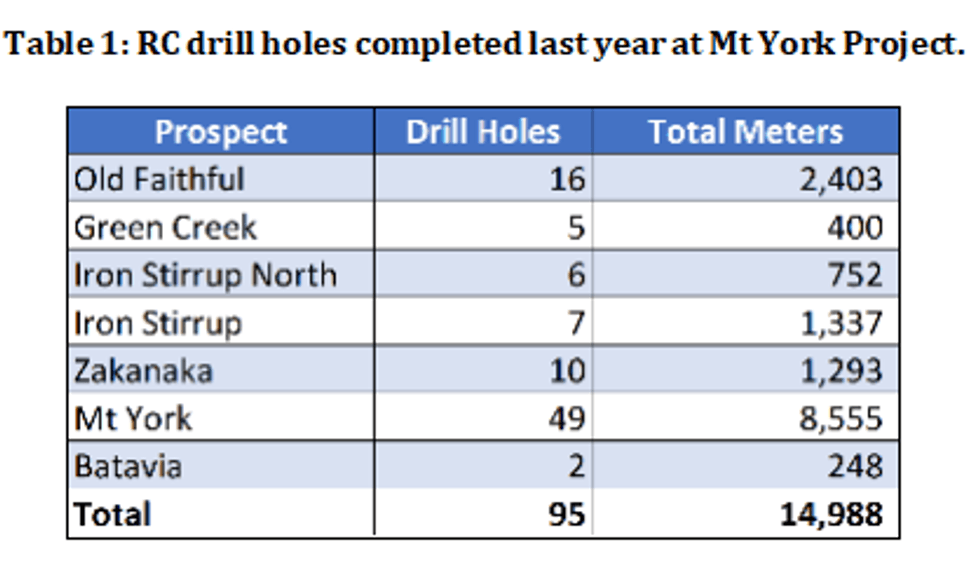

Kairos Minerals Ltd (ASX: KAI) is pleased to advise that it has received all final 4m-composite sample results from the RC drilling program conducted in 2021 at its 100%-owned Mt York Gold Project located in the Pilbara region of Western Australia. The 2021 RC drilling program at Mt York project comprised 95 drill holes for a total of 14,988m, and it was completed on the 19th of November. A breakdown of the drilling program is shown in Table 1. Previous results of this programme were announced in press releases by Kairos Minerals on 15th September 2021, 23rd November 2021 and 13th January 2022.

Highlights

- Final 4m-composite sample results received from the 14,988m Reverse Circulation drilling program completed in 2021 at the 873,500oz Mt York Gold Project

- Latest results include:

- 49m @ 1.75g/t Au from 135m in KMYC196 (The Gap), including:

- 19m @ 3.29g/t Au from 153m

- 24m @ 3.14g/t Au from 100m in KMYC198 (The Gap), including:

- 14m @ 4.30g/t Au from 104m

- 28m @ 1.66g/t Au from 32m in KMYC194 (Main Hill), including:

- 12m @ 3.26g/t Au from 32m

- 49m @ 1.75g/t Au from 135m in KMYC196 (The Gap), including:

- Results extend the new high-grade lode down-dip at “The Gap”, with intercepts including 8m @ 6.16g/t Au from 172m (KMYC197)

- These highly encouraging new results will help underpin a resource upgrade

- 1m re-splits submitted with results expected in June

Kairos Managing Director Dr Peter Turner said: “These results confirm that the Mt York Gold Project is a big system that is yet to be fully understood. The technical team has done a superb job targeting parts of the orebody that are either under-drilled or not drilled at all and have provided the Company with excellent results that it will take into the next round of resource estimation. These are some of the best grade and widths we have seen at Mt York to date.

“We have commenced a technical review of the deposit and are looking for more opportunities to increase our confidence in the mineralisation and importantly, substantially grow the resource. I remain extremely positive about delivering cost-effective exploration to deliver value with this highly promising asset.

“Organic growth through targeted drilling is in our view the best way to create shareholder value and is entirely in line with our strategy. We anticipate a further 10,000m drill programme at Mt York in the second half of the year”.

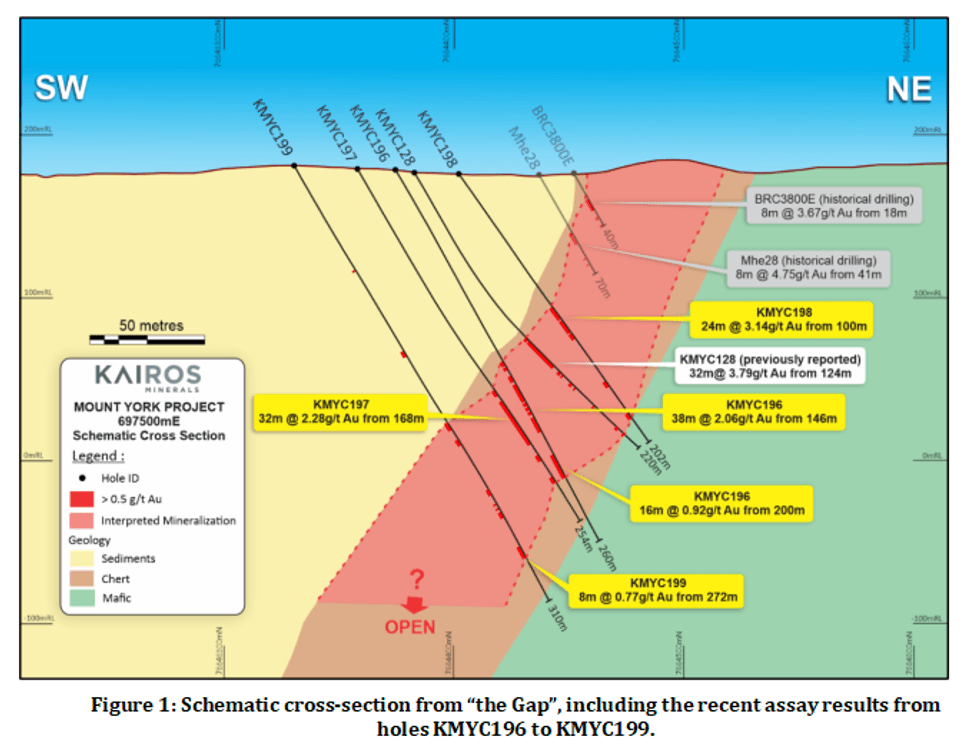

The RC holes drilled at the Mt York deposit continue to deliver exceptional results, including 49m @ 1.75g/t Au from 135m in KMYC196. See Figure 1 for a cross-section and Figure 3 for a plan view.

The Company is expecting results of the 1m resplit samples of mineralised intervals next month in preparation for a mineral resource update later in the year.

Mt York RC Drilling Program

This follow-up drilling at “The Gap” prospect, between Main Hill and Breccia Hill historic pits extends the mineralization zone approximately 75m down-dip with mineralisation remaining open at depth. KMYC197 returned exceptional intercepts of 8m @ 6.16g/t Au, extending the high-grade lode previously intercepted in hole KMYC128 (see ASX release, 15 September 2021).

These latest results will likely have a positive impact on the next mineral resource estimate, especially for the Gap prospect, where the previous estimate relied on only shallow drilling (see press release dated 4th March 2020).

Figure 1 shows the cross-section with the RC holes drilled to follow up the results from the KMYC128.

In-fill drilling conducted underneath the historic Main Hill pit, returned exceptional grades of up to 6.31 g/t Au (KMYC194), within a thick and shallow zone of 16m @ 2.60 g/t Au from 32m. See Figure 2 for a cross- section and Figure 3 for a plan view.

Click here for the full ASX Release

This article includes content from Kairos Minerals , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

KAI:AU

The Conversation (0)

14 February 2022

Kairos Minerals

Developing Highly Prospective Gold Projects in a World-Class Gold District

Developing Highly Prospective Gold Projects in a World-Class Gold District Keep Reading...

5h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

23h

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

31 January

Chris Vermeulen: Gold, Silver to Go "Dramatically Higher," This is When

Speaking ahead of this week's gold and silver price correction, Chris Vermeulen, chief market strategist at TheTechnicalTraders.com, said the metals were due for a "significant pullback." After that, they'll be positioned for a new leg up."There will be a time definitely to get back into metals,... Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00