Western Resources Corp. (the "Company") (TSX: WRX) is pleased to announce today that its wholly owned subsidiary, Western Potash Corp. ("Western"), has closed the first tranche, in the amount of C$45 million, of its Loan Transaction with Appian Capital Advisory LLP ("Appian"), the terms of which were previously announced in the press release of April 28, 2022.

The first tranche of funds from the Loan Transaction will be used by Western to restart immediately construction of the Milestone Phase 1 Project ("Project") and continue with its optimized mining development plan. The funding will also be applied in the settlement of all outstanding legal claims against Western and the removal of all liens related to those claims.

In addition, pursuant to Section 604 (d) of the TSX Company Manual, the Company has received the written consent from its majority shareholder Tairui Mining Inc. ("Tairui"), which holds 56.55% of the total issued and outstanding common shares of the Company as of the date hereof. Tairui consents to and approves of the issuance by the Company of 20,774,030 Warrants to WPC Investments B.V. (the "Warrantholder"), an affiliate of Appian pursuant to a Warrant Certificate.

Following the closing of the first tranche of the Loan Transaction funding, the Company issued 20,774,030 common share purchase warrants ("Warrants") which will allow the Warrantholder, after exercise, to acquire up to 20,774,030 common shares of the Company ("Warrant Shares") at a price of $0.2834 for 6 years. The Warrants and the Warrant Shares are subject to a statutory four-month hold period. The Toronto Stock Exchange has conditionally approved the listing of the Warrant Shares.

Mr. Bill Xue, Western Potash Corp. CEO, commented, "We are very excited to have this timely and critical funding from Appian. Appian's endorsement of the Project gives us renewed confidence in our innovative mining technology. Our entire team can't wait for the restart of the Milestone Project construction. Western looks forward to working closely with all related partners to kick off the construction."

About Appian Capital Advisory LLP

Appian is a London-based leading investment advisor to long-term value-focused private equity funds that invest solely in mining and mining-related companies, with global experience across South America, North America, Australia and Africa and a successful track record of supporting companies to achieve their development targets. Appian has a global operating portfolio and a team of 54 experienced professionals with presences in London, Toronto, Vancouver, Lima, Belo Horizonte, Montreal and Sydney overseeing nearly 5,000 employees in the projects and the companies it invested.

About Western Resources Corp.

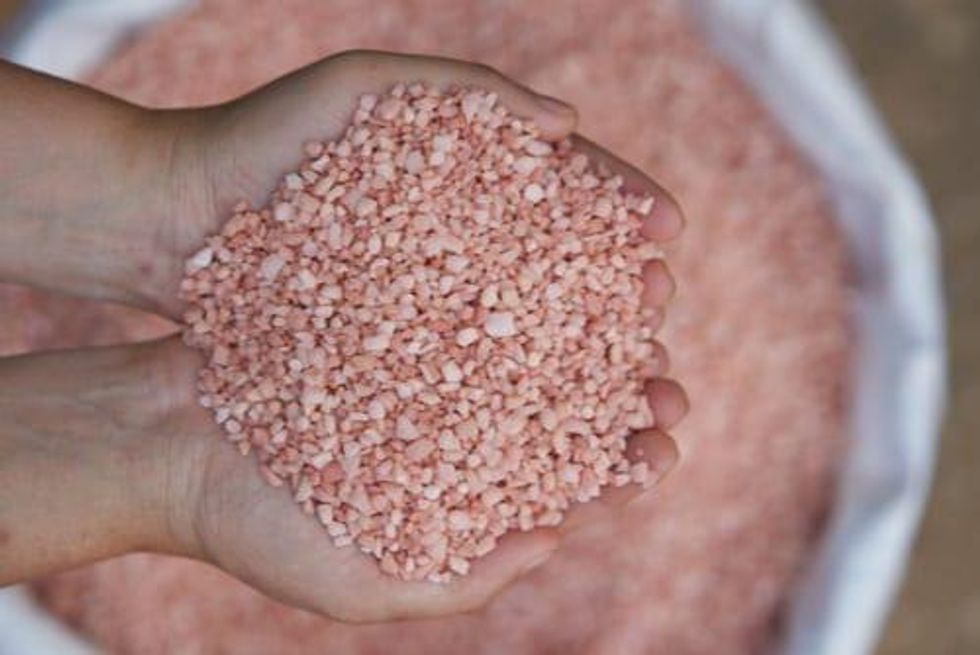

Western Resources Corp. (TSX: WRX) ("the Company") and the Company's wholly owned subsidiary Western Potash Corp. are constructing one of Canada's newest and most innovative, environmentally friendly and capital-efficient potash mines. It is expected to be the first potash mine internationally to leave no salt tailings at the surface, thereby reducing the water consumption by approximately half as well as significantly improving energy efficiency. Successful completion of the Project will form the basis for further expansion.

ON BEHALF OF THE BOARD OF DIRECTORS

Bill Xue

Chairman and CEO

For more information on the contents of this release please contact Simon Guo, Corporate Secretary, at 306-924-9378.

Cautions Regarding Forward-Looking Statements

Certain statements contained in this news release constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by words such as "anticipate", "continue", "estimate", "expect", "expected", "intend", "may", "will", "project", "plan", "should", "believe" and similar expressions (including negative variations), or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information that is set out herein, except in accordance with applicable securities laws.