May 02, 2022

Sarama Resources Ltd. (“Sarama” or the “Company”) (ASX:SRR, TSXV:SWA) is pleased to announce that the Company’s securities have commenced trading on the Australian Securities Exchange (“ASX”) under the ASX code SRR following a strongly supported public offering which saw A$8M raised predominantly from a broad base of domestic and international institutional and sophisticated investors.

The funds will primarily be used to recommence exploration at the Company’s Sanutura Project (the “Project”), which hosts a multi-million ounce Mineral Resource and a suite of targets that provide significant exploration upside.

Highlights

- Sarama Resources opens trade on ASX today, now dual-listed on ASX and TSX Venture Exchange (Canada)

- Associated equity raising of A$8M strongly supported by domestic and international institutional and sophisticated investors

- Funds used to recommence exploration at the at the 100%-owned(4) Sanutura Project on Burkina Faso’s Houndé Belt; one of West Africa’s most prolific gold belts

- Existing large Mineral Resource of 0.6Moz Au (Indicated) plus 2.3Moz Au (Inferred) (1)

- +50,000m drill program targeting increases to the Mineral Resource from highly accretive, predominantly shallow, oxide targets

- Mineral Resource update anticipated in 2023, incorporating additional and extensional drilling • Abundant regional exploration targets within a large landholding of 1,420km² at the Sanutura Project

- Additional opportunity for value creation from early-stage exploration atthe 100%-owned Koumandara Project

Sarama’s President, CEO & MD, Andrew Dinning commented: “

Sarama is delighted to have attracted the support of several high quality domestic and international institutional and sophisticated investors who have joined our existing shareholders and so enthusiastically backed our plans to grow and exploit the multi-million ounce Sanutura Gold Project. Burkina Faso is well-known to the Australian market for its prospective greenstone belts which have frequently delivered multi-million ounce discoveries in recent times, leading to the development of a new generation of highly profitable mines.

The Company has planned a large scale, +50,000m drill program to grow the Mineral Resource at the Sanutura Project which will be the first major drill campaign conducted at the Project since 2017 and will produce strong news flow over the coming months.

The Company’s ASX listing and associated equity raising was an essential precursor to re-activating the Project and with that completed, we now look forward to advancing the Project, initially focusing on drilling the resource growth-oriented targets which offer immediate opportunity for value accretion.”

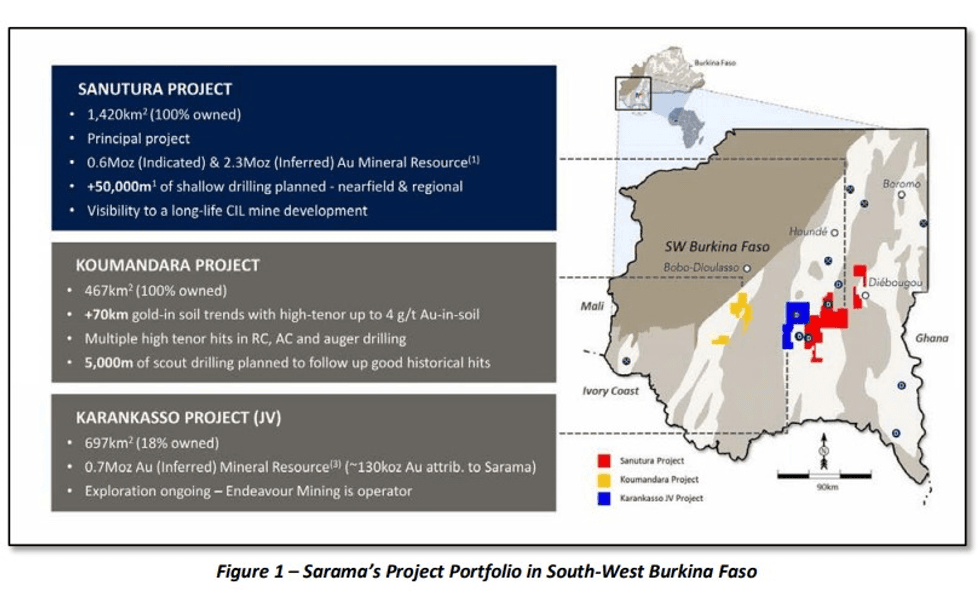

Project Portfolio – Multi Project Exposure in Burkina Faso

Sarama is a West African-focused gold explorer/developer and holds a commanding land position of approximately 1,900km² across two 100%-owned projects in highly prospective Houndé and Banfora Belts in Burkina Faso.

The Company’s flagship Sanutura Project has an existing multi-million ounce Mineral Resource of 0.6Moz Au (Indicated) plus 2.3Moz Au (Inferred)(1) with significant growth potential available from its position along 70km of strike in one of the most prolific gold belts in West Africa, the Houndé Belt.

Burkina Faso is a well-established jurisdiction for gold explorer/developers with 12 gold mines in operation and development combining to achieve a total gold production of +2Moz in 2021. A summary of the Company’s projects is presented in Figure 1.

Sanutura Project – Material Resource Foundation with Significant Exploration Upside

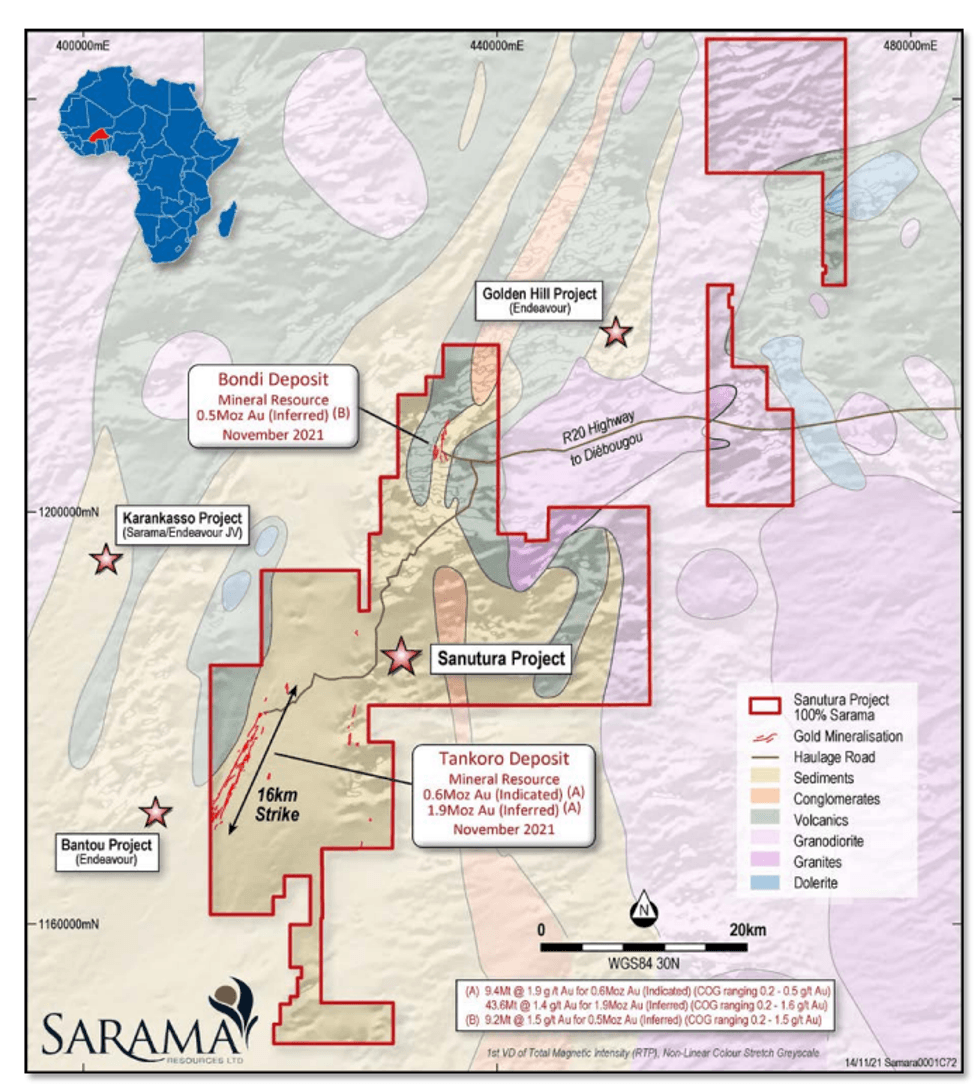

The Company’s primary focus is its 100%-owned(4) Sanutura Project, which hosts a large Mineral Resource and covers an area of 1,420km2 . The Project lies 60km south of Endeavour Mining’s Houndé Mine (5Moz Au); 120km south of Fortuna Silver’s high-grade Yaramoko Mine (1Moz), and 140km south of Endeavour Mining’s Mana Mine (5Moz), highlighting the significant gold endowment of the Houndé Belt.

Figure 2 –Sanutura Project Location Plan

Significant brownfields and greenfields potential remain at the Project, with over 30 compelling exploration focus areas currently identified across the key Tankoro and Bondi Deposits. A +50,000m drill program is planned, with the objective of testing high-probability targets, predominantly in near-surface oxide material and proximal to the current Mineral Resource. This will be the first major drill program at the Project in 5 years and it is anticipated that it will deliver meaningful increases to the Mineral Resource through an update in 2023

Click here for the full ASX Release

This article includes content fromSarama Resources Ltd. , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SRR:AU

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 November 2025

Sarama Resources

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim.

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim. Keep Reading...

14 August 2025

Q2 2025 Interim Financial Statements

Sarama Resources (SRR:AU) has announced Q2 2025 Interim Financial StatementsDownload the PDF here. Keep Reading...

04 August 2025

Sarama Provides Update on Arbitration Proceedings

Sarama Resources (SRR:AU) has announced Sarama Provides Update on Arbitration ProceedingsDownload the PDF here. Keep Reading...

09 July 2025

Completion of Tranche 1 Equity Placement & Cleansing Notice

Sarama Resources (SRR:AU) has announced Completion of Tranche 1 Equity Placement & Cleansing NoticeDownload the PDF here. Keep Reading...

29 June 2025

A$2.7m Equity Placement to Fund Laverton Drilling Campaign

Sarama Resources (SRR:AU) has announced A$2.7m Equity Placement to Fund Laverton Drilling CampaignDownload the PDF here. Keep Reading...

25 June 2025

Trading Halt

Sarama Resources (SRR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00