Power Nickel Inc. (the "Company" or "Power Nickel") (TSX-V:PNPN, OTCBB:CMETF, Frankfurt:IVVI) is pleased to announce that it has issued 5,557,125 shares as a result of warrant exercise. The $833,568.75 was added to the capital of the Company and will as announced fund the up to 5000 Metre follow-up drill program on its promising Nisk Nickel Sulphide project south of James Bay Quebec

"We were very pleased with the drilling results (see below) at Nisk and are quite excited to be able to follow up our initial program with this new program in Q2 after breakup. We will continue to test the extension of Nisk Main and additionally several new target zones. Globally these deposits tend to exist as pods or as a string of pearls. With each pearl representing a deposit. We believe this is what we have here at Nisk and, with our actual understanding of the Nisk litho-structural setting, we can expect a well-planned drill program to help expand beyond our first pearl at Nisk Main to hopefully other pearls located in our project land package" commented Power Nickel CEO Terry Lynch.

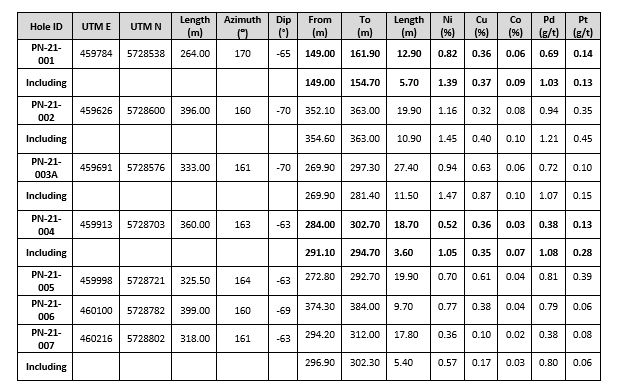

Results obtained during the 2021 drilling program are from 7 holes that were planned to either confirm or expand the historical resources reported in 2009. These results, presented below, successfully demonstrated the existence of the Nisk main mineralized lense, and appear to be representative of what was expected from the historical work.

*UTM NAD83, Zone 18N

**True widths are estimated to be 70 to 90% of core length

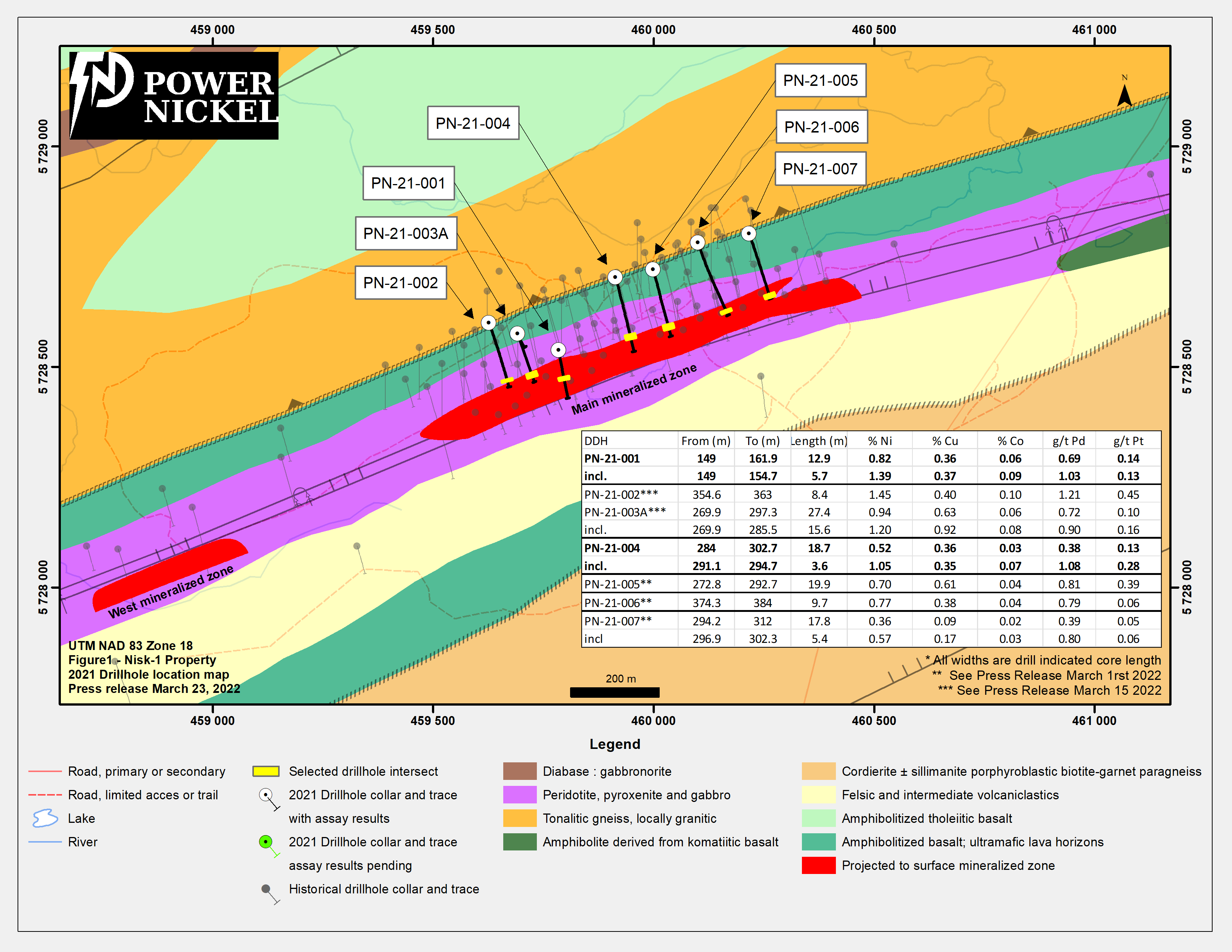

The table above and the illustration below detail the current results and location of drill holes covered in the releases dated March 1, March 14, and March 30, 2022.

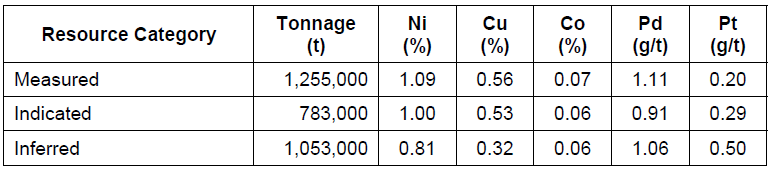

The existing resource estimates at the Nisk project are of historic nature and the Company's geology team has not completed sufficient work to confirm a NI 43-101 compliant mineral resource. Therefore, caution is appropriate since these historic estimates cannot, and should not be relied on. For merely informational purposes see Table 1.

Table ‑1: Historical Resource Estimate figures for respective confidence categories at the NISK-1 deposit, After RSW Inc 2009: Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec.

The information regarding the NISK-1 deposit was derived from the technical report titled "Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec" dated December 2009. The key assumptions, parameters, and methods used to prepare the mineral resource estimates described above are set out in the technical report.

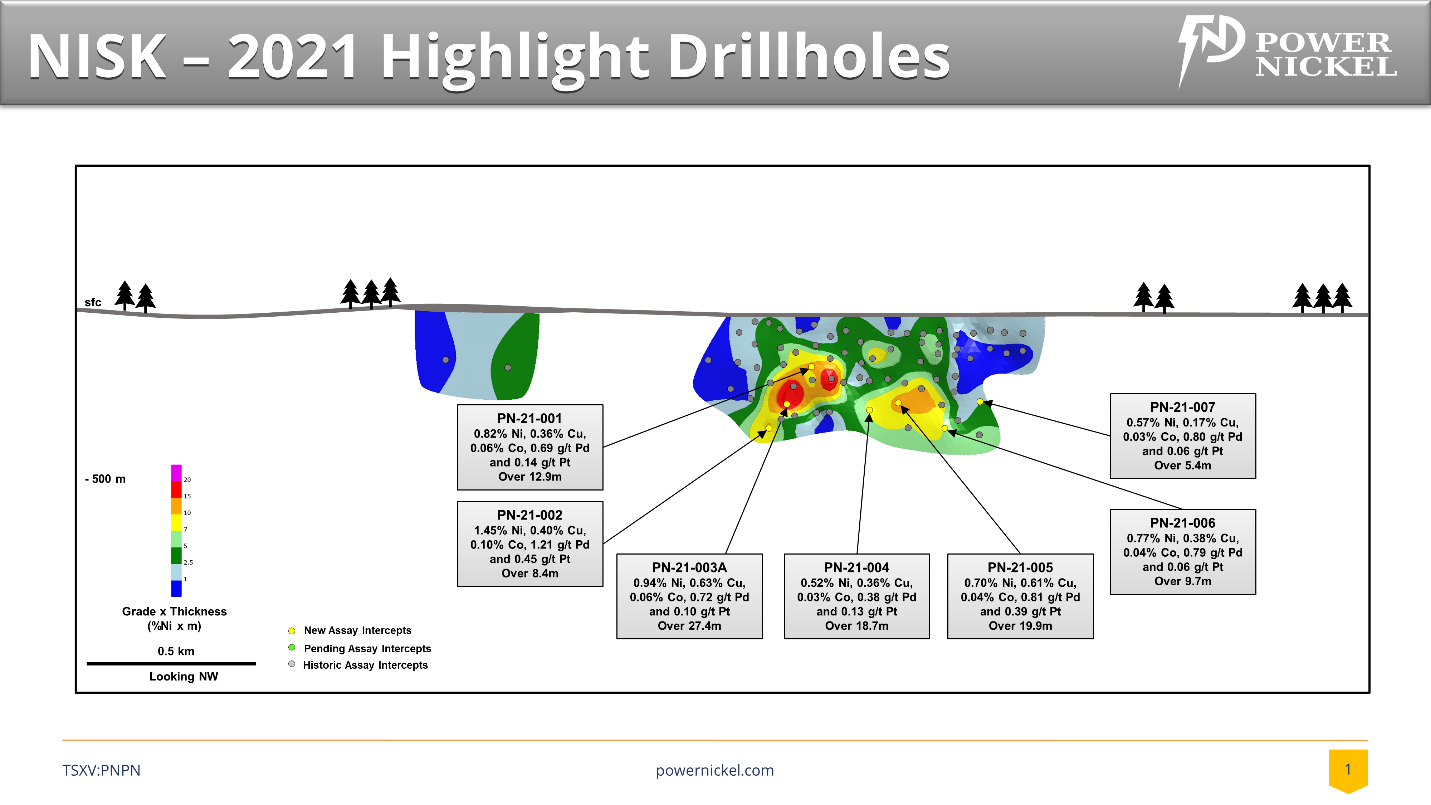

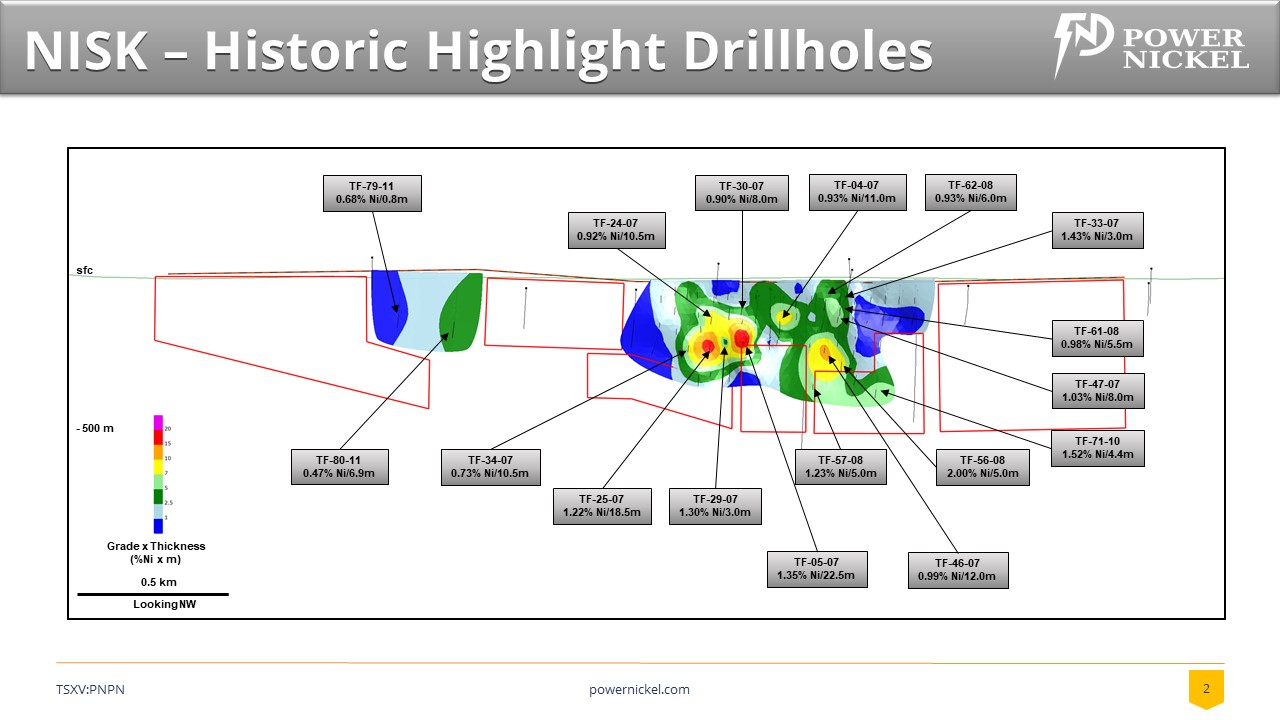

The 3D geological model developed by 3DGeo Solution Inc. ("3DGS") identified a prospective set of targets that the Company feels will give the best potential to expand the Nisk historical deposit. The image below is a view of the mineralization projected from the surface of the area we refer to as Nisk Main.

"Nisk has four distinct target areas covering over 7 Kilometres of strike length. Our focus this round was on the Nisk Main target. Historically, we know globally these types of deposits typically have multiple pods. We are encouraged by what we see on Nisk Main and feel we can continue to build commercial tonnage there but we are also looking forward to exploring Nisk West and the two wildcat targets in subsequent drilling in Q2", commented Power Nickel's CEO Terry Lynch.

ABOUT NISK

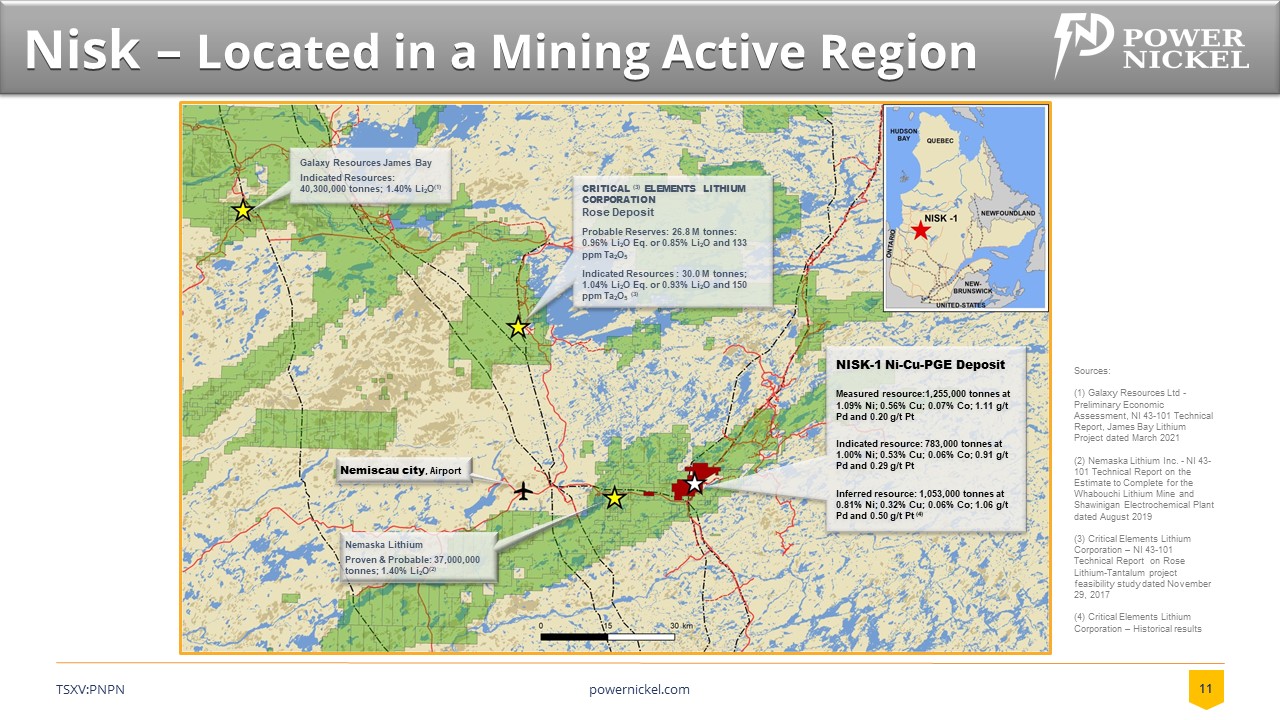

Nisk is located south of James Bay as illustrated in the area map below. This region is the site of a number of mining projects and improving infrastructure.

Nisk has historically had some very high-grade Nickel intercepts as shown below. The Grade-Thickness iso-contours are representative of the nickel distribution only.

Analysis and QAQC Procedures

All samples were submitted to and analyzed at ALS Global ("ALS"), an independent commercial laboratory located in Val-d'Or, Québec for both the sample preparation and assaying. ALS is a commercial laboratory independent of Power Nickel with no interest in the Project. ALS is an ISO 9001 and 17025 certified and accredited laboratory. Samples submitted through ALS are run through standard preparation methods and analyzed using ME-ICP61a (33 element Suite; 0.4g sample; Intermediate Level Four Acid Digestion) and PGM-ICP27 (Pt, Pd, and Au; 30g fire assay and ICP-AES Finish) methods. ALS also undertakes its own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration.

Power Nickel's QA/QC program includes the regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results. Historic holes were assayed by various accredited laboratories.

About Power Nickel Inc.

Power Nickel is a Canadian junior exploration company focusing on high-potential copper, gold, and battery metal prospects in Canada and Chile.

On February 1, 2021, Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corp. (CRE: TSXV)

The NISK property comprises a large land position (20 kilometers of strike length) with numerous high-grade intercepts. Power Nickel, formerly Chilean Metals is focused on confirming and expanding its current high-grade nickel-copper PGE mineralization historical resource by preparing a new Mineral Resource Estimate in accordance with NI 43-101, identifying additional high-grade mineralization, and developing a process to potentially produce nickel sulphates responsibly for batteries to be used in the electric vehicles industry.

Power Nickel (then called Chilean Metals) announced on June 8th, 2021 that an agreement has been made to complete the 100% acquisition of its Golden Ivan project in the heart of the Golden Triangle. The Golden Triangle has reported mineral resources (past production and current resources) in a total of 67 million ounces of gold, 569 million ounces of silver, and 27 billion pounds of copper. This property hosts two known mineral showings (gold ore and Magee), and a portion of the past-producing Silverado mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described to be Polymetallic veins that contain quantities of silver, lead, zinc, plus/minus gold, and plus/minus copper.

Power Nickel is the 100-per-cent owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold belt of northern Chile. It also owns a 3-per-cent NSR royalty interest on any future production from the Copaquire copper-molybdenum deposit, recently sold to a subsidiary of Teck resources Inc. Under the terms of the sale agreement, Teck has the right to acquire one-third of the 3-per-cent NSR for $3-million at any time. The Copaquire property borders Teck's producing Quebrada Blanca copper mine in Chile's first region.

For further information on Power Nickel Inc., please contact:

Mr. Terry Lynch, CEO

647-448-8044

terry@powernickel.com

For further information, readers are encouraged to contact:

Power Nickel Inc.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON

ON BEHALF OF THE BOARD OF DIRECTORS

Terry Lynch & CEO

Qualified Person

Kenneth Williamson, Géo (OGQ #1490), M.Sc., Senior Consulting Geologist, and Matthew DeGasperis, Géo (OGQ #2261), B.Sc., Consulting Geologist, from 3DGeo Solution Inc. is the independent qualified persons pursuant to the requirements of NI 43-101, and have reviewed and approved the technical content of this press release.

Cautionary Note Regarding Forward-Looking Statement

This news release may contain certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that PNPN expects to occur, including details related to the proposed spin-out transactions, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements in this document include statements regarding current and future exploration programs, activities, and results. Although PNPN believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration success, continued availability of capital and financing, inability to obtain required regulatory or governmental approvals, and general economic, market, or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

SOURCE: Power Nickel Inc.

View source version on accesswire.com:

https://www.accesswire.com/700070/Warrant-Exercise-raises-over-800000-for-Power-Nickel