February 23, 2023

Voltage Metals Corp., ("Voltage" or the "Company") (TSXV: VOLT) is pleased to report final assay results from the diamond drill program at the Company's 100% owned St. Laurent Nickel-Copper-Cobalt Project, located 160 km northeast of Timmins, Ontario. Exploration consisted of seven holes, (2,457m), with borehole EM geophysical surveys completed on six holes. The 2022 program was a follow up to encouraging results from a 2019 program by a previous operator, with SL-19-01 intersecting three separate intervals of >1.0% Ni, and SL-19-03 intersecting 113.4 m 0.22% Ni, 0.17% Cu

Highlights

- Six out of Seven holes intersected encouraging Ni-Cu sulphide mineralization.

- SL-22-07 intersected 51.8 metres of 0.24% Ni 0.18% Cu, was drilled to provide definition on the broad zone of mineralization intersected in SL-19-03 which included 113.4 metres 0.22% Ni, 0.17% Cu.

- SL-22-09 intersected 23.1 metres of 0.36% Ni, 0.23% Cu, including a higher-grade section of 6.0 metres of 0.62% Ni, 0.36% Cu. A deeper intersection in this hole returned 14.0 metres of 0.25% Ni, 0.14% Cu.

- SL-22-10 intersected 10.3 metres of 0.29% Ni, 0.17 % Cu and a deeper higher-grade interval of 0.67% Ni, 0.44% Cu over 4.0 metres..

- SL-22-11 intersected multiple intervals of mineralization including 17.5m of 0.28% Ni 0.19% Cu, an intermediate interval of 13.0 metres of 0.53% Ni, 0.27 % Cu, and a deeper intersection of 14.4 metres of 0.36% Ni, 0.32% Cu.

- A newly identified Maxwell Plate EM anomaly positioned between SL-10-01 and SL-19-02 suggests size and continuity of mineralization for follow-up drill testing.

- A recently defined Maxwell Plate EM anomaly proximal to SL-19-06 providing a priority target for follow-up work and suggests continuity of the mineralized system to the northeast.

St. Laurent Nickel Sulphide Mineralized System

The St. Laurent Project displays geological characteristics indicative of a gabbro breccia/conduit hosted style of nickel mineralization, comparable to the Lynn Lake Deposit (28.4 million tons @ 0.91% Ni, 0.49% Cu)1 the Kenbridge deposit (7.5 million tonnes @ 0.58% Ni, 0.32% Cu)2, and the Montcalm Deposit (3.9 million tonnes @ 1.3% Ni, 0.67% Cu, 0.05 Co)3. Characteristics of these systems include, irregular massive sulphide lenses contained within broad intervals of lower grade mineralization, often disrupted by barren xenoliths of gabbro intrusion material and the surrounding wall rock material.

Nickel and sulphur assay data from St Laurent predicts a high nickel tenor4 of 5% Ni for massive sulphides (35% S) in the St. Laurent system. Drilling to date has intersected multiple intervals of wide, lower grade disseminated, stringers and blebby sulphide mineralization.

2022 Drill Hole Result

SL-22-05 was drilled 45 metres up-dip from the three closely spaced mineralized zones intersected in SL-19-01 (1.1% Ni, 0.5% Cu, 503 ppm Co, 5.1% S over 3.6m, 1.3% Ni, 0.5 % Cu, 568 ppm Co, 5.6% S over 4.2m, 1.0% Ni, 0.8% Cu, 506 ppm Co, 4.8% S over 4.7m) coincident with the center of a strong Maxwell Plate EM anomaly. The hole encountered sulphide mineralization at the expected depth with 0.7% Ni, 0.3% Cu over 2.6 m, but was abruptly terminated by the presence of mafic volcanic xenoliths. Several narrow intervals were intersected, including 3.9 m of 0.21% Ni, 0.25% Cu, and a deeper section of 0.8m of 0.81% Ni, 0.14% Cu. The presence of mafic volcanic xenoliths is an expected component of the conduit type system. Identifying the position of the larger xenoliths is important for future drill planning.

SL-22-06 was drilled to test the north-east extension of the mineralized system in the down plunge direction, targeting a deep-strong Maxwell Plate EM anomaly. Non mineralized Gabbro and Diorite were intersected throughout the entirety of hole with no explanation for the anomaly. Follow up Borehole EM surveys have defined a strong, large off-hole anomaly indicating the presence of conductive material continuing in the northeast down-plunge direction.

SL-22-07 was drilled 400 metres in front and oriented back towards SL-19-03. The purpose of the hole was to further define the width and orientation of the low- grade mineralization in SL-19-03, while at the same time testing multiple Maxwell Plate EM anomalies. SL-22-07 intersected 51.8m of 0.24% Ni, 0.18% Cu. The broad zone of mineralization was cut-off early by the presence of a large mafic volcanic xenolith. The mineralized zone in this area is interpreted to be approximately 75 metres wide. Borehole EM surveys have defined a large continuous Maxwell Plate EM anomaly coincident with the broad zone of mineralization, suggesting good continuity to the system.

SL-22-08 was drilled 80 metres east of SL-22-05 to test the edge of a Maxwell Plate EM anomaly. A wide interval of 52.7 metres of 0.12% Ni, 0.09% Cu with a higher-grade interval of 0.25% Ni, 0.18% Cu over 9.0 metres was intersected.

SL-22-09 was drilled from the same setup as SL-22-08 at a steeper dip. SL-22-09 intersected 0.62% Ni, 0.36% Cu over 6.0 m within a broader interval of 23.1 metres of 0.34% Ni, 0.23% Cu. Variation in grade of mineralization between SL-22-09, SL-22-08 drilled 60 metres above, and SL-19-01 drilled 65 metres to the west, highlight the expected variations in this style of a mineralized system. SL-22-09 encountered a large mafic volcanic xenolith interpreted to have cut off a portion of the mineralized zone.

SL-22-10 was drilled to test wide sections of mineralization reported in drill holes PA-2 and PA-4 (1966). Drill casings for these two holes were located in the field, which allows the historical data to be accurately incorporated into the current model. SL-22-10 was positioned between the two older setups and planned to evaluate the western portion of the mineralized system. SL-22-10 intersected 10.3 metres of 0.29% Ni, 0.17% Cu and a second interval of 4.0 metres of 0.70% Ni, 0.44% Cu.

SL-22-11 was drilled from the same setup as SL-22-10 at a shallower dip. Multiple zones of mineralization were intersected throughout the hole, including 5.5 metres of 0.28% Ni, 0.18% Cu, 6.5 metres of 0.22% Ni, 0.21% Cu, 17.5 metres of 0.28% Ni, 0.42% Cu, and 13.0 metres of 0.53% Ni, 0.27% Cu. The mineralized zone is interpreted to be approximately 100 metres thick based on drilling in this area.

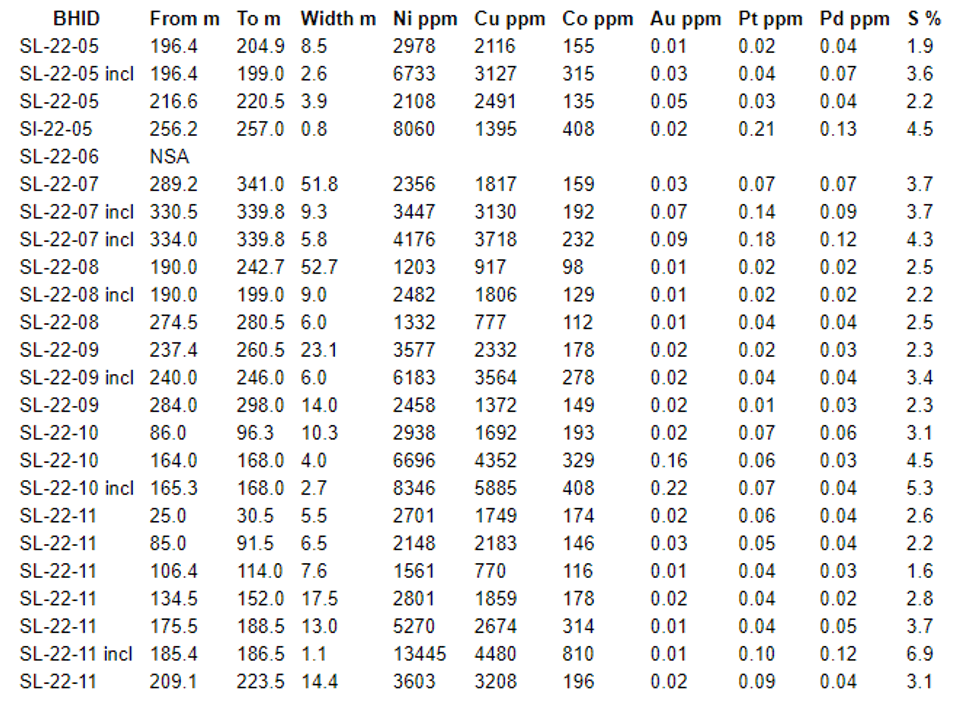

Assay results are included in Table 1. Drill intervals in the table are core lengths, as true widths have not been determined due to insufficient drill detail.

Table 1 – St. Laurent 2022 Diamond Drill Program Assay Results

2022 Drill Program

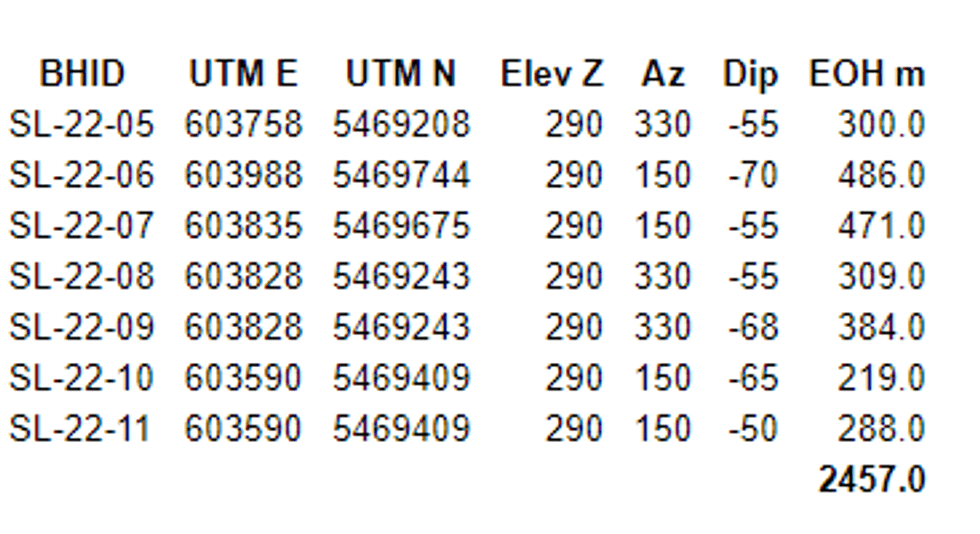

Exploration consisted of seven holes, (2,457m), with borehole EM geophysical surveys completed on six holes. A total of 570 samples, representing 800 metres of core were split for analysis. All drill holes, with the exception of SL-22-06, intersected multiple intervals of sulphide mineralization. The St. Laurent mineralized system has been sporadically tested along 650 metres strike extent, with only 4,792 metres of drilling in three separate programs since 2008. In 1966, 13 holes were competed, with drill logs (limited assay data) provided for 7 of the 13 holes (1,081m). Drill Hole locations for the 2022 program are included in Table 2.

Table 2- 2022 Drill Hole Locations

Borehole EM Surveys

Borehole EM surveys were performed on the majority of 2019 and 2022 drill holes. The interpreted Maxwell Plate modeling is an effective method at tracking the trend of the mineralization and provides a high level of confidence for future drill targeting.

Comment on Results

The 2022 Voltage diamond drill program has improved the geological understanding of the St. Laurent project and greatly expanded the footprint of the mineralized system. Bob Bresee, President of Voltage states "The objective of the 2022 drill program was to identify massive sulphide mineralization, which based on the nickel tenor of this system indicates high grade 5% nickel. The St. Laurent magmatic system includes appreciable amounts of cobalt and PGE's which combined with a high nickel grade provides an extremely desirable exploration target due to the high dollar value of the contained minerals. Although massive sulphides are the primary exploration focus, wide lower grade nickel mineralization in conjunction with the current high metal prices present exploration opportunities to evaluate lower nickel grade, larger volume material. The broad zones of lower grade mineralization at St. Laurent indicate a large continuous system that has been lightly drill tested with 5,873 metres total drilling since 1966, along a strike distance of 650 metres."

Assaying & QAQC

Core was logged, tagged and sawn at the Company's logging facility in Cochrane, Ontario. Samples were transported in sealed bags to ALS Canada Ltd. facility in Timmins for preparation. Pulps were transported to Vancouver, British Columbia for 35 element MEICP41 Aqua regia ICP AES analysis, PGM ICP23 analysis for Au- Pt- Pd analysis, S-IR08 for Sulphur analysis, Cu OG46 analysis for >10000 ppm Cu and NiOG46 analysis for >10000 ppm Ni. the sampling of, and assay data, from drill core is monitored through the implementation of a quality assurance - quality control (QA-QC) program designed to follow industry best practice.

Qualified Person

The St. Laurent 2022 diamond drill project was completed under the direct supervision of Todd Keast, P.Geo, a consultant to Voltage Metals Corp. Todd Keast, P.Geo. is a Qualified Person as defined in National Instrument 43-101. He has reviewed and approved the technical content of this press release.

References:

- Pinsent R.H., 1980, Nickel Copper Mineralization in the Lynn Lake Gabbro, Manitoba Department of Energy and Mines Minerals Resources Division Economic Geology Report ER-79-3.

- Tartisan Nickel Corp. Sedar Website P & E Mining Consultants, Sept 17,2020, Technical Report and Updated Mineral Resource Estimate of the Kenbridge Nickel Project.

- Atkinson, 2011, Ministry of Northern Development and Mines.

- Nickel Tenor is a common practice in magmatic nickel-copper exploration where the nickel vs S ratio is extrapolated to 100% sulphides (35% S), to estimate the grade of massive sulphide. Nickel tenor does not provide certainty that massive sulphides will be discovered.

Click here to connect with Voltage Metals Corp., (TSXV: VOLT), to receive an Investor Presentation

VOLT:CNX

The Conversation (0)

19 April 2022

Voltage Metals

Exploring Promising Battery Metal Assets in Canada

Exploring Promising Battery Metal Assets in Canada Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00