April 21, 2023

Vizsla Copper (TSXV:VCU, OTCQB:VCUFF) develops promising copper assets in British Columbia, Canada. The company’s flagship Woodjam copper project is a significant district-scale opportunity with the potential to become a world-class copper producer. Vizsla Copper’s additional assets build upon its portfolio of copper projects in BC, a tier 1, mining-friendly jurisdiction.

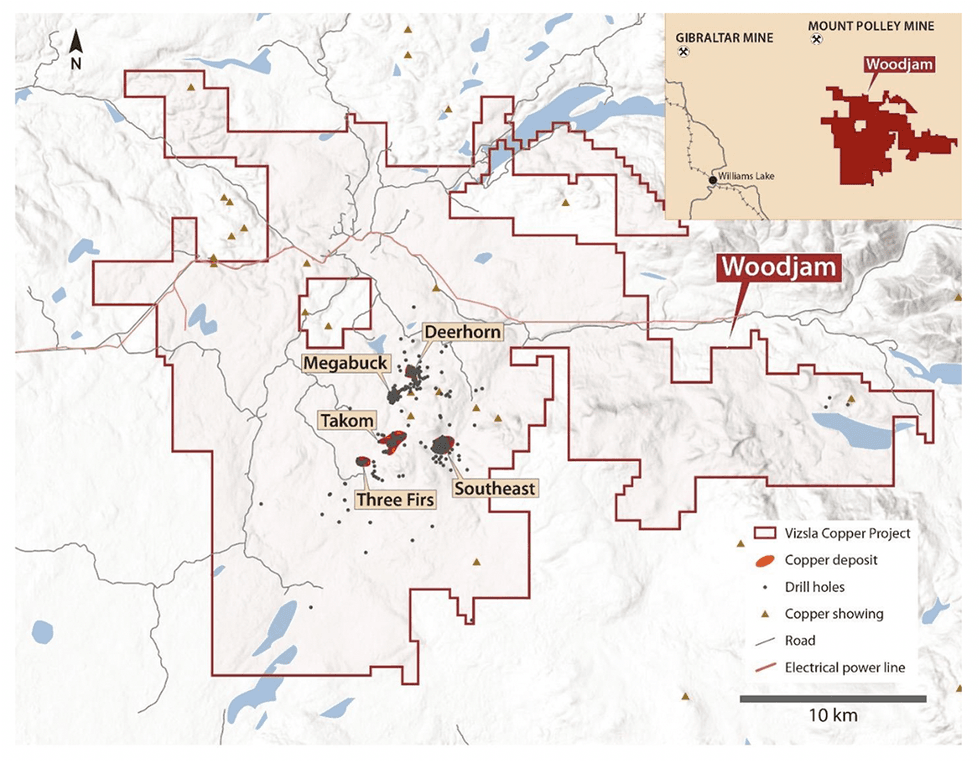

The Woodjam copper project covers over 64,000 hectares with several identified and untested targets. Historical inferred resource estimates for the project indicate 1.7 billion pounds of copper and 968,000 ounces of gold.

Vizsla’s acquisition of the Consolidated Woodjam Copper Corp. in December 2022 was a transformational acquisition for the company, allowing Vizsla Copper to significantly improve its copper holdings as it prepares to meet the impending copper supply shortage.

An experienced team of managers with expertise throughout the natural resource industry leads the company toward its goal. Craig Parry, executive chairman, talked about the Vizsla Copper management team in an interview, “We've been able to really recruit some absolute superstars. Looking around for good geologists these days, they're in red hot demand. It's hard to find those people.” Parry and Steve Blower, VP exploration for Vizsla Copper, were awarded the AME 2022 Colin Spence Award for excellence in global mineral exploration for their integral roles in the discovery of the Hurricane uranium deposit during their time with IsoEnergy Ltd.

Company Highlights

- Vizsla Copper is a mineral exploration and development company focusing on exploring its underexplored assets in British Columbia, Canada.

- Copper is essential for the ongoing energy transition and has been called “the new gold” for its applications throughout the clean energy industry.

- A copper shortage is expected as demand rises due to the electrification of the world, while supply struggles to keep up.

- Vizsla Copper acquired the Consolidated Woodjam Copper Corp. in December 2022, further enabling the company to focus on meeting growing copper demand.

- The flagship Woodjam asset is a district-scale opportunity, located in an established mining district, with promising historical results yet remains underexplored.

- Vizsla Copper’s additional projects in BC create future opportunities to improve shareholder value as exploration continues.

- The company is committed to socially responsible exploration at every step by minimizing environmental impact and supporting community involvement.

- An experienced team of managers with expertise throughout the natural resource industry leads the company toward its goal.

This Vizsla Copper profile is part of a paid investor education campaign.*

Click here to connect with Vizsla Copper (TSXV:VCU, OTCQB:VCUFF) to receive an Investor Presentation

VCU:CA

The Conversation (0)

15 January 2024

Vizsla Copper

Exploring District-scale Copper Opportunities in British Columbia

Exploring District-scale Copper Opportunities in British Columbia Keep Reading...

24 January 2023

VIZSLA COPPER ACQUIRES ADDITIONAL CLAIMS AT THE WOODJAM COPPER PROJECT

Vizsla Copper Corp. (TSXV: VCU) (OTQB: VCUFF) (" Vizsla Copper " or the " Company ") is pleased to report the acquisition of additional claims at the Woodjam Copper Project (" Woodjam " or the " Project "). Woodjam is prospective for copper and copper-gold porphyry style mineralization and is... Keep Reading...

2h

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data showed that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drilling Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia is taking part in a ministerial meeting hosted by the US aimed at exploring a strategic critical minerals... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00